Corrugated Bulk Bins Market Key Insights:

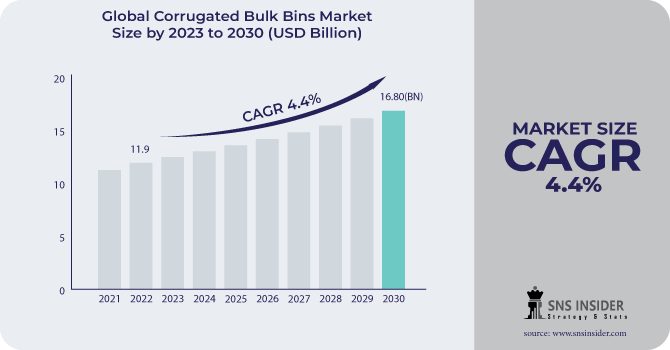

The Corrugated Bulk Bins Market size was USD 12.43 billion in 2023 and is expected to Reach USD 17.68 billion by 2031 and grow at a CAGR of 4.5 % over the forecast period of 2024-2031.

A cardboard container is a packaging or storage unit made of cardboard. Used for storing and transporting bulk goods such as agricultural products, dry goods and industrial materials. The term "corrugated" means a material or surface that has a series of grooves or ridges. We develop, manufacture and sell large corrugated containers for end-user industries. The industry has grown in recent years as the demand for sustainable packaging solutions has increased. Other benefits of using corrugated bulk containers have also led to increased demand for the product.

Get More Information on Corrugated Bulk Bins Market - Request Sample Report

However, the bulk corrugated industry is also highly competitive, especially as more and more companies are entering the packaging sector. While industry players can expect multiple growth opportunities during the forecast period, they may also face certain challenges.

With increasing environmental concerns and a growing emphasis on sustainability, corrugated bulk bins are gaining popularity as an green packaging solution. The recyclable and renewable nature of the materials used aligns with the goals of reducing waste and promoting a circular economy. The corrugated bulk bin market is witnessing technological advancements that enhance the functionality and durability of these bins. Innovations in design, such as improved strength and load-bearing capacity, along with advancements in printing and customization capabilities, allow for branding and product differentiation.

MARKET DYNAMICS

KEY DRIVERS:

-

The growth of the market is being driven by increasing demand for sustainability

The global bulk corrugated board market is expected to grow owing to increasing demand for sustainable solutions especially in the packaging and storage sector. It is one of the most polluting sectors producing huge amounts of waste. The packaging industry in some regions lacks effective disposal systems, leading to further environmental damage. However, increasing pressure from businesses and growing public awareness of the negative impact of poor consumer decisions are increasing demand for sustainable solutions. Bulk cardboard containers are made from renewable resources such as wood pulp. It can be easily harvested and renewed.

-

Corrugated bulk bins can be recycled which is driving the market growth.

RESTRAIN:

-

Market growth is being hampered by growing competition from alternatives.

One of the biggest obstacles to the growth of the global bulk corrugated market is the increasing competition from substitutes in the packaging sector. Although corrugated bulk containers have received a positive response from end-users, a large portion of potential consumer groups still rely on alternative solutions. For example, storage units made of plastic or metal, also have certain associated advantages and their use depends on various external factors such as personal choice and local availability of corrugated containers.

OPPORTUNITY:

-

Growth in the online retail market to offer a number of growth opportunities

The corrugated bulk container industry is expected to continue to grow owing to the expanding e-commerce sector, which is one of the main reasons for the increasing demand in the packaging sector. Demand for sustainable packaging solutions is expected to grow as sales increase through various online portals such as social media and e-commerce sites. Factors such as increased use of smartphones and other devices, access to cheap internet, and lucrative offers on e-commerce portals have led many to choose to use web-based shopping sites for small or large purchases.

-

Increasing demand for corrugated bulk bins in emerging regions.

CHALLENGES:

-

Pressure to reduce costs can pose a challenge for the industry

Corrugated bulk containers can be costly to manufacture and maintain compared to other alternatives. This could put pressure on players in the bulk corrugated industry to cut costs in the final product, which may not be in line with trading firms' profit targets. In addition, the impact on the initial price of the main raw material, wood pulp, has a direct impact on the tail section of corrugated bulk containers, with implications for the entire supply chain.

IMPACT OF RUSSIA-UKRAINE WAR

The conflict between Russia and Ukraine is affecting the global logistics market at every level. The impact of the pandemic on storage capacity and container availability was only beginning to fade when the war between Russia and Ukraine began to affect the industry. The war disrupted the flow of goods, increasing costs and product shortages, resulting in devastating food shortages around the world. Six months after the beginning of the war, natural gas prices across Europe increased by about 120% while coal prices were up 95.97% over a similar period. The European Union also suffered from the limited availability and high prices of these energy sources. The EU imports a significant portion of its energy from Russia. Furthermore, 35% of natural gas imports, about 20% of crude oil imports and 40% of coal imports are dependent on Russia.

