Carbonization Furnace Market Report Scope & Overview:

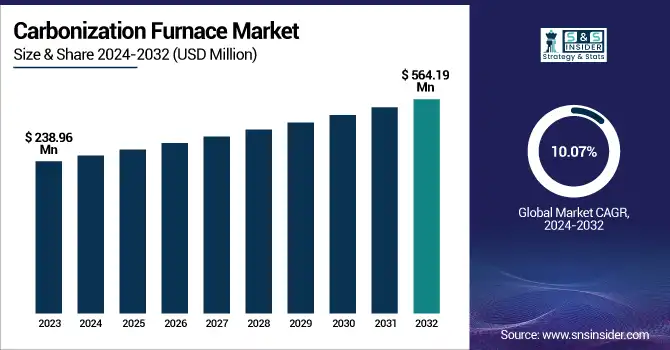

The Carbonization Furnace Market Size was valued at USD 238.96 Million in 2023 and is expected to reach USD 564.19 Million by 2032 and grow at a CAGR of 10.07% over the forecast period 2024-2032.

To Get more information on Carbonization Furnace Market - Request Free Sample Report

The Carbonization Furnace Market is experiencing rapid growth fueled by increasing demand for biochar, charcoal, and renewable fuel sources. The furnaces, which are utilized to transform biomass into rich carbon products, are gaining momentum in agriculture, metallurgy, and the energy industries. Growing environmental issues, along with the trend towards renewable energy and waste-to-energy solutions, are additionally fueling adoption. Advances in continuous carbonization technologies are making the processes more efficient and scalable.

The U.S. Carbonization Furnace Market was valued at USD 33.17 Million in 2023 and is expected to reach USD 73.97 Million by 2032, growing at a CAGR of 9.37% during 2024-2032. The United States Carbonization Furnace Market is growing steadily, with rising demand for green energy solutions and biochar in farming. As there is a growing focus on carbon emission reduction and agricultural waste management, U.S. industries are implementing sophisticated carbonization technologies, especially continuous furnaces, for greater efficiency and automation. Government incentives for clean energy and waste-to-energy conversion are driving market growth.

Carbonization Furnace Market Dynamics

Key Drivers:

-

Increasing Usage of Biochar in Horticulture and Agriculture Fuels the Carbonization Furnace Market Growth.

The expanding application of biochar in agriculture and horticulture is a key driver for the carbonization furnace market growth. Farmers and agronomists worldwide, particularly in the U.S. and the European region, are using biochar due to its soil conditioning, moisture holding, and carbon sequestration aspects. This green farming alternative has attracted interest in the face of increasing environmental issues and calls for enhanced soil fertility. Since carbonization furnaces are a key requirement for producing biochar, their demand is being driven faster by this agricultural change. Government incentives promoting green practices and organic cultivation further drive the market for efficient and high-volume carbonization technologies.

Restrain

-

High Capital Expenditure and Operating Costs Restrict the Use of Carbonization Furnaces by Small and Medium Enterprises.

Although the environmental and economic advantages, carbonization furnaces have high capital expenditure and operating costs, particularly continuous models with automation and emission controls. These costs are a heavy burden for small and medium enterprises (SMEs), discouraging them from embracing advanced carbonization technologies. Other costs associated with raw material handling, energy usage, and compliance with regulations add to the financial burden. This constraint impacts market penetration in price-sensitive areas and by low-scale producers. Consequently, market expansion can be impeded without subsidies, financing arrangements, or cost-reduction innovations that seek to alleviate entry barriers for small players.

Opportunities

-

Growth in Focus on Renewable Energy and Waste-to-Energy Conversion Opens New Avenues for Carbonization Furnace Manufacturers.

The worldwide adoption of renewable energy and waste-to-energy conversion is a key growth driver for carbonization furnace manufacturers. As governments and industries work towards minimizing fossil fuel reliance and sustainably utilizing organic waste, carbonization furnaces are becoming an attractive solution. These furnaces can transform agricultural, forestry, and municipal waste into energy-dense byproducts such as biochar, tar, and wood vinegar. This is in line with circular economy objectives and sustainability requirements. Additionally, the growing interest in decentralized energy systems and carbon credits provides fertile ground for innovation and growth in the furnace industry, especially in North America, Europe, and the Asia-Pacific region.

Challenges

-

Sophisticated Regulatory Approvals and Emission Standards Are a Significant Challenge to Carbonization Furnace Deployment in Major Markets

Environmental regulations and securing emissions-related approvals are key challenges for carbonization furnace operators and manufacturers. The furnaces, particularly when dealing with mixed biomass, release volatile organic compounds and other pollutants. To counter these effects, governments have established strict standards, particularly in developed markets such as the U.S. and EU. Adherence to such norms usually means the incorporation of sophisticated filtration units and real-time emission monitoring, raising equipment costs and complexity. Additionally, lag in regulatory clearances can affect project schedules and deter new installations. Overcoming these challenges means close coordination with environmental authorities and ongoing technological updates to address changing standards.

