Strategy Consulting Market Report Scope & Overview:

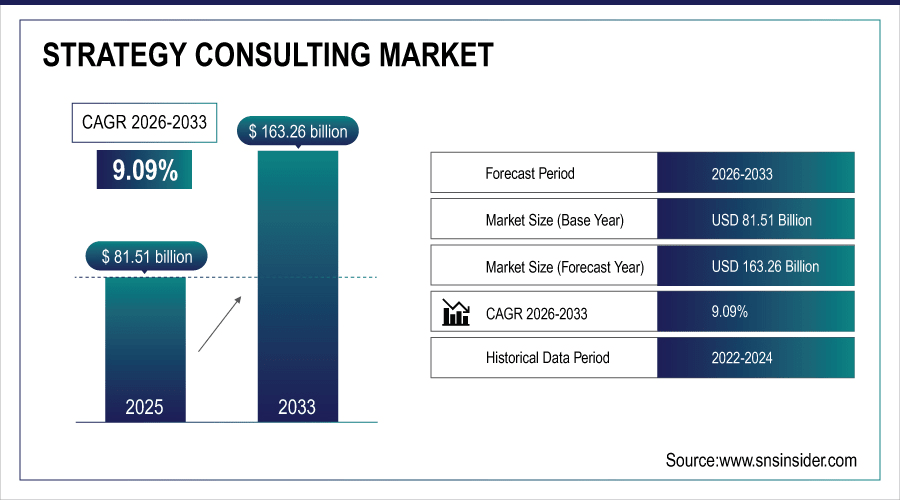

The Strategy Consulting Market size was valued at USD 81.51 billion in 2025E and is projected to reach USD 163.26 billion by 2033, growing at a CAGR of 9.09% during the forecast period 2026–2033.

The demand is highest for industry: Strategy Consulting market examines service types such as Corporate Strategy, Digital Transformation, Operations and Business Advisory the across different industries and regions. There were 28,711 major strategy projects completed worldwide in 2025, and digital strategy accounted for 34% of work. Enterprises, however, comprised 61% of clients. Growing demand for business transformation, operational efficiency, and digital adoption is propelling the market forwards, with robust expansion anticipated to continue until 2033.

Business transformation initiatives contributed 22% of market activity, reflecting increasing operational optimization efforts.

To Get More Information On Strategy Consulting Market - Request Free Sample Report

Market Size and Forecast:

-

Market Size in 2025: USD 81.51 Billion

-

Market Size by 2033: USD 163.26 Billion

-

CAGR: 9.09% from 2026 to 2033

-

Base Year: 2025

-

Forecast Period: 2026–2033

-

Historical Data: 2022–2024

Strategy Consulting Market Trends:

-

In 2025, more than 15,200 workshops and strategic sessions were carried out worldwide, showcasing a rising need for on-the-ground consulting assistance.

-

Over 6,400 technology integration consultancy projects were kicked off in 2025, indicating the operation of digital tools.

-

25% of consulting work centred on sustainability and ESG strategies in 2025, with a growing focus on responsible business practices.

-

Mergers & Acquisitions advisory projects totalled 4,900 benefitting from corporate restructurings and growth initiatives.

-

18% of studies included consortia or partnerships, indicating a greater cooperation between organisations and consultants.

U.S. Strategy Consulting Insights:

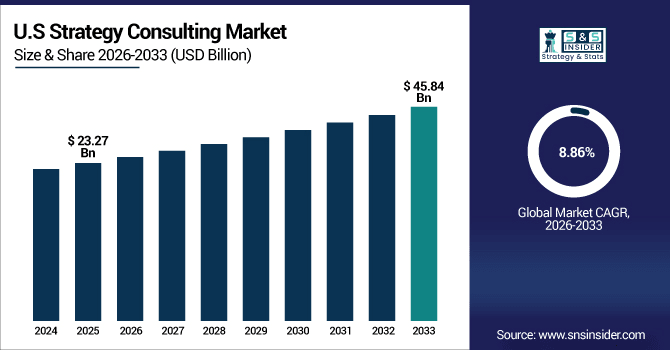

The U.S. Strategy Consulting Market was valued at USD 23.27 billion in 2025E, projected to reach USD 45.84 billion by 2033 at a CAGR of 8.86%. Strong demand for digital transformation, operational restructuring, and data-driven strategies across finance, healthcare, and technology sectors is driving market growth.

Strategy Consulting Market Growth Drivers:

-

Increasing Corporate Demand for Business Transformation and Strategic Planning Fuels Growth of Strategy Consulting Market.

