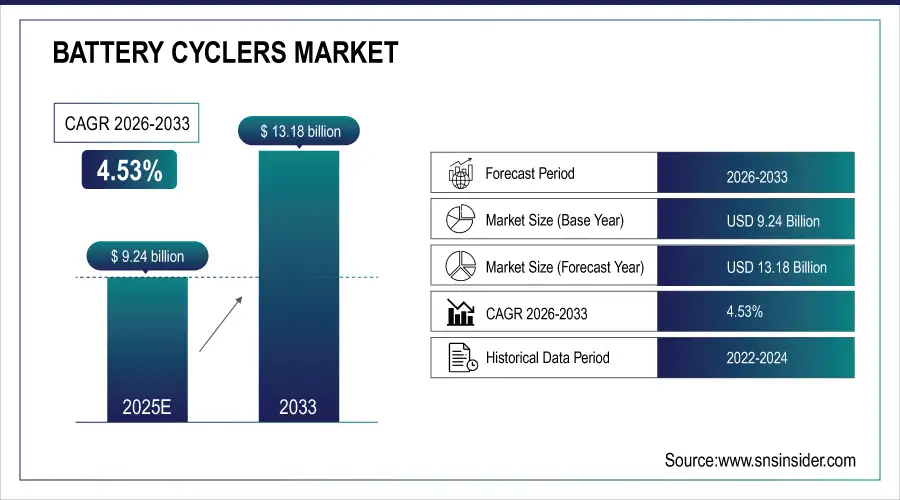

Battery Cyclers Market Size Analysis:

The Battery Cyclers Market is estimated at USD 9.24 Billion in 2025E and is projected to reach USD 13.18 Billion by 2033, growing at a CAGR of 4.53% over 2026 to 2033.

The Battery Cyclers Market analysis report provides a comprehensive overview of the technologies used to test batteries, the requirements for validating their lifecycle, and the trends in their use in electric vehicles, energy storage systems, consumer electronics, and industrial batteries. During the forecast period, the market is likely to increase because of more money going into battery research and development, more electric vehicles on the road, stricter safety rules, and lithium-based chemistries becoming more complicated.

Battery cyclers are expected to be deployed across over 14,500 battery R&D labs, gigafactories, and testing facilities globally by 2025, driven by accelerating battery production volumes and the need for precision testing across charge-discharge cycles, aging, and performance validation.

Battery Cyclers Market Size and Growth Projection:

-

Market Size in 2025: USD 9.24 Billion

-

Market Size by 2033: USD 13.18 Billion

-

CAGR: 4.53% from 2026 to 2033

-

Base Year: 2025

-

Forecast Period: 2026–2033

-

Historical Data: 2022–2024

To Get more information on Battery Cyclers Market - Request Free Sample Report

Key Battery Cyclers Market Trends:

-

Investment in lithium-ion battery gigafactories is driving demand for multi-channel battery cyclers, with battery manufacturing capacity growing at 20%+ CAGR.

-

Adoption of solid-state and next-generation chemistries is increasing demand for programmable cyclers, with advanced battery testing growing at 15%+ annually.

-

Focus on battery safety and compliance is boosting end-of-line cycler deployment, with over 80% of EV battery lines using automated testing.

-

Growth of battery recycling and second-life applications is raising demand for cyclers supporting health diagnostics, expanding at 25%+ annually.

-

Integration of AI analytics and cloud connectivity is reducing test cycle time by 20–30%.

-

Emphasis on battery lifespan and reliability is accelerating adoption of high-channel-density, long-duration cycling systems.

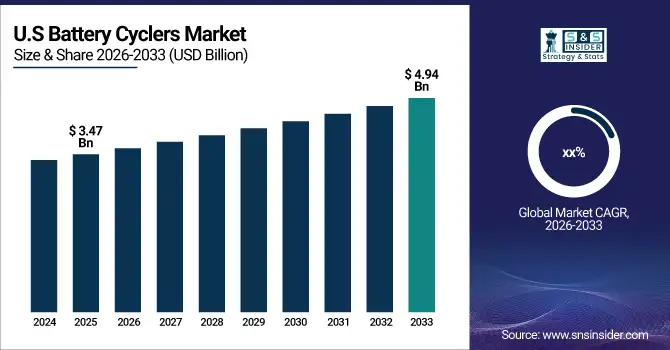

U.S. Battery Cyclers Market Analysis

The U.S. Battery Cyclers Market size is projected to grow from USD 3.47 Billion in 2025E to reach USD 4.94 Billion by 2033. The fast growth of local electric vehicle and battery cell manufacturing, strict testing and safety rules for battery quality assurance, and increased investments in grid-scale energy storage are all driving growth. More research and development into new battery chemistries at national labs and in the business sector is driving up demand for improved cycling and profiling devices.

