Transmission Immersion Probe Market Report Scope & Overview:

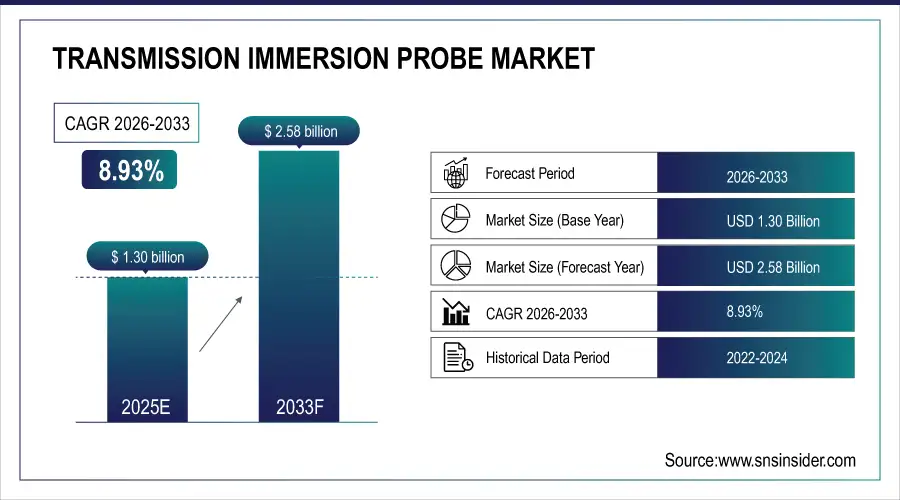

The Transmission Immersion Probe Market size was valued at USD 1.30 Billion in 2025E and is projected to reach USD 2.58 Billion by 2033, growing at a CAGR of 8.93% during 2026–2033.

The Transmission Immersion Probe market is witnessing significant growth driven by rising demand for precise, real-time, and non-destructive monitoring solutions across various industries, including aerospace, healthcare, chemical processing, and smart manufacturing. Advanced probe technologies enable accurate analysis of liquids, solids, and multiphase samples, improving process efficiency and product quality. Increasing adoption of automation and inline measurement systems is fueling the integration of immersion probes in laboratory and industrial setups. Growing emphasis on quality control, regulatory compliance, and operational efficiency is further accelerating market expansion, while continuous innovation in optical materials and sensor designs is enhancing probe performance and versatility.

In June 2024, Automated ultrasonic testing (AUT) enhances flaw detection in aircraft engine fan blades and cases, offering high-resolution, non-destructive inspection with improved accuracy, repeatability, and reduced inspection time.

Transmission Immersion Probe Market Size and Forecast:

-

Market Size in 2025E: USD 1.30 Billion

-

Market Size by 2033: USD 2.58 Billion

-

CAGR: 8.93% from 2026 to 2033

-

Base Year: 2025

-

Forecast Period: 2026–2033

-

Historical Data: 2022–2024

To Get more information on Transmission Immersion Probe Market - Request Free Sample Report

Transmission Immersion Probe Market Highlights:

-

Rising demand for real-time, inline monitoring solutions across water treatment, chemical processing, pharmaceuticals, and food & beverage drives Transmission Immersion Probe (TIP) market growth, enabling accurate, non-destructive, and continuous measurement of liquids, solids, and multiphase samples.

-

Advanced TIP technologies improve process efficiency, quality control, and regulatory compliance, while integration with automation, 2D/3D spectroscopy, and smart evaluation software reduces human error and enhances operational efficiency.

-

High initial costs, complex installation, fragile components, limited standardization, and competition from alternative measurement technologies constrain TIP market adoption, particularly for small- and medium-sized enterprises.

-

Delicate fiber-optic components and variations in probe designs hinder integration with existing systems, while limited awareness and the need for skilled operators restrict widespread deployment.

-

Opportunities exist in compact, high-accuracy, and wireless-enabled probes, supporting real-time process monitoring, smart factory applications, and multi-modal operation for improved repeatability and reduced setup time.

-

Adoption of wireless and high-precision probes can minimize material waste, optimize workflows, and support continuous monitoring in industries like medical devices, micro-mechanics, and electronics, fueled by rising automation and smart manufacturing trends.

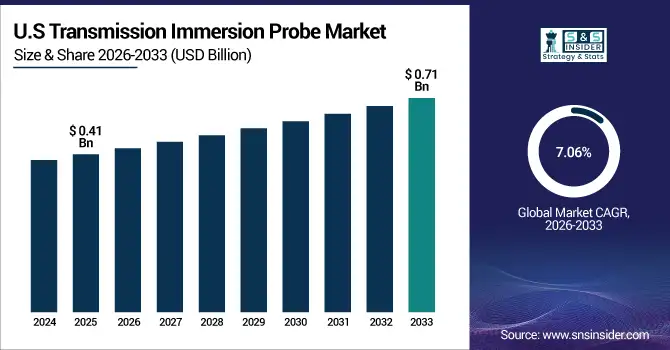

The U.S. Transmission Immersion Probe Market size was valued at USD 0.41 Billion in 2025E and is projected to reach USD 0.71 Billion by 2033, growing at a CAGR of 7.06% during 2026–2033, driven by the growing demand for accurate and reliable measurement solutions in industrial and scientific applications. Increasing adoption in research, manufacturing, and process monitoring, coupled with advancements in probe technology, is fueling market growth. Industries are seeking precise immersion probes to enhance operational efficiency, ensure safety, and support high-quality outcomes, making technological innovation and reliability key drivers of market expansion.

