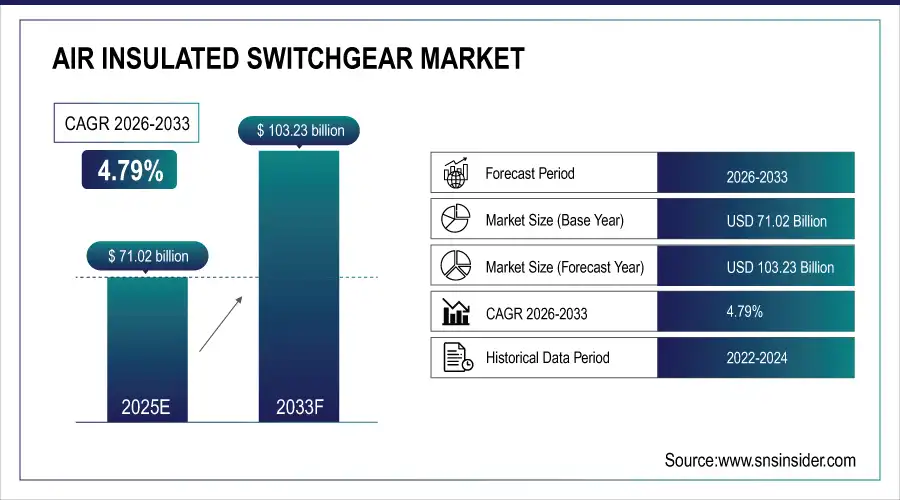

Air Insulated Switchgear Market Size Analysis:

The Air Insulated Switchgear Market Size was valued at USD 71.02 billion in 2025E and is expected to reach USD 103.23 billion by 2033, growing at a CAGR of 4.79% over the forecast period of 2026-2033.

The Air Insulated Switchgear (AIS) Market is witnessing strong growth, driven by increasing demand for reliable power distribution and grid modernization. Rising adoption of renewable energy, smart grid integration, and industrial electrification is fueling AIS deployment. Solutions include indoor and outdoor switchgear, covering low, medium, and high-voltage applications with advanced safety and efficiency features.

Market Size and Forecast:

-

Air Insulated Switchgear Market Size in 2025E: USD 71.02 Billion

-

Air Insulated Switchgear Market Size by 2033: USD 103.23 Billion

-

CAGR: 4.79% from 2026 to 2033

-

Base Year: 2025

-

Forecast Period: 2026–2033

-

Historical Data: 2022–2024

To Get more information On Air Insulated Switchgear Market - Request Free Sample Report

Key Air Insulated Switchgear Market Trends

-

Increasing adoption of smart grids and digital monitoring solutions is driving AIS deployment globally.

-

Growing integration of renewable energy sources, such as solar and wind, is boosting demand for modern switchgear.

-

Rising industrial electrification and urbanization in emerging economies are creating new AIS market opportunities.

-

Transition from conventional to automated and IoT-enabled AIS is enhancing operational efficiency and predictive maintenance.

-

Regulatory support and government incentives for energy-efficient and reliable power distribution systems are accelerating market growth.

-

Technological advancements in compact, hybrid, and modular AIS solutions are improving space utilization and safety.

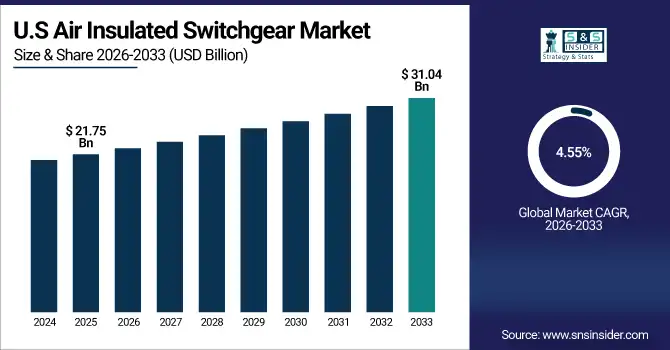

U.S. Air Insulated Switchgear Market Insights

The U.S. Air Insulated Switchgear Market size was USD 21.75 billion in 2025 and is expected to reach USD 31.04 billion by 2033 growing at a CAGR of 4.55% over the forecast period of 2026-2033. The growth is driven by increasing demand for reliable power distribution, rising integration of renewable energy sources, and expanding industrial electrification. Advancements in digital monitoring, IoT-enabled switchgear, and modular designs are enabling enhanced operational efficiency, safety, and grid stability. Utilities and industrial end-users are increasingly adopting AIS solutions to optimize energy management and reduce downtime.

