Superdisintegrants Market Size and Growth Outlook

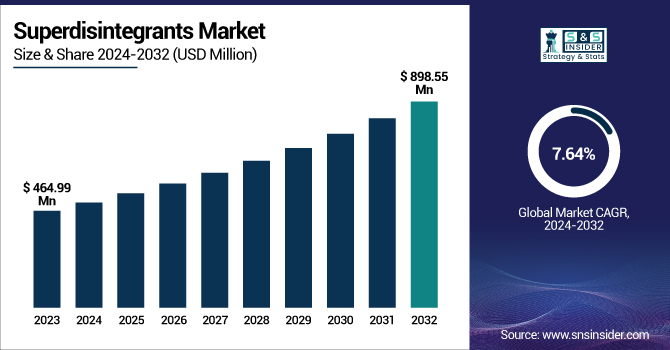

The Superdisintegrants Market was valued at USD 464.99 million in 2023 and is expected to reach USD 898.55 million by 2032, growing at a CAGR of 7.64% from 2024 to 2032.

To Get more information on Superdisintegrants Market - Request Free Sample Report

The Superdisintegrants Market report provides exclusive insights into market use trends by examining the use of superdisintegrants in different drug formulations, such as tablets, capsules, and mouth-dissolving films. It provides pharmaceutical industry demand trends across regions, emphasizing key markets that are driving the use of these excipients. Moreover, the report includes a detailed analysis of manufacturing and supply quantity trends, providing an analysis of manufacturing capability and supply chain evolution. The report also estimates pharmaceutical R&D expenditure on formulation technologies, prioritizing investment in innovative drug delivery technologies that support bioavailability and patient compliance and drive the pharmaceutical excipients market of the future.

Superdisintegrants Market Dynamics

Drivers

-

The increasing demand for orally disintegrating tablets (ODTs) and quickly dissolving drug formulations is one of the key drivers for the Superdisintegrants Market.

ODTs increase patient compliance, particularly in pediatric and geriatric patients, by removing the necessity for water consumption. The shift in the pharmaceutical industry toward patient-centric drug delivery has driven ODT approvals. As per recent updates, the FDA has approved more than 35 ODT products between 2020 and 2023, reflecting the direction toward fast-dissolving drugs. Moreover, advances in superdisintegrant materials, including co-processed excipients, have enhanced drug stability and disintegration effectiveness. Large pharmaceutical companies are using superdisintegrants such as crospovidone, croscarmellose sodium, and sodium starch glycolate in their products, further driving market demand. The trend is likely to persist as greater numbers of businesses concentrate on cutting-edge drug delivery solutions.

-

Expanding Generic Drug Production and Increased Regulatory Approvals are propelling the market to grow.

More generic drugs have been produced across the globe in recent times, and this has greatly increased demand for affordable yet high-performance superdisintegrants. With ever-expanding numbers of blockbuster drug patents expiring, pharmaceutical manufacturers are concentrating efforts on creating rapid disintegration generics. Generic medicines represented more than 90% of all prescriptions filled in the U.S. in 2023, highlighting the dominance of the segment. In addition, regulatory agencies like the FDA, EMA, and WHO have been speeding up approvals for generic versions, fueling demand for excipients such as superdisintegrants. The cost-effectiveness of crospovidone, croscarmellose sodium, and ion-exchange resins renders them favored options for pharmaceutical firms developing generics. In addition, greater investments in pharmaceutical manufacturing growth, particularly in the developing world such as India and China, are further driving the use of superdisintegrants in drug formulation.

Restraint

-

Stringent regulatory requirements and compliance challenges are restraining the market.

The Superdisintegrants Market is characterized by severe challenges in light of strict regulatory demands from organizations like the FDA (Food and Drug Administration), EMA (European Medicines Agency), and ICH (International Council for Harmonisation of Technical Requirements for Pharmaceuticals for Human Use). Superdisintegrants are subject to stringent quality, safety, and efficacy standards, especially in pharmaceutical formulations. Adherence to Good Manufacturing Practices (GMP) and regular audits contribute to the cost and complexity of production. Moreover, differences in regulatory standards across geographies pose challenges for players in the global market. For instance, excipients employed in formulations need to undergo dissolution and bioavailability tests, and the slightest deviation can lead to product recalls or rejection by regulators. These compliance issues tend to delay product launches and drive R&D expenses, thus limiting the growth of the market, particularly for small pharma and generic drugmakers.

