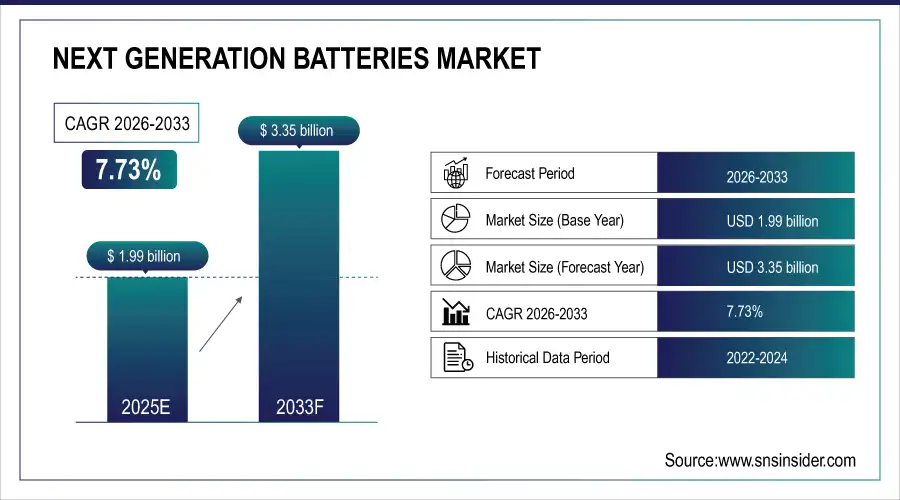

Next Generation Batteries Market Size Analysis:

The Next Generation Batteries Market Size was valued at USD 1.99 billion in 2025E and is expected to reach USD 3.35 billion by 2033 and grow at a CAGR of 7.73% over the forecast period 2026-2033.

The global market for next generation batteries is growing strongly, with increasing use of electric vehicles, growth of renewable energy, and further advances in battery technology. Solid-State, Lithium-Sulfur, and Lithium-Air batteries developments are improving energy density, safety and cycle life, enabling them a wider range of applications. Favorable government policies, growing environmental policies and high investments from both public and private sector is boosting commercialization of high end storage solutions. Furthermore, increasing requirement for the energy-efficient storage solutions for transportation, commercial and grid applications are also fueling market growth across the globe.

According to BloombergNEF, over 77% of the world’s new power capacity added in 2023 came from renewables, driving demand for next-gen energy storage solutions.

Next Generation Batteries Market Size and Forecast

-

Market Size in 2025: USD 1.99 Billion

-

Market Size by 2033: USD 3.35 Billion

-

CAGR: 7.73% from 2026 to 2033

-

Base Year: 2025

-

Forecast Period: 2026–2033

-

Historical Data: 2022–2024

To Get more information On Next Generation Batteries Market - Request Free Sample Report

Next Generation Batteries Market Trends:

-

Rising adoption of electric vehicles (EVs) accelerating demand for advanced battery technologies.

-

Increasing focus on solid-state and lithium-sulfur chemistries for improved performance and safety.

-

Government incentives and emission regulations driving large-scale investment in EV and battery infrastructure.

-

Integration of artificial intelligence and machine learning in battery R&D and manufacturing.

-

Growing emphasis on automation and predictive analytics to enhance quality, efficiency, and reliability.

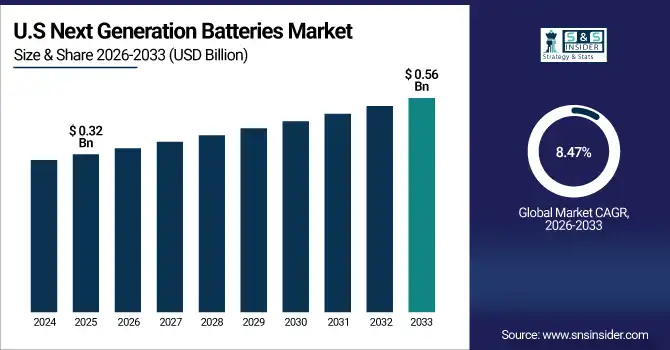

The U.S. Next Generation Batteries Market size was USD 0.32 billion in 2025E and is expected to reach USD 0.56 billion by 2032, growing at a CAGR of 8.47% over the forecast period of 2026–2033.

The US next generation batteries market growth is primarily driven by surging demand for electric vehicles, growing investment in renewable energy storage solutions, and federal funding initiatives aimed at boosting battery innovation. The presence of major technology players, rising sustainability mandates, and the strategic shift towards domestic battery supply chains further enhance market expansion across industrial and consumer verticals.

