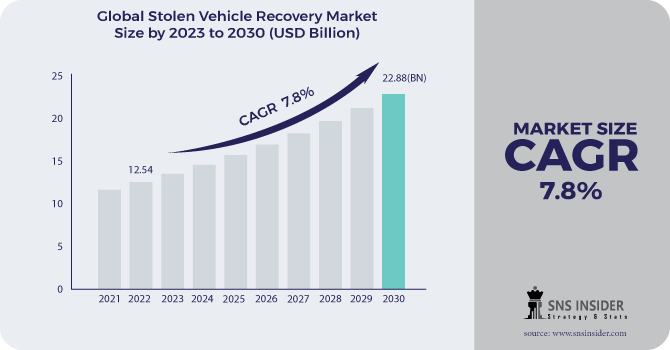

The Stolen Vehicle Recovery Market Size was valued at USD 7 billion in 2023 and is expected to reach USD 12.48 billion by 2031 and grow at a CAGR of 7.5% over the forecast period 2024-2031.

The stolen vehicle security system is an intelligent, dependable, and effective system that uses various components to eliminate the possibility of vehicle theft, such as a central locking system, remote keyless entry system, and ultrasonic intruder protection system (UIP), and automatic collision detection system. This security system comprises threat detection, prevention, and reaction using various technologies such as radio frequency identification and ultrasonic.

Get More Information on Stolen Vehicle Recovery Market - Request Sample Report

The purpose of stolen car recovery systems is to safeguard high-value automobiles belonging to users in order to facilitate their prompt recovery in the event that they are stolen. It uses a variety of technologies to either monitor the location of a car in real-time or provide a history of the vehicle's locations over time. This allows it to keep track of where a vehicle is at all times. The majority of these devices collect data using global positioning system (GPS) technology, but others collect data using cellular or radio transmitters.

In 2020, CalAmp, the brand owner of LoJack and Transunion, announced the launch of LoJack Stolen Vehicle Recovery (SVR) services for insurance carriers which aims to drastically reduce stolen vehicle losses worldwide, and improve risk management, and increase vehicle recovery rates for consumers.

KEY DRIVERS:

Increased consumer awareness is propelling the market for recovering stolen vehicles to new heights

The market for biometric vehicle security is growing

The growing consciousness among customers regarding the importance of vehicle safety

Rising numbers of both passenger and commercial automobiles are being manufactured

Improvement in the precision of vehicle recovery systems

RESTRAINTS:

The market for stolen vehicle recovery is hampered by the high cost of stolen vehicle recovery equipment

During the projection period, the probable failure of electronic components may operate as a market restraint

OPPORTUNITIES:

The opportunity is provided by advancements in stolen car recovery system technology

The market for IoT-enabled vehicle recovery will see significant growth

IoT solution providers have established geo-location-based on network triangulation to locate stolen vehicles

CHALLENGES:

The high price of stolen car security systems may be a market challenge

Anti-theft systems have advanced technologically

COVID-19 has had a negative influence on the stolen vehicle recovery business as a result of a large decrease in automobile spending. The imposition of lockdowns and the suspension of economic operations by a number of countries in an effort to limit the risk of pandemic spread led to a major decrease in sales, which was followed by a decline in trust among consumers. However, once the effects of the pandemic begin to subside, the market for recovered stolen vehicles will once again pick up speed. As a result of the execution of government directives, it is anticipated that travel and trade will restart, albeit at a reduced capacity. This will provide a bright picture for the market for the recovery of stolen vehicles throughout the projection period.

Ultrasonic

Radio Frequency Identification

Others

Based on the technology segment, the global market has been divided into Ultrasonic, Radio Frequency Identification, and Others based automotive brake linings. The radio frequency identification subsegment of the stolen vehicle recovery market is anticipated to have the greatest amount of market share due to the fact that it assists in recognizing the movement of the thief via the use of radio waves. Through the use of radio waves, information may be sent to a little chip that is attached to the object, allowing the object to be located, identified, and tracked.

Market, By Component:

Ultrasonic Intruder Protection System (UIP)

Backup Battery Siren (BBS)

Central Locking System

Automatic Collision Detection System

Automatic Driver Recognition System (ADRS)

Remote Keyless Entry System

Others

The global market has been divided into Ultrasonic Intruder Protection System (UIP), Backup Battery Siren (BBS), Central Locking System, Automatic Collision Detection System, Automatic Driver Recognition System (ADRS), Remote Keyless Entry System, and Others Based on the component segment. Over the course of the time covered by this forecast, the central locking system will have the majority share of the market.

