Spray Dryer Market Report Scope & Overview:

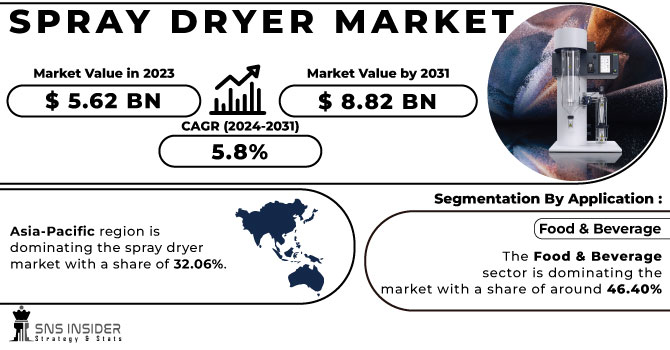

The Spray Dryer Market Size was valued at USD 5.55 Billion in 2023 and is now anticipated to grow to USD 8.83 Billion by 2032, displaying a compound annual growth rate of CAGR 5.29% during the forecast Period 2024 - 2032. This report offers unique insights into regional manufacturing output, utilization rates, and downtime metrics in the spray dryer market. It highlights the adoption of cutting-edge technologies and how they vary across different regions. The report also focuses on export/import dynamics and their contribution to market growth. It also discusses trends in energy consumption and efficiency, pinpointing critical areas where improvements can be made to enhance operational performance.

Get More Information on Spray Dryer Market - Request Sample Report

Market Dynamics:

Drivers

-

The growing demand for powdered products in industries like dairy, pharmaceuticals, and food ingredients is driving the spray dryer market due to benefits like longer shelf life, easier transport, and improved convenience.

The growing demand for powdered products across various industries, including dairy, pharmaceuticals, food ingredients, and chemicals, is a key driver of the spray dryer market. powdered products include delivery and shelf life, as well as transportation of products. As an example, spray drying is widely employed in the dairy sector for the production of powdered milk, whey protein, and infant formula. Likewise, spray dryers are critical to producing fine powders for drug delivery systems in the pharmaceutical industry. Spray drying is also utilized by the food and beverage industry to create ingredients such as powdered flavors, seasonings, and nutrients. With the growing demand from consumers for convenience and products that last longer, the market for spray dryers is ongoing growth. Trends such as the rise in demand for organic and clean-label products and advancements in spray dryer technology, improving energy efficiency and product quality, further fuel market expansion, especially in emerging markets.

Restraint

-

High initial investment costs and ongoing operational expenses make spray dryers a significant financial burden for SMEs, limiting their adoption of this technology.

The high initial investment costs associated with spray dryer equipment can be a major barrier for small and medium-sized enterprises (SMEs) looking to adopt this technology. These systems are usually highly complex, with specialized components, and require a significant capital outlay for purchase and installation. Usually, the constant maintenance and operating expenses like energy costs, workforce, and routine maintenance are part of the huge financial burden. Such continuing costs may lead SMEs to question the investment, especially to the other methods of drying which may be less capital-intensive. This, in turn, may deter SMEs from implementing spray drying systems, particularly in sectors with narrow profit margins or volatile demand. For these businesses, the ability to secure financing or access cost-effective solutions is crucial in overcoming the financial challenge posed by high upfront costs.

Opportunities

-

Emerging markets in Asia Pacific and Latin America are rapidly adopting spray drying technology in food, pharmaceuticals, and chemicals, driven by economic growth and increasing demand for processed products.

Emerging markets, especially in regions like Asia Pacific and Latin America, are witnessing rapid adoption of spray drying technologies across industries such as food, pharmaceuticals, and chemicals. This demand is being driven by GDP growth, urbanization, and an expanding middle class in these regions, leading to demand for processed food, nutritional products, and pharmaceuticals. In these sectors, spray drying provides an energy-efficient technology for the conversion of the liquid material into powder, making it easier to store and transport the end product over longer periods. Also, as these markets invest in modernizing manufacturing infrastructure and improving product quality, spray drying is being perceived as a preferred solution for producing quality powders at scale. The increasing demand for dairy products, protein supplements and pharmaceutical formulations also fuels market growth. This adoption provides significant growth opportunities for spray dryer manufacturers, enabling them to tap into the expanding demand for powdered goods and more sophisticated production processes in these regions.

Challenges

-

Spray drying processes can generate emissions and waste, requiring manufacturers to adopt sustainable practices and comply with strict environmental regulations.

