Steam Trap Market Size & Overview:

Get More Information on Steam Trap Market - Request Sample Report

The Steam Trap Market Size was valued at USD 4.14 Billion in 2023 and is expected to grow to USD 5.94 Billion by 2032 and grow at a CAGR of 4.09% over the forecast period of 2024-2032.

The steam trap market is witnessing robust growth, primarily driven by the growing focus on energy efficiency and cost reduction across various industries. Steam trap play a pivotal role in steam systems by preventing steam leakage, which can lead to significant energy losses. The U.S. Department of Energy estimates that steam leaks account for 20-30% of energy losses in steam systems, highlighting the critical need for effective steam trap to enhance system efficiency. As industries increasingly prioritize cost-saving and energy-saving measures, the adoption of advanced technologies is accelerating, further boosting market growth.

Steam trap help reduce energy consumption by effectively discharging condensate while preventing steam loss. Inefficient or malfunctioning traps can lead to energy losses of up to 25% in certain systems, particularly in sectors such as chemical manufacturing, food and beverages, and pharmaceuticals, where steam is integral to many processes The rising trend toward preventive maintenance and the adoption of IoT-based monitoring systems is driving industries to enhance steam trap performance through predictive maintenance, thus improving overall energy efficiency.

In addition to technological advancements, regulatory pressure is pushing industries toward more sustainable practices, including reducing carbon emissions, which is further driving the demand for efficient steam management solutions. The industrial sector accounts for nearly 40% of global energy consumption, with steam systems consuming 30% of energy in manufacturing. As governments and industries focus more on clean energy transitions and reducing energy losses, there is a growing demand for energy-efficient technologies like steam traps. This trend is accelerating the market as industries strive to optimize energy use, reduce emissions, and improve cost-efficiency in their steam systems.

Steam Trap Market Dynamics

Drivers

-

Energy Efficiency and Cost Savings Fueling the Rising Demand for Steam Traps Across Industries

These vital components in steam systems play a critical role in ensuring the efficient use of steam while preventing costly steam leaks. Steam loss not only raises operational expenses but also leads to increased carbon emissions, making energy efficiency a crucial goal for businesses striving to minimize their environmental impact. Steam traps contribute to improved system performance by effectively removing condensate and preventing steam from escaping. The advent of IoT-based monitoring systems has further advanced steam trap performance, allowing for predictive maintenance, minimizing downtime, and reducing maintenance costs. Industries such as chemical manufacturing, food and beverage, and pharmaceuticals, where steam is essential for many processes, are increasingly adopting steam traps to improve energy efficiency and operational effectiveness. Additionally, the growing adoption of energy-saving technologies aligns with global sustainability efforts and regulatory requirements, as industries are pressured to reduce energy usage and emissions.

Restraints

-

Impact of Improper Installation and Maintenance on Steam Trap Efficiency and System Performance

Improper installation and maintenance of steam traps can severely affect the efficiency and performance of steam systems, leading to operational failures, energy loss, and increased costs. Steam traps play a vital role in removing condensate from steam lines while allowing steam to pass through. When these traps are not correctly installed, they may fail to function properly, causing condensate buildup in the system, which results in several issues. Improper sizing or placement of steam traps can hinder their ability to remove condensate efficiently, leading to steam loss, reduced heating efficiency, and increased energy consumption as the system works harder to maintain pressure and temperature. One of the key functions of steam traps is to prevent heat loss by discharging condensate without allowing steam to escape. However, poorly installed or maintained traps may allow steam leakage or fail to remove condensate effectively, resulting in energy inefficiency, particularly costly in industries using large volumes of steam. Over time, inadequate installation can cause mechanical failures, clogging, or corrosion, leading to issues like water hammer, pressure fluctuations, and excessive condensate buildup, which disrupt operations and lead to costly repairs and downtime. Additionally, poorly installed traps can cause overpressure or moisture buildup in steam lines, accelerating wear and tear on equipment and shortening its lifespan. Inadequate maintenance, including failure to clean or inspect traps regularly, can worsen these problems. To prevent these issues, companies must prioritize proper installation, follow manufacturer guidelines, and conduct regular maintenance to ensure optimal performance and extend equipment longevity.

Steam Trap Market Segment Analysis

by Product

Based on Product, Mechanical Segment is dominate the largest share revenue in steam trap market of around 44% in 2023 Mechanical steam traps continue to lead the market due to their robust construction, reliability, and simple design, making them highly preferred across various industries. They operate using a float mechanism that controls the valve based on condensate levels, excelling at handling large volumes in high-pressure systems. Their cost-effectiveness and low-maintenance nature appeal to industries seeking durable solutions. Commonly used in chemical processing, oil and gas, and food and beverage sectors, mechanical traps ensure efficient condensate removal for smooth operations. With fewer moving parts, they are less prone to failure, offering extended service life, even in harsh environments.

by Body Material

Based on Body Material, The steel segment dominated the steam trap market, capturing around 59% in 2023, due to its exceptional durability, corrosion resistance, and strength. These properties make steel ideal for high-performance applications in harsh environments, such as power plants, chemical processing, and oil and gas. Steel’s ability to withstand high temperatures, pressure, and exposure to corrosive substances ensures reliable operation and extended lifespan, minimizing the risk of failure. Steel steam traps enhance energy efficiency, reduce operational costs, and lower maintenance expenses. Their versatility across industries like food, beverage, and pharmaceuticals further solidifies their importance in maintaining consistent steam system operation.