The Strategy Consulting Market growth is driven by rising demand for business transformation and strategic planning. In 2025, more than 12,700 large consulting projects were launched worldwide with one-quarter of them related to sustainability and ESG. There were approximately 4,900 M&A advisory assignments performed highlighting corporate reorganization patterns. 18% of the engagements were joint ventures or partnerships and represented partnership leading strategies. The vast majority (61%) of clients consulting the services were large companies, evidencing their overwhelming influence on market expansion.

Mergers & acquisitions advisory projects made up 17% of engagements, indicating strong corporate restructuring activity.

Strategy Consulting Market Restraints:

-

High Implementation Costs and Limited In-House Expertise Restrain Strategy Consulting Adoption Across Small and Medium Enterprises.

High implementation costs and limited in-house expertise remain major barriers to Strategy Consulting Market growth. In 2025, professional services' engagements lost 28% of work because of delays and cancellations thanks to budget issues primarily with SMEs. Insufficient skilled resources in digital strategy and operational transformation affected nearly 19% of projects. Furthermore, smaller firms could not afford sophisticated analytics systems, standardized approach models and senior consultants. These combined forces retard market growth even though demand for change-the-business and strategic planning continues.

Strategy Consulting Market Opportunities:

-

Expansion of Corporate Restructuring, Mergers & Acquisitions, and Global Market Entry Strategies Drives Strategy Consulting Opportunities.

Rising corporate restructuring, mergers & acquisitions, and global market entry strategies are creating significant opportunities for strategy consulting. In 2025, the number of global advisory projects regarding M&A and market development exceeded 4,900. It is predicted that there will be over 11,500 of these strategic projects by 2033. Early adoption trends reveal that 18% of our engagements have included cross-border partnerships further evidence of a surge in demand for expertise brought on by complex, international consulting assignments.

Cross-border partnership initiatives represented 18% of strategic projects, emphasizing collaboration-driven growth opportunities.

Strategy Consulting Market Segmentation Analysis:

-

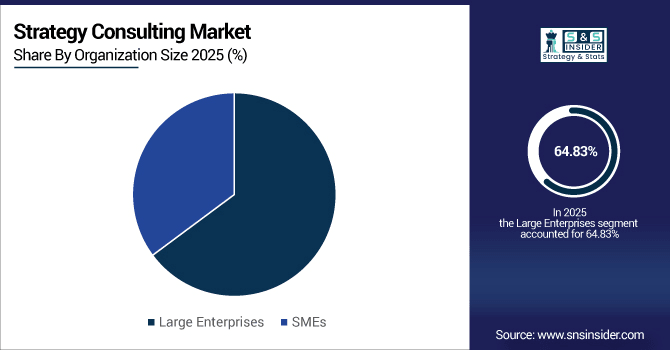

By Organization Size, Large Enterprises accounted for the dominant share of 64.83% in 2025, while Small & Medium Enterprises (SMEs) are projected to grow at the fastest CAGR of 12.41%.

-

By Service Type, Corporate Strategy held the largest market share of 34.76% in 2025, while Business Transformation is expected to grow at the fastest CAGR of 11.12%.

-

By Industry Vertical, Banking & Financial Services contributed the highest market share of 29.52% in 2025, while Healthcare & Life Sciences is forecasted to expand at the fastest CAGR of 11.36%.

-

By Engagement Type, Advisory Services held the largest share of 49.68% in 2025, while Implementation & Execution is anticipated to grow at the fastest CAGR of 10.27%.

By Organization Size, Large Enterprises Dominate While SMEs Grow Fastest:

Global enterprise demand for altitude advisory services tops 18,700 consulting engagements in 2025 focused on global expansion, turnaround and M&A. Small and Medium Enterprises (SMEs) have begun 10,200 projects in 2025 and exceeded 23,400 by the year 2033. Growing globalization, competitive intensity and adoption of digital are forcing the SMEs to increasingly depend on external consulting support thereby becoming the fastest growing customer segment in strategy consulting.

By Service Type, Corporate Strategy Leads While Business Transformation Expands Rapidly:

The world saw more than 12,400 corporate strategy projects in 2025, with growth planning and competitive positioning fueling demand. Business transformation projects grew to 7,800 in 2025 and are expected to exceed the number of those launched by 2033 with over 15,600. Firms are increasingly turning to the method to help them manage digital disruption, sustainability transitions and operational restructuring a recent analysis of transformation-focused consulting services providers in global growth markets finds.