Carbonization Furnace Market Segments Outlook

By Type

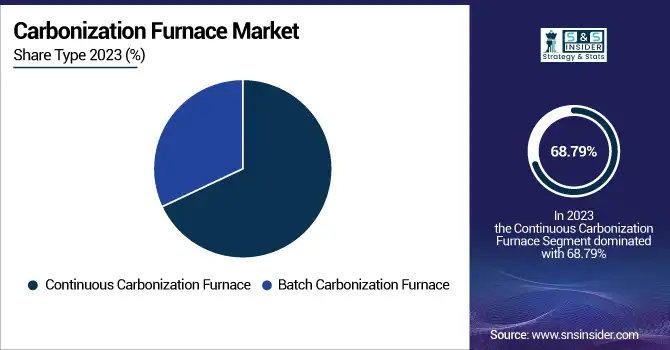

The Continuous Carbonization Furnace dominated the Carbonization Furnace Market with the highest revenue share of 68.79% and was the fastest-growing type with a CAGR of 10.25% in 2023. The growth is due to the increased demand for efficient, automated biomass processing solutions for agriculture, energy, and waste management industries. Beston Group Co. Ltd. launched the BST-50 Pro, a modular continuous furnace, whereas GreenPower LTD upgraded its EKKO-2 model with emission control systems. These product launches demonstrate the market's trend toward continuous systems for greater productivity, scalability, and environmental regulatory compliance, affirming their dominance and quick uptake across the world.

By Feedstock

The Agricultural Waste segment dominated the Carbonization Furnace Market in 2023, commanding the highest revenue share of 39.58%. This supremacy is driven by the availability and affordability of crop residues, husks, and straws throughout developing and agriculture-intensive countries. Beston Group and Bioforcetech Corporation are among the firms that have introduced sophisticated carbonization systems for processing various agricultural biomass with greater efficiency and control of emissions. These technologies align with emerging sustainability agendas, which stimulate farms and agri-businesses to transform waste into value-added resources such as biochar and wood vinegar. The segment's visibility is an indication of the increasing demand for circular and zero-waste agriculture.

The Nutshell Waste segment is expected to expand with the fastest CAGR of 11.79% through the forecast period due to the increasing application of coconut, walnut, and almond shells as high-carbon biomass for high-grade biochar and activated carbon. Firms like Amisy Group and MoreGreen Environmental have come up with specialized carbonization furnaces that can process nutshell waste effectively with minimal exhaust. The increased demand for nutshell-produced biochar in water treatment, soil amendments, and industrial filtering is further driving this growth. This phenomenon is evidencing a transformation towards high-efficiency use of feedstock, rendering nutshell waste as a strategic material in the developing Carbonization Furnace Market.

By Application

The charcoal component held the highest revenue share of 63.64% in 2023 in the Carbonization Furnace Market owing to its widespread application in metallurgy, industrial heating, and production of activated carbon. Major producers like GreenChar, Namchar, and Kingsford have increased production capacity to cater to the increasing demand for superior-quality charcoal. Interestingly, Yilkins launched sophisticated carbonization systems with real-time monitoring for better charcoal yield and energy efficiency. This expansion directly drives the demand for high-capacity carbonization furnaces, especially continuous furnaces, to facilitate industrial-scale production. Technological innovations and rising global consumption are strengthening the supremacy of the charcoal application category.

The wood vinegar category is expected to expand at the fastest CAGR of 11.70% over the forecasting period, driven by its increasing utilization in organic agriculture, pest management, and soil enrichment. Entities like Tagrow Co., Ltd., and NETAFIM have brought natural crop improvers and bio-stimulants using wood vinegar. Further, Carbon Gold Ltd. incorporated wood vinegar as part of its regenerative farming-focused product range. This booming demand inspires feedstock choice improvements and furnace design efficiencies for higher wood vinegar yield. Therefore, the increase in this sector greatly increases the Carbonization Furnace Market through the encouragement of furnace flexibility towards bio-based and renewable feedstocks.

