Steel Wire Market Report Scope & Overview:

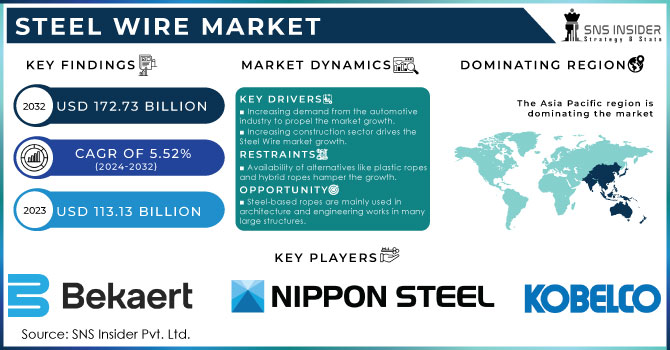

The Steel Wire Market Size was valued at USD 102.1 billion in 2023 and is expected to reach USD 167.4 billion by 2032 and grow at a CAGR of 5.7% over the forecast period 2024-2032.

During the projected period, rising investments in the construction sector are expected to support market expansion. Ropes and strands, which are downstream products of steel wires, are used extensively in the construction sector, including as additional reinforcement in towers and as a means of sustaining suspension bridges. They are widely utilized in the construction of prestressed concrete, which supports large retaining walls, runways, roofs, and floor beams.

Get E-PDF Sample Report on Steel Wire Market - Request Sample Report

The U.S. increasing construction expenditures are expected to increase the nation's need for steel wires. The United States will require more than USD 2600 billion over the course of the next ten years to meet its infrastructure repair needs, according to the American Society of Civil Engineers. In November 2021, the government approved USD 550 billion in funding for infrastructure improvements under the Infrastructure Investment and Jobs Act.

Another significant end-use for steel wire ropes in the market is the automotive sector, where they are used to produce different vehicle parts, move weights, and place equipment. Moreover, radial vehicle tires, wire pads, cables, exhaust lines, fasteners, and wire pads are some additional end uses. It is anticipated that the market will gain from the renewed emphasis on raising auto output.

It is expected that the market's growth will be limited due to the availability of alternatives such as plastic ropes. Some small-scale producers have shifted to using plastic ropes because of factors like cost-effectiveness and sustainability, which come with advantages including lighter products, more stability, and reduced production waste. Thus, over the next several years, it is anticipated that expanding developments in the creation of plastic ropes will obstruct market growth.

Steel Wire Market Dynamics

Drivers

-

Increasing demand from the automotive industry to propel the market growth.

One of the primary applications for steel wire in the automotive industry is tire bead reinforcement. It is a substance that is frequently utilized in the automotive industry to give windshields and other components performance, durability, and safety. These wires are employed in the automotive sector as wire strands that are twisted together to create a helix structure, which is then utilized in production lines, hoists, and different kinds of cranes. In military vehicles, wire rope isolators rely heavily on this wire. Wire rope isolators are made to endure harsh conditions and strong vibrations and shocks. They are perfect for military vehicles like tanks, jeeps, and airplanes that are subjected to explosives or difficult terrain because of their functionality.

The market for electric vehicles is increasing quickly. Among the essential parts of electric vehicles is the electric wire harness. In comparison to traditional ICE vehicles, electric vehicles require three times more wire harnesses, which are provided by auto component suppliers. Therefore, businesses in the cables and wires sector should see a rise in production volume due to the growing demand for EVs. During the projected period, the expanding electric vehicle industry is expected to support steel wire market growth.

-

Increasing construction sector drives the Steel Wire market growth.

Restraint

-

Availability of alternatives like plastic ropes and hybrid ropes hamper the growth.

Some small-scale producers have switched to using plastic ropes because of its advantages such as high stability, low product weight, and less production waste. Sustainability and affordability are two of these benefits. Because of this, it is projected that the development of plastic ropes will continue to advance, which will limit steel wire market growth. Due to its benefits, the production of plastic and hybrid ropes has increased which hampered the market growth.

Opportunities

- Steel-based ropes are mainly used in architecture and engineering works in many large structures.

Steel Wire Market Segmentation

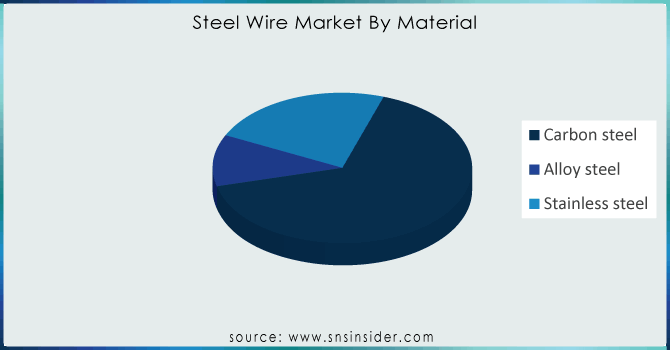

By Material

-

Carbon steel

-

Alloy steel

-

Stainless steel

The carbon steel dominated the steel wire market with the highest revenue share of more than 66% in 2023 and it is projected that this tendency holds throughout the upcoming period. Wires are made from both low- and high-carbon steel and are mostly utilized in the construction, automotive, and military industries. A wide range of diameters, from 0.2 mm to 8 mm, can be drawn into them.