Imports of raw materials from Russian companies were halted due to a slight but not massive shortage of raw materials for production, which led to higher prices. As consumers switched to cheaper and more affordable packaging materials, overall production costs increased, leading to a shrinking market. Energy prices soared due to the war situation, which affected the production market for corrugated bulk bins market.

IMPACT OF ONGOING RECESSION

The ongoing recession could have both positive and negative impacts on the bulk corrugated market.

On the downside, recessions usually result in lower consumer spending and an overall economic slowdown. This could reduce demand for various products, such as agricultural products, which are often transported and stored in cardboard containers. A drop in demand for goods could lead to a decline in bulk container orders, which would affect the market.

Additionally, during a recession, businesses may tighten budgets and seek cost-cutting measures. This could lead to a shift to alternative packaging options and a reduction in the overall volume of goods being transported and stored, further impacting demand for bulk corrugated containers.

However, there are also potentially positive effects. During recessions, companies often focus on optimizing their supply chains and cutting costs. Bulk cardboard containers are known for their cost-effectiveness, durability, and recyclability. They are attractive to businesses looking to streamline operations and minimize costs, as they offer a cost-effective solution for storing and transporting goods. Moreover, the recession may lead to a greater focus on sustainability and environmental responsibility. Bulk cardboard containers are recyclable and made from renewable resources, in line with these sustainability goals. This could increase the demand for eco-friendly packaging solutions such as corrugated bulk containers.

Overall, the impact of a prolonged recession on the bulk corrugated cardboard market will depend on factors such as the severity and duration of the recession, specific industry trends, and companies' ability to adapt their supply chains and packaging strategies to changing market conditions.

KEY MARKET SEGMENTATION

By Type

-

Pallets

-

Hinged

-

Totes

By Format

-

Single Wall

-

Double Wall

-

Triple Wall

By Application

-

Food

-

Pharmaceuticals

-

Consumer Goods

-

Tobacco

-

Chemical

.png)

Get Customized Report as per your Business Requirement - Request For Customized Report

REGIONAL ANALYSIS

Asia Pacific dominates the bulk corrugated market. This is due to the improving global economy, increased domestic demand for ready-to-eat and ready-to-eat meals, growth in the food, pharmaceutical, chemical, and consumer goods industries, and an increase in the labor force. Demand for bulk corrugated boards is expected to increase along with the increasing demand in the food and beverage industry in the Asia-Pacific region. China, India, Japan, and South Korea will be the largest contributors to the region.

The highest growth rate is expected in North America. The main reason for the high CAGR by region is the growing demand for sustainable bulk packaging options. The US government is tightening sustainability regulations across all businesses and sectors, resulting in more end-consumers choosing environmentally friendly packaging options.

REGIONAL COVERAGE:

North America

-

US

-

Canada

-

Mexico

Europe

-

Eastern Europe

-

Poland

-

Romania

-

Hungary

-

Turkey

-

Rest of Eastern Europe

-

-

Western Europe

-

Germany

-

France

-

UK

-

Italy

-

Spain

-

Netherlands

-

Switzerland

-

Austria

-

Rest of Western Europe

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Vietnam

-

Singapore

-

Australia

-

Rest of Asia Pacific

Middle East & Africa

-

Middle East

-

UAE

-

Egypt

-

Saudi Arabia

-

Qatar

-

Rest of Middle East

-

-

Africa

-

Nigeria

-

South Africa

-

Rest of Africa

-

Latin America

-

Brazil

-

Argentina

-

Colombia

-

Rest of Latin America

Key Players

The Major Players are Packaging Corporation of America, WestRock Company, Mondi Group, DS Smith Plc, Stora Enso Oyj, Georgia-Pacific LLC, Smurfit Kappa Group, International Paper Company, Sonoco Products Company, Oji Holdings Corporation and other players.

Mondi Group-Company Financial Analysis

RECENT DEVELOPMENTS

-

Mondi will be replacing the stainless steel containers with TankerBox, a paper based alternative aimed at enhancing shipping capacity, facilitating transport and reducing maintenance costs, through collaboration with flavour company Aromsa.

-

A new branch was opened in the facility building at Samail Industrial City and 4 brand new, innovative products have been launched by Apex Business Trading represented by Corrugated Box Factory.

| Report Attributes | Details |

| Market Size in 2023 | US$ 12.43 Bn |

| Market Size by 2031 | US$ 17.68 Bn |

| CAGR | CAGR of 4.5 % From 2024 to 2031 |

| Base Year | 2023 |

| Forecast Period | 2024-2031 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (Pallets, Hinged, Totes) • By Format (Single Wall, Double Wall, Triple Wall) • By Application (Food, Pharmaceuticals, Consumer Goods, Tobacco, Chemical) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]). Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia Rest of Latin America) |

| Company Profiles | Corporation of America, WestRock Company, Mondi Group, DS Smith Plc, Stora Enso Oyj, Georgia-Pacific LLC, Smurfit Kappa Group, International Paper Company, Sonoco Products Company, Oji Holdings Corporation |

| Key Drivers | • The growth of the market is being driven by increasing demand for sustainability • Corrugated bulk bins can be recycled which is driving the market growth. |

| Market Restraints | • Market growth is being hampered by growing competition from alternatives |