System Integrator Market Report Scope & Overview:

Get more information on System Integrator Market - Request Sample Report

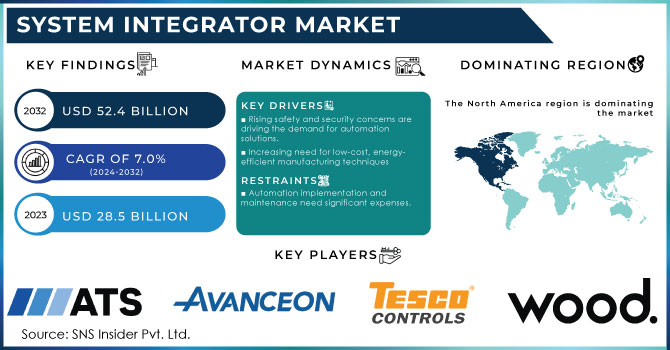

The System Integrator Market Size was valued at USD 28.5 Billion in 2023. It is expected to grow to USD 52.4 Billion by 2032 and grow at a CAGR of 7.0% over the forecast period of 2024-2032.

The widespread IoT integration is reshaping industries like manufacturing, healthcare, and smart cities and presents system integrators with huge opportunities. With the growing number of IoT devices, companies are switching to comprehensive solutions to keep their devices connected and effective. In line with this trend, system integrators are in need because it is they who design and deploy systems that make various devices interconnected. For example, thanks to system integrators, IoT devices can be interconnected, and vast volumes of data can be collected and analyzed by devices. This analysis can help businesses obtain valuable data through them to facilitate their businesses’ operations and decision-making. In the case of production, sensors incorporated in the devices can analyze the equipment data in real-time and predict the malfunction and the exact time for the maintenance of the equipment and avoid downtime.

In healthcare, patients can be monitored through their devices, and the results can be analyzed by systems connecting all devices and an alert can be sent on the required degree of interventions. The same goes for the smart city project, where resources such as energy, traffic, and waste are all monitored and managed. In all these cases, the role of system integrators is in their expertise to design, develop, and deploy effective IoT systems that satisfy the needs and specifications of one or another company and bring the anticipated benefits helping to stay competitive.

According to the U.S. Department of Commerce, the adoption of IoT technologies in manufacturing could add up to USD 1.4 trillion in value to the sector by 2025 through increased operational efficiencies and improved productivity.

The trend towards cloud computing has a considerable impact on the job of system integrators, as more and more identify the need to elaborate on the set of solutions related to cloud integrations. As more and more businesses adopt cloud solutions and recognize their benefits, such as scalability, flexibility, and cost-effectiveness, organizations are interested in rapidly switching their operations to the cloud. The focus on the cloud introduces a set of challenges that should be addressed in terms of introducing the cloud services to already present on-premise technologies and systems. Cloud integration is aimed at delivering the advanced flow of relevant information to businesses via the existing systems. System integrators may be able to use their skills and knowledge to develop a specific architecture for the usage of both cloud and on-premises applications to support the communication between the two and advance the cloud experience.

According to the U.S. National Institute of Standards and Technology (NIST), the cloud computing market is expected to reach USD 832 billion by 2025, driven by increasing demand for scalable and flexible solutions across various industries.

System Integrator Market Dynamics

Drivers

-

Rising safety and security concerns are driving the demand for automation solutions.

-

Increasing need for low-cost, energy-efficient manufacturing techniques

-

The adoption of the Internet of Things (IoT) and cloud computing in industrial automation is growing.

The emergence of the Internet of Things and cloud computing in industrial automation pertaining to the desire of organizations to enhance their operational efficiency and productivity. Modern companies tend to accept the importance of related devices and systems that can be easily connected and collect real-time data for better decision-making. On the one hand, such devices as sensors and actuators in IoT are highly beneficial for manufacturers as they can monitor equipment and environmental parameters constantly. Thus, predictive and preventive maintenance is highly facilitated, which reduces downtime. On the other hand, cloud computing in combination provides IoT with handy scalable storage and processing solutions to work with a considerable amount of data. It allows for developing memory-intensive neural networks and, thus, empowers modern enterprises to optimize their systems and streamline production.

Moreover, it adjusts businesses to work with more flexibility and develop rapid responses to internal needs or market changes. Finally, it ensures better innovative processes with easier access to understanding the necessities of production. Overall, it is evident that industries face the requirement of financial issues reduction and productivity increase. In such a context, the emergence of IoT in combination with cloud computing is highly beneficial and, to some extent, a driving force in related changes.