Opportunities

-

The increasing adoption of superdisintegrants beyond traditional pharmaceutical applications presents a significant opportunity for market growth.

Biopharmaceutical firms are incorporating superdisintegrants into biologic drug products to increase bioavailability and facilitate the fast disintegration of solid dose forms. Also, the nutraceutical market is witnessing increased demand for quick-dispensing supplements, such as vitamins, probiotics, and herbal products, where superdisintegrants are an essential input in enhancing consumer convenience. Advances in plant-derived and synthetic superdisintegrants are opening up opportunities for clean-label and vegan products, responding to changing consumer trends. In addition, the creation of multi-functional excipients that possess disintegration, binding, and controlled release characteristics is gaining momentum, enabling formulators to maximize production efficiency. The worldwide regulatory drive toward patient-focused dosage forms continues to drive demand for superdisintegrants, making them an essential ingredient in future drug and supplement development.

Challenges

-

One of the key challenges in the Superdisintegrants Market is that high-quality raw materials are very expensive and hard to find.

Superdisintegrants need to be made with pharmaceutical-grade excipients that meet very strict regulations, so they are costly and time-consuming to source. Furthermore, the varying availability of raw materials like cellulose derivatives, starch-based polymers, and synthetic excipients affects supply chains, especially for companies in developing economies. The COVID-19 pandemic and international trade disruptions have also added pressure to the supply of critical raw materials, resulting in higher production costs and possible shortages. Additionally, companies that invest in sustainable and environmentally friendly excipients are challenged by balancing performance, cost, and regulatory approval. These conditions constrain new market entrants and present financial challenges for small and medium-sized pharmaceutical firms seeking to produce cost-efficient drug formulations.

Superdisintegrants Market Segmentation Analysis

By product

Croscarmellose sodium segment dominated the superdisintegrants market with around 33.18% market share in 2023 as a result of its extensive application in pharmaceutical preparations, good disintegration characteristics, and affordability. Being a cross-linked cellulose derivative, it facilitates the fast disintegration of tablets and capsules to enhance drug bioavailability. Its compatibility with multiple drug preparations, such as immediate-release tablets and orally disintegrating tablets (ODTs), has also propelled its use among pharmaceutical firms. Also, robust regulatory approvals by regulators such as the FDA and EMA have cemented its credibility as a go-to option for excipient producers. Strong demand for generic medicines and a growing penchant for patient-centric dosage forms have also contributed significantly to cementing the leadership of the croscarmellose sodium segment in 2023.

The ion exchange resin segment is anticipated to exhibit the fastest growth during the forecast period due to its multifaceted applications in controlled-release and taste-masking formulations. In contrast to traditional disintegrants, ion exchange resins provide better drug stability, enhanced solubility, and the provision for the alteration of drug release profiles, which makes them extremely appealing for contemporary pharmaceutical formulations. With the increasing need for pediatric- and geriatric-formulated drugs, the ability of ion exchange resins to mask taste is finding increasingly high levels of acceptance. In addition, advances in pharmaceutical technology and greater investigation into new functions of excipients have contributed to the increased use of ion exchange resins in branded and generic formulations. Increasing R&D investments and pharmaceutical production in developing nations such as India and China further drive the segment's strong growth prospects.