Steam Trap Market Regional Outlook

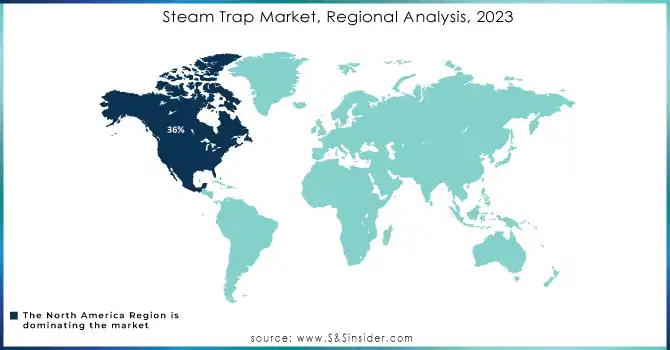

In 2023, North America holds a dominant 36% share of the steam trap market, driven by a strong industrial base and significant investments in sectors like oil and gas, power generation, chemical processing, and food and beverage. The region’s focus on energy efficiency and sustainability fuels the demand for steam traps as industries seek to optimize steam systems and reduce operational costs. Key factors include industrial growth, technological advancements in automation and predictive maintenance, and government regulations promoting energy efficiency and environmental sustainability. The U.S. leads with substantial investments in energy and manufacturing, while Canada’s focus on sustainable energy further drives the demand for steam traps across various industries.

Get Customized Report as Per Your Business Requirement - Request For Customized Report

Key Players

Some of the major key players in Steam Trap Market with their products:

-

Emerson Electric Co. (Mechanical, Thermodynamic, Thermostatic Steam Traps)

-

Velan Inc. (Thermodynamic, Thermostatic Steam Traps)

-

Aventics GmbH (Parker Hannifin) (Mechanical, Thermodynamic Steam Traps)

-

Spirax Sarco Ltd. (Mechanical, Thermodynamic, Thermostatic Steam Traps)

-

GROVE U.S. LLC (Mechanical, Thermostatic Steam Traps)

-

TLV Co. Ltd. (Mechanical, Thermodynamic, Thermostatic Steam Traps)

-

KSB SE & Co. KGaA (Mechanical, Thermodynamic Steam Traps)

-

Pentair plc (Mechanical, Thermodynamic Steam Traps)

-

Bosch Rexroth AG (Mechanical Steam Traps)

-

IMI Critical Engineering (Mechanical, Thermostatic Steam Traps)

-

Thermodyne Engineering Systems (Thermodynamic Steam Traps)

-

Xylem Inc. (Thermodynamic, Thermostatic Steam Traps)

-

Cameron International Corporation (Mechanical, Thermodynamic Steam Traps)

-

Danfoss Group (Thermostatic, Thermodynamic Steam Traps)

-

Samson AG (Mechanical, Thermostatic Steam Traps)

-

M&M International (Mechanical, Thermostatic Steam Traps)

-

Watson McDaniel (Mechanical, Thermodynamic Steam Traps)

-

Flowserve Corporation (Mechanical, Thermodynamic Steam Traps)

-

Schneider Electric (Mechanical, Thermostatic Steam Traps)

-

AFT Inc. (Thermodynamic, Thermostatic Steam Traps)

List of companies that supply raw materials for the steam trap market:

-

ArcelorMittal

-

Thyssenkrupp Materials NA

-

POSCO

-

Nippon Steel Corporation

-

AK Steel (Cleveland-Cliffs Inc.)

-

Outokumpu

-

Vallourec

-

Sandvik

-

United States Steel Corporation (U.S. Steel)

-

Schmolz + Bickenbach

-

Hyundai Steel

-

Thyssenkrupp Stainless GmbH

Recent Development

On October 28, 2024, IMI announced the launch of its Steam Trap Monitoring (STM-10) system at ADIPEC 2024. The system features advanced IIoT technology with wireless sensors and smart algorithms to detect blockages or leaks in steam traps, optimizing steam system performance and reducing maintenance costs.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 4.14 Billion |

| Market Size by 2032 | USD 5.94 Billion |

| CAGR | CAGR of 4.09% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Product (Mechanical, Thermodynamics, Thermostatic) • By Body Material (Steel, Iron, Others) • By Application (Tracing Application, Drip Application, Process Application) • By End-Use( Chemical, Oil & Gas, Food & Beverage, Energy & Power, Pharmaceutical, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Emerson Electric Co., Velan Inc., Aventics GmbH (Parker Hannifin), Spirax Sarco Ltd., GROVE U.S. LLC, TLV Co. Ltd., KSB SE & Co. KGaA, Pentair plc, Bosch Rexroth AG, IMI Critical Engineering, Thermodyne Engineering Systems, Xylem Inc., Cameron International Corporation, Danfoss Group, Samson AG, M&M International, Watson McDaniel, Flowserve Corporation, Schneider Electric, and AFT Inc. are key players in the steam trap market. |

| Key Drivers | • Energy Efficiency and Cost Savings Fueling the Rising Demand for Steam Traps Across Industries. |

| Restraints | • Impact of Improper Installation and Maintenance on Steam Trap Efficiency and System Performance. |