Market, By Vehicle type:

Passenger cars

Commercial vehicles

The global market has been divided into passenger cars and commercial vehicles based on the vehicle type segment. Over the course of the analysis period, passenger automobiles are expected to dominate the market.

Get Customized Report as per your Business Requirement - Ask For Customized Report

In comparison to other regions, such as North America and Europe, it is anticipated that the demand for stolen car tracking systems will be greatest in the Asia Pacific region. Despite a recent trend of falling sales, major companies in the market for stolen car monitoring systems have shown a significant amount of interest in China and India since they have emerged as the world's largest automobile marketplaces in recent years. Over the projection period, the APAC region will lead the stolen car recovery market. In terms of market share, China, India, and Japan have the most. The growth of the global stolen vehicle recovery market in the Asia-Pacific region is being fueled by the increasing demand for automobiles in India and China, the presence of major manufacturers and operating units of global players, and rising demand from SMEs and various industries verticals, and the booming automobile market.

REGIONAL COVERAGE:

North America

US

Canada

Mexico

Europe

Eastern Europe

Poland

Romania

Hungary

Turkey

Rest of Eastern Europe

Western Europe

Germany

France

UK

Italy

Spain

Netherlands

Switzerland

Austria

Rest of Western Europe

Asia Pacific

China

India

Japan

South Korea

Vietnam

Singapore

Australia

Rest of Asia Pacific

Middle East & Africa

Middle East

UAE

Egypt

Saudi Arabia

Qatar

Rest of Middle East

Africa

Nigeria

South Africa

Rest of Africa

Latin America

Brazil

Argentina

Colombia

Rest of Latin America

Denso Corporation (Japan), Robert Bosch GmbH (Germany), HELLA GmbH & Co. KGaA (Germany), Valeo (France), Mitsubishi Electric Corporation (Japan), Continental AG (Germany), Lear Corporation (US), CalAmp, Tokairika, Co, Ltd (Japan), OMRON Corporation (Japan), and are some of the affluent competitors with significant market share in the Stolen Vehicle Recovery Market.

Denso Corporation (Japan)-Company Financial Analysis

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 7 Billion |

| Market Size by 2031 | US$ 12.48 Billion |

| CAGR | CAGR of 7.5% From 2023 to 2030 |

| Base Year | 2023 |

| Forecast Period | 2024-2031 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • by Technology (Ultrasonic, Radio Frequency Identification, Others) • by Component (Ultrasonic Intruder Protection System (UIP), Backup Battery Siren (BBS), Central Locking System, Automatic Collision Detection System, Automatic Driver Recognition System (ADRS), Remote Keyless Entry System, Others) • by Vehicle Type (Passenger cars, Commercial vehicles) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Denso Corporation (Japan), Robert Bosch GmbH (Germany), HELLA GmbH & Co. KGaA (Germany), Valeo (France), Mitsubishi Electric Corporation (Japan), Continental AG (Germany), Lear Corporation (US), CalAmp, Tokairika, Co, Ltd (Japan), OMRON Corporation (Japan), and ALPS Alpine Co., Ltd (Japan) |

| Key Drivers | •Increased consumer awareness is propelling the market for recovering stolen vehicles to new heights. •The market for biometric vehicle security is growing. |

| RESTRAINTS | •The market for stolen vehicle recovery is hampered by the high cost of stolen vehicle recovery equipment. •During the projection period, the probable failure of electronic components may operate as a market restraint. |

USD 7 billion is the market value in 2023.

The forecast period of the Stolen Vehicle Recovery Market is 2024-2031.

COVID-19 has had a negative influence on the stolen vehicle recovery business as a result of a large decrease in automobile spending. The imposition of lockdowns and the suspension of economic operations by a number of countries in an effort to limit the risk of pandemic spread led to a major decrease in sales, which was followed by a decline in trust among consumers.