Spray drying processes, while efficient in converting liquids to powders, can contribute to environmental concerns, particularly in terms of emissions and waste generation. Spray drying involves high temperatures, which can cause the emission of volatile organic compounds (VOCs), particulate matter, and other pollutants that can impact quality of the air and contribute to environmental degradation. Moreover, the waste products from this process, including residual liquid or material leftovers, can be difficult to minimize in relation to their environmental impact, and can also create problems in their disposal. Hence, manufacturers have to incorporate sustainable procedures in their operations, such as, utilising energy-efficient tools, optimising process parameters to lower the emissions and introducing waste management systems such as recycling or proper disposal techniques. In addition to all of this, companies also need to adhere to stricter environmental regulations at the local, regional, and international levels. These regulations often mandate lower emission limits and require the use of cleaner technologies, prompting the industry to invest in more eco-friendly solutions.

Segmentation Analysis:

By Type

The Nozzle Atomizer segment dominated with a market share of over 38% in 2023, primarily due to its widespread use and cost-effectiveness across various industries. It is essential to control droplet size and drying efficiency in industries such as food, pharmaceuticals, and chemicals. This level of control, made possible by nozzle atomizers, works by atomizing the liquid into small droplets, which can then be dried uniformly and quickly. This accuracy is essential in fields where the quality and consistency of the product are of utmost importance. In food processing, for example, it prevents powders from losing their nutritional value, taste, and texture. In pharmaceuticals, nozzle atomizers are crucial for producing uniform drug powder batches. Nozzle atomizers are commonly used as they have relatively low operational costs, are easy to maintain, and are adaptable to a wide variety of feedstocks. This makes them a known option in industries looking for economical and efficient drying solutions

By Drying Stage

The Two-Stage segment dominated with a market share of over 48% in 2023, due to its enhanced efficiency in handling a variety of materials. In this method, atomization and drying are conducted as two separate operations, which enables you to have greater control and precision in drying. With their efficient, staged operation, these Two-Stage dryers provide excellent heat transfer and moisture removal for consistent output and product quality. This versatility combined with high throughput means it is commonly adopted in sectors including food and beverage, pharmaceuticals, chemicals, and cosmetics. Additionally, the Two-Stage systems provide optimized energy consumption, further contributing to their dominance in the market, as companies seek cost-effective, high-performance solutions.

By Application

The Food & Dairy segment dominated with a market share of over 46% in 2023, primarily due to the extensive use of spray drying for food preservation and dairy processing. Spray drying is a widely used process in food industry, where liquid food products are converted into powder form to provide longer shelf life and minimize distribution cost. This technology has found extensive applications in the manufacturing of dairy products including milk powder, infant formula, and cheese powder, as well as in beverage production, including coffee and powdered soups. This segment is flourishing due to the rising demand for ready-to-eat and convenience food items, along with the increasing inclination for shelf-stable products. Additionally, the ability to preserve nutritional value and flavors through spray drying further contributes to the market dominance of this segment.

Regional Analysis:

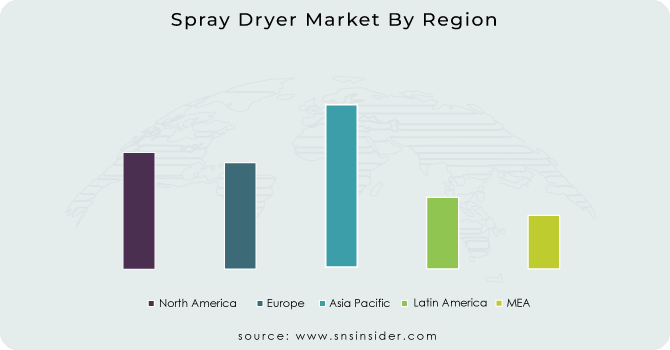

North America region dominated with a market share of over 36% in 2023, primarily due to the robust demand across industries such as food and beverage, pharmaceuticals, and chemicals. Because of the presence of well-developed technological infrastructure in the region, advanced manufacturing processes are implemented, which encourage the adoption of advanced drying technologies. Moreover, a few key market players, including GEA Group and SPX Flow, help solidify North America's dominance in the market. Spray dryers are used extensively in these industries, due to high demand for powdered products and a need for quality and consistency of production. Further, North America dominates spray dryer advancements and applications owing to ongoing innovations and heavy R&D investments.

The Asia-Pacific region is experiencing the fastest growth in the Spray Dryer Market, driven by rapid industrialization and expanding sectors like pharmaceuticals and food processing. Countries like China, India and Japan have played a vital role in driving this growth, in particular, increased investments in advanced manufacturing technologies. As spray dryers are essential for drying sensitive materials such as food powders, pharmaceuticals, and chemicals, demand from these regions is increasing. The broad consumer base, production capacity, and technological advances in the region are some other factors contributing to the market growth. These factors, a combination of which are pushing Asia-Pacific to the top in terms of both market growth and spray dryer technology innovation.

