Insomnia Therapeutics Market Report Scope & Overview:

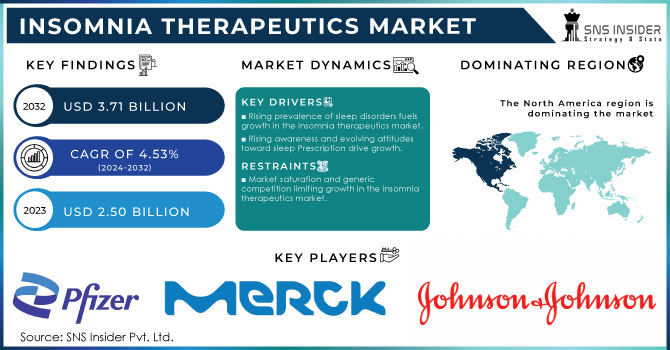

The Insomnia Therapeutics Market size was valued at USD 2.50 Billion in 2023 and is expected to reach USD 3.71 Billion by 2032 and grow at a CAGR of 4.53% over the forecast period 2024-2032. The insomnia therapeutics market is experiencing significant growth as the global prevalence of insomnia and other sleep disorders continues to rise. This market includes various therapeutic methods such as medications, cognitive behavioral therapy, and upcoming alternative therapies. Medications like sedatives and sleep aids have always been essential in treating insomnia. Commonly used medications such as benzodiazepines and non-benzodiazepine sleep aids are widely utilized for temporary relief. In the United States, benzodiazepines are often recommended for issues such as anxiety, sleeplessness, and seizures; however, there are notable dangers associated with their usage, especially when used alongside opioids. In 2023, around 12.6% of American adults acknowledged using benzodiazepines, while 2.1% confessed to misusing them. Nevertheless, these drugs frequently carry the potential for addiction and adverse reactions, leading researchers to seek out safer and more efficient therapies. Consequently, there is a growing interest in new medications with better safety profiles and mechanisms of action in the market.

Get More Information on Insomnia Therapeutics Market - Request Sample Report

Recently, there has been a noticeable change in the use of cognitive behavioral therapy for insomnia (CBT-I). CBT-I is a method that is based on evidence and has a structured approach to address the psychological factors that cause disruptions in sleep. Research shows that Cognitive Behavioral Therapy for Insomnia (CBT-I) is a very successful remedy for chronic insomnia, helping roughly 70-80% of individuals dealing with this issue. Around 10-15% of adults in the U.S. are impacted by chronic insomnia, which is defined as having trouble falling or staying asleep at least three times a week for three months or longer. The price range for CBT-I sessions can be anywhere from USD 100 to USD 200, and although insurance coverage is getting better, it remains uneven. This alternative therapy has become more popular because of its effectiveness over time and few adverse reactions. The increasing availability of telemedicine has made it easier for people who couldn't access traditional therapy to utilize CBT-I.

Market Dynamics

Drivers

-

Rising prevalence of sleep disorders fuels growth in the insomnia therapeutics market.

The increasing occurrence of insomnia and other sleep disorders is a key factor for the growth of the insomnia therapeutics market. Research shows that a significant number of people around the world experience sleep problems, which range in severity. The increasing prevalence of insomnia is influenced by factors like stress, lifestyle adjustments, and undisclosed Prescription issues. An example of this is the rise in sleep disorders caused by today's high-stress levels and excessive use of screens. Chronic sleeplessness impacts daily activities, mental abilities, and general well-being, leading to a need for efficient treatment options. Pharmaceutical companies and research institutions are making significant investments in creating new drugs and therapies to meet the increasing demand. Emerging drug formulations, such as extended-release and combination therapies, are being developed to improve effectiveness and safety. Furthermore, the growing understanding of how sleep disorders affect mental Prescription and productivity is driving the need for effective insomnia treatments. The increasing number of people suffering from insomnia has led to a rise in demand for sleep aids, both prescription and over-the-counter, which is driving the growth of the market.

-

Rising awareness and evolving attitudes toward sleep Prescription drive growth.