By Industry Vertical, Banking & Financial Services Leads While Healthcare & Life Sciences Grows Fastest:

Banking & financial services was the top consulting sector in 2025, receiving over than 9,200 projects addressing compliance, risk management and fintech adoption. Healthcare & life sciences produced more than 4,800 projects in 2025, and this figure will reach over 10,200 by the end of 2033. Increasing patient-centric care models, innovation in pharmaceutical companies and worldwide healthcare reforms are driving the growth of strategic consulting and healthcare is one of our fastest-growing verticals.

By Engagement Type, Advisory Services Dominate While Implementation Expands Rapidly:

In 2025, advisory services accounted for more than 14,600 consulting engagements delivered worldwide. Implementation & execution services, not far behind, saw 8,900 projects find its way in 2025 with the numbers looking to peak at over 18,000 by 2033. Companies are increasingly moving beyond strategic advice and insisting on end-to-end execution, driving greater demand for consultants to manage digital rollouts, operational transformation programs and change management.

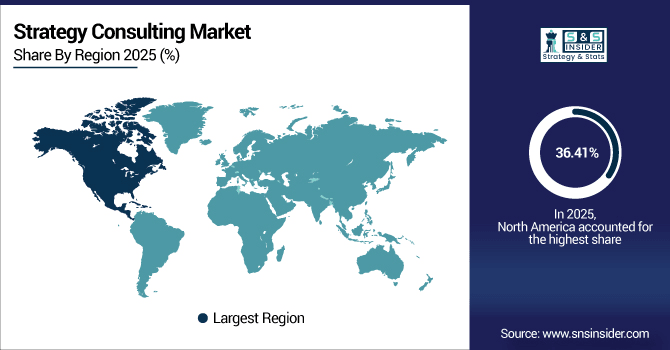

Strategy Consulting Market Regional Analysis:

North America Strategy Consulting Market Insights:

North America accounted for 36.41% of the global Strategy Consulting Market in 2025, with more than 11,800 consulting projects executed across corporate strategy, mergers & acquisitions, and business transformation. Robust uptick in digital deals, restructuring programs and sustainability focused consulting engagements also encouraging. Growth drivers also include more spending on technology integration, organizational redesign and global expansion. The region’s beyond is solid as well through 2033, led by aggressive enterprise spending and competitive market trends.

Get Customized Report as Per Your Business Requirement - Enquiry Now

U.S. Strategy Consulting Market Insights:

The U.S. finished more than 7,850 strategy consulting projects last year, including 1,120 in digital transformation and 880 in sustainability. More than 430 large companies and 270 SMEs hired consultants for corporate strategy, M&A, and operational reorganisation. Growth through 2033 will continue to be spurred by growing acceptance of analytics-based decision making and organizational alternation.

Asia-Pacific Strategy Consulting Market Insights:

The Asia-Pacific Strategy Consulting Market accounted for 10.05% of the global market in 2025, with over 4,200 consulting projects executed across China, India, Japan, and Australia. Top priorities: corporate strategy, operations restructuring and M&A. Rising adoption of digital transformation, sustainability efforts and the use of data for making decisions along with a surge in multi-country expansionism and cross-border collaboration are expected to fuel strong growth trends across the industry on the forecast horizon lasting through 2033.

China Strategy Consulting Market Insights:

China leads the Asia-Pacific Strategy Consulting market by 2025, accounting for more than 2,350 consulting engagements covering corporate strategy, M&A and operational restructuring. Growing awareness toward digital transformation, sustainability mandates, and analytics-based decision-making along with widening horizons of multinational expansions & cross border partnerships will stimulate the market growth during 2026-2033.

Europe Strategy Consulting Market Insights:

Europe logged more than 4,870 consulting engagements in 2025, with the lion’s share of projects based in Germany, the UK and France. Corporate strategy and mergers & acquisitions were the most critical. Advisory services were adopted by more than 740 big firms, largely in support of digital transformation, sustainability and analytics-enabled decision making. Strong regulatory support as well as pan-European industry partnerships and industry-academia relations mean that the European market will continue to grow in a slow-and-steady fashion until 2033.

Germany Strategy Consulting Market Insights:

One of Europe’s powerhouse Strategy Consulting markets executed more than 1,950 consulting projects in 2025 in the area of corporate strategy and M&A and operational restructuring (excluding precise location). Robust uptake of digital transformation, sustainability, and analytics-driven decision-making supported by mature infrastructure and regulatory guidance is establishing Germany as a front runner in Europe and growth is forecast to continue to 2033.