Air Insulated Switchgear Market Growth Driver

-

Rising Adoption of Renewable Energy Sources and Smart Grid Integration Fuels Growth in Air Insulated Switchgear Market

The Air Insulated Switchgear (AIS) market is significantly driven by the increasing integration of renewable energy sources, such as solar and wind, into existing power grids. As utilities and industrial consumers shift toward clean energy to meet sustainability targets, there is a growing need for reliable, efficient, and flexible switchgear solutions that can manage variable loads and maintain grid stability. Advancements in digital monitoring, IoT-enabled AIS, and modular designs allow real-time load management, predictive maintenance, and reduced operational downtime. Government policies promoting renewable energy adoption further accelerate AIS deployment. The trend is particularly pronounced in regions investing heavily in grid modernization and smart city projects, creating long-term demand for high-performance AIS solutions capable of supporting both traditional and renewable energy integration.

For instance, In March 2025, a U.S.-based utility company upgraded its medium-voltage AIS to integrate a new 150 MW solar farm. This installation improved grid reliability, allowed real-time monitoring of renewable output, and optimized energy distribution, demonstrating the direct impact of renewable adoption on AIS demand.

Air Insulated Switchgear Market Restraint

-

High Initial Capital Investment and Installation Costs Limit Adoption of Air Insulated Switchgear Solutions Globally

The growth of the AIS market faces challenges due to high upfront costs associated with purchasing, installing, and commissioning switchgear, particularly in developing regions. The requirement for specialized technical expertise for installation, calibration, and maintenance further increases total project costs, making utilities and industrial customers cautious in large-scale deployments. Smaller industrial units and emerging economies often prefer lower-cost alternatives or delay upgrades, limiting market penetration. Additionally, maintenance and replacement of conventional components can be expensive, and budget constraints in power utilities and commercial facilities can slow the adoption of advanced AIS solutions. Despite the clear operational and efficiency benefits, cost sensitivity remains a primary restraint, impacting investment decisions and slowing the rate of modernization in regions with tight capital expenditure frameworks.

In July 2024, a medium-sized manufacturing facility in Southeast Asia postponed replacing its outdated AIS due to high procurement and installation costs, opting to continue operations with conventional switchgear, illustrating the effect of capital constraints on market growth.

Air Insulated Switchgear Market Opportunity

-

Growing Demand for Compact and Modular Air Insulated Switchgear Solutions Supports Market Expansion Globally

The AIS market is witnessing significant opportunities from the development of compact, modular, and hybrid switchgear solutions that optimize space, improve safety, and enhance operational flexibility. These innovations allow utilities, industrial facilities, and commercial complexes to deploy AIS in constrained environments without compromising performance. Advancements in digital monitoring, remote diagnostics, and standardized modular designs reduce installation time and facilitate easier maintenance. Manufacturers focusing on space-efficient and scalable AIS solutions can cater to rapidly urbanizing regions and smart city projects. The trend toward miniaturization and modularization is particularly beneficial for retrofitting existing substations, expanding market potential in both developed and emerging economies while meeting regulatory requirements and sustainability targets.

For instance, In September 2025, Schneider Electric launched a compact, modular AIS solution for urban substations in Europe, enabling faster deployment, reduced floor space, and enhanced energy management, highlighting the market opportunity for innovative switchgear designs.

