UV Curable Resins and Formulated Products Market Report Scope & Overview:

Get more information on UV Curable Resins and Formulated Products Market - Request Sample Report

The UV Curable Resins And Formulated Products Market Size was valued at USD 5.5 billion in 2023, and is expected to reach USD 12.8 billion by 2032, and grow at a CAGR of 9.9% over the forecast period 2024-2032.

The UV Curable Resins and Formulated Products market is witnessing steady growth due to the increasing demand for high-performance coatings, adhesives, and inks across various industries such as automotive, packaging, and electronics. A key dynamic driving the market is the growing emphasis on sustainability, with companies focusing on developing eco-friendly, renewable, and low-emission products. This has prompted significant innovation in the field of UV-curable resins, where raw materials derived from renewable sources, such as cottonseed oil, are being explored for their potential to create highly functional UV-curable materials. The focus on sustainability not only aligns with regulatory standards but also meets consumer demand for greener products. The trend of reducing volatile organic compounds (VOCs) in formulations is another factor propelling the adoption of UV-curable resins. Companies like Arkema have responded by ensuring the sustainability of their operations and products, with developments such as the ISCC certification for their Nansha plant in China in August 2024. This certification, which verifies the sustainable sourcing and production of materials, highlights its commitment to offering innovative and environmentally responsible solutions.

Recent advancements in raw material innovations have also been significant. In July 2024, researchers explored cottonseed oil as a renewable resource for the development of UV-curable materials, which has the potential to significantly reduce dependency on petroleum-based products. This development is an example of how companies are increasingly turning to sustainable bio-based feedstocks to create high-performance resins. BASF also made significant strides in July 2023 with the launch of new UV-curable resin products, reflecting the growing demand for solutions that provide enhanced durability and functionality in a wide range of applications. These advancements demonstrate a continued commitment to improving the performance and environmental footprint of UV-curable products. Such innovations are not only reshaping the market by increasing product versatility and performance but also contributing to the overall trend of sustainability that is becoming crucial in modern manufacturing.

UV Curable Resins And Formulated Products Market Dynamics:

Drivers:

-

Growing Demand for Eco-Friendly Products in Various Industries Boosts the UV Curable Resins and Formulated Products Market Growth

The shift toward eco-friendly solutions across industries such as automotive, packaging, and electronics is driving significant growth in the UV curable resins and formulated products market. As sustainability becomes a key focus, companies are increasingly opting for UV-curable resins due to their lower environmental impact, reduced volatile organic compound (VOC) emissions, and energy efficiency. These products offer a greener alternative to traditional solvent-based coatings and adhesives, aligning with growing consumer demand for environmentally conscious products. The trend is further accelerated by regulations that promote the use of low-VOC, low-emission materials. Furthermore, advancements in bio-based raw materials and the development of renewable, sustainable resins further contribute to this growing market demand. For instance, in recent years, companies have focused on developing products using renewable resources, which is expected to continue to push the market forward as industries seek solutions that meet both performance and environmental criteria.

-

Technological Advancements in UV Curing Technology Propel the Market Growth

-

Increasing Regulatory Support for Environmentally Friendly Coatings and Adhesives Drives Market Growth

-

Rising Demand for UV-curable coatings in the Automotive and Packaging Industries Fuels Market Growth

The automotive and packaging industries have been significant contributors to the demand for UV-curable resins. In the automotive sector, the growing need for durable, high-performance coatings that offer resistance to wear and tear, as well as environmental factors, has driven the adoption of UV-curable coatings. These coatings offer superior performance compared to traditional coatings, such as faster curing times, enhanced durability, and greater chemical resistance. Similarly, in the packaging industry, there is an increasing demand for UV-curable coatings due to their ability to deliver high-quality finishes on materials like plastics and cardboard. These coatings are not only eco-friendly but also offer improved efficiency in production, reducing processing time and energy consumption. As both sectors continue to evolve, the demand for UV-curable resins and formulated products is expected to rise significantly, driving further market growth.