Get Customized Report as per your Business Requirement - Request For Customized Report

Some of the major key players of the Spray Dryer Market:

-

Swenson Technology, Inc. (Spray Dryers, Fluidized Bed Dryers, Drying Systems)

-

GEA Group (Spray Drying Equipment, Centrifugal Spray Dryers, Milk Powder Spray Dryers)

-

SPX Flow (Spray Dryers, Homogenizers, Filtration Equipment)

-

Shandong Tianli Drying Technology and Equipment (Spray Dryers, Flash Dryers, Rotary Dryers)

-

Dedert Corporation (Spray Dryers, Evaporation Systems, Drying Plants)

-

Changzhou Lemar Drying Engineering (Spray Dryers, Rotary Dryers, Fluid Bed Dryers)

-

Acmefil Engineering Systems Pvt. Ltd (Spray Dryers, Fluidized Bed Dryers, Mixing Equipment)

-

New AVM Systech (Spray Dryers, Fluidized Bed Dryers, Mixing Equipment)

-

Advanced Drying Systems (Spray Drying Equipment, Flash Dryers, Rotary Dryers)

-

Tetra Pak International S.A. (Spray Dryers, Dairy Processing Equipment, Powdered Milk Dryers)

-

Büchi Labortechnik AG (Laboratory Spray Dryers, Pilot Spray Dryers)

-

Sonic Corp. (Spray Dryers, Fluidized Bed Dryers, Spray Dryer Systems)

-

Patterson Kelley (Spray Dryers, Fluid Bed Dryers, Powder Processing Equipment)

-

SWECO (Spray Dryers, Sifting Equipment, Filtration Systems)

-

Shandong Zouping Shuangyu (Spray Dryers, Fluid Bed Dryers, Vacuum Dryers)

-

Jiangsu Xianfeng Drying (Spray Dryers, Flash Dryers, Airflow Dryers)

-

Kason Corporation (Spray Dryers, Air Classifiers, Sifters)

-

FEECO International, Inc. (Spray Dryers, Rotary Dryers, Mixing Equipment)

-

Jiangsu Liancheng (Spray Dryers, Fluidized Bed Dryers, Airflow Dryers)

-

Tama Engineering (Spray Dryers, Evaporators, Industrial Drying Equipment)

Suppliers for (Offers a wide range of spray dryers, particularly in the dairy, food & beverage, and pharmaceutical sectors) on Spray Dryer Market

-

GEA Group (Germany)

-

SPX Flow (U.S.)

-

Swenson Technology, Inc. (U.S.)

-

Dedert Corporation (U.S.)

-

Shandong Tianli Drying Technology and Equipment (China)

-

Changzhou Lemar Drying Engineering (China)

-

Acmefil Engineering Systems Pvt. Ltd (India)

-

New AVM Systech (India)

-

Advanced Drying Systems (U.S.)

-

Tetra Pak International S.A. (Switzerland)

Recent Development:

In April 2023: RELCO introduced the Parvus pilot spray dryer for various food applications having two variants’ Parvus Nomad, a single-stage dryer for trial batches and small production volumes and Parvus Multi-Stage dryer, for larger production volumes.

In October 2023: Dedert Corporation launched Air Assisted Pressure Nozzle (AAPN), which can produce very fine liquid droplets and, once these are dried, an even finer dry powder. This machine is suitable for drying lithium and battery materials.

| Report Attributes | Details |

|---|---|

|

Market Size in 2023 |

USD 5.55 Billion |

|

Market Size by 2032 |

USD 8.83 Billion |

|

CAGR |

CAGR of 5.29% From 2024 to 2032 |

|

Base Year |

2023 |

|

Forecast Period |

2024-2032 |

|

Historical Data |

2020-2022 |

|

Report Scope & Coverage |

Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

|

Key Segments |

• By Type (Rotary Atomizer, Nozzle Atomizer, Fluidized, Closed Loop, Centrifugal) |

|

Regional Analysis/Coverage |

North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

|

Company Profiles |

Swenson Technology, Inc., GEA Group, SPX Flow, Shandong Tianli Drying Technology and Equipment, Dedert Corporation, Changzhou Lemar Drying Engineering, Acmefil Engineering Systems Pvt. Ltd, New AVM Systech, Advanced Drying Systems, Tetra Pak International S.A., Büchi Labortechnik AG, Sonic Corp., Patterson Kelley, SWECO, Shandong Zouping Shuangyu, Jiangsu Xianfeng Drying, Kason Corporation, FEECO International, Inc., Jiangsu Liancheng, Tama Engineering |