More and more people are recognizing and embracing mental Prescription concerns like insomnia and sleep disorders. Efforts to raise public awareness, educate, and advocate have helped increase understanding of the significance of sleep Prescription. As societal views on mental Prescription progress, an increasing number of people are seeking assistance for their sleep disorders and are willing to consider different treatment choices. Prescription care providers are increasingly taking a proactive approach to addressing sleep disorders by incorporating sleep Prescription into comprehensive mental Prescription and wellness initiatives. The increasing importance placed on sleep Prescription is creating a need for efficient treatments for insomnia. The reduced stigma around seeking assistance for sleep issues is resulting in more people seeking help and being more open to trying out new treatments. The increase in societal attitudes is driving the expansion of the insomnia therapeutics market.

Restraints

-

Market saturation and generic competition limit growth in the insomnia therapeutics market.

The insomnia therapeutics market is significantly limited by market saturation and competition from generic products. With an increasing number of therapies on the market, competition between pharmaceutical companies is growing due to a wide range of available options. Having many products available for sale can result in a decrease in profit margins due to competition over prices. Moreover, the expiry of patents for common sleep disorder drugs paves the way for generic alternatives to be introduced in the market. Generic medications, usually less expensive than branded drugs, can greatly affect the sales of patented treatments. The presence of generic options can decrease market share for branded items and constrain revenue growth for pharmaceutical firms. Key factors like market saturation and generic competition can hinder the growth of the insomnia therapeutics market.

Market Segmentation

By Type

Benzodiazepines held a major market share of 30% in 2023 and led the market. These drugs function by amplifying the impact of a neurotransmitter known as gamma-aminobutyric acid (GABA), which helps with calming and decreasing anxiety, ultimately aiding in sleep. Benzodiazepines like diazepam and lorazepam are commonly utilized due to their rapid onset of action and efficacy in treating short-term and chronic insomnia. Big pharmaceutical companies such as Pfizer and Roche remain dedicated to creating and selling benzodiazepine-based sleep medications, securing their dominant position in the market.

Antidepressants are accounted to have a faster CAGR during 2024-2032. Trazodone and amitriptyline are becoming more popular because of their ability to treat both insomnia and mood disorders such as depression simultaneously. The rise in their development is spurred by a growing acknowledgment of mental Prescription and the demand for treatments with multiple functions. Leading companies such as Eli Lilly and GlaxoSmithKline, are working on creating new formulations and combinations to improve effectiveness while reducing side effects.

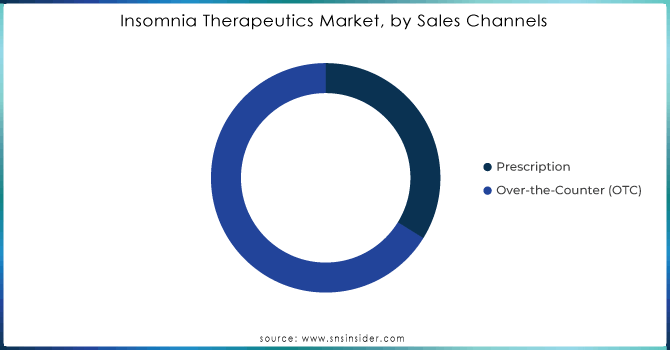

By Sales Channel

The over-the-counter (OTC) segment dominated in 2023 with a 59% market share. The segment's growth is driven by the growing trend towards self-treatment and the expanding range of safe, non-addictive sleep aids. Companies like GSK are extending their over-the-counter product lines in response to increased consumer knowledge about sleep Prescription and available options. The increasing popularity of melatonin supplements as natural sleep aids is contributing to the rapid growth of the insomnia therapeutics market segment.

The prescriptions are expected to grow at a faster rate during the forecast period because of their connection to specific treatments such as benzodiazepines and other medications that promote sleep. Valium (Diazepam) and Xanax (Alprazolam) are commonly used to treat short-term insomnia due to their strong sedative properties. Prescription care professionals commonly recommend these medications to patients with severe or chronic insomnia to effectively manage the condition. Major pharmaceutical companies such as Pfizer, the manufacturer of Ativan (Lorazepam), are crucial players in this industry, providing various medications for treating insomnia.