-

Growing Adoption of UV-Curable Resins in Electronics and Consumer Goods Applications

Restraint:

-

High Production Costs of UV Curable Resins Limit Market Penetration in Emerging Economies

Opportunity:

-

Expansion of Bio-Based Raw Materials for UV Curable Resins Presents Significant Market Opportunities

The growing focus on sustainability and the shift toward renewable resources present significant opportunities for the UV curable resins market. The development and use of bio-based raw materials, such as plant oils, for resin formulations can lower dependence on petroleum-based products. This shift not only contributes to more sustainable production practices but also opens up new market segments, particularly as consumers and industries become more eco-conscious. Companies that invest in the development of bio-based resins and formulations can tap into the growing demand for environmentally friendly products, thus expanding their market share. The exploration of raw materials like cottonseed oil in the production of UV curable materials, as seen in recent advancements, presents a promising opportunity for growth in this sector.

-

Technological Advancements in UV Curing Equipment Create New Growth Opportunities in the Market.

-

Growing Trend of Digital Printing Applications Driving Demand for UV Curable Resins.

Challenge:

-

Technical Limitations in UV Curable Resins for High-Performance Applications Pose Challenges to Market Growth.

-

End-User Application Focus in the UV Curable Resins and Formulated Products Market.

The UV curable resins and formulated products market is heavily driven by key end-user applications, with automotive coatings and industrial coatings leading the way, each accounting for 25% of the market share. These sectors require high-performance, durable coatings that can withstand harsh conditions, making UV-curable resins a perfect solution due to their fast-curing times and enhanced properties. Packaging materials follow closely, making up 20% of the market, driven by the demand for high-quality, eco-friendly finishes. Electronics and electrical applications, along with consumer goods, each represent 15% of the market share, reflecting the growing need for UV-curable resins in electronics and durable consumer products, where speed, precision, and performance are critical. This distribution highlights the diverse applications of UV curable resins across multiple industries.

UV Curable Resins And Formulated Products Market Segment Analysis

By Type

In 2023, Acrylate Oligomers dominated the UV Curable Resins and Formulated Products Market, capturing a 70% market share. Acrylate oligomers are favored for their superior properties, including fast curing time, high chemical resistance, and excellent adhesion to a variety of substrates, making them ideal for high-performance coatings and adhesives in industries such as automotive, packaging, and electronics. Their versatility in different formulations for coatings, inks, and adhesives drives their widespread adoption. For example, in automotive coatings, acrylate oligomers provide the durability and weather resistance required for long-lasting finishes.

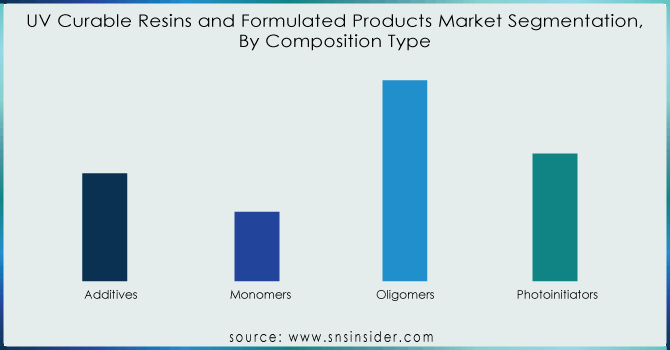

By Composition

In 2023, Oligomers dominated the UV curable resins market with a market share of 40%. Oligomers are critical for providing the necessary mechanical properties in formulations, such as hardness and flexibility, which are essential for a wide range of applications like coatings, adhesives, and printing inks. They act as the backbone in resin formulations, contributing to the final product's performance. The high demand for durable coatings in automotive and industrial applications, where oligomers are heavily utilized, has significantly fueled their dominance in the market.