Carbonization Furnace Market Regional Analysis

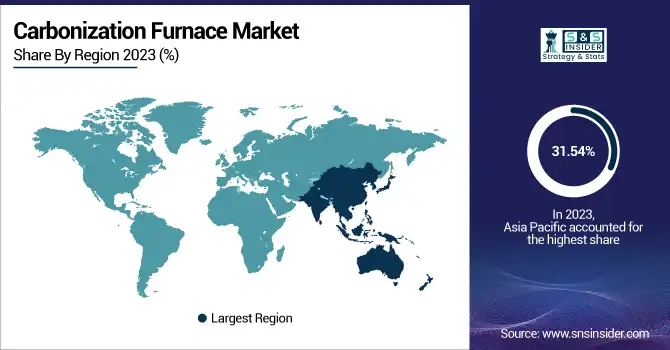

Asia Pacific dominated the largest revenue share of 31.54% in the Carbonization Furnace Market in 2023 due to high biomass availability and rising demand for sustainable charcoal and biochar production. China, India, and Japan are significantly investing in biomass conversion technologies to promote renewable energy objectives and lower carbon emissions. Recent trends involve the introduction of high-efficiency continuous carbonization systems by firms such as Henan Olten Environmental Sci-Tech Co., Ltd. for industrial-scale use. Indian manufacturers are also diversifying product offerings focused on agricultural waste utilization. These trends are in line with local clean energy objectives, reinforcing the dominance of the segment.

Europe is poised to record the highest CAGR of 11.41% in the Carbonization Furnace Market in the forecast period due to stringent environmental regulations, carbon neutrality targets, and increasing organic farming solution demands. The continent is witnessing growing applications of wood vinegar and biochar in farming and environmental cleansing. Interestingly, in 2023, German firm PYREG GmbH unveiled a high-end pyrolysis-based carbonization module to be used in decentralized waste processing and the generation of biochar. France and the Netherlands also have pilot schemes for the capture of carbon through biochar underway. All this is evidence of Europe's firm regulatory backing and innovation-led development in this space.

Get Customized Report as per Your Business Requirement - Enquiry Now

Carbonization Furnace Market Key Players are:

-

GreenPower LTD – (Biomass Carbonization Plant BST-30, Carbonization Furnace EKKO)

-

Beston Group Co. Ltd. – (BST-50 Charcoal Making Machine, BST-J40 Batch Carbonization Furnace)

-

Zhengzhou Belong Machinery Co. Ltd. – (Continuous Coconut Shell Carbonization Furnace, Wood Charcoal Making Machine)

-

Zhengzhou Shuliy Machinery Co. Ltd. – (Continuous Rice Husk Carbonization Furnace, Horizontal Carbonization Kiln)

-

Tianjin Mikim Technique Co. Ltd. – (Activated Carbon Rotary Carbonization Furnace, Biomass Charcoal Carbonization Stove)

-

Henan Chengjinlai Machinery Co. Ltd. – (Straw Charcoal Carbonization Furnace, Wood Chips Carbonization Machine)

-

Gongyi Xiaoyi Mingyang Machinery Plant – (Continuous Palm Shell Carbonization Furnace, Charcoal Briquette Carbonization Kiln)

-

Gongyi Sanjin Charcoal Machinery Factory – (Hoisting Type Carbonization Furnace, Environmental Protection Carbonization Stove)

-

Zhengzhou Jiutian Machinery Equipment Co. Ltd. – (Charcoal Carbonization Furnace for Sawdust, Rotary Carbonization Machine)

-

Henan Sunrise Biochar Machine Co., Ltd. – (Sunrise Continuous Biochar Furnace, Sunrise Mini Batch Biochar Kiln)

-

Brycoat Inc. – (Vacuum Plasma Spray Coatings, Ceramic Thermal Spray Coatings)

-

Höganäs AB – (Amperit Thermal Spray Powders, Plasma Transferred Arc Solutions)

-

General Magnaplate Corporation – (Plasmadize Coatings, Nedox Thermal Spray Surface Treatments)

-

Flame Spray Technologies BV – (Arc Spray System FST-ArcJet, HVOF System FST-MultiCoat)

-

Others – (Customized HVOF Equipment, On-site Coating Services)

Recent Developements

-

October 2023 – GreenPower introduced an upgraded version of its EKKO-2 model featuring an integrated gas cleaning system for ultra-low emissions, targeting stricter EU regulations.

-

January 2024 – Beston launched an enhanced BST-50 Pro with a modular design, allowing multiple feedstock types like bamboo, coconut shell, and rice husk with minimal downtime.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 238.96 Million |

| Market Size by 2032 | US$ 564.19 Million |

| CAGR | CAGR of 10.07% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type – (Continuous Carbonization Furnace, Batch Carbonization Furnace) • By Feedstock – (Agricultural Waste, Forestry Waste, Nutshell Waste) • By Application – (Charcoal, Wood Vinegar, Tar) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | GreenPower LTD, Beston Group Co. Ltd., Zhengzhou Belong Machinery Co. Ltd, Zhengzhou Shuliy Machinery Co. Ltd, Tianjin Mikim Technique Co. Ltd., Henan Chengjinlai Machinery Co. Ltd., Gongyi Xiaoyi Mingyang Machinery Plant, Gongyi Sanjin Charcoal Machinery Factory, Zhengzhou Jiutian Machinery Equipment Co. Ltd., Henan Sunrise Biochar Machine Co.,Ltd |