Transmission Immersion Probe Market Drivers:

-

Driving Precision and Efficiency in the Transmission Immersion Probe Industry

The rising demand for real-time, inline monitoring solutions is driving growth in the Transmission Immersion Probe (TIP) market. Industries such as water treatment, chemical processing, pharmaceuticals, and food & beverage increasingly require accurate, non-destructive, and continuous measurement of liquids, solids, and multiphase samples. Advanced TIP technologies enable high-precision analysis, improving process efficiency, quality control, and regulatory compliance. Integration with automation, 2D/3D spectroscopy, and smart evaluation software reduces human error and enhances operational efficiency. Growing emphasis on energy savings, resource optimization, and process reliability further fuels adoption, while ongoing innovations in optical materials and probe design continue to expand market potential.

In May 2024, Fraunhofer ILT developed a laser-based immersion probe for real-time, inline monitoring of water and wastewater using 2D fluorescence spectroscopy.

Transmission Immersion Probe Market Restraints:

-

High costs, complex installation, fragility, limited standards, and competition constrain Transmission Immersion Probe market growth.

The Transmission Immersion Probe (TIP) market is influenced by factors that may limit growth. High initial costs, along with the complexity of installation, calibration, and maintenance, can restrict adoption, particularly among small- and medium-sized enterprises. Variations in probe designs and interfaces hinder seamless integration with existing systems, while the delicate nature of fiber-optic components increases the risk of damage in demanding industrial environments. Competition from alternative measurement technologies, including conventional sensors and non-optical probes, can reduce demand. Limited awareness of TIP capabilities and the need for skilled operators further constrain widespread deployment and market expansion.

Transmission Immersion Probe Market Opportunities:

-

Emerging Opportunities in Wireless and High-Precision Transmission Immersion Probes

The Transmission Immersion Probe market presents growing opportunities in precision manufacturing due to increasing demand for compact, high-accuracy, and wireless-enabled probes. These probes enable seamless integration into small, high-value component production, supporting real-time process monitoring and smart factory applications. Advanced wireless and multi-modal technologies allow reliable operation alongside other systems, improving repeatability, reducing setup time, and enhancing overall operational efficiency. Adoption of such probes can minimize material waste, optimize production workflows, and support continuous inline monitoring across industries like medical devices, micro-mechanics, and electronics. Rising automation and smart manufacturing trends are expected to further drive market growth.

In August 2024, Renishaw launched the RMP24-micro, the world’s smallest wireless machine tool probe, offering high-precision measurement and 5 m wireless range

Transmission Immersion Probe Market Segment Highlights:

-

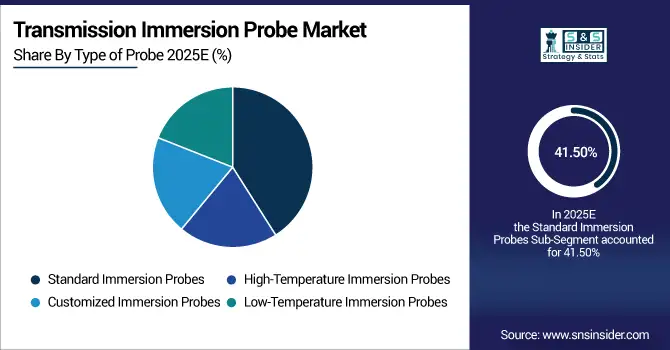

By Type of Probe: Dominant – Standard Immersion Probes (41.50% in 2025 → 38.50% in 2033); Fastest-Growing – High-Temperature Immersion Probes (CAGR 13.04%)

-

By Functionality: Dominant – Temperature Measurement (47.63% in 2025 → 45.38% in 2033); Fastest-Growing – Electrical Conductivity Measurement (CAGR 12.27%)

-

By Technology Integration: Dominant – Smart Probes with IoT Capabilities (35.88% in 2025 → 41.13% in 2033); Fastest-Growing – Wireless Transmission Probes (CAGR 10.98%

-

By End-User Industry: Dominant – Manufacturing (39.75% in 2025 → 38.25% in 2033); Fastest-Growing – Energy and Utilities (CAGR 10.36%)

Transmission Immersion Probe Market Segment Analysis:

By Type of Probe, Standard Immersion Probes Remain Dominant and High-Temperature Immersion Probes Are Fastest-Growing

Standard Immersion Probes continue to lead the market due to their versatility and widespread use across various industrial applications. High-Temperature Immersion Probes are the fastest-growing segment, driven by increasing demand in harsh industrial environments where elevated temperature monitoring is critical, offering enhanced durability, reliability, and performance for advanced process control and inline monitoring solutions.