According to research, over 30 U.S. states now offer EV purchase incentives, clean energy storage rebates, or zero-emission vehicle mandates.

Next Generation Batteries Market Growth Drivers:

-

Rising EV adoption and regulatory pressure accelerate demand for efficient and safer energy storage alternatives globally

The increasing global shift toward electric vehicles (EVs) is significantly driving the demand for next generation batteries. With countries enforcing strict emissions regulations and phasing out internal combustion engines, automakers are accelerating EV production. This trend boosts the need for high-performance batteries with longer life, faster charging, and improved safety. Next generation chemistries like solid-state and lithium-sulfur batteries address these demands. Government subsidies, carbon emission penalties, and major investment in EV infrastructure are all supporting this transition, making next generation batteries an essential enabler of global clean transportation targets and climate policies.

According to research, the number of public EV charging points worldwide surpassed 4 million in early 2024, with fast chargers making up over 30% of new installations.

Next Generation Batteries Market Restraints:

-

Limited raw material availability and underdeveloped supply chains challenge stable production and scalability

Critical materials such as lithium, cobalt, and rare-earth elements used in next generation batteries are geographically concentrated and subject to geopolitical risk. Supply bottlenecks and inconsistent access to these raw materials can delay production timelines and increase costs. Moreover, the recycling infrastructure for new battery chemistries remains underdeveloped, compounding resource constraints. Many next-gen technologies also depend on materials not yet widely mined or processed at scale. Without diversified supply chains and efficient circular economy solutions, the battery industry’s growth may be slowed by resource insecurity and raw material dependencies.

Next Generation Batteries Market Opportunities:

-

Advancement in AI-driven battery design and manufacturing offers efficiency and performance improvements

Artificial intelligence and machine learning are increasingly being used in battery R&D to accelerate material discovery, predict performance, and optimize designs. These tools help reduce trial-and-error cycles, cut R&D costs, and enable predictive maintenance once batteries are deployed. In manufacturing, AI-driven automation enhances quality control and efficiency. These advancements open new opportunities for rapid prototyping, custom battery solutions, and safer deployment of next generation technologies. As digital transformation sweeps across the energy sector, companies integrating AI in battery innovation are well-positioned for competitive advantage and faster time-to-market.

According to research, more than 50 battery and EV manufacturers, including Tesla, Samsung SDI, and QuantumScape, are integrating AI tools for materials development, cell design, and process automation.

Next Generation Batteries Market Segment Analysis:

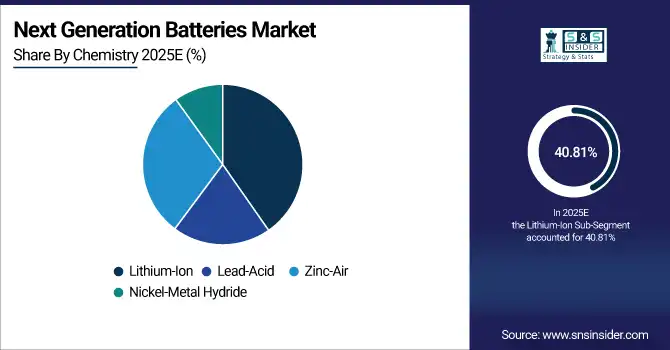

By Chemistry

The Lithium-Ion segment dominated the highest next generation batteries market share of 40.81% in 2025E due to its widespread commercial maturity, high energy density, long cycle life, and strong integration across electric vehicles, consumer electronics, and renewable storage systems. Continuous advancements in lithium-ion chemistries and manufacturing scale have significantly reduced production costs, enhancing their competitiveness. The segment also benefits from a robust global supply chain and supportive regulatory frameworks, which make lithium-ion batteries the most reliable and commercially viable next-generation energy storage solution currently available.

The Nickel-Metal Hydride segment is projected to grow at the fastest CAGR of around 8.88% from 2026 to 2033, driven by increasing demand in hybrid electric vehicles and industrial applications due to its safety, durability, and environmental friendliness. Next generation batteries companies like Panasonic Corporation are expanding NiMH battery portfolios for eco-friendly transport solutions, particularly in hybrid vehicles. Unlike lithium-based chemistries, NiMH batteries are less prone to thermal runaway, making them attractive for applications where safety is paramount. Continued R&D in improving energy density and reducing costs is further enhancing their growth outlook.