Air Insulated Switchgear Market Segment Highlights:

-

By Voltage Level: Low Voltage (Up to 1 kV) – 28%, Medium Voltage (1–36 kV) – 52% (largest), High Voltage (Above 36 kV) – 20%

-

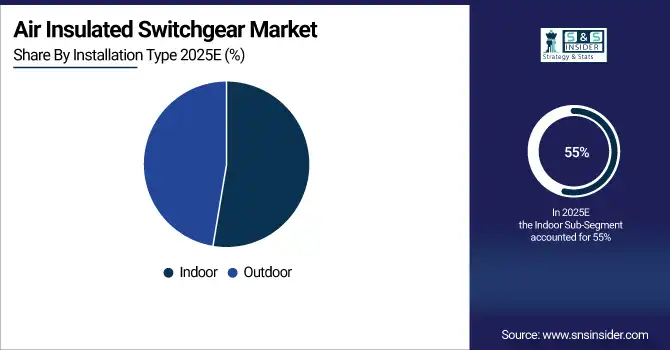

By Installation Type: Indoor – 55% (largest), Outdoor – 45%

-

By Component: Circuit Breakers – 30%, Isolators – 25%, Busbars – 20%, Current Transformers – 15%, Voltage Transformers – 10%

-

By End-User Industry: Transmission & Distribution Utilities – 40% (largest), Industrial – 30%, Commercial – 20%, Residential – 10%

By Voltage Level

The Medium Voltage (1–36 kV) segment dominates the market with a 52% share, driven by its widespread use in industrial, commercial, and utility applications that require reliable power distribution and fault protection. Low Voltage (Up to 1 kV), holding 28%, is widely adopted in commercial and residential settings, while High Voltage (Above 36 kV), with 20%, serves transmission networks and large industrial complexes. The demand for medium-voltage AIS is further boosted by grid modernization initiatives and renewable energy integration projects globally.

By Installation Type

Indoor installations hold the largest market share at 55%, due to their controlled environment, ease of maintenance, and protection from weather conditions. Outdoor AIS, accounting for 45%, is preferred for substations in open areas or regions with space constraints. Utilities and industrial end-users increasingly select installation type based on space availability, environmental conditions, and operational requirements, influencing deployment strategies and market growth across different regions.

By Component

Circuit Breakers lead the component segment with a 30% share, as they are essential for interrupting fault currents and ensuring system protection. Isolators (25%) and Busbars (20%) facilitate safe maintenance and efficient power transfer, while Current Transformers (15%) and Voltage Transformers (10%) provide accurate monitoring and metering. The performance, reliability, and technological enhancements of these components drive AIS adoption across transmission, distribution, and industrial networks.

By End-User Industry

Transmission & Distribution Utilities dominate with 40% share, fueled by large-scale investments in grid infrastructure, substations, and renewable energy integration. The Industrial segment, at 30%, grows due to electrification of manufacturing plants and process optimization needs. Commercial users hold 20%, adopting AIS for high-rise buildings and large complexes, while Residential applications account for 10%, mostly in multi-unit developments. The end-user preference is shaped by operational efficiency, safety standards, and regulatory compliance requirements.

Air Insulated Switchgear Market Regional Analysis

North America Air Insulated Switchgear Market Insights

North America leads the AIS market with a 40% share in 2025, driven by advanced grid infrastructure, regulatory incentives, and high industrial electrification. The U.S. spearheads adoption with widespread deployment of medium- and high-voltage AIS, smart meters, and automated demand response platforms. Focus on renewable integration, peak load management, and decarbonization initiatives accelerates adoption across utilities, manufacturing, and commercial sectors. Partnerships between technology providers and utilities further enhance efficiency, safety, and cost optimization, solidifying North America as a key hub for AIS innovations.

Get Customized Report as per Your Business Requirement - Enquiry Now

Europe Air Insulated Switchgear Market Insights

Europe holds 25% of the AIS market in 2025, supported by stringent energy efficiency regulations, carbon-neutrality goals, and investments in grid digitalization. Germany, France, and the U.K. are leading adopters, emphasizing smart grid upgrades and industrial automation. Incentives for demand response participation and collaborations between utilities and industrial consumers promote intelligent load management, reinforcing Europe’s commitment to achieving sustainable energy and net-zero targets.

Asia-Pacific Air Insulated Switchgear Market Insights

Asia-Pacific accounts for 23% of the market in 2025 and is the fastest-growing region due to rapid industrialization, rising energy demand, and government-backed grid modernization initiatives. China, India, Japan, and Australia are key contributors, implementing AMI meters, IoT-enabled monitoring, and renewable energy integration. Incentives for peak load management, energy efficiency awareness, and industrial adoption are driving significant AIS deployment across the region.