Battery Cyclers Market Growth Drivers:

-

Rising Battery Production and EV Adoption Driving Testing Demand to Drive Market Growth Globally

The Battery Cyclers Market is growing as there is high demand for electric cars, energy storage systems, and portable devices globally. In 2024, the world made more than 1.2 TWh of lithium-ion batteries. By 2030, that number is predicted to reach more than 3.0 TWh. This means that testing needs will rise dramatically for cell development, module validation, and pack-level qualification.

Battery cyclers are very important for checking performance, safety, cycle life, and how the battery degrades over time. Manufacturers depend on cyclers with excellent precision to meet strict OEM criteria, regulatory standards, and warranty obligations. As battery topologies get more complicated, more and more people want multi-channel, programmable cyclers that can run all the time.

The amount of money spent on battery testing is expected to rise by more than 11% in 2025 as new EV platforms and energy storage systems will be released.

Battery Cyclers Market Restraints:

-

High Equipment Costs and Long Testing Cycles Limiting Adoption May Hamper Market Expansion Globally

The Battery Cyclers Market has a lot of problems as it needs a lot of money to start out and takes a long time to test. Advanced cyclers with high channel density, precise control, and thermal integration need a lot of money up front, which makes it hard for smaller manufacturers and research institutes to use them.

Tests that endure for a long time, sometimes months, cost more to run and slow down the process of making new products. Also, connecting cyclers to current lab infrastructure and data management systems can be hard and require professional workers and calibration knowledge. These problems make it harder for businesses to enter the market, especially in areas where people are sensitive to prices.

Battery Cyclers Market Opportunities:

-

Growth of Solid-State Batteries and Recycling Applications Creating New Demand for Market Expansion Globally

The Battery Cyclers Market has enormous opportunities to grow as more people are using solid-state batteries and more places are recycling batteries. Next-generation cyclers are in high demand because solid-state technologies need very regulated cycling profiles, accurate voltage management, and sophisticated safety monitoring.

Battery recycling and second-life evaluation are becoming popular new uses that need cyclers to check capacity, analyze state of health, and grade. Test equipment makers and automation companies can take advantage of this trend by building cycling platforms that can grow and run on software.

By 2025, more than 26% of new battery cyclers are estimated to be used for solid-state and recycling-related testing.

Battery Cyclers Market Segmentation Analysis:

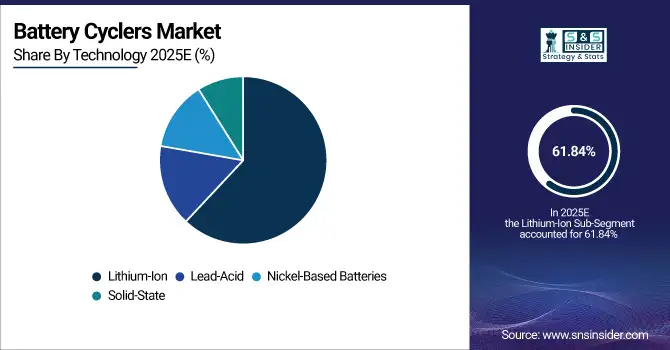

-

By Technology, Lithium-Ion held the largest market share of 61.84% in 2025, while Solid-State is expected to grow at the fastest CAGR of 10.42% during 2026–2033.

-

By Type, Multi-Channel battery cyclers dominated with a 47.96% share in 2025, while Programmable cyclers are projected to grow at the fastest CAGR of 9.68%.

-

By Application, Research & Development accounted for the largest share of 38.12% in 2025, while Battery Recycling is expected to grow at the fastest CAGR of 9.91% during the forecast period.

By Technology, Lithium-Ion Dominates While Solid-State Expands Rapidly

Lithium-ion segment dominated the market due to its widespread use across EVs, consumer electronics, and stationary energy storage. Over 9,000 testing facilities globally relied on lithium-ion battery cyclers in 2025 to validate capacity, cycle life, and safety performance.

Solid-state batteries are the fastest-growing segment, driven by investments from automotive OEMs and battery developers. In 2025, over 1,100 labs and pilot lines deployed solid-state-compatible cyclers, reflecting growing demand for high-voltage precision and advanced safety testing.