By End Use

The Transportation segment dominated the next generation batteries market in 2025E with a substantial 41.66% revenue share, owing to the accelerating shift toward electric mobility and stringent emission regulations globally. Electric cars, buses, and trucks increasingly rely on advanced batteries to enhance driving range and energy efficiency. Government subsidies, automaker investments in EV production, and robust demand for cleaner alternatives to internal combustion engines have significantly fueled the adoption of next-generation batteries across the transportation industry, making it the largest end-use sector in the market.

The Commercial segment is forecasted to expand at the fastest CAGR of approximately 9.42% from 2026 to 2033, supported by growing integration of renewable energy in commercial infrastructures such as office buildings, data centers, and retail complexes. Players such as Tesla, Inc. are innovating with scalable battery energy storage solutions like Powerpack and Megapack to meet the rising demand from commercial customers. Increasing sustainability mandates and the need for efficient backup and peak-shaving systems are making the commercial sector a major growth engine for advanced battery technologies.

By Application

Electric Vehicles segment dominated the next generation batteries market with the highest revenue share of 37.79% in 2025E, primarily due to rapid electrification in the automotive industry and rising consumer preference for sustainable mobility. Major EV manufacturers are investing heavily in battery technology to enhance vehicle range, reduce charging times, and lower costs. BYD Company Limited, one of the global leaders in EV production, continues to scale its battery manufacturing capacity to meet surging demand. Favorable policies and expanding charging infrastructure have further accelerated adoption across global markets.

Energy Storage Systems are anticipated to record the highest CAGR of about 8.69% from 2026 to 2033, driven by the global transition toward decentralized and renewable energy sources. The need for grid stability, load balancing, and backup power is increasing, especially with the expansion of solar and wind installations. Fluence Energy, a key player in energy storage solutions, is actively deploying large-scale battery systems worldwide. Their advanced platforms support utility-scale storage applications, helping accelerate adoption across both developed and developing regions.

By Technology

Solid-State Batteries segment dominated the next generation batteries market with the highest revenue share of 44.38% in 2025E, due to their superior energy density, safety profile, and long-term performance over traditional lithium-ion batteries. Their solid electrolytes eliminate leakage risks and thermal issues, enabling broader adoption across electric vehicles, aerospace, and wearable electronics. Companies like QuantumScape Corporation are at the forefront of solid-state battery development, backed by major automotive partners and venture capital. These features have made solid-state batteries the most promising and dominant technology in the next-generation battery landscape.

Lithium-Air Batteries are projected to grow at the fastest CAGR of 9.39% between 2026 and 2033, attributed to their exceptionally high theoretical energy density, which surpasses conventional lithium-based systems. These batteries offer the potential for ultra-lightweight and long-range energy solutions, particularly appealing for electric aviation and next-gen electric vehicles. IBM Research has been exploring lithium-air chemistry using AI-guided materials discovery, aiming to overcome historical challenges with air cathode stability. As progress continues, lithium-air batteries are gaining momentum as a future-defining battery innovation.

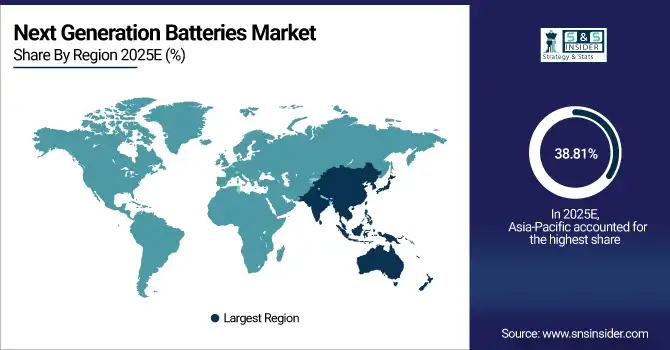

Next Generation Batteries Market Regional Analysis:

Asia Pacific Next Generation Batteries Market Insights

Asia Pacific dominated the market with the highest revenue share of 38.81% in 2025E, driven by strong manufacturing capabilities, abundant raw materials, and aggressive clean energy initiatives in countries like China, Japan, and South Korea. The region benefits from well-established EV and battery supply chains, making it a global hub for both innovation and large-scale production. Government support through subsidies, mandates, and industrial policy has fueled exponential growth in electric mobility, renewable energy deployment, and grid-scale battery installations across the region.