Latin America and Middle East & Africa (MEA) Air Insulated Switchgear Market Insights

Latin America holds 5% and MEA 7% of the AIS market in 2025. Brazil, Mexico, UAE, and Saudi Arabia are investing in grid modernization, industrial automation, and DSM technologies. Government initiatives, public-private partnerships, and rising renewable energy adoption support AIS deployment. Expansion of industrial infrastructure, energy efficiency awareness, and IoT-based monitoring solutions are driving steady market growth in both regions over the forecast period.

Competitive Landscape for Air Insulated Switchgear Market:

ABB Ltd.

ABB Ltd. is a multinational corporation specializing in electrification, automation, and digitalization technologies, including solutions for energy management and demand response.

-

In December 2024, ABB announced the acquisition of the power electronics business of Gamesa Electric from Siemens Gamesa. This acquisition strengthens ABB's position in renewable power conversion technology and enhances its offerings for demand-side management and AIS applications.

Siemens AG

Siemens AG is a global technology leader providing electrification, automation, and smart grid solutions for utilities, industries, and infrastructure projects.

-

In November 2024, Siemens launched its first fluorinated-gas-free gas-insulated switchgear for the U.S. medium-voltage market, supporting environmental sustainability and aligning with global decarbonization goals.

Schneider Electric SE

Schneider Electric SE is a global provider of energy management and automation solutions, delivering innovative technologies for industrial, commercial, and utility sectors.

-

In August 2025, Schneider Electric partnered with E.ON to deploy SF₆-free medium-voltage switchgear, accelerating energy transition initiatives and reducing greenhouse gas emissions across power distribution networks.

Air Insulated Switchgear Companies are:

-

ABB Ltd

-

Schneider Electric SE

-

Eaton Corporation PLC

-

General Electric (GE)

-

Mitsubishi Electric Corporation

-

Hitachi ABB Power Grids

-

Toshiba Corporation

-

Hyundai Electric & Energy Systems Co., Ltd.

-

Crompton Greaves Limited

-

Larsen & Toubro Limited (L&T)

-

Fuji Electric Co., Ltd.

-

CG Power and Industrial Solutions Limited

-

KEPCO (Korea Electric Power Corporation)

-

SGB-SMIT Group

-

Nari Group Corporation

-

Alstom SA

-

Toshiba Energy Systems & Solutions Corporation

-

Schneider Electric India Pvt. Ltd.

| Report Attributes | Details |

|---|---|

| Market Size in 2025E | USD 71.02 Billion |

| Market Size by 2033 | USD 103.23 Billion |

| CAGR | CAGR of4.79% from 2026 to 2033 |

| Base Year | 2025E |

| Forecast Period | 2026-2033 |

| Historical Data | 2022-2024 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Installation Type: (Indoor, Outdoor) • By Voltage Level: (Low Voltage (Up to 1 kV), Medium Voltage (1–36 kV), High Voltage (Above 36 kV)) • By Component: (Circuit Breakers, Isolators, Busbars, Current Transformers, Voltage Transformers) • By End-User Industry: (Transmission & Distribution Utilities, Industrial, Commercial, Residential) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, France, UK, Italy, Spain, Poland, Russsia, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia,ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia Rest of Latin America) |

| Company Profiles | ABB Ltd, Siemens AG, Schneider Electric SE, Eaton Corporation PLC, General Electric (GE), Mitsubishi Electric Corporation, Hitachi ABB Power Grids, Toshiba Corporation, Hyundai Electric & Energy Systems Co., Ltd., Crompton Greaves Limited, Larsen & Toubro Limited (L&T), Fuji Electric Co., Ltd., CG Power and Industrial Solutions Limited, KEPCO (Korea Electric Power Corporation), SGB-SMIT Group, Powell Industries, Inc., Nari Group Corporation, Alstom SA, Toshiba Energy Systems & Solutions Corporation, Schneider Electric India Pvt. Ltd. |