PET-CT Scanner Device Market Size & Overview:

To Get More Information on PET-CT Scanner Device Market - Request Sample Report

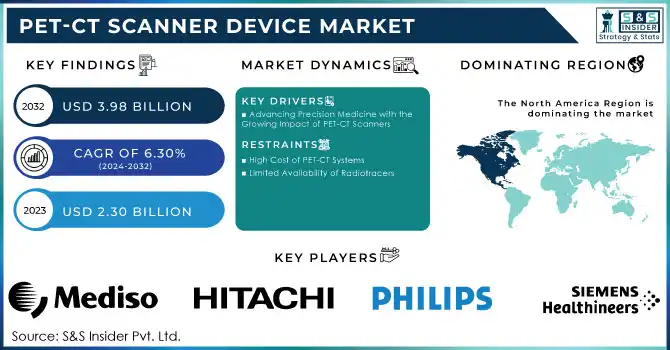

The PET-CT Scanner Device Market size was estimated at USD 2.30 billion in 2023 and is expected to reach USD 3.98 billion by 2032 with a growing CAGR of 6.30% during the forecast period of 2024-2032.

The PET-CT scanner device market is witnessing remarkable growth, fueled by advancements in imaging technologies and expanding applications in oncology, neurology, and cardiology. These devices integrate positron emission tomography (PET) with computed tomography (CT), enabling precise metabolic and anatomical imaging, crucial for early disease detection and personalized treatment.

Recent innovations, including digital PET technologies and whole-body dynamic imaging, are transforming the diagnostic imaging landscape. For instance, in 2024, cutting-edge systems like the Discovery MI Gen 2 offer increased sensitivity (up to 125%), faster scan times, and enhanced image quality using AI-driven reconstruction methods such as TrueFidelity. These advancements minimize radiation exposure while delivering superior diagnostic insights. Advances in radiotracers, critical for PET imaging, continue to expand the applications of PET-CT scanners. For example, newer radiotracers introduced in 2023 have shown promise in diagnosing neurological disorders such as Alzheimer’s disease. Similarly, research from 2022 highlighted innovations in hybrid imaging systems, integrating PET with high-sensitivity digital detectors for improved lesion detectability.

Global investments in healthcare infrastructure are also accelerating market growth. In 2024, Southern New Hampshire announced the acquisition of advanced PET-CT scanners to enhance diagnostic services. Simultaneously, Israel launched initiatives to improve medical device accessibility, focusing on underserved regions. The increasing adoption of PET-CT scanners for theranostics, combining diagnostic imaging with targeted therapies, and the rising burden of chronic diseases further propel market demand. With precision medicine gaining traction, the PET-CT scanner market is positioned for significant advancements, offering manufacturers opportunities to integrate AI, develop novel radiotracers, and improve patient-centric designs.

These innovations, coupled with a focus on early disease detection, ensure that PET-CT technology will remain a cornerstone in modern diagnostics and therapeutic planning.

PET-CT Scanner Device Market Dynamics

Drivers

-

Advancing Precision Medicine with the Growing Impact of PET-CT Scanners

The PET-CT scanner device market is driven by several influential factors, underscoring its critical role in modern healthcare diagnostics. A primary driver is the increasing global burden of chronic diseases such as cancer, cardiovascular conditions, and neurological disorders. The ability of PET-CT scanners to integrate metabolic and anatomical imaging ensures unparalleled precision in early disease detection, cancer staging, and monitoring, making them indispensable in patient care.

Advancements in imaging technology, such as digital PET systems and AI-powered image reconstruction, are revolutionizing diagnostic capabilities. Innovations like digital detectors and whole-body dynamic imaging have enhanced sensitivity, reduced scan times, and improved image clarity while minimizing radiation exposure. Additionally, the development of novel radiotracers targeting specific biomarkers in oncology and neurology has expanded the scope of PET-CT applications. The growing adoption of PET-CT scanners for theranostics—combining diagnostic imaging with personalized therapeutic planning—has further accelerated market growth. Increased awareness of early detection's importance and the global shift toward precision medicine are fueling demand.

Healthcare infrastructure advancements, such as cutting-edge installations in regions like Southern New Hampshire and Israel, are making these technologies more accessible. Furthermore, government initiatives and private investments aimed at improving healthcare outcomes continue to drive the adoption of PET-CT scanners, positioning them as a cornerstone in diagnostic imaging for the future. These factors collectively highlight the dynamic and growing nature of the PET-CT scanner market.