Restraint

-

Automation implementation and maintenance need significant expenses.

-

The drop in crude oil prices has an impact on investments in infrastructure automation.

The drop in the cost of crude oil has a significant impact on investment in infrastructure automation. First of all, it serves as a limiting factor, since oil and gas sector companies earn less revenue. The reduction in oil prices automatically leads to a decrease in the profit margin and budgets of related enterprises, which leads to a reassessment of the priorities of capital expenditures for modernization and innovative developments. Thus, investments in more advanced technologies of infrastructure automation, namely, the introduction of IoT systems, artificial intelligence, and robotic technologies, are being postponed or canceled in favor of urgent operational needs or maintenance. For this reason, companies are postponing or abandoning automation projects that could optimize spending, personnel structure, and other resources in the long run in favor of projects aimed at short-term survival. In addition, a drop in oil prices increases the unpredictability and risks of the outcome of IPOs and the fundraising associated with infrastructure automation projects. Thus, the reduction in funding opportunities is directly related to the reduction in oil prices, which weakens automation.

Opportunity

-

Healthcare has increased the demand for remote operations.

-

Industry 4.0 and digitization provide new opportunities.

Industry 4.0 and the accompanying processes of digitization have the potential to significantly change the approaches to various sectors by boosting the levels of efficiency, flexibility, and innovation in the field of manufacturing and industry. Specifically, companies need to adopt the use of the Internet of Things technologies and artificial intelligence, apply big data analytics, and make use of robotics to develop smart factories. As a result, the end enterprise acquires an asset that can provide feedback, inform itself on the issue of production based on real-time data, and automate its processes. The technical capacity to do so contributes to higher levels of operational output by cutting waste and preserving or even raising the quality of production while drastically reducing lost time due to predictive maintenance and downscale adjustments.

System Integrator Market Segmentation Overview

By Type

The hardware market segment accounted for the largest market share of over 44% as of 2023. It is primarily attributed to the growing demand for advanced infrastructure across different industries, such as telecommunications, BFSI, healthcare, or education. As companies adopt interconnection systems, networking hardware, servers, and data storage solutions are experiencing increased demand. Furthermore, IoT, AI, and cloud advancements have facilitated the demand for new hardware to support specific technologies. In the UAE and KSA, the hardware purchase services market segment is experiencing increased demand, as these regions have been investing in smart cities

The services market segment is anticipated to experience rapid growth throughout the forecast period. It is primarily caused by the increasing complexity of IT systems and the emergence of digitalization within various industries. As companies seek to adjust to cloud-based platforms, as well as to adopt such solutions as IoT and AI, services, including consulting, implementation, customization, or support are in high demand. Qatar is characterized by a considerable demand for system integration services, as it pursues the Smart Qatar Program, TASMU. Similar initiatives oriented toward IT infrastructure modernization, cybersecurity, and real-time analytics are observed in the BFSI and healthcare sectors, thus causing increased demand for comprehensive integration services.

By Organization Size

Large enterprises held the largest market share around 54% in 2023. Large enterprises often lead in terms of investment capacity, access to resources, and the ability to implement complex digital transformation initiatives on a broader scale. Their established infrastructure allows them to integrate advanced technologies like artificial intelligence, big data analytics, and the Internet of Things (IoT) more effectively. These companies can leverage their scale to optimize operations, improve supply chain management, and enhance customer experiences, making them frontrunners in the competitive landscape.

By End-Use

IT & Telecom segment dominated the market with over 25% of the overall revenue gains within the given timeframe. It implies that the IT & Telecom segment within the market displays notable upward progress, primarily caused by the high pace of the digitalization of numerous businesses and the growing use of cloud-centric solutions. As a result of companies transitioning to cloud computing and focusing on the growth of their networks, the demand for system integrators, who will work on the complicated IT infrastructure to ensure that the legacies and the new options are closely aligned, is increasing. In addition, the pressure caused by the rapid expansion of the 5G telecommunications segment and the necessity to ensure strong cybersecurity solutions has indicated that telecom companies are starting to collaborate with system integrators to simplify deployment and improve general network management and connectivity to ensure that the performance is kept at a high level of quality.