Get Customized Report as per your Business Requirement - Request For Customized Report

By Application

In 2023, Coatings accounted for the largest segment in the UV curable resins market, with a market share of 35%. The high demand for UV-curable coatings in industries such as automotive, construction, and packaging drives this dominance. UV coatings offer rapid curing times, superior finish quality, and low environmental impact due to reduced VOC emissions. These advantages make UV coatings an ideal solution for applications requiring high durability, scratch resistance, and chemical resistance, such as in automotive parts and high-end consumer goods packaging.

By End-Use Industry

In 2023, Packaging dominated the end-use industry segment of the UV Curable Resins and Formulated Products Market, with a market share of 30%. The increasing demand for sustainable and high-quality packaging solutions, including food and beverage packaging, has led to the widespread adoption of UV-curable coatings in this industry. UV coatings in packaging provide excellent printability, abrasion resistance, and environmental benefits such as reduced VOC emissions. The shift toward eco-friendly and efficient packaging solutions in the packaging sector continues to drive the growth of UV curable resins in this application.

UV Curable Resins And Formulated Products Market Regional Overview

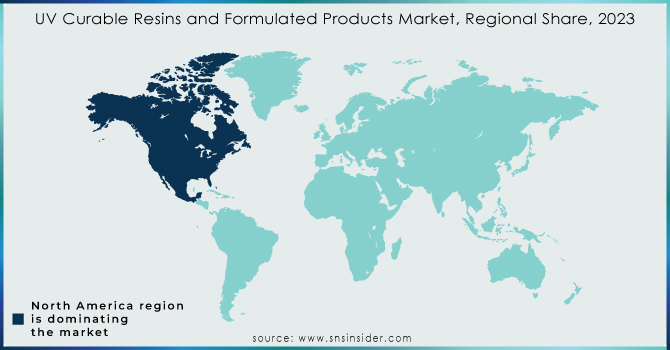

In 2023, North America dominated the UV Curable Resins and Formulated Products Market with a market share of 40%. The region’s strong industrial infrastructure, significant demand for eco-friendly coatings, and advancements in UV curing technology have fueled this dominance. The U.S., being a key player, leads the market due to its widespread adoption of UV-cured coatings in various sectors such as automotive, packaging, and electronics. For example, the automotive industry in the U.S. has increasingly embraced UV-curable coatings for faster production times, enhanced durability, and reduced environmental impact. The packaging sector, driven by demand for sustainable materials, also heavily utilizes UV curable resins for packaging coatings that offer high gloss, scratch resistance, and lower VOC emissions. Canada, too, contributes significantly to the market growth with growing industrial applications of UV curable products, particularly in the automotive and coatings industries. The region benefits from the regulatory push for reducing environmental pollution, further driving the preference for UV-curable products. Furthermore, North American companies such as BASF and Covestro are at the forefront of developing innovative UV curable resin formulations, further solidifying the region’s leadership in the global market.

Moreover, in 2023, Asia-Pacific emerged as the fastest-growing region in the UV Curable Resins and Formulated Products Market, with a CAGR of 8.5%. This rapid growth can be attributed to the burgeoning demand from emerging economies, particularly in China and India, where industrialization and urbanization are accelerating. The APAC region is experiencing a surge in demand for UV curable resins due to their use in industries like automotive, packaging, electronics, and consumer goods. China, with its rapidly expanding automotive and packaging industries, is a major contributor to this growth. For example, the demand for UV-curable coatings in the Chinese automotive sector has increased significantly, as manufacturers look for environmentally friendly, durable, and high-performance coatings to meet both local and global standards. India’s expanding packaging industry, spurred by the rise in e-commerce and food packaging, is another key factor driving market expansion in the region. The rise of e-commerce has increased the demand for aesthetically appealing, durable, and safe packaging, all of which can be achieved using UV curable resins. Additionally, governments in countries like China and India are implementing stricter environmental regulations, further encouraging the adoption of UV curing technology due to its low environmental impact. The region's economic growth and its increasing adoption of sustainable technologies make it the fastest-growing market globally.

