Preterm Birth and PROM Testing Market Size Analysis

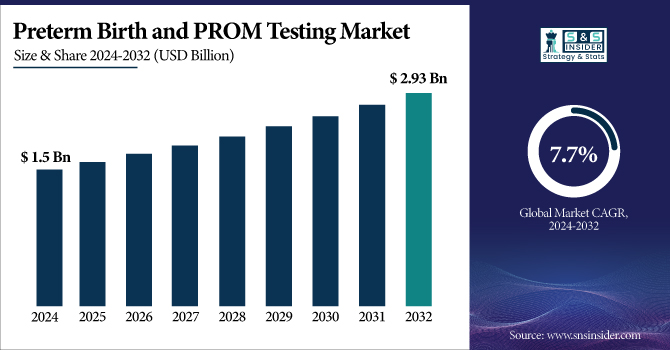

The Preterm Birth and PROM Testing Market Size was valued at USD 1.5 billion in 2023 and is expected to reach USD 2.93 billion by 2032, growing at a CAGR of 7.7% over the forecast period 2024-2032.

This report offers key statistics on the market status of the leading Preterm Birth and PROM Testing market players and offers key trends and opportunities in the market. It delves into trends in the prescribing of diagnostic tests and treatments, as well as the volume and rate of adoption of this testing. The report also analyzes patterns of spending on health care, including from government, private, and out-of-pocket sources. It also covers technological innovations such as biomarker-based testing & AI-driven diagnostics as well as recent regulatory approvals impacting market dynamics.

It offers a detailed analysis of regional market growth, highlighting differences in access among developed and emerging economies. Such insights allow stakeholders to grasp the significant market drivers, investment prospects, and other possible future growth opportunities. The global market for preterm birth and PROM testing is primarily driven by the increasing incidence of preterm births across the globe. There are an estimated 15 million premature births each year, according to the World Health Organization, and this number is increasing.

Preterm Birth and PROM Testing Market Dynamics

Drivers

-

Technological advancements, such as the development of predictive blood tests like PreTRM, enhance early detection and management of preterm births.

The integration of technology has greatly improved the early diagnosis and management of preterm births, which has ultimately reduced maternal and neonatal morbidity and mortality. An example is a blood test called PreTRM, which measures the levels of certain proteins to predict the risk of preterm delivery. The test, which can be performed between the 18th and 21st weeks of gestation, provides healthcare providers with the ability to take preventive measures, potentially decreasing the rate of preterm birth. In Australia, researchers at the University of Queensland have developed a rapid "nanoflower sensor" capable of detecting pregnancy complications, including risks of preterm birth, in the first trimester. Multiple cell biomarkers can be screened in blood samples, with an early detection accuracy of more than 90%, so that medical approaches can be initiated early. AI has also been incorporated into prenatal care to analyze the chances of preterm birth. Machine learning models, namely Support Vector Machines (SVMs), which were trained on data available immediately after the therapy, achieved an accuracy of 82% for assessing the risk of preterm birth, according to a study published in Scientific Reports. This method uses complex data patterns to detect pregnancies at risk and does this before a clinical diagnosis.

Additionally, for predicting the risk of imminent spontaneous preterm delivery, the PartoSure test has been designed to measure placental alpha microglobulin-1 (PAMG-1). Clinical studies have shown that this test provides a 97.4% negative predictive value for delivery within seven days among symptomatic women, offering a reliable tool for clinical decision-making. These breakthroughs in technology, which offer both high accuracy and early detection, play a key role in decreasing the rates of preterm birth and its subsequent complications. They also facilitate timely interventions, contributing to improved health outcomes for mothers and infants alike.

Restraint:

-

The high cost of advanced diagnostic tests and a shortage of skilled healthcare professionals limit accessibility, especially in low-resource settings.