The Asia Pacific region high share of the Stolen Vehicle Recovery Market

TABLE OF CONTENTS

1. Introduction

1.1 Market Definition

1.2 Scope

1.3 Research Assumptions

2. Industry Flowchart

3. Research Methodology

4. Market Dynamics

4.1 Drivers

4.2 Restraints

4.3 Opportunities

4.4 Challenges

5. Impact Analysis

5.1 Impact of Russia-Ukraine Crisis

5.2 Impact of Economic Slowdown on Major Countries

5.2.1 Introduction

5.2.2 United States

5.2.3 Canada

5.2.4 Germany

5.2.5 France

5.2.6 UK

5.2.7 China

5.2.8 Japan

5.2.9 South Korea

5.2.10 India

6. Value Chain Analysis

7. Porter’s 5 Forces Model

8. Pest Analysis

9. Stolen Vehicle Recovery Market Segmentation, By Technology

9.1 Introduction

9.2 Trend Analysis

9.3 Ultrasonic

9.4 Radio Frequency Identification

9.5 Others

10. Stolen Vehicle Recovery Market Segmentation, By Component

10.1 Introduction

10.2 Trend Analysis

10.3 Ultrasonic Intruder Protection System (UIP)

10.4 Backup Battery Siren (BBS)

10.5 Central Locking System

10.6 Automatic Collision Detection System

10.7 Automatic Driver Recognition System (ADRS)

10.8 Remote Keyless Entry System

10.9 Others

11. Stolen Vehicle Recovery Market Segmentation, By Vehicle Type

11.1 Introduction

11.2 Trend Analysis

11.3 Passenger cars

11.4 Commercial vehicles

12. Regional Analysis

12.1 Introduction

12.2 North America

12.2.1 Trend Analysis

12.2.2 North America Stolen Vehicle Recovery Market by Country

12.2.3 North America Stolen Vehicle Recovery Market By Technology

12.2.4 North America Stolen Vehicle Recovery Market By Component

12.2.5 North America Stolen Vehicle Recovery Market By Vehicle Type

12.2.6 USA

12.2.6.1 USA Stolen Vehicle Recovery Market By Technology

12.2.6.2 USA Stolen Vehicle Recovery Market By Component

12.2.6.3 USA Stolen Vehicle Recovery Market By Vehicle Type

12.2.7 Canada

12.2.7.1 Canada Stolen Vehicle Recovery Market By Technology

12.2.7.2 Canada Stolen Vehicle Recovery Market By Component

12.2.7.3 Canada Stolen Vehicle Recovery Market By Vehicle Type

12.2.8 Mexico

12.2.8.1 Mexico Stolen Vehicle Recovery Market By Technology

12.2.8.2 Mexico Stolen Vehicle Recovery Market By Component

12.2.8.3 Mexico Stolen Vehicle Recovery Market By Vehicle Type

12.3 Europe

12.3.1 Trend Analysis

12.3.2 Eastern Europe

12.3.2.1 Eastern Europe Stolen Vehicle Recovery Market by Country

12.3.2.2 Eastern Europe Stolen Vehicle Recovery Market By Technology

12.3.2.3 Eastern Europe Stolen Vehicle Recovery Market By Component

12.3.2.4 Eastern Europe Stolen Vehicle Recovery Market By Vehicle Type

12.3.2.5 Poland

12.3.2.5.1 Poland Stolen Vehicle Recovery Market By Technology

12.3.2.5.2 Poland Stolen Vehicle Recovery Market By Component

12.3.2.5.3 Poland Stolen Vehicle Recovery Market By Vehicle Type

12.3.2.6 Romania

12.3.2.6.1 Romania Stolen Vehicle Recovery Market By Technology

12.3.2.6.2 Romania Stolen Vehicle Recovery Market By Component

12.3.2.6.4 Romania Stolen Vehicle Recovery Market By Vehicle Type

12.3.2.7 Hungary

12.3.2.7.1 Hungary Stolen Vehicle Recovery Market By Technology

12.3.2.7.2 Hungary Stolen Vehicle Recovery Market By Component

12.3.2.7.3 Hungary Stolen Vehicle Recovery Market By Vehicle Type

12.3.2.8 Turkey

12.3.2.8.1 Turkey Stolen Vehicle Recovery Market By Technology

12.3.2.8.2 Turkey Stolen Vehicle Recovery Market By Component

12.3.2.8.3 Turkey Stolen Vehicle Recovery Market By Vehicle Type

12.3.2.9 Rest of Eastern Europe