Key Players in UV Curable Resins And Formulated Products Market

-

Alberdingk Boley GmbH (Alberdink Boley Acrylates, ALBEMARLE UV Resins)

-

Allnex Netherlands B.V. (Ebecryl, Pliocene)

-

BASF SE (Joncryl, Uvaflex)

-

Covestro AG (Desmodur, Bayhydrol)

-

DIC Corporation (Sun chemical UV inks, DIC UV Resins)

-

Eternal Materials (Eternal UV Resins, Eternal Adhesives)

-

Hitachi Chemical (Ecolite, Hitachi UV Resins)

-

IGM Resins (Photomer, IGM UV Resins)

-

Miwok Specialty Chemical Co. Ltd. (Miwok UV Resins, Miwok Acrylates)

-

Showa Denko Materials Co. (Showa Denko UV Resins, Showa Denko Inks)

-

TOAGOSEI CO.,LTD. (UVB resins, UV curable coating materials)

-

Wanhua Chemical Group Co. (Wanhua UV Resins, Wanhua Acrylics)

-

Arkema S.A. (Elium, Sartomer Photoinitiators)

-

DSM NeoResins (NeoCure, NeoResin UV)

-

Kraton Polymers (Kraton G, Kraton D)

-

LyondellBasell Industries (LyondellBasell UV Coatings, LyondellBasell Resins)

-

Sartomer (part of Arkema) (Sartomer Photoinitiators, Sartomer Resins)

-

Urethane Soy Systems Company (SoyResins, Urethane Soy Products)

-

Rahn AG (Rahn UV Resins, Rahn Photoinitiators)

-

Vega Polymers, Inc. (Vega UV Resins, Vega Coating Products)

Recent Developments

-

August 2024: Arkema received ISCC PLUS certification for its UV/LED/EB curing resins facility in Nansha, China, enabling the production of bio-based resins with up to 85% biobased content. This certification supports the company’s sustainability goals and enhances eco-friendly solutions for industries like electronics and green mobility.

-

April 2023: IGM Resins introduced their innovations, the Premium and Standard BAPO-L photoinitiators (LFC 5103 and LFC 5105). These products leveraged BAPO-L technology to revolutionize the energy-curing industry. They offered superior performance and versatility, excelling in applications with both traditional mercury lamps and the growing LED technology.

-

January 2023: Showa Denko K.K. and Showa Denko Materials Co., Ltd. joined forces, creating a new entity named "Resonac." This merger signified a "second inauguration" for the group, with ambitions to become a global leader in the chemical industry. Resonac aimed to achieve this goal by focusing on advanced functional materials and further transformative efforts.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 5.5 Billion |

| Market Size by 2032 | US$ 12.8 Billion |

| CAGR | CAGR of 9.9% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Composition Type (Additives, Monomers, Oligomers, Photoinitiators) • By Technology (Solventborne UV Resins, Waterborne UV Resins, 120% Solid UV Resins, Powder UV Resins) • By Application (Coatings, Printing Inks, Overprint Varnishes, Adhesives, Others) • By Chemistry (Acrylate Oligomers, Non-Acrylated Oligoamines) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | IGM Resins (Netherlands), Alberdingk Boley GmbH, Showa Denko Materials Co., Miwok Specialty Chemical Co. Ltd., BASF SE, Wanhua Chemical Group Co., Covestro AG, Eternal Materials, Allnex Netherlands B.V, TOAGOSEI CO.,LTD., Alberdingk Boley GmbH, DIC Corporation, Hitachi Chemical |

| Drivers | • Rising awareness, environmental concerns, and stricter VOC regulations are driving the demand for eco-friendly alternatives like UV curable resins. |

| Restraints | • Fluctuation in prices can be challenging for the UV Curable Resins and Formulated Products Growth. |