By Type, Multi-Channel Dominates While Programmable Expands Rapidly

Multi-channel battery cyclers dominated the market as they enable simultaneous testing of multiple cells, improving throughput and reducing testing time. Over 6,800 multi-channel systems were operational in 2025 across gigafactories and R&D labs.

Programmable cyclers are the fastest-growing segment, driven by demand for customized charge-discharge profiles, dynamic load simulation, and AI-driven test automation. Programmable systems were deployed across 3,900 facilities in 2025, supporting advanced battery development.

By Application, R&D Dominates While Battery Recycling Expands Rapidly

Research and Development dominated the market due to continuous innovation in battery chemistries and cell architectures. Over 5,500 R&D labs utilized advanced battery cyclers in 2025 for performance optimization and material evaluation.

Battery recycling is the fastest-growing application, fueled by sustainability mandates and end-of-life battery regulations. Approximately 2,100 recycling and second-life facilities adopted battery cyclers in 2025 for health diagnostics and capacity grading.

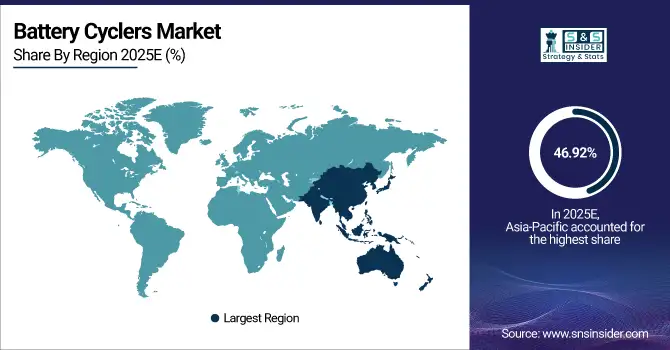

Asia Pacific Battery Cyclers Market Insights:

Asia Pacific dominated the Battery Cyclers Market, holding approximately 46.92% of global market share in 2025. Big battery factories in China, South Korea, Japan, and India are what make the market grow in the region. Asia Pacific is the global hub for battery cycler demand because it has a lot of electric vehicle (EV) manufacturing, a lot of lithium-ion and solid-state gigafactories that are growing quickly, and strong government support for battery localization and energy storage systems.

Get Customized Report as per Your Business Requirement - Enquiry Now

China Battery Cyclers Market Insights:

China is the largest contributor in Asia-Pacific, accounting for over 58% of regional battery cycler demand. The market is growing in the region due to strong goals for EV adoption, the world's greatest battery manufacturing capacity, and better battery recycling systems. China's leadership is still strong since there is a growing need for lithium-ion, LFP, and new solid-state battery testing systems in research and development, end-of-line testing, and recycling facilities.

North America Battery Cyclers Market Insights:

North America is the fastest-growing regional market, projected to expand at a CAGR of 9.41% during the forecast period. Investments in electric vehicles (EVs), large-scale energy storage systems (ESS), and federal incentives for making batteries in the US all help growth. Battery cycler usage is speeding up because battery supply chains are becoming more localized and there is more focus on quality assurance and safety testing.

U.S. Battery Cyclers Market Insights:

The U.S. dominates North America, contributing nearly 74% of regional market revenue. Demand is driven by strong research and development, the existence of top battery cycler makers, and the growth of electric vehicle (EV) and grid-scale energy storage system (ESS) projects. As more automation, high-precision testing, and data analytics are added to battery cyclers, testing becomes more efficient and faster in U.S. production and research facilities.

Europe Battery Cyclers Market Insights:

Europe’s Battery Cyclers Market is driven by accelerated automotive electrification, stringent battery safety and performance regulations, and sustainability-focused manufacturing initiatives. The region benefits from strong OEM participation and increasing investments in battery R&D and pilot production lines, supporting consistent demand for advanced battery testing equipment.

Germany Battery Cyclers Market Insights:

Germany leads the European market, accounting for approximately 32% of regional demand. A strong automotive OEM ecosystem, big investments in battery R&D, and widespread use of modern testing infrastructure all help growth. There is a growing need for battery cyclers that are very accurate and can work with several channels in EV development, validation labs, and quality control in production.

Latin America Battery Cyclers Market Insights:

Latin America is seeing consistent market expansion owing to the rise of electric vehicles, investments in battery manufacturing, and a greater focus on localized energy storage solutions. Government-led efforts to electrify the country and the slow growth of regional battery supply chains are helping to get more people to use battery testing devices.