These factors create significant growth challenges for the Preterm Birth and PROM Grid Test market as the high cost of advanced diagnostic tests limits its adoption, and there is a lack of skilled healthcare professionals. It said that there was a 22% shortage of doctors, 35% shortage of nurses, and 29% shortage of paramedical staff in primary and secondary healthcare under the state's Health Department, in a recent report by the Comptroller and Auditor General (CAG). The lack of trained staff inhibits the appropriate administration and ongoing interpretation of these specialty diagnostics. As a result, women who become pregnant may be inadequately, if at all, tested for conditions such as preterm birth and PROM, especially in rural and underserved communities, resulting in delayed interventions and poorer maternal and neonatal outcomes. Tackling these workforce shortages is essential to enhancing the accessibility and efficacy of diagnostic services across the region.

Opportunity:

-

The growing demand for point-of-care diagnostics, including home testing kits, offers convenient and accessible solutions for at-risk pregnant women.

The increasing need for point-of-care diagnostics, comprising home-based testing kits, provides a major opportunity in the Preterm Birth and PROM (Premature Rupturing of Membranes) Testing Market. Preterm birth, which is delivery before 37 weeks of gestation, happens in about 1 in 10 births in the United States and carries significant health risks for newborns. In recent years, new diagnostic tools have been developed for the early detection of the risk of preterm birth. For example, Researchers at the Ohio State University College of Nursing are developing a blood test that can determine the risk of preterm birth with up to 97.5% accuracy when taken before 20 weeks of pregnancy. The test is designed to be part of standard prenatal care, allowing clinicians to monitor and intervene as necessary, potentially cutting down on several preterm births and bettering health for both mothers and babies.

Moreover, the University of Queensland has developed a rapid "nanoflower sensor" capable of detecting neonatal problems, including preterm birth risks, in the first trimester by screening blood samples for cell biomarkers. This particular sensor has proven to be more than 90% effective at distinguishing pregnant women on the verge of experiencing pregnancy complications, which can lead to preventive medical intervention and can help avoid neonatal intensive care unit admissions and emergency interventions. Implementing point-of-care diagnostics into standard prenatal care may help reduce the risk of preterm birth. They help providers take action early to ensure that the health of both mothers and babies is at its best.

Challenge:

-

Navigating regulatory requirements and obtaining approvals for new testing technologies can be complex and time-consuming, hindering market penetration.

The regulatory requirements involved are a major challenge in the Preterm Birth and Premature Rupture of Membranes (PROM) testing market. Novel clinical diagnostics, including the PreTRM blood test produced by Sera Prognostics, promise to forecast the likelihood of preterm labor based on the concentration of particular proteins found within maternal blood. Though promising, these tests frequently do not have regulatory approval from leading organizations, such as the U.S. Food and Drug Administration (FDA), which can hinder broader implementation. For instance, the PreTRM test is currently not FDA-approved, though it is available for order by physicians and directly by women through Sera's website.

The regulatory approval pathway is complex and frequently long, often involving extensive clinical trials to prove safety and efficacy. This complexity can lead to delays in the rollout of new testing technologies to market, hampering timely access to healthcare providers and patients. The regulatory differences from country to country also make the task of achieving approval more difficult, as companies need to customize their respective approval strategies to meet these various standards. These obstacles may limit access to advanced diagnostic options, impacting the quality of prenatal care and outcomes. Partnership between diagnostic companies and the regulatory agencies is required to ensure the approval processes are not hindered but are aligned to make sure safety is paramount. All of these will be necessary to help ensure that such innovative testing solutions can get to market in a timely way, providing healthcare professionals with reliable tools to predict and manage preterm births effectively.

