UV-Curable Coatings Market Report Scope & Overview:

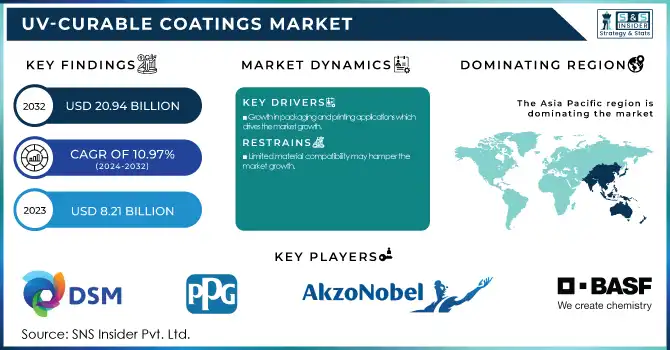

The UV-Curable Coatings Market size was USD 8.21 Billion in 2023 and is expected to reach USD 20.94 Billion by 2032 and grow at a CAGR of 10.97 % over the forecast period of 2024-2032.

To get more information on UV-Curable Coatings Market - Request Free Sample Report

The ultraviolet-curable coatings market is driven by the automotive and electronics sectors, which require durable, high-performance, and eco-friendly coatings. UV-curable coatings are mainly applied in the automotive industry for interior parts, exterior trims, headlights and touchscreens due to their excellent scratch resistance, high gloss finish, and fast curing property. With the rise of newer vehicle models to make them look as aesthetically pleasing and last longer, the demand for advanced protective coatings is also rising. On the flip side, UV-curable coatings are being utilized in PCBs, smartphone screens, and display panels in the electronics sector, due to their high adhesion with OLEDs and other materials functional for lower volatility, wear-resistant coatings, and electrical insulation. As electric vehicles (EVs) continue to rollout, consumer electronics grow increasingly sophisticated, and newer semiconductor components emerge, there is greater demand for high-performance coatings that can cure fast and possess minimal negative environmental impact.

Advancements in UV-LED technology are significantly transforming the UV-curable coatings market, driving efficiency, sustainability, and broader application possibilities. Unlike traditional mercury-based UV lamps, UV-LED curing systems offer several advantages, including lower energy consumption, longer operational lifespan, and reduced heat generation, making them ideal for temperature-sensitive substrates such as plastics and electronics. Additionally, UV-LED technology eliminates the production of ozone and hazardous mercury waste, aligning with global environmental regulations such as the U.S. Environmental Protection Agency (EPA) guidelines and the European Union’s REACH directives. The shift towards high-intensity UV-LED curing enables faster production speeds and enhanced coating performance, benefiting industries like automotive, packaging, and 3D printing.

According to the U.S. Department of Energy (DOE), UV-LED technology can achieve up to 70% energy savings compared to traditional curing methods, making it a cost-effective and eco-friendly alternative. As research and development efforts continue, the adoption of UV-LED curing systems is expected to accelerate, further strengthening the market for UV-curable coatings across diverse industrial applications.

UV-Curable Coatings Market Dynamics

Drivers

-

Growth in packaging and printing applications which drives the market growth.

UV-cured coatings are boosting growth in the packaging and printing market. The rapid curing, durability, and print quality of these coatings make them suitable for a range of applications. The printing industry involves a range of methods, including lithographic, flexographic, screen, and inkjet, but UV-curable inks are also used for the production of clear, sharp, and bright images. UV-curable coatings are used on many different substrates, such as paper, cardboard, plastics, glass, metal, and wood benefit the packaging industry. This flexibility enables efficient finishing on a wide range of different packaging substrates, allowing for optical and barrier functionality. In addition, the efficiency of UV and LED inks, as well as the growing use of UV inks and LED inks in food-safe applications, has led to a rapid increase in the demand for UV and LED inks in the food packaging segment. Curing LED under nitrogen is a major trend and displays the industry adapting to forward-thinking and safe practices. Such improvements in the quality and environmental benefits of UV-curable coatings, including lower VOCs, are assisting growth in the packaging and printing sectors.