12.3.2.9.1 Rest of Eastern Europe Stolen Vehicle Recovery Market By Technology

12.3.2.9.2 Rest of Eastern Europe Stolen Vehicle Recovery Market By Component

12.3.2.9.3 Rest of Eastern Europe Stolen Vehicle Recovery Market By Vehicle Type

12.3.3 Western Europe

12.3.3.1 Western Europe Stolen Vehicle Recovery Market by Country

12.3.3.2 Western Europe Stolen Vehicle Recovery Market By Technology

12.3.3.3 Western Europe Stolen Vehicle Recovery Market By Component

12.3.3.4 Western Europe Stolen Vehicle Recovery Market By Vehicle Type

12.3.3.5 Germany

12.3.3.5.1 Germany Stolen Vehicle Recovery Market By Technology

12.3.3.5.2 Germany Stolen Vehicle Recovery Market By Component

12.3.3.5.3 Germany Stolen Vehicle Recovery Market By Vehicle Type

12.3.3.6 France

12.3.3.6.1 France Stolen Vehicle Recovery Market By Technology

12.3.3.6.2 France Stolen Vehicle Recovery Market By Component

12.3.3.6.3 France Stolen Vehicle Recovery Market By Vehicle Type

12.3.3.7 UK

12.3.3.7.1 UK Stolen Vehicle Recovery Market By Technology

12.3.3.7.2 UK Stolen Vehicle Recovery Market By Component

12.3.3.7.3 UK Stolen Vehicle Recovery Market By Vehicle Type

12.3.3.8 Italy

12.3.3.8.1 Italy Stolen Vehicle Recovery Market By Technology

12.3.3.8.2 Italy Stolen Vehicle Recovery Market By Component

12.3.3.8.3 Italy Stolen Vehicle Recovery Market By Vehicle Type

12.3.3.9 Spain

12.3.3.9.1 Spain Stolen Vehicle Recovery Market By Technology

12.3.3.9.2 Spain Stolen Vehicle Recovery Market By Component

12.3.3.9.3 Spain Stolen Vehicle Recovery Market By Vehicle Type

12.3.3.10 Netherlands

12.3.3.10.1 Netherlands Stolen Vehicle Recovery Market By Technology

12.3.3.10.2 Netherlands Stolen Vehicle Recovery Market By Component

12.3.3.10.3 Netherlands Stolen Vehicle Recovery Market By Vehicle Type

12.3.3.11 Switzerland

12.3.3.11.1 Switzerland Stolen Vehicle Recovery Market By Technology

12.3.3.11.2 Switzerland Stolen Vehicle Recovery Market By Component

12.3.3.11.3 Switzerland Stolen Vehicle Recovery Market By Vehicle Type

12.3.3.1.12 Austria

12.3.3.12.1 Austria Stolen Vehicle Recovery Market By Technology

12.3.3.12.2 Austria Stolen Vehicle Recovery Market By Component

12.3.3.12.3 Austria Stolen Vehicle Recovery Market By Vehicle Type

12.3.3.13 Rest of Western Europe

12.3.3.13.1 Rest of Western Europe Stolen Vehicle Recovery Market By Technology

12.3.3.13.2 Rest of Western Europe Stolen Vehicle Recovery Market By Component

12.3.3.13.3 Rest of Western Europe Stolen Vehicle Recovery Market By Vehicle Type

12.4 Asia-Pacific

12.4.1 Trend Analysis

12.4.2 Asia-Pacific Stolen Vehicle Recovery Market by Country

12.4.3 Asia-Pacific Stolen Vehicle Recovery Market By Technology

12.4.4 Asia-Pacific Stolen Vehicle Recovery Market By Component

12.4.5 Asia-Pacific Stolen Vehicle Recovery Market By Vehicle Type

12.4.6 China

12.4.6.1 China Stolen Vehicle Recovery Market By Technology

12.4.6.2 China Stolen Vehicle Recovery Market By Component

12.4.6.3 China Stolen Vehicle Recovery Market By Vehicle Type

12.4.7 India

12.4.7.1 India Stolen Vehicle Recovery Market By Technology

12.4.7.2 India Stolen Vehicle Recovery Market By Component

12.4.7.3 India Stolen Vehicle Recovery Market By Vehicle Type

12.4.8 Japan

12.4.8.1 Japan Stolen Vehicle Recovery Market By Technology

12.4.8.2 Japan Stolen Vehicle Recovery Market By Component

12.4.8.3 Japan Stolen Vehicle Recovery Market By Vehicle Type

12.4.9 South Korea

12.4.9.1 South Korea Stolen Vehicle Recovery Market By Technology

