Neuroscience Market Size & Trends:

Get more information on Neuroscience Market - Request Free Sample Report

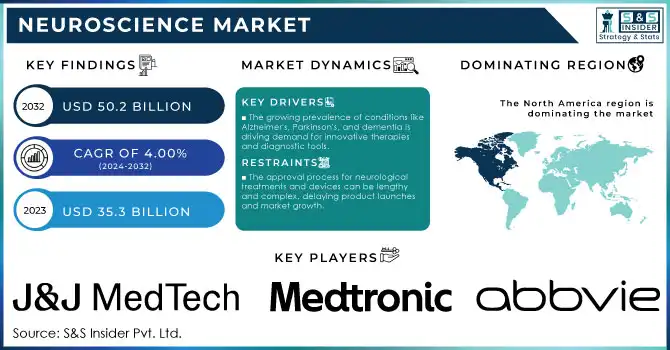

The Neuroscience Market Size was valued at USD 35.3 billion in 2023 and is expected to reach USD 50.2 Billion by 2032, growing at a CAGR of 4.00% from 2024-2032.

The neuroscience market is witnessing substantial growth, fueled by rising research and development investments, technological advancements, and a deeper understanding of brain functions and disorders. Key focus areas include drug development, mental health, and brain-computer interfaces (BCIs), all of which are contributing to the market's expansion. By 2023, global funding for neuroscience research had exceeded USD 25 billion, with a significant portion allocated to brain health and cognitive enhancement initiatives. The increasing prevalence of neurological conditions like Alzheimer's, Parkinson's, and dementia is a major catalyst for market growth, affecting millions of people globally.

A significant driver of this growth is the escalating demand for advanced diagnostics and treatments for neurological diseases. As the global population ages, the need for therapies addressing cognitive decline has grown considerably. For example, the Alzheimer’s Therapeutics market alone is expected to surpass USD 13.42 billion by 2032, as pharmaceutical companies develop therapies to slow disease progression. Innovations in biomarkers and imaging technologies are advancing early detection and treatment options, further propelling the market forward.

Technological breakthroughs, particularly in artificial intelligence (AI) and machine learning (ML), are revolutionizing neuroscience research and healthcare. AI tools are enabling researchers to process vast amounts of brain data, uncover patterns in brain activity, and refine diagnostic accuracy. Brain-computer interfaces (BCIs) are also gaining traction, providing assistive technologies and rehabilitation solutions for individuals with motor impairments. The BCI market is expected to grow rapidly, driven by advancements in non-invasive EEG-based systems, which make these technologies more affordable and accessible.

Additionally, the focus on mental health has intensified, particularly in the aftermath of the COVID-19 pandemic. Increased funding for research into mental health disorders such as depression, anxiety, and PTSD is ensuring that neuroscience continues to thrive. This heightened attention, combined with continuous technological advancements and greater investment in research, positions the neuroscience market for sustained growth and innovation in the years to come.

Neuroscience Market Dynamics

Drivers

-

The growing prevalence of conditions like Alzheimer's, Parkinson's, and dementia is driving demand for innovative therapies and diagnostic tools.

-

As the elderly population increases, the need for treatments targeting age-related cognitive decline grows, particularly for Alzheimer’s and other neurodegenerative diseases.

-

The rise of non-invasive BCIs is facilitating rehabilitation and assistive technologies, making them more accessible and cost-effective

Non-Invasive Brain-Computer interfaces (BCIs) are transforming neuroscience market with cheaper, easily accessible solutions in the area of rehabilitation technologies and assistive technology devices. These BCIs enable brain-communication with the outside world without needing a surgical procedure. Such technology has been very promising for patients with motor disabilities secondary to neurological disorders like stroke, cerebral palsy, and spinal cord injury. EEG-based non-invasive systems are rendering importance in the restoration of motor functions, communication & overall quality of life to the patients.

These BCIs have become more affordable over time, as they had previously relied on costly surgical implants. These systems have gained widespread support for various rehabilitation applications, such as prosthetic limb control and communication for locked-in syndrome, and increasingly, both healthcare providers and patients are becoming more familiar with them. More affordable than ever, it will drive adoption at a faster pace across the healthcare sector. Integration of Machine learning (ML) and artificial intelligence (AI) have played an important role in the improvement of non-invasive BCIs. These algorithms enhance the accuracy of mapping macroscale brain signals, enabling real-time control of external devices. When integrated with VR platforms for rehabilitation, Brain-Computer Interfaces (BCIs) are broadening their medical applications, offering innovative solutions in treatment.