Latin America Strategy Consulting Market Insights:

The Latin America Strategy Consulting Market recorded over 1,050 consulting engagements in 2025, led by Brazil, Mexico, and Argentina. Corporates are growing on the back of strategy and operational restructuring with increased M&A, digital penetration growth as well as multinational partnerships. The market expansion is anticipated till 2033, owing to increasing sustainability strategies, analytics-based decision making and the cross-border consulting partnerships.

Middle East and Africa Strategy Consulting Market Insights:

The Middle East & Africa Strategy Consulting Market recorded over 640 consulting engagements in 2025, led by the UAE, Saudi Arabia, and South Africa. Growth is fueled by corporate strategy, operating model transformation, and digital business efforts underpinned by government policies, multinational collaborations and growing uptake of analytics-based advisory services across the region.

Strategy Consulting Market Competitive Landscape:

McKinsey dominates the global strategy consulting market, executing over 12,400 consulting engagements in 2025 across corporate strategy, mergers & acquisitions, and operational restructuring. It served 4,200 large enterprises worldwide with digital transformation and data-driven advisory capabilities. Competitive, proprietary models Global footprint McKinsey Full potential capabilities to drive high value decision making on critical strategic issues efficient operations and complex transformations Proprietary knowledge Base Industry practice Market leading client service.

-

In July 2025, McKinsey launched its Quantum Technology Monitor 2025, exploring advancements in quantum computing and sensing.

In 2025, BCG delivered more than 9,750 strategic projects for business transformation, digital strategy and sustainability programs. With a strong emphasis on technology stack as well as analytics led insights, it helped over 3,600 companies improve decision-marking and operational efficiencies, in addition to expedited M&A. With a powerful blend of deep industry knowledge and innovative approaches, mind-opening people and process click that deliver future-today ideas, highly creative people collaborate with clients to solve their most important problems from strategy through implementation.

-

In May 2025, Boston Consulting Group (BCG) partnered with Pencil to enhance its strategy consulting offerings by integrating AI-driven analytics into marketing and business transformation operations.

Bain executed more than 8,200 consulting projects in 2025, emphasizing corporate strategy, private equity advisory, and organizational transformation. Serving 2,900 of the world’s largest corporations and mid-sized firms with growth ambitions, Bain develops practical insights that clients act on and transfers skills that make change stick. With its relentless focus on quality and results, driven by an infection of strategic passion in everything we do, Bain is leading the way to deliver value through strategy consulting globally defined as innovation with a bias towards making strategy pay off.

-

In September 2025, Bain & Company introduced its Global Strategy Advisory Platform, assisting more than 400 clients worldwide in corporate strategy, business transformation, and M&A projects.

Strategy Consulting Market Key Players:

Some of the Strategy Consulting Market Companies are:

-

McKinsey & Company

-

Boston Consulting Group (BCG)

-

Bain & Company

-

Deloitte Consulting LLP

-

Accenture Strategy & Consulting

-

EY-Parthenon

-

KPMG Advisory

-

Oliver Wyman

-

L.E.K. Consulting

-

Roland Berger

-

Kearney

-

Strategy& (PwC)

-

Monitor Deloitte

-

AlixPartners

-

Booz Allen Hamilton

-

Protiviti

-

Frost & Sullivan

-

Zinnov

-

A.T. Kearney

-

Arthur D. Little

| Report Attributes | Details |

|---|---|

| Market Size in 2025 | USD 81.51 Billion |

| Market Size by 2033 | USD 163.26 Billion |

| CAGR | CAGR of 9.09% From 2026 to 2033 |

| Base Year | 2025 |

| Forecast Period | 2026-2033 |

| Historical Data | 2022-2024 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Service Type (Corporate Strategy, Business Transformation, Digital Strategy, Operations Strategy, Others) • By Industry Vertical (Banking & Financial Services, Healthcare & Life Sciences, Manufacturing, Technology & IT, Retail & Consumer Goods, Energy & Utilities, Others) • By Engagement Type (Advisory, Implementation, Outsourcing, Others) • By Organization Size (Large Enterprises, SMEs) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

| Company Profiles | McKinsey & Company, Boston Consulting Group (BCG), Bain & Company, Deloitte Consulting LLP, Accenture Strategy & Consulting, EY-Parthenon, KPMG Advisory, Oliver Wyman, L.E.K. Consulting, Roland Berger, Kearney, Strategy& (PwC), Monitor Deloitte, AlixPartners, Booz Allen Hamilton, Protiviti, Frost & Sullivan, Zinnov, A.T. Kearney, Arthur D. Little |