Restraint

-

Limited material compatibility may hamper the market growth.

One of the major restraining factors for the growth of the UV curable coatings market is low material compatibility. These coatings work best on substrates with high UV light penetration that create a plastic, glass, or metal substrate. Meanwhile, rubber, opaque polymers, and thick or heavily pigmented surfaces can block UV light, and things will end up uncured or poorly adhered. However, this is a major disadvantage that limits the adoption of UV-curable coatings in industries where a wide range of materials is used, including automotive, aerospace, and consumer goods manufacturing. As such, manufacturers may be reluctant to use UV-curable coatings universally and instead continue using traditional curing methods with a broader material base. To this end, continued R&D is needed to develop UV curable coatings with more cross-linking functionality and to invent new curing technologies that could handle more substrate types.

UV-Curable Coatings Market Segmentation

By Type

Wood coatings segment held the largest market share around 28% in 2023. This is because various factors make UV-curable coatings an excellent fit for wood applications. With so many advantages over traditional coatings such as faster cure times, better durability, and high-quality finish to enhance the natural beauty of wood, UV-curable coatings have become a popular choice for consumers. Not only this but environmentally these coatings do not require any solvents, which result in low emission of harmful gases, making them more appealing to manufacturer in their quest for sustainable solutions. Furthermore, UV-cured coatings have excellent scratch, abrasion, and weather resistance, which makes them an ideal match for wood products that experience high traffic or outdoor exposure. This is further bolstered the segment's share in the market with the increasing demand for high performance and environmentally friendly coatings for furniture, cabinetry, flooring, and other wood-based materials. The dominance of the wood applications segment can primarily be attributed to government regulations regarding environmental sustainability and the emission of low-VOC, which in turn, has led to increasing utilization of UV-curable coatings.

By Composition

The monomers segment held the largest market share around 34% in 2023. In UV-cured coatings, monomers eventually become polymerized (cured) when the APIs are exposed to ultraviolet (UV) light, thus converting the liquid film to a solid and durable finish. Then on, these monomers offer the requisite characteristics like flexibility, hardness, and chemical resistance, which are significant for all end-users such as automotive, industrial, and packaging. The rising popularity of UV-curable systems, which rely on monomers to improve performance and decrease the environmental footprint compared to conventional solvent-based coatings, has contributed to this trend toward sustainable coatings. In addition, the increasing use of UV-curable coatings in the electronics and graphic arts industries, which require rapid curing and high-performance surfaces, is positively impacting monomer demand on a large scale.

By End-Use Industry

The industrial coatings segment held the largest market share around 48% in 2023. This is especially because urbanization is the common factor for each building and construction work, thus leading to wide-scale demand in manufacturing and heavy-duty applications which necessitate durability and high-performance properties of UV curable coatings. In industrial coatings, such as automotive coatings, machinery coatings, metal coatings, and construction applications, UV-curable coatings can offer faster-curing speeds, improved chemical resistance, and environmental benefits. Sustainability and volatile organic compound (VOC) emissions are receiving more focus now than ever, which has led more users to move to UV-curable systems for a better alternative to traditional coatings within the industrial coatings segment. Moreover, the requirement of coatings that need to withstand the extreme environment including fluctuations in temperature and the ability to withstand the effects of chemicals further increases the adoption of the UV-curable coatings in this industry.