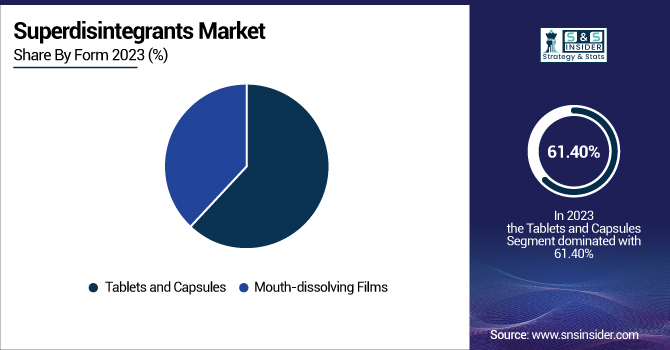

By form

The tablets and capsules segment dominated the market for superdisintegrants with a 61.40% market share in 2023, owing to its widespread application as the first choice of dosage form in the pharmaceutical sector. Tablets and capsules are characterized by ease of production, precise dosing, stability, and affordability, and hence, they are the most commonly used drug delivery systems. The increased need for generic drugs, over-the-counter medicines, and prescription-based solid oral dosage forms has contributed heavily towards the market share of this segment. Furthermore, tablets and capsules are favored by pharmaceutical firms because they are easily scalable in terms of production and have a longer shelf life. The growing prevalence of chronic diseases, coupled with the increasing use of oral solid drugs for therapeutic control, has further cemented the dominance of tablets and capsules in the worldwide superdisintegrants market.

The mouth-dissolving films (MDF) segment will witness the fastest growth over the forecast years, owing to growing patient affinity for rapid-dissolving and easy-to-swallow drug delivery systems. These films offer improved patient compliance, especially for pediatric, geriatric, and dysphagic patients who experience swallowing problems with traditional tablets or capsules. Increased demand for quick action in therapeutic classes like pain management, allergy, and neurological disorders has spurred the use of MDFs. The advancements in thin-film drug delivery technology and better polymer-based formulations have also improved the efficiency and efficacy of mouth-dissolving films. As pharma players invest in breakthrough oral thin-film products and approvals for novel products are growing, this category is expected to grow significantly during the forecast years.

Regional Insights

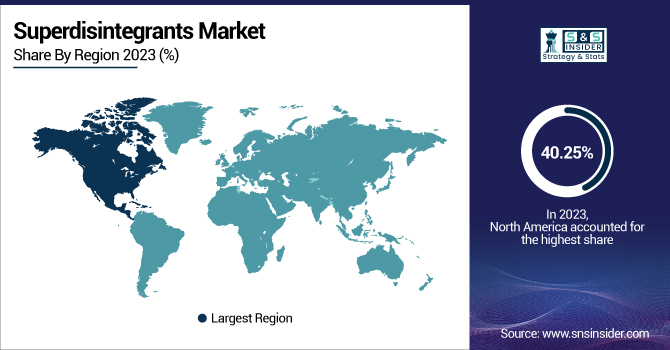

North America dominated the superdisintegrants market with around 40.25% market share in 2023 because of its established pharmaceutical sector, significant R&D spending, and strict regulatory environment guaranteeing the quality and performance of excipients. The United States, where key players like Pfizer, Merck, and Johnson & Johnson are located, has been responsible for the high demand for high-quality superdisintegrants in oral solid dosage forms. Moreover, the increasing number of elderly people in the region and the rising incidence of chronic diseases have spurred the demand for oral disintegrating tablets (ODTs) and quick-dissolving drug products. Advances in technology, coupled with the FDA's focus on patient-focused dosage forms, also add to North America's leadership in the market. Additionally, the availability of major excipient manufacturers and suppliers, including DuPont and Ashland Global, guarantees a consistent supply chain and development in superdisintegrants, supporting the leadership of the region.

Asia Pacific is expecting significant growth in the superdisintegrants market with around 7.78% CAGR due to fast-growing pharmaceutical production, increasing healthcare spending, and more generic drug manufacturing. India and China are among the largest manufacturers of generic drugs, where economically priced superdisintegrants are crucial in improving drug formulations. The availability of a large pool of patients and increasing demand for orally disintegrating formulations have further supported demand in the region. Moreover, government policies to encourage domestic pharmaceutical manufacturing, including India's "Make in India" initiative and China's pharmaceutical policy reformation, are driving market growth. Multinational excipient and pharmaceutical producers are also increasing their footprint in Asia Pacific to take advantage of lower production expenses and high market potential, which is a key region for future growth in the superdisintegrants market.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players in the Superdisintegrants Market