Preterm Birth and PROM Testing Market Segmentation Analysis

By Test Type

In 2023, the ultrasound segment accounted for 32% of the global preterm births and PROM testing market. This preference can be explained by multiple factors, in particular, the noninvasive character of US technology, its global availability, and its capability to reveal immediate images of fetal development and cervix microstructure changes, among others. Ultrasound assessments determine an individual's risk for preterm birth based on the length of her cervix and evaluate the health of the fetus. Pregnant women with a history of spontaneous preterm birth are recommended by the U.S. Preventive Services Task Force to have transvaginal ultrasound cervical length screening. As a result, this recommendation has led to an increasing use of ultrasound in prenatal care. Between 16 and 24 weeks of gestation, measurement of the cervical length by transvaginal ultrasound may, according to the American College of Obstetricians and Gynecologists, help in identifying women at increased risk for preterm birth. Moreover, new ultrasound technologies (3D and 4D imaging) have improved preterm birth risk prediction. These advancements enable greater characterization of fetal anatomy and improve the assessment of possible complications. Its relatively low cost and ease of use compared with other diagnostic procedures have led to the widespread use of ultrasound in both developed and developing countries.

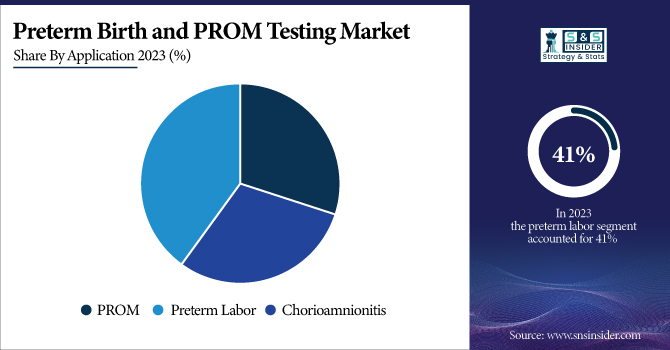

By Application

In 2023, the preterm labor segment accounted for 41% of the market share, owing to the high prevalence of preterm birth across the globe. Preterm birth strikes 1 of every 10 babies born in the United States, according to the CDC. The March of Dimes reports that the preterm birth rate in the U.S. has increased for the third year in a row, reaching 10.5% in 2021. The Premature Rupture of Membranes (PROM) application segment is projected to grow at a significant rate. The Increasing recognition of PROM-associated complications and the availability of new diagnostic tests with higher accuracy are the major factors driving the growth of this segment. According to the American Journal of Obstetrics & Gynecology, PROM only happens in 3% of pregnancies, but it accounts for 30-40% of preterm deliveries. The increasing maternal age, along with rising associated risk factors (e.g., multiple pregnancies, infections, etc.) is driving the growth of this segment. Biomarker testing for PROM has advanced and, combined with the enhanced diagnostic accuracy seen with its use, has helped to improve outcomes in such women. For example, several non-invasive tests have been approved by the FDA for the detection of amniotic fluid proteins, and these tests have demonstrated high sensitivity and specificity in diagnosing PROM.

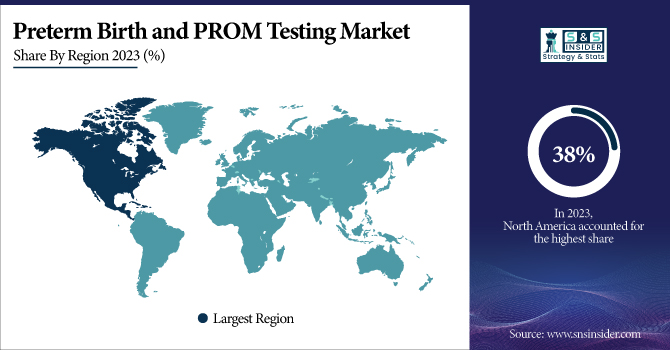

Preterm Birth and PROM Testing Market Regional Insights

In 2023, North America accounted for the highest share of the preterm birth and PROM testing market, with a share of around 38%. This leadership position is attributed to a mature healthcare infrastructure, high healthcare spending, and high focus on maternal and neonatal care in the region. The U.S. is leading the way in research and development in this area. The rate of preterm birth in the U.S. increased to 10.5% in 2021, a 4% increase from 2020, according to the National Center for Health Statistics. This persistent challenge has resulted in additional resources being allocated for research and prevention programs related to extreme or very preterm births. The National Institutes of Health (NIH) spent more than $500 million in 2022 on research related to preterm birth and its complications.