High carbon steel wire is used in cutting silicon ingots for the musical instruments, solar industry, bridge cables and tire reinforcement materials. These have less ductility but are stronger than low carbon. Additional benefits of carbon steel wire are its durability, safety during handling, and recyclable nature. These features, together with the fact that they are widely used in industries like equipment, railroads, construction, and other similar ones, should accelerate the expansion of this market.

Over the course of the projected period, stainless steel is expected to increase at the fastest rate. This material's wires are utilized in hardware, screws, cables, metallic nets, and springs. Because of qualities like strong corrosion resistance, pressure resistance, hygiene, aesthetics, imperviousness to heat and fire, flexibility, and longevity, it is highly demanded in industries like electronics, oil, and kitchenware. Its high cost in comparison to other materials is the reason for its poor market share.

Get Customized Report as Per Your Business Requirement - Request For Customized Report

By End User

-

Automotive

-

Industrial

-

Energy

-

Agriculture

-

Construction

-

Other

The construction segment held the highest revenue share of more than 42.54% in 2023. The segment's dominance is expected to be sustained during the forecast period by the widespread usage of steel wire-based ropes, cables, strands, and cords in moving equipment, supporting structures, and other applications in the construction industry.

Over the course of the projection period, energy is expected to increase at the quickest rate of any application segment. Massive investments in the energy sector are being driven by the expanding need for power and its distribution, which is good for market expansion. For instance, in April 2022, Dubai, has invested worth USD 10.9 billion for the following five years. This investment plan covered clean and renewable energy, distribution networks, and water and electricity projects.

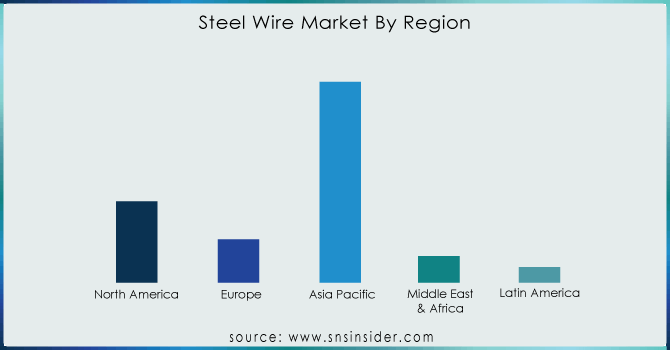

Steel Wire Market Regional Analysis

Asia Pacific led the Steel Wire market with the highest revenue share of around 58.45% in 2023. The presence of producers, end users, and raw material suppliers accounts for the region's strength. Asia's manufacturers are producing more to satisfy the needs of their home and international markets. For example, in October 2021, India's Rajratan Global Wire Limited has started a production facility in Chennai, Tamil Nadu with an annual capacity of 60 kilotons to meet domestic demand in the Europe and U.S.

It is projected that the region with the quickest rate of growth in the worldwide market would be North America. Increasing investments in the energy, industrial, and construction sectors are expected to boost product demand in the region during the course of the projected period. In October 2021, for example, the American company WTEC announced that it would be establishing a new production facility in Chamberino, New Mexico. The business manufactures steel wire cables for wind and solar energy systems.

REGIONAL COVERAGE

North America

-

USA

-

Canada

-

Mexico

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

The Netherlands

-

Rest of Europe

Asia-Pacific

-

Japan

-

South Korea

-

China

-

India

-

Australia

-

Rest of Asia-Pacific

The Middle East & Africa

-

Israel

-

UAE

-

South Africa

-

Rest of the Middle East & Africa

Latin America

-

Brazil

-

Argentina

-

Rest of Latin American

KEY PLAYERS

ArcelorMittal, Bekaert, JFE Steel Holding, Nippon Steel Co, Tianjin Huayuan Metal Wire Products Co. Ltd., VAN MERKSTEIJN INTERNATIONAL. Tata Steel, Kobe Steel Limited, Insteel Industries, WireCo WorldGroup Inc., and other key players are mentioned in the final report.

RECENT DEVELOPMENTS

-

In 2024, Van Merksteijn has resumed its plans for a new greenfield wire rod factory in the Netherlands, with construction set to begin this year. Production is scheduled to with an estimated investment of USD 344 million.

-

In July 2023, KOBE Steel has launched Kobenable Steel, and Japan is the first country where autos made of low-CO2 blast furnace steel have chosen to use unique steel wire rods.

-

In March 2022, VisionTek Engineering Srl has been acquired by Bridon-Bekaert Ropes Group. In order to grow and offer cutting-edge services in the steel wire and rope industry, this acquisition was a crucial strategic move

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 102.1 billion |

| Market Size by 2032 | US$ 167.4 Billion |

| CAGR | CAGR of 5.7% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | •By Material (Carbon Steel, Alloy Steel, Stainless Steel) • By End User (Automotive, Industrial, Energy, Agriculture, Construction, Other) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | ArcelorMittal, Bekaert, JFE Steel Holding, Nippon Steel Co, Tianjin Huayuan Metal Wire Products Co. Ltd., Van Merksteijn International. Tata Steel, Kobe Steel Limited, Insteel Industries, WireCo WorldGroup Inc., and others |

| Key Drivers | • Increasing demand from the automotive industry to propel the market growth |

| Restraints | • Availability of alternatives like plastic ropes and hybrid ropes hamper the growth |