12.4.9.2 South Korea Stolen Vehicle Recovery Market By Component

12.4.9.3 South Korea Stolen Vehicle Recovery Market By Vehicle Type

12.4.10 Vietnam

12.4.10.1 Vietnam Stolen Vehicle Recovery Market By Technology

12.4.10.2 Vietnam Stolen Vehicle Recovery Market By Component

12.4.10.3 Vietnam Stolen Vehicle Recovery Market By Vehicle Type

12.4.11 Singapore

12.4.11.1 Singapore Stolen Vehicle Recovery Market By Technology

12.4.11.2 Singapore Stolen Vehicle Recovery Market By Component

12.4.11.3 Singapore Stolen Vehicle Recovery Market By Vehicle Type

12.4.12 Australia

12.4.12.1 Australia Stolen Vehicle Recovery Market By Technology

12.4.12.2 Australia Stolen Vehicle Recovery Market By Component

12.4.12.3 Australia Stolen Vehicle Recovery Market By Vehicle Type

12.4.13 Rest of Asia-Pacific

12.4.13.1 Rest of Asia-Pacific Stolen Vehicle Recovery Market By Technology

12.4.13.2 Rest of Asia-Pacific Stolen Vehicle Recovery Market By Component

12.4.13.3 Rest of Asia-Pacific Stolen Vehicle Recovery Market By Vehicle Type

12.5 Middle East & Africa

12.5.1 Trend Analysis

12.5.2 Middle East

12.5.2.1 Middle East Stolen Vehicle Recovery Market by Country

12.5.2.2 Middle East Stolen Vehicle Recovery Market By Technology

12.5.2.3 Middle East Stolen Vehicle Recovery Market By Component

12.5.2.4 Middle East Stolen Vehicle Recovery Market By Vehicle Type

12.5.2.5 UAE

12.5.2.5.1 UAE Stolen Vehicle Recovery Market By Technology

12.5.2.5.2 UAE Stolen Vehicle Recovery Market By Component

12.5.2.5.3 UAE Stolen Vehicle Recovery Market By Vehicle Type

12.5.2.6 Egypt

12.5.2.6.1 Egypt Stolen Vehicle Recovery Market By Technology

12.5.2.6.2 Egypt Stolen Vehicle Recovery Market By Component

12.5.2.6.3 Egypt Stolen Vehicle Recovery Market By Vehicle Type

12.5.2.7 Saudi Arabia

12.5.2.7.1 Saudi Arabia Stolen Vehicle Recovery Market By Technology

12.5.2.7.2 Saudi Arabia Stolen Vehicle Recovery Market By Component

12.5.2.7.3 Saudi Arabia Stolen Vehicle Recovery Market By Vehicle Type

12.5.2.8 Qatar

12.5.2.8.1 Qatar Stolen Vehicle Recovery Market By Technology

12.5.2.8.2 Qatar Stolen Vehicle Recovery Market By Component

12.5.2.8.3 Qatar Stolen Vehicle Recovery Market By Vehicle Type

12.5.2.9 Rest of Middle East

12.5.2.9.1 Rest of Middle East Stolen Vehicle Recovery Market By Technology

12.5.2.9.2 Rest of Middle East Stolen Vehicle Recovery Market By Component

12.5.2.9.3 Rest of Middle East Stolen Vehicle Recovery Market By Vehicle Type

12.5.3 Africa

12.5.3.1 Africa Stolen Vehicle Recovery Market by Country

12.5.3.2 Africa Stolen Vehicle Recovery Market By Technology

12.5.3.3 Africa Stolen Vehicle Recovery Market By Component

12.5.3.4 Africa Stolen Vehicle Recovery Market By Vehicle Type

12.5.3.5 Nigeria

12.5.3.5.1 Nigeria Stolen Vehicle Recovery Market By Technology

12.5.3.5.2 Nigeria Stolen Vehicle Recovery Market By Component

12.5.3.5.3 Nigeria Stolen Vehicle Recovery Market By Vehicle Type

12.5.3.6 South Africa

12.5.3.6.1 South Africa Stolen Vehicle Recovery Market By Technology

12.5.3.6.2 South Africa Stolen Vehicle Recovery Market By Component

12.5.3.6.3 South Africa Stolen Vehicle Recovery Market By Vehicle Type

12.5.3.7 Rest of Africa

12.5.3.7.1 Rest of Africa Stolen Vehicle Recovery Market By Technology

12.5.3.7.2 Rest of Africa Stolen Vehicle Recovery Market By Component

12.5.3.7.3 Rest of Africa Stolen Vehicle Recovery Market By Vehicle Type

12.6 Latin America