Restraints

-

High Cost of PET-CT Systems

The significant initial investment and maintenance costs of PET-CT scanners can limit their adoption, particularly in resource-constrained healthcare settings.

-

Limited Availability of Radiotracers

The production and availability of specific radiotracers required for PET-CT imaging are often limited, hindering the widespread use and application of these scanners.

PET-CT Scanner Device Market - Key Segmentation

By Type

Stationary PET-CT scanners maintained their dominance in the market, accounting for the majority of the market share in 2023, with a dominant share of approximately 70.0%. This is due to their robust performance, superior image quality, and capability for high-volume diagnostics. Stationary scanners are preferred in hospitals and diagnostic centers because they offer more stability and reliability for large-scale imaging. They are commonly used in oncology, neurology, and cardiology due to their precise imaging capabilities and high throughput, making them suitable for frequent patient examinations and complex diagnostic procedures.

The portable/mobile PET-CT segment is growing at a CAGR of 10%, driven by advancements in mobile health technology and the increasing demand for on-site diagnostics in remote areas or critical care settings. These scanners are ideal for providing quick imaging capabilities in emergency medical situations or in areas where stationary installations are not feasible, contributing to their accelerated adoption.

By Service Provider

Hospitals accounted for the largest share in the service provider category in 2023, with an estimated 65.0% of the market. Hospitals remain the primary setting for PET-CT scans due to the availability of comprehensive medical services and advanced diagnostic equipment. The presence of specialized departments such as oncology, cardiology, and neurology ensures high demand for PET-CT scanners, particularly for complex diagnostic purposes.

Diagnostic Centers are witnessing rapid growth, with a significant CAGR of 9%. The increase in specialized diagnostic centers focusing on advanced imaging is driven by the growing trend toward outpatient services and the need for efficient, quick diagnostics. These centers often provide more affordable and accessible services compared to hospitals, attracting a large patient base.

By Application

Oncology continued to be the dominant application for PET-CT scanners, accounting for approximately 55.0% of the market share in 2023. The ability of PET-CT scanners to detect cancer at its earliest stages and assist in cancer staging, treatment planning, and monitoring is crucial in improving patient outcomes. PET-CT’s role in personalized cancer therapy has been a major factor driving its dominance in oncology.

Neurology is emerging as the fastest-growing segment, with a CAGR of 10%. The increasing prevalence of neurological disorders such as Alzheimer's disease, Parkinson's disease, and epilepsy, combined with advancements in imaging techniques, has led to a surge in the use of PET-CT for neurology applications. The ability to detect metabolic changes in the brain allows for earlier diagnosis and better treatment management, fueling its growth in the market.

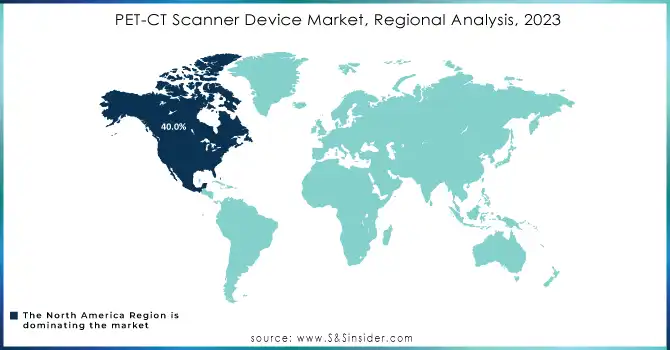

PET-CT Scanner Device Market Regional Analysis

In 2023, North America held the largest share of the PET-CT scanner market, accounting for approximately 40.0% of the global market. This dominance is driven by advanced healthcare infrastructure, high adoption of cutting-edge medical technologies, and substantial healthcare spending. The U.S., in particular, leads the region with a high concentration of hospitals and diagnostic centers investing in advanced diagnostic equipment. Additionally, strong government initiatives, along with private investments in healthcare, continue to support market growth in the region. The growing focus on precision medicine and early disease detection, particularly in oncology and neurology, further fuels demand for PET-CT scanners.