Need any customization research on Insomnia Therapeutics Market - Enquiry Now

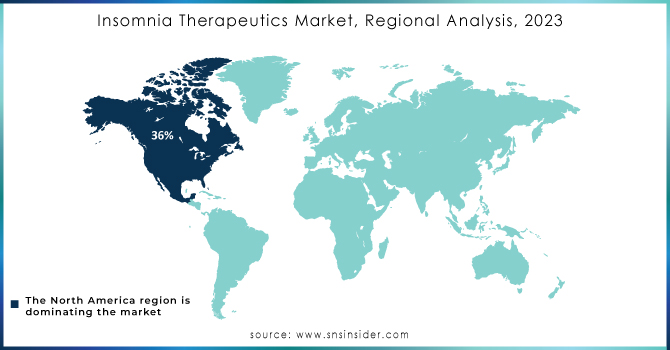

Regional Analysis

North America captured a market share of 36% in 2023 because of its high prescription care spending, advanced medical infrastructure, and well-established pharmaceutical sector. Big companies such as Eli Lilly, Pfizer, and Merck provide a range of treatments for insomnia, including both prescription drugs and behavioral therapies. These companies prioritize research and development to bring about groundbreaking treatments. Strong regulatory frameworks and high consumer awareness about sleep disorders continue to bolster North America's market strength.

The APAC region is accounted to grow at a faster rate during the forecast period 2024-2032. China and India play a major role in driving this growth. An uptick in insomnia cases and a rise in curiosity for pharmaceutical and non-pharmaceutical remedies are propelling the market. For example, Mylan's Ambien and Taro's Zolpidem are commonly utilized in these sectors. The rapid market growth in APAC is driven by the expansion of Prescriptioncare services and increased adoption of advanced treatments.

Key Players

The major key players in the market are:

-

Merck & Co., Inc.

-

Johnson & Johnson

-

Sanofi S.A.

-

Takeda Pharmaceutical Company Limited

-

Novartis International AG

-

Astellas Pharma Inc.

-

Sumitomo Dainippon Pharma Co., Ltd.

-

SAGE Therapeutics

-

Almore Bio

-

Neos Therapeutics

-

Axovant Gene Therapies Ltd.

-

Zyla Life Sciences

Recent Development

-

April 2024: Insomnia Therapeutics entered into a strategic partnership with SleepTech Innovations to integrate their AI-driven sleep monitoring Type with Insomnia Therapeutics’ treatment solutions, enhancing patient outcomes through personalized treatment plans.

-

August 8, 2024: Insomnia Therapeutics received FDA approval for "SlumberX," a new pharmaceutical treatment for insomnia. This drug aims to provide a fast-acting solution with minimal side effects, marking a significant advancement in its product portfolio.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 2.50 Billion |

| Market Size by 2032 | USD 3.71 Billion |

| CAGR | CAGR of 4.53% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (Benzodiazepines, Nonbenzodiazepines, Antidepressants, Orexin Antagonists, Melatonin Antagonists, Others) • By Sales Channel (Prescription, OTC) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Pfizer Inc., Merck & Co., Inc., Johnson & Johnson, Sanofi S.A., Takeda Pharmaceutical Company Limited, Novartis International AG, Astellas Pharma Inc., Sumitomo Dainippon Pharma Co., Ltd., SAGE Therapeutics, Vanda Pharmaceuticals Inc., Almore Bio, Neos Therapeutics, Axovant Gene Therapies Ltd., and Zyla Life Sciences |

| Key Drivers | • Rising prevalence of sleep disorders fuels growth in the insomnia therapeutics market. • Rising awareness and evolving attitudes toward sleep health drive growth. |

| Restraints | • Market saturation and generic competition limiting growth in the insomnia therapeutics market. |