Get Customized Report as per Your Business Requirement - Enquiry Now

- China dominates the Asia Pacific market with its vast battery manufacturing capacity, control over critical raw materials, and strong government support for electric vehicles and renewable energy. Its vertically integrated supply chain ensures global influence across production, innovation, and exports.

North America Next Generation Batteries Market Insights

North America is expected to witness the fastest CAGR of 9.32% from 2026 to 2033, fueled by growing investments in domestic battery manufacturing, rising electric vehicle adoption, and federal support for clean energy transitions. The Inflation Reduction Act and similar regional initiatives are boosting demand for localized battery supply chains and clean energy projects. Additionally, the expansion of grid modernization programs and community storage projects is enhancing energy resilience. This supportive policy environment and technological momentum are positioning North America as a key emerging leader in the global battery industry.

- The U.S. leads the North American next-generation batteries market due to strong federal incentives, major EV production hubs, and rising investments in domestic battery manufacturing. Robust R&D infrastructure and strategic partnerships across automotive and energy sectors further reinforce its regional dominance.

Europe Next Generation Batteries Market Insights

Europe’s next-generation batteries market is driven by stringent carbon emission targets, a rapid shift to electric mobility, and strong funding for sustainable energy solutions. Countries like Germany, France, and the Netherlands are investing in gigafactories and fostering battery innovation. The region’s emphasis on environmental regulation and supply chain localization is accelerating the adoption of advanced battery technologies across automotive, industrial, and energy sectors.

- Germany dominates the European next-generation batteries market due to its advanced automotive sector, strong government support, and significant investments in battery R&D and gigafactories. Its leadership in electric vehicle production and innovation solidifies its central role in the regional battery ecosystem.

Latin America (LATAM) and Middle East & Africa (MEA) Next Generation Batteries Market Insights

The Middle East & Africa next-generation batteries market is led by the UAE, driven by clean energy initiatives and large-scale energy storage projects. In Latin America, Brazil dominates due to its growing electric vehicle sector, favorable government policies, and access to lithium resources supporting regional battery manufacturing and deployment.

Next Generation Batteries Companies are:

-

BYD

-

LG Energy Solution

-

Panasonic

-

SK On

-

CALB

-

EVE Energy

-

Sunwoda

-

QuantumScape

Competitive Landscape for Next Generation Batteries Market:

BYD is a leading Chinese manufacturer of electric vehicles and advanced battery technologies, specializing in lithium-ion and next generation battery solutions. The company focuses on innovation in solid-state batteries to enhance energy density, safety, and sustainable mobility worldwide.

- In March 2025, BYD introduced a 1 MW ultra-fast charging Blade battery, enabling approximately 400 km range in five minutes, featuring advanced electrolyte and separator technology for superior high-speed charging performance.

SK On, a subsidiary of SK Innovation, is a leading South Korean battery manufacturer specializing in lithium-ion and next generation battery technologies. The company focuses on high-performance, safe, and energy-dense batteries for electric vehicles and energy storage systems globally.

- In March 2025, SK On revealed a dual-track solid-state battery strategy, targeting polymer/oxide and sulfide chemistries, while leveraging AI-powered workflows to accelerate innovation and advance commercialization of next-generation battery technologies.

| Report Attributes | Details |

|---|---|

| Market Size in 2025 | USD 1.99 Billion |

| Market Size by 2033 | USD 3.35 Billion |

| CAGR | CAGR of 7.73% From 2026 to 2033 |

| Base Year | 2024 |

| Forecast Period | 2026-2033 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Chemistry (Lithium-Ion, Nickel-Metal Hydride, Lead-Acid, Zinc-Air) • By End Use (Transportation, Residential, Commercial, Utilities) • By Application (Electric Vehicles, Energy Storage Systems, Consumer Electronics, Industrial Applications) • By Technology (Solid-State Batteries, Lithium-Sulfur Batteries, Lithium-Air Batteries, Sodium-Ion Batteries) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, Poland, Turkey, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Singapore, Australia,Taiwan, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Rest of Latin America) |

| Company Profiles | CATL, BYD, LG Energy Solution, Panasonic, Samsung SDI, SK On, CALB, EVE Energy, Sunwoda, QuantumScape, Tesla Inc., A123 Systems LLC, Northvolt AB, Sion Power Corporation, Solid Power Inc., Amprius Technologies, Enovix Corporation, Saft Groupe S.A., Johnson Controls International plc, GS Yuasa Corporation. |