Europe followed as the second-largest market, holding about 30.0% of the market share. The region benefits from well-established healthcare systems, a high demand for non-invasive diagnostic solutions, and a growing emphasis on personalized medicine. Countries such as Germany, France, and the UK are key contributors to the market’s expansion, with innovations in imaging technology and a focus on improving healthcare outcomes.

In Asia-Pacific, the market is the fastest-growing, with a projected CAGR of 9%. The rapid adoption of PET-CT scanners in countries like China, India, and Japan is attributed to improving healthcare infrastructure, rising healthcare awareness, and the increasing burden of chronic diseases. The demand for affordable diagnostic solutions, along with expanding private healthcare investments, is also contributing to market growth in the region.

Do You Need any Customization Research on PET-CT Scanner Device Market - Enquire Now

Key Players

-

General Electric Co. - Discovery PET/CT Series (e.g., Discovery MI, Discovery 690)

-

Siemens Healthineers - Biograph mCT, Biograph Vision

-

Koninklijke Philips N.V. - Ingenuity TF PET-CT, PET/CT Vereos

-

Canon Medical Systems - Celesteion PET-CT Scanner

-

Hitachi, Ltd. - PET-CT System: Scintillator-based and Digital PET-CT

-

Mediso Ltd. - NanoPET/CT (Preclinical PET-CT system)

-

PerkinElmer, Inc. - Triumphant PET/CT

-

Toshiba Corporation - Aquilion ONE PET/CT

-

Bruker Corporation - Quadra PET-CT

-

Neusoft Medical Systems - Neusoft PET-CT Scanner

-

Yangzhou Kindsway Biotech Co. Ltd. - KDW-PET/CT

-

Shimadzu Corporation - NexCore PET/CT

-

United Imaging - uMI 550 PET/CT

-

Positron Corporation - NovoPET PET/CT Scanner

-

MIE (Medical Imaging Electronics) - MIE PET-CT

-

Basda - BD-PET/CT

-

MinFound Medical Systems - MinFound PET-CT System

-

Radimage Technologies Pvt. Ltd. - RadPET-CT

-

Edge Medical Solutions Pvt. Ltd. - EdgePET-CT

-

GS Medical Imaging Private Limited - GS PET-CT

Recent Development

In Nov 2024, Philips received FDA 510(k) clearance for its new detector-based spectral CT radiotherapy solution, the Spectral CT 7500 RT. This breakthrough technology is designed to enhance precision in radiotherapy treatments, improving patient care and outcomes.

In June 2024, The IRCCS in Bologna inaugurated the world's first Total-Body PET/CT scanner with a 194 cm axial FOV, enabling the entire human body to be studied in a single scan. This cutting-edge technology reduces examination time and offers unique research opportunities in oncology, particularly for radiopharmaceutical development. The uEXPLORER system, co-developed by UC Davis and United Imaging Healthcare, marks a significant advancement in diagnostic imaging.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 2.30 Billion |

| Market Size by 2032 | USD 3.98 Billion |

| CAGR | CAGR of 6.30% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (Stationary Scanners, Portable Scanners/Mobile Scanners) • By Service Provider (Hospitals, Diagnostic Centers, Research Institutes) • By Application (Oncology, Neurology, Cardiology, Others) • By Slice Count (Low Slice Scanner (<64 Slices), Medium Slice Scanner (64 Slices), High Slice Scanner (>64 Slices)) • By Isotope/Detector Type (Fluorodeoxyglucose (FDG), 62Cu ATSM, 18 F Sodium Fluoride, FMISO, Gallium, Thallium, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | General Electric Co., Siemens Healthineers, Koninklijke Philips N.V., Canon Medical Systems, Hitachi, Ltd., Mediso Ltd., PerkinElmer, Inc, Toshiba Corporation, Bruker Corporation, Neusoft Medical Systems, Yangzhou Kindsway Biotech Co. Ltd., Shimadzu Corporation, United Imaging, Positron Corporation, MIE (Medical Imaging Electronics), Basda, MinFound Medical Systems, Radimage Technologies Pvt. Ltd., Edge Medical Solutions Pvt. Ltd, GS Medical Imaging Private Limited, and Others |

| Key Drivers | • Advancing Precision Medicine with the Growing Impact of PET-CT Scanners |

| RESTRAINTS | • High Cost of PET-CT Systems • Limited Availability of Radiotracers |