The Asia-Pacific region is expected to witness the fastest CAGR during the forecast period. This growth is mainly due to a large population base and improving healthcare infrastructure and awareness toward prenatal care in countries such as India and China. Over 60% of preterm births take place in Africa and South Asia, according to the World Health Organization, demonstrating the significant market potential for the solution. The National Health Commission has released several policies related to maternal and child health services in China, enabling efficient screening and management of high-risk pregnancy. Services like the Pradhan Mantri Surakshit Matritva Abhiyan have been introduced to offer free antenatal care to pregnant women in India, which is likely to accelerate the demand for preterm birth and PROM testing services.

Key Players in the Preterm Birth and PROM Testing Market

Key Service Providers/Manufacturers

-

Hologic, Inc. (Rapid fFN Test, AmniSure ROM Test)

-

Abbott Laboratories (i-STAT System, ARCHITECT Clinical Chemistry)

-

Sera Prognostics Inc. (PreTRM Test)

-

CooperSurgical Inc. (ROM Plus, AmnioTest)

-

IQ Products (Actim PROM, Actim Partus)

-

Qiagen N.V. (PartoSure Test, AmniSure ROM Test)

-

Biosynex (PREMAQUICK, Amnioquick)

-

LifeCell International Pvt. Ltd. (Maternal Blood Test, Fetal Monitoring Services)

-

Clinical Innovations, LLC (ROM Plus, Koala Intrauterine Pressure Catheter)

-

NX Prenatal, Inc. (NeXosome Assay)

-

Medixbiochemica (Actim PROM, Actim Partus)

-

Medtronic (InSync III, Reveal LINQ)

-

Fisher & Paykel Healthcare Limited (Airvo 2, Optiflow)

-

FUJIFILM Holdings Corporation (SonoSite Ultrasound Systems, Synapse PACS)

-

Nonin Medical, Inc. (Onyx Vantage 9590, SenSmart Model X-100)

-

Getinge AB (Servo-n Neonatal Ventilator, Flow-c Anesthesia Machine)

-

General Electric Company (Voluson E10 Ultrasound, Corometrics 250cx Series)

-

Koninklijke Philips N.V. (EPIQ Ultrasound System, Avalon Fetal Monitor)

-

Promega Corporation (Maxwell RSC Instrument, GoTaq qPCR Master Mix)

-

Medical Predictive Science Corporation (Heart Rate Observation System, HeRO Duo)

Recent Developments in the Preterm Birth and PROM Testing Market

-

In September 2024, Qiagen N.V. was granted FDA Approval for a new biomarker-based test predictive of risk for spontaneous preterm birth. The test examines a panel of protein biomarkers in maternal blood specimens.

-

In January 2025, Abbott Laboratories launched an AI-enabled ultrasound system for preterm birth risk analysis. The system employs machine learning algorithms to scrutinise cervical images and output risk scores.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 1.5 Billion |

| Market Size by 2032 | USD 2.93 Billion |

| CAGR | CAGR of 7.7% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Test Type (Ultrasound, Pelvic exam, Biochemical Markers {Interleukin (IL)-6, Corticotropin-Releasing Hormone (CRH), C-Reactive Protein (CRP), IL-1, IL-2, IL-8, TNF-a, Alpha-fetoprotein (AFP)}, Uterine Monitoring, Nitazine Test, Ferning Test, IGFBP Test, Pooling, PAMG-1 Immunoassay, Fetal Fibronectin (fFN), Others) • By Application (PROM, Preterm Labor, Chorioamnionitis) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Hologic Inc., Abbott Laboratories, Sera Prognostics Inc., CooperSurgical Inc., IQ Products, Qiagen N.V., Biosynex, LifeCell International Pvt. Ltd., Clinical Innovations LLC, NX Prenatal Inc., Medixbiochemica, Medtronic, Fisher & Paykel Healthcare Limited, FUJIFILM Holdings Corporation, Nonin Medical Inc., Getinge AB, General Electric Company, Koninklijke Philips N.V., Promega Corporation, Medical Predictive Science Corporation |