12.6.1 Trend Analysis

12.6.2 Latin America Stolen Vehicle Recovery Market by country

12.6.3 Latin America Stolen Vehicle Recovery Market By Technology

12.6.4 Latin America Stolen Vehicle Recovery Market By Component

12.6.5 Latin America Stolen Vehicle Recovery Market By Vehicle Type

12.6.6 Brazil

12.6.6.1 Brazil Stolen Vehicle Recovery Market By Technology

12.6.6.2 Brazil Stolen Vehicle Recovery Market By Component

12.6.6.3 Brazil Stolen Vehicle Recovery Market By Vehicle Type

12.6.7 Argentina

12.6.7.1 Argentina Stolen Vehicle Recovery Market By Technology

12.6.7.2 Argentina Stolen Vehicle Recovery Market By Component

12.6.7.3 Argentina Stolen Vehicle Recovery Market By Vehicle Type

12.6.8 Colombia

12.6.8.1 Colombia Stolen Vehicle Recovery Market By Technology

12.6.8.2 Colombia Stolen Vehicle Recovery Market By Component

12.6.8.3 Colombia Stolen Vehicle Recovery Market By Vehicle Type

12.6.9 Rest of Latin America

12.6.9.1 Rest of Latin America Stolen Vehicle Recovery Market By Technology

12.6.9.2 Rest of Latin America Stolen Vehicle Recovery Market By Component

12.6.9.3 Rest of Latin America Stolen Vehicle Recovery Market By Vehicle Type

13. Company Profiles

13.1 Denso Corporation

13.1.1 Company Overview

13.1.2 Financial

13.1.3 Products/ Services Offered

13.1.4 SWOT Analysis

13.1.5 The SNS View

13.2 Robert Bosch GmbH

13.2.1 Company Overview

13.2.2 Financial

13.2.3 Products/ Services Offered

13.2.4 SWOT Analysis

13.2.5 The SNS View

13.3 HELLA GmbH & Co. KGaA

13.3.1 Company Overview

13.3.2 Financial

13.3.3 Products/ Services Offered

13.3.4 SWOT Analysis

13.3.5 The SNS View

13.4 Valeo

13.4.1 Company Overview

13.4.2 Financial

13.4.3 Products/ Services Offered

13.4.4 SWOT Analysis

13.4.5 The SNS View

13.5 Mitsubishi Electric Corporation

13.5.1 Company Overview

13.5.2 Financial

13.5.3 Products/ Services Offered

13.5.4 SWOT Analysis

13.5.5 The SNS View

13.6 Continental AG

13.6.1 Company Overview

13.6.2 Financial

13.6.3 Products/ Services Offered

13.6.4 SWOT Analysis

13.6.5 The SNS View

13.7 Lear Corporation

13.7.1 Company Overview

13.7.2 Financial

13.7.3 Products/ Services Offered

13.7.4 SWOT Analysis

13.7.5 The SNS View

13.8 CalAmp

13.8.1 Company Overview

13.8.2 Financial

13.8.3 Products/ Services Offered

13.8.4 SWOT Analysis

13.8.5 The SNS View

13.9 Tokairika, Co, Ltd

13.9.1 Company Overview

13.9.2 Financial

13.9.3 Products/ Services Offered

13.9.4 SWOT Analysis

13.9.5 The SNS View

13.10 OMRON Corporation

13.10.1 Company Overview

13.10.2 Financial

13.10.3 Products/ Services Offered

13.10.4 SWOT Analysis

13.10.5 The SNS View

14. Competitive Landscape

14.1 Competitive Benchmarking

14.2 Market Share Analysis

14.3 Recent Developments

14.3.1 Industry News

14.3.2 Company News

14.3.3 Mergers & Acquisitions

15. Use Case and Best Practices

16. Conclusion

An accurate research report requires proper strategizing as well as implementation. There are multiple factors involved in the completion of good and accurate research report and selecting the best methodology to compete the research is the toughest part. Since the research reports we provide play a crucial role in any company’s decision-making process, therefore we at SNS Insider always believe that we should choose the best method which gives us results closer to reality. This allows us to reach at a stage wherein we can provide our clients best and accurate investment to output ratio.