Need any customization research/data on System Integrator Market - Enquiry Now

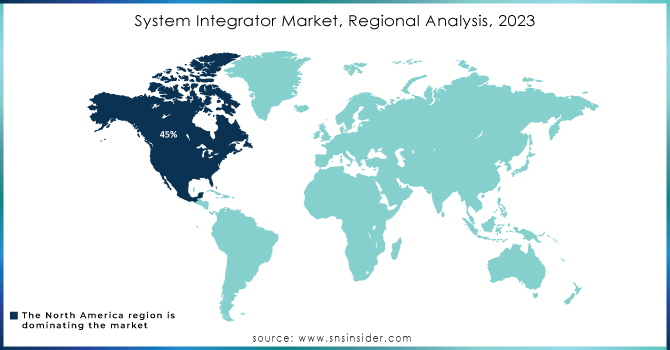

System Integrator Market Regional Analysis

North America held the largest market share around 45% in 2023. The largest market share in the sphere of Industry 4.0 and digitization belongs to North America. Its leading position can be explained by the existing technical infrastructure, economic power, and focus on innovations in the region. North America is known for its leading technology brands, such as Apple, Google, and Microsoft, and research organizations that are already actively implementing such advanced technologies as IoT, AI, and automation systems. A high level of investment in research and workforce training also plays a vital role in the industry’s development of manufacturing automation and smart manufacturing processes.

According to the U.S. Federal Communications Commission (FCC), the U.S. ranks first globally in broadband adoption, with approximately 93% of households having access to high-speed internet, a critical enabler for Industry 4.0 technologies.

Key Players in System Integrator Market

-

John Wood Group (Wood Group's Integrated Solutions)

-

ATS Automation (ATS Digital Factory)

-

Avanceon Limited (Avanceon Smart Factory Solutions)

-

JR Automation (JR Automation Industrial Solutions)

-

Tesco Controls, Inc. (Tesco SCADA Solutions)

-

Burrow Global LLC (Burrow Automation Services)

-

Prime Controls LP (Prime Controls Automation Solutions)

-

MAVERICK Technologies (MAVERICK Manufacturing Operations Management)

-

Barry-Wehmiller (BW Integrated Systems)

-

INTECH Process Solutions (INTECH Automation Services)

-

Emerson Electric Co. (Emerson Process Management)

-

Honeywell International Inc. (Honeywell Process Solutions)

-

Rockwell Automation (FactoryTalk Software)

-

Schneider Electric (EcoStruxure Architecture)

-

Siemens AG (Siemens Digital Industries Software)

-

KUKA AG (KUKA Robotics Solutions)

-

FANUC Corporation (FANUC Robotics Automation)

-

ABB Ltd. (ABB Ability Digital Solutions)

-

Yokogawa Electric Corporation (Yokogawa Industrial Automation)

-

Mitsubishi Electric Corporation (Mitsubishi Electric Factory Automation)

Key User

-

BP (British Petroleum)

-

Tesla

-

PepsiCo

-

Procter & Gamble

-

Nestlé

-

ExxonMobil

-

Valero Energy Corporation

-

Coca-Cola

-

Heineken

-

Johnson & Johnson

-

Shell

-

Dow Chemical

-

Ford Motor Company

-

Apple Inc.

Recent Development:

-

In 2023, Launched ATS Digital Factory 2.0, offering enhanced analytics and AI-driven insights for manufacturing efficiency.

-

In 2023, Burrow Global LLC launched Burrow AI, a cutting-edge suite of AI-powered solutions designed specifically for predictive maintenance in the energy sector. This innovative platform leverages advanced machine learning algorithms and data analytics to analyze equipment performance, predict potential failures, and optimize maintenance schedules.

-

In 2023, Mitsubishi's e-F@ctory, a comprehensive solution for integrating factory automation with IoT technologies.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 28.5 Billion |

| Market Size by 2032 | US$ 45.4 Billion |

| CAGR | CAGR 7% From 2024 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • by Services (Infrastructure Integration, Application Integration, and Consulting) • by End-use (IT & Telecom, Defense & Security, BFSI, Oil & Gas, Healthcare, Transportation, Retail, and Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe [Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | John Wood Group, ATS Automation, Avanceon Limited, JR Automation, Tesco Controls, Inc., Burrow Global LLC, Prime Controls LP, MAVERICK Technologies, Barry-Wehmiller, and INTECH Process |

| Key Drivers | • Rising safety and security concerns are driving the demand for automation solutions. • Increasing need for low-cost, energy-efficient manufacturing techniques |

| Market Restraints | • Automation implementation and maintenance need significant expenses. • The drop in crude oil prices has an impact on investments in infrastructure automation. |