With continuous research, rising cases of neurological disorders, and introduction of devices with more intuitive and easy-to-use features, it is anticipated that non-invasive BCIs will continue to flourish. And, these technologies are not just helping people with motor disabilities, they are also providing some benefit when used in the treatment for other neurological disorders, including epilepsy, depression, and anxiety. Recent advances in available non-invasive BCIs promise to significantly reduce their financial burden associated with the cost and implementation of the technology, which will help move BCI into common usage as part of the neurosciences market in rehabilitation and assistive technologies.

Restraints

-

The approval process for neurological treatments and devices can be lengthy and complex, delaying product launches and market growth.

-

Technologies like BCIs and genetic research raise ethical issues regarding privacy, consent, and the potential misuse of neuro technologies.

-

Some neurological treatments, especially experimental ones, may have adverse side effects, impacting patient safety and limiting their use in the market.

In the neuroscience field, many new neurological treatments, especially experimental therapies, are limited by the possibility of adverse side effects, which can be a safety issue and prevent widespread use. These treatments have potential uses in diseases such as Alzheimer, Parkinson and epilepsy, but they pose significant safety hurdles. Clinical trials are necessary for revealing these risks, but they can also find serious side effects that threaten development. The anti-amyloid antibody therapies for Alzheimer's disease had performed well but were associated with adverse events like brain swelling and bleeding, making wide use impossible.

The brain is a highly complex organ and this makes it all the more difficult to predict how things will turn out longer down the line. While intended to suppress individual symptoms, these therapies may unknowingly suppress cognitive functioning, motor skills, or emotional well-being in other areas, sometimes, in ways that cannot easily be predicted. Such unpredictability creates wariness: health professionals and patients alike may shun therapies bringing fresh uncertainties, even if they directly track the target ailment.

Moreover, the existence of these side effects complicates the approval process from a regulatory view. Health authorities such as the FDA and EMA impose extensive safety testing, which frequently delays entry of effective therapies into the market. As such, the prolonged approval times decrease the rate at which novel treatment options can be discovered, which in turn leads to slower growth and impact of the neuroscience industry. This cautious method of regulation safeguards patients but will delay the adoption of cutting-edge therapies into healthcare systems.

Overall, although there is much promise in the ability to develop ground breaking treatments to improve functional recovery from neurologic disease and injury, the potential of experimental therapies is greatly limited by the risk of off-target effects. The challenge hinders their uptake in the market, and slows the progress of neuroscience as a whole.

Segment Analysis

By Component

In 2023, the instruments segment held the largest share of 65.41%, dominated due to high demand of advanced diagnostics and therapeutics technologies. One such innovative device is the CT 3500, an artificial intelligence-powered computed tomography (CT) scanner that Koninklijke Philips N.V. introduced in May 2023. Ideal for routine radiology and for high-volume screening, this device is aimed to provide imaging with high resolution to assist radiologists to diagnose with higher accuracy.

The consumables segment is expected to gain significant market share over the next few years. Market Growth to be Driven by Durable, Easy-to-Use Consumables for Neurology Procedures from Leader Firms Such as B. Braun SE, GE HealthCare. Moreover, the ongoing availability of new consumables is likely to propel market growth in this segment, and delivery of precise diagnosis and therapeutics.

By Technology

In 2023, the brain imaging segment dominated the market, accounting for 26.07% of the share, driven by the growing application of MRI, EEG, and CT scans in hospitals, diagnostic centers, and ambulatory surgical centers (ASCs) to diagnose neurological conditions. According to the NHS England and NHS Improvement Report, over 67,000 brain MRI referrals were made in March 2022, primarily for cancer diagnosis. This growing reliance on imaging technologies is expected to continue fueling demand in the years ahead.

The neuro-microscopy segment is also set for substantial growth during the forecast period, driven by innovations in the field. For instance, in May 2023, MIT nanotechnologist Deblina Sarkar introduced ultra-small electronic machines capable of entering the brain, which could help detect and potentially reverse neurological disorders. Furthermore, major companies such as Danaher Corporation and Carl Zeiss AG are significantly contributing to the segment’s expansion through their diverse range of neuro-microscopy products, expected to support continued growth in the coming years.

