Road Haulage Market size Report Scope & Overview:

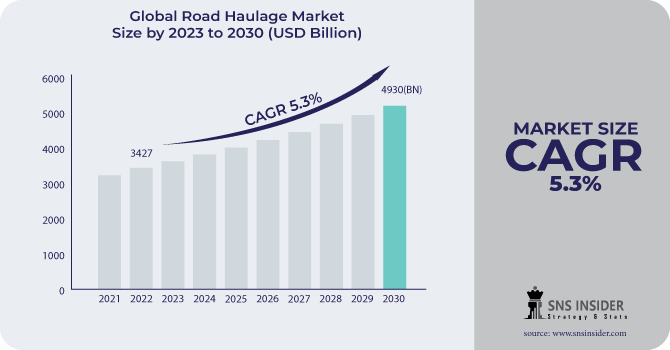

The Road Haulage Market size is expected to reach USD 4930 Bn by 2030, the value for the year 2022 was recorded USD 3427 Bn in 2022, and grow at a CAGR of 5.3% over the forecast period of 2023-2030.

Delivery vans, light trucks, big articulated lorries, and specialized vehicles for delivering particular types of cargo, like refrigerated trucks for perishable goods or tankers for liquids, can all be used in road haulage. Transporting and unloading cargo are the responsibilities of road haulage businesses. To ensure safe shipping, they frequently offer services including palletizing, packaging, and securing the Vehicle Types. Road haulage can include long-haul transportation between cities, states, or even countries, as well as short-haul local delivery inside a city. Depending on the particular requirements of the customer and the goods, a route and destination are chosen.

Transportation businesses are required to abide by a number of laws regarding highway safety, vehicle upkeep, driver hours, and environmental norms. By location and nation, these laws may differ. Those who need to transport Vehicle Types are known as shippers. Some businesses and people function as freight brokers, putting shippers in touch with haulage companies that have space available. In order to maximize the movement of Vehicle Types, freight brokers are important. The road haulage business has adopted technology for efficient logistics management, real-time shipment tracking, and route optimization. This speeds up deliveries and lowers costs. Making road haulage more sustainable is becoming increasingly popular due to worries about carbon emissions and environmental damage. This involves the use of alternative fuels, the deployment of electric and hybrid vehicles, and increased fuel efficiency.

The road haulage industry is highly competitive, with numerous businesses providing comparable services. Success frequently relies on elements including cost, dependability, client satisfaction, and the capacity to accommodate certain transportation requirements. Road haulage is a crucial component of global supply chains, which link producers, distributors, retailers, and customers. It is essential for ensuring that Vehicle Types efficiently reach their target audiences.

Market Dynamics

Driver

-

The increase in supply chain resilience which supports the growth of road haulage across industries.

Just-in-time inventory management systems have been implemented by many sectors to lower storage costs and boost productivity. This strategy depends on the prompt delivery of commodities, which frequently needs to be transported by road. Globalization of Supply networks: As parts and goods are supplied from many countries throughout the world, supply networks have become more and more globalized. Transporting commodities to and from ports, airports, and cross-border commerce hubs requires the use of the road network. Consumer expectations in terms of Vehicle Type customization and personalization have increased. The demand for road haulage services may increase as a result of lower batch sizes and more frequent deliveries. Customers have grown accustomed to receiving their orders more quickly, and many businesses have started offering express or same-day delivery services that mainly rely on road transportation.

Restrain

-

The effectiveness and safety of road haulage can be impacted by the state of the road infrastructure. In addition to raising car maintenance expenses, poorly maintained roads may result in delays from road closures or detours.

Opportunity

-

The rising investments by the government for road infrastructure.

The efficiency and dependability of road haulage operations have increased thanks to technological advancements like GPS navigation, telematics, and route planning software. Because of this, it is more lucrative for businesses and competitive. Although there are certain environmental issues with road haulage, efforts to cut emissions and increase fuel efficiency have made it a more environmentally friendly option for transportation than some alternatives, such as air cargo.

Challenge

-

There is a severe lack of skilled truck drivers in many areas, particularly in wealthy nations. This may make it difficult to meet delivery deadlines and may increase labour expenditures.

Market Segmentation

By Vehicle Type

-

LCV

-

HCV

By Type

-

International

-

Domestic

By Application

-

Minning & Construction

-

Oil & Gas

-

Retail

-

Healthcare

-

Others

.png)

Regional Analysis:

North America was the region with the highest share because of substantial road networks and enormous geographic expanse have given rise to well-developed road haulage industries in this region. Cross-border trade, the expansion of e-commerce, and the requirement for effective supply chain logistics are important considerations. Challenges include a lack of drivers and legal compliance, particularly with regard to emissions.

APAC will be the region with the highest CAGR growth rate because of the massive road haulage business in China is fuelled by domestic demand and the country's manufacturing industry. Congestion, pollution, and regulatory changes, such as environmental requirements, provide difficulties for the sector. The primary means of transportation there is road haulage. E-commerce, the improvement of infrastructure, and economic growth are all contributing to the market's growth. However, it encounters difficulties because of poor road conditions, numerous regulatory issues, and safety worries.

Regional Coverage

North America

-

US

-

Canada

-

Mexico

Europe

-

Eastern Europe

-

Poland

-

Romania

-

Hungary

-

Turkey

-

Rest of Eastern Europe

-

-

Western Europe

-

Germany

-

France

-

UK

-

Italy

-

Spain

-

Netherlands

-

Switzerland

-

Austria

-

Rest of Western Europe

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Vietnam

-

Singapore

-

Australia

-

Rest of Asia Pacific

Middle East & Africa

-

Middle East

-

UAE

-

Egypt

-

Saudi Arabia

-

Qatar

-

Rest of Middle East

-

-

Africa

-

Nigeria

-

South Africa

-

Rest of Africa

-

Latin America

-

Brazil

-

Argentina

-

Colombia

-

Rest of Latin America

Key Players:

The major key players are CONCOR, Kindersley Transport, Gosselin Group, AM Cargo, UK Haulier, SLH Transport, Monarch Transport, LKW WALTER, Manitoulin Transport and others.

Kindersley Transport-Company Financial Analysis

Recent Industry Highlights

-

New fuels and technologies are being developed by businesses to lessen the negative environmental effects of road transportation. For instance, some businesses are creating trucks that run on hydrogen, while others are creating vehicles that run on biodiesel or renewable natural gas.

-

Data analytics are being used more and more by transportation businesses to enhance their operations. They use data, for instance, to streamline routes, use less fuel, and provide better customer service.

-

The need for last-mile delivery services is being driven by the expansion of e-commerce. New advancements in road haulage are being made as a result, including the usage of drones and delivery robots.

| Report Attributes | Details |

| Market Size in 2022 | US$ 3427 Billion |

| Market Size by 2030 | US$ 4930 Billion |

| CAGR | CAGR of 5.3 % From 2023 to 2030 |

| Base Year | 2022 |

| Forecast Period | 2023-2030 |

| Historical Data | 2019-2021 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Vehicle Type (LCV, HCV) • By Type (International, Domestic) • By Application (Minning & Construction, Oil & Gas, Retail, Healthcare, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia Rest of Latin America) |

| Company Profiles | CONCOR, Kindersley Transport, Gosselin Group, AM Cargo, UK Haulier, SLH Transport, Monarch Transport, LKW WALTER, Manitoulin Transport |

| Key Drivers | • The increase in supply chain resilience which supports the growth of road haulage across industries. |

| Market Opportunity | • The rising investments by the government for road infrastructure. |