Each report that we prepare takes a timeframe of 350-400 business hours for production. Starting from the selection of titles through a couple of in-depth brain storming session to the final QC process before uploading our titles on our website we dedicate around 350 working hours. The titles are selected based on their current market cap and the foreseen CAGR and growth.

The 5 steps process:

Step 1: Secondary Research:

Secondary Research or Desk Research is as the name suggests is a research process wherein, we collect data through the readily available information. In this process we use various paid and unpaid databases which our team has access to and gather data through the same. This includes examining of listed companies’ annual reports, Journals, SEC filling etc. Apart from this our team has access to various associations across the globe across different industries. Lastly, we have exchange relationships with various university as well as individual libraries.

Step 2: Primary Research

When we talk about primary research, it is a type of study in which the researchers collect relevant data samples directly, rather than relying on previously collected data. This type of research is focused on gaining content specific facts that can be sued to solve specific problems. Since the collected data is fresh and first hand therefore it makes the study more accurate and genuine.

We at SNS Insider have divided Primary Research into 2 parts.

Part 1 wherein we interview the KOLs of major players as well as the upcoming ones across various geographic regions. This allows us to have their view over the market scenario and acts as an important tool to come closer to the accurate market numbers. As many as 45 paid and unpaid primary interviews are taken from both the demand and supply side of the industry to make sure we land at an accurate judgement and analysis of the market.

This step involves the triangulation of data wherein our team analyses the interview transcripts, online survey responses and observation of on filed participants. The below mentioned chart should give a better understanding of the part 1 of the primary interview.

Part 2: In this part of primary research the data collected via secondary research and the part 1 of the primary research is validated with the interviews from individual consultants and subject matter experts.

Consultants are those set of people who have at least 12 years of experience and expertise within the industry whereas Subject Matter Experts are those with at least 15 years of experience behind their back within the same space. The data with the help of two main processes i.e., FGDs (Focused Group Discussions) and IDs (Individual Discussions). This gives us a 3rd party nonbiased primary view of the market scenario making it a more dependable one while collation of the data pointers.

Step 3: Data Bank Validation

Once all the information is collected via primary and secondary sources, we run that information for data validation. At our intelligence centre our research heads track a lot of information related to the market which includes the quarterly reports, the daily stock prices, and other relevant information. Our data bank server gets updated every fortnight and that is how the information which we collected using our primary and secondary information is revalidated in real time.

Step 4: QA/QC Process

After all the data collection and validation our team does a final level of quality check and quality assurance to get rid of any unwanted or undesired mistakes. This might include but not limited to getting rid of the any typos, duplication of numbers or missing of any important information. The people involved in this process include technical content writers, research heads and graphics people. Once this process is completed the title gets uploader on our platform for our clients to read it.

Step 5: Final QC/QA Process:

This is the last process and comes when the client has ordered the study. In this process a final QA/QC is done before the study is emailed to the client. Since we believe in giving our clients a good experience of our research studies, therefore, to make sure that we do not lack at our end in any way humanly possible we do a final round of quality check and then dispatch the study to the client.

The Tubeless Tire Market size is expected to reach USD 280 Bn by 2030, the market was valued at USD 160.8 Bn in 2022 and will grow at a CAGR of 7.05% over the forecast period of 2023-2030.

The Automotive Communication Technology Market Size was valued at USD 7.10 billion in 2022 and is expected to reach USD 22.61 billion by 2030 and grow at a CAGR of 15.57% over the forecast period 2023-2030.

The Automotive Parking Sensors Market Size was valued at USD 12 billion in 2023 and is expected to reach USD 38.02 billion by 2031 and grow at a CAGR of 15.5% over the forecast period 2024-2031.

The Light Commercial Vehicles Market Size was valued at USD 610.07 billion in 2023 and is expected to reach USD 936.27 billion by 2031 and grow at a CAGR of 5.5% over the forecast period 2024-2031.

The Electric Forklift Market size is expected to reach USD 152.30 Bn by 2030, the value for the year 2022 was recorded USD 56.89 Bn and the CAGR is expected to be 13.1% over the forecast year 2023-2030.

The Road Haulage Market size is expected to reach USD 4930 Bn by 2030, the value for the year 2022 was recorded USD 3427 Bn in 2022 and grow at a CAGR of 5.3% over the forecast period of 2023-2030.

Hi! Click one of our member below to chat on Phone