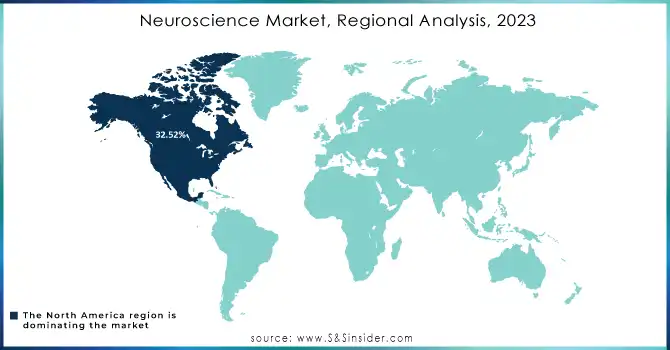

Neuroscience Market Regional Analysis

In 2023, North America held the largest share of the neuroscience market, with 32.52%, largely due to the robust presence of companies focused on the development, manufacturing, and commercialization of diagnostic and therapeutic devices for neurological conditions. For instance, Cerenovus also expanded its stroke care portfolio with new liquid embolic systems in March 2024, offering advanced solutions for minimally invasive stroke treatments. These developments underscore the ongoing commitment to enhancing neurovascular technologies for better clinical outcomes.

The Asia Pacific region is projected to experience the fastest growth during the forecast period, driven by rising investments in healthcare infrastructure and increasing healthcare expenditures. A key example of substantial investment in neuroscience is the BRAIN Initiative in the United States, which continues to progress in 2023. Launched by the National Institutes of Health (NIH), this effort aims to map the human brain in remarkable detail, improving the understanding of neurological diseases and driving the development of new treatments. Similarly, In September 2023, the NIH unveiled the BRAIN CONNECTS project, focused on deciphering the neural circuits behind behavior, which could transform how brain disorders are managed. Similar to China's China Brain Project, this initiative is expected to spur breakthroughs in brain research, marking a major leap forward in both understanding and treating neurological conditions.

Need any customization research on Neuroscience Market - Enquiry Now

Key players

The major key players are

-

Johnson & Johnson MedTech - EMBOGUARD Balloon Guide Catheter

-

Philips Healthcare - Philips Ingenia MRI Scanner

-

Medtronic - Mazor X Stealth Edition

-

GE Healthcare - Discovery MI PET/CT Scanner

-

Siemens Healthineers - SOMATOM X.cite CT Scanner

-

AbbVie - Vraylar (Cariprazine)

-

Boston Scientific - Neurovascular Stents

-

Cerenovus (Johnson & Johnson) - EMBOLIZER Balloon Catheter

-

NeuroPace - RNS System

-

Stryker Corporation - Penumbra Aspiration System

-

Elekta - Unity MR-Linac

-

Astellas Pharma - Xtandi (Enzalutamide)

-

NeuroSigma - Monarch eTNS System

-

Mindmaze - MindMotion GO

-

Cortech Solutions - NeuraLACE

-

Baxter International - Brain Anatomy Dissection Kit

-

Fresenius Medical Care - Fresenius 4008S Hemodialysis Machine (for stroke care)

-

Illumina - NovaSeq 6000 System

-

Biogen - Spinraza (Nusinersen)

-

Abbott Laboratories - Infinity Deep Brain Stimulation (DBS) System

Recent Developments

March 2024: Siemens Healthineers introduced an upgraded version of its brain imaging technology, incorporating AI for faster and more accurate diagnostics of neurological diseases such as multiple sclerosis.

January 2024: GE Healthcare launched new advancements in its MRI technology, offering higher resolution imaging for improved brain diagnostics, which is essential for understanding neurological conditions like Alzheimer's disease and brain tumors.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 35.3 Billion |

| Market Size by 2032 | USD 50.2 Billion |

| CAGR | CAGR of 4.00% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Component (Instruments, Consumables, Software & Services) • By End-Use (Hospitals, Diagnostic laboratories, Research and Academic Institute) • By Technology (Brain Imaging, Neuro-Microscopy, Stereotaxic Surgeries, Neuro-Proteomic Analysis, Neuro-Cellular Manipulation, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Johnson & Johnson MedTech, Philips Healthcare, Medtronic, GE Healthcare, Siemens Healthineers, AbbVie, Boston Scientific, Cerenovus (Johnson & Johnson), NeuroPace, Stryker Corporation, Elekta, Astellas Pharma |

| Key Drivers | • The growing prevalence of conditions like Alzheimer's, Parkinson's, and dementia is driving demand for innovative therapies and diagnostic tools. • As the elderly population increases, the need for treatments targeting age-related cognitive decline grows, particularly for Alzheimer’s and other neurodegenerative diseases. |

| RESTRAINTS | • The approval process for neurological treatments and devices can be lengthy and complex, delaying product launches and market growth. • Technologies like BCIs and genetic research raise ethical issues regarding privacy, consent, and the potential misuse of neuro technologies. |