Brazil Battery Cyclers Market Insights:

Brazil represents the largest market in Latin America, contributing approximately 41% of regional demand. EV pilot programs, battery assembly plants, and investments in renewable energy storage are all responsible for market growth. The need for battery cyclers is growing steadily since testing standards for lithium-ion batteries in both transportation and stationary storage applications are getting stricter.

Middle East & Africa Battery Cyclers Market Insights:

The market in the Middle East & Africa is growing slowly but surely, thanks to projects that store renewable energy, modernize the grid, and provide the infrastructure for electric vehicles (EVs) in their early stages. Investments by the government in diversifying energy sources are making battery testing solutions more popular.

United Arab Emirates Battery Cyclers Market Insights:

The UAE leads the MEA region, accounting for nearly 28% of regional market share. Growth is driven by large-scale renewable energy storage deployments, smart grid initiatives, and pilot EV programs. Increasing emphasis on battery performance validation and lifecycle testing is supporting rising adoption of advanced battery cyclers.

Battery Cyclers Market Competitive Landscape:

Kikusui Electronics Corporation, is a top producer of electronic measurement tools, power supply, and battery test systems. The company was founded in 1951 and has its main office in Yokohama, Japan. Many people utilize the company's battery cyclers in electric vehicles, energy storage, and research and development. They are very accurate and reliable for testing charge and discharge across a wide range of chemistries.

-

In 2023, Kikusui expanded its high-capacity regenerative DC power supply lineup to support advanced lithium-ion and solid-state battery testing.

EnerSys, founded in 1999 and based in Reading, Pennsylvania, is a world leader in stored energy solutions, such as industrial batteries, chargers, and energy management systems. The company works with telecom, data centers, industrial equipment, and grid-scale storage. It is also getting more involved in testing and validating batteries to improve their performance and safety during their lifetimes.

-

In 2024, EnerSys invested in advanced battery diagnostics and testing capabilities to accelerate development of next-generation lithium-based energy storage solutions.

Arbin Instruments, founded in 1991 and based in College Station, Texas, the company makes high-precision battery test equipment and cyclers for research and development, quality control, and production settings. Its solutions work with lithium-ion, solid-state, and next-generation batteries, and they serve battery manufacturers, car OEMs, and research institutes globally.

-

In 2023, Arbin introduced enhanced multi-channel battery cycler platforms with higher current density and improved software analytics for EV battery development.

MTI Instruments, founded in 1963 and based in Albany, New York, this company makes advanced test and measurement tools, such as battery testing systems, materials processing equipment, and analytical instruments. The organization is well-positioned in university research, battery research and development, and pilot-scale manufacturing, which helps new energy storage technologies.

-

In 2024, MTI expanded its battery testing portfolio to support solid-state and sodium-ion battery research with higher temperature and precision testing capabilities.

Battery Cyclers Companies are:

-

EnerSys

-

Arbin Instruments

-

MTI Instruments

-

Htest

-

BIT BUDDY

-

Hyperbat

-

Neware Technology

-

Zhengzhou Dazhong Machinery

-

Umicore

-

BASF

-

LG Chem

-

POSCO Chemical

-

Ganfeng Lithium

-

Tianqi Lithium

-

Cadex Electronics

-

Precision Electronics Corporation

-

Chroma ATE

-

Maccor

| Report Attributes | Details |

|---|---|

| Market Size in 2025E | USD 9.24 Billion |

| Market Size by 2033 | USD 13.18 Billion |

| CAGR | CAGR of 4.53 % From 2026 to 2033 |

| Base Year | 2025E |

| Forecast Period | 2026-2033 |

| Historical Data | 2022-2024 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Technology (Lithium-Ion, Lead-Acid, Nickel-Based Batteries, Solid-State) • By Type (Single Channel, Multi Channel, Programmable) • By Application (Research and Development, End-Of-Line Testing, Battery Recycling, Manufacturers) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

| Company Profiles | Kikusui Electronics, EnerSys, Arbin Instruments, MTI Instruments, National Instruments, Htest, BIT BUDDY, Hyperbat, Neware Technology, Zhengzhou Dazhong Machinery, Umicore, BASF, LG Chem, POSCO Chemical, Ganfeng Lithium, Tianqi Lithium, Cadex Electronics, Precision Electronics Corporation, Chroma ATE and Maccor. |