-

BASF SE (Kollidon CL, Kollidon CL-F)

-

Ashland Global Holdings Inc. (Polyplasdone XL, Polyplasdone Ultra)

-

DuPont (Ac-Di-Sol, Polyplasdone)

-

Roquette Frères (NUTRIOSE, PEARLITOL)

-

DFE Pharma (Pharmaburst 500, Prosolv ODT)

-

JRS Pharma (VIVASTAR, VIVAPUR)

-

Merck KGaA (Parteck SI, Parteck ODT)

-

Nippon Soda Co., Ltd. (NISSO HPC, NISSO EXCEL)

-

Corel PharmaChem (Sodium Starch Glycolate, Croscarmellose Sodium)

-

Gangwal Healthcare (Glycolys, Primojel)

-

Evonik Industries AG (EUDRAGIT, SIPERNAT)

-

FMC Corporation (Avicel, Alubra)

-

Asahi Kasei Corporation (Ceolus, Tuftec)

-

Anhui Sunhere Pharmaceutical Excipients Co., Ltd. (Croscarmellose Sodium, Sodium Starch Glycolate)

-

Huzhou Zhanwang Pharmaceutical Co., Ltd. (Croscarmellose Sodium, Sodium Starch Glycolate)

-

Maple Biotech Pvt. Ltd. (Sodium Starch Glycolate, Pregelatinized Starch)

-

DFE Pharma (Pharmaburst, Prosolv)

-

Blanver Farmoquímica Ltda. (Sodium Starch Glycolate, Microcrystalline Cellulose)

-

DFE Pharma (Pharmaburst, Prosolv)

-

Anhui Sunhere Pharmaceutical Excipients Co., Ltd. (Croscarmellose Sodium, Sodium Starch Glycolate)

Suppliers (These suppliers commonly provide superdisintegrants such as Croscarmellose Sodium, Sodium Starch Glycolate, and Crospovidone, which are essential excipients used in tablet formulations to enhance disintegration and dissolution.) in Superdisintegrants Market

-

FMC Corporation

-

Asahi Kasei Corporation

-

Anhui Sunhere Pharmaceutical Excipients Co., Ltd.

-

Huzhou Zhanwang Pharmaceutical Co., Ltd.

-

Maple Biotech Pvt. Ltd.

-

Blanver Farmoquímica Ltda.

-

DFE Pharma

-

Gangwal Healthcare

-

Evonik Industries AG

-

JRS Pharma

Recent Development

-

July 2024 – JRS PHARMA solidified its foothold in India with the opening of its new plant, GMW III. This addition enhances the firm's superdisintegrant product line manufacturing capacity for its premium products, VIVASOL and EXPLOTAB. The new factory's opening was celebrated with an official ribbon-cutting ceremony, which demarcates JRS PHARMA's determination to expand its capability in the region.

-

In November 2023, IFF's Pharma Solutions business collaborated with BASF to incorporate IFF's top pharmaceutical excipients into BASF's Virtual Pharma Assistant platform, ZoomLab. This science-based digital platform is created to streamline pharmaceutical formulation development by precisely predicting the best excipients, enabling researchers to overcome formulation issues more effectively.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 464.99 Million |

| Market Size by 2032 | US$ 898.55 Million |

| CAGR | CAGR of 7.64% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Product (Croscarmellose Sodium, Crospovidone, Sodium Starch Glycolate, Ion Exchange Resin, Others) • By Form (Tablets and Capsules, Mouth-dissolving Films) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | BASF SE, Ashland Global Holdings Inc., DuPont, Roquette Frères, DFE Pharma, JRS Pharma, Merck KGaA, Nippon Soda Co., Ltd., Corel PharmaChem, Gangwal Healthcare, Evonik Industries AG, FMC Corporation, Asahi Kasei Corporation, Anhui Sunhere Pharmaceutical Excipients Co., Ltd., Huzhou Zhanwang Pharmaceutical Co., Ltd., Maple Biotech Pvt. Ltd., Blanver Farmoquímica Ltda., and other players. |