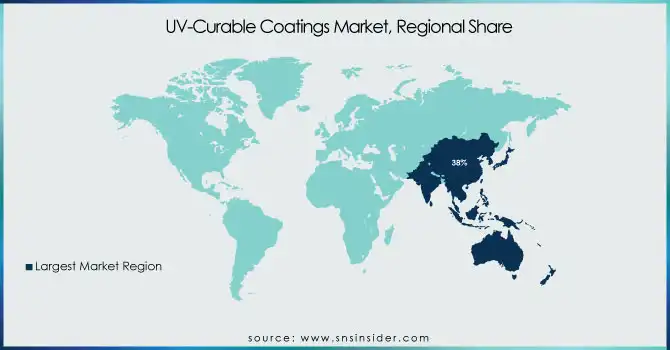

UV-Curable Coatings Market Regional Analysis

Asia Pacific held the largest market share around 38% in 2023. This is due to rapid industrialization, the development of the manufacturing sector, and the increasing demand for sustainable solutions. China, Japan, and South Korea are significant automotive, electronics, and industrial coatings industries where UV-curable coatings are used due to their high-performance and environmental friendliness. Additionally, the growth of the UV-curable coatings market in this region has been driven by a government focus on the adoption of sustainable technologies and a reduction of environmental footprint, as low-emission UV-curable coatings can replace solvent-based coatings. In addition, the growing electronics and graphic arts industries in Asia-Pacific and multiple investments in infrastructure and construction are proliferating the demand for fast-cure, wear-resistant, and high-quality finishes are UV-curable coatings. Asia-Pacific has become a major area for the market, with many local and foreign companies spending large amounts of money to meet the increasing regulatory pressure for lower VCO emissions and demand for green products, thereby reinforcing Asia-Pacific as the dominant region in the global UVC coatings market.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players

-

Royal DSM N.V. (Netherlands)

-

PPG Industries Inc. (USA)

-

Akzo Nobel N.V. (Netherlands)

-

BASF SE (Germany)

-

The Sherwin-Williams Company (USA)

-

Axalta Coating Systems Ltd. (USA)

-

Dymax Corporation (USA)

-

Eternal Chemical Co. Ltd. (Taiwan)

-

DIC Corporation (Japan)

-

Croda International Plc (UK)

-

Nippon Paint Holdings Co., Ltd. (Japan)

-

ACTEGA Schmid Rhyner AG (Switzerland)

-

Ashland Global Holdings Inc. (USA)

-

PhiChem Corporation (China)

-

Dow (USA)

-

Arkema S.A. (France)

-

Sika AG (Switzerland)

-

Allnex (Germany)

-

Teknos Group (Finland)

-

Cardinal Industrial Finishes (USA)

Recent Development:

-

In 2023, DSM, a global leader in performance materials, introduced a new line of UV-curable resins designed specifically for the industrial coatings sector. These resins provide enhanced scratch resistance and durability, making them ideal for high-performance applications in automotive and metal coatings.

-

In 2022, AkzoNobel launched a new range of UV-curable coatings for the electronics industry, which are designed to meet the rising demand for energy-efficient, environmentally friendly solutions.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 8.21 Billion |

| Market Size by 2032 | USD 20.94 Billion |

| CAGR | CAGR of 10.97% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (Wood Coatings, Plastic Coatings, Over Print Varnish, Display Coatings, Conformal Coatings, Paper Coatings) • By Composition (Oligomers, Monomers, Photoinitiators, PU Dispersions, Others) • By End-Use Industry (Industrial Coatings, Electronics, Graphic Arts) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Royal DSM N.V., PPG Industries Inc., Akzo Nobel N.V., BASF SE, The Sherwin-Williams Company, Axalta Coating Systems Ltd., Dymax Corporation, Eternal Chemical Co. Ltd., DIC Corporation, Croda International Plc, Nippon Paint Holdings Co., Ltd., ACTEGA Schmid Rhyner AG, Ashland Global Holdings Inc., PhiChem Corporation, Dow, Arkema S.A., Sika AG, Allnex, Teknos Group, Cardinal Industrial Finishes |

| Key Drivers | • Growth in packaging and printing applications which drives the market growth. |

| Restraints | • Limited material compatibility may hamper the market growth. |