By Functionality, Temperature Measurement Leads and Electrical Conductivity Measurement Grows Fastest

Temperature Measurement dominates functionality, while Electrical Conductivity Measurement grows fastest due to precise fluid monitoring. Smart IoT-enabled probes lead technology integration, with Wireless Transmission Probes expanding for remote, automated applications. Manufacturing remains the largest end-user, while Energy and Utilities grow rapidly, leveraging probes for process optimization and improved operational efficiency.

By Technology Integration, Smart Probes with IoT Capabilities Dominate and Wireless Transmission Probes Grow Fastest

Smart IoT-enabled probes are increasingly adopted for real-time monitoring, data collection, and analytics, enabling improved process control and operational efficiency. Meanwhile, Wireless Transmission Probes are rapidly gaining traction for flexible, remote, and automated applications, supporting seamless integration, enhanced accessibility, and reliable performance across diverse industrial environments and complex process workflows.

By End-User Industry, Manufacturing Remains Dominant and Energy & Utilities Grow Fastest

Manufacturing remains the primary adopter of transmission probes, using them to enhance precision, quality, and process control. Simultaneously, the Energy and Utilities sector is experiencing rapid growth in probe usage, leveraging real-time monitoring and advanced analytics to optimize operations, improve efficiency, reduce downtime, and support sustainable, cost-effective industrial processes.

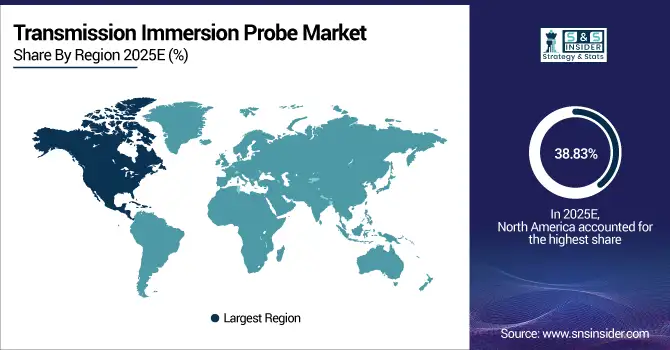

Transmission Immersion Probe Market Regional Highlights:

-

North America: In 2025E 38.83% → 35.55%, Dominating Region (CAGR 7.73%)

-

Europe: In 2025E 20.23% → 20.89%, Significant Market (CAGR 9.37%)

-

Asia-Pacific: In 2025E 27.05% → 29.58%, Fastest-Growing Region (CAGR 10.15%)

-

South America: In 2025E 7.77% → 7.11%, Steady Growth (CAGR 7.73%)

-

Middle East & Africa: In 2025E 6.13% → 6.88%, Stable Share (CAGR 10.50%)

Transmission Immersion Probe Market Regional Analysis:

North America Transmission Immersion Probe Market Insights:

North America leads the Transmission Immersion Probe market due to advanced industrial infrastructure, high adoption of smart manufacturing, and continuous investment in process automation. Strong demand from manufacturing, energy, and utilities sectors, coupled with technological advancements and emphasis on real-time monitoring, positions the region as the dominant market throughout the forecast period.

Get Customized Report as per Your Business Requirement - Enquiry Now

U.S. Transmission Immersion Probe Market Insights:

The U.S. dominates the Transmission Immersion Probe market, driven by advanced industrial adoption, smart manufacturing integration, and high demand for real-time monitoring and process optimization across key sectors.

Asia-Pacific Transmission Immersion Probe Market Insights:

Asia-Pacific is the fastest-growing region in the Transmission Immersion Probe market, fueled by rapid industrialization, increasing adoption of smart manufacturing technologies, and rising demand for real-time monitoring solutions. Investments in energy, utilities, and advanced manufacturing sectors are driving market expansion and accelerating technological integration across the region.

China Transmission Immersion Probe Market Insights:

China dominates the Transmission Immersion Probe market due to rapid industrial growth, high adoption of advanced monitoring technologies, strong manufacturing and energy sectors, and increasing investment in smart and automated process solutions.

Europe Transmission Immersion Probe Market Insights:

The Europe Transmission Immersion Probe market is witnessing emerging trends driven by the adoption of smart manufacturing, integration of IoT-enabled probes, and increasing demand for real-time monitoring in manufacturing, energy, and environmental applications. Focus on automation and advanced process analytics is further shaping market growth across the region.

Germany Transmission Immersion Probe Market Insights:

Germany dominates the Europe Transmission Immersion Probe market due to its advanced industrial infrastructure, strong manufacturing sector, early adoption of smart monitoring technologies, and continuous investments in automation and precision process control solutions.

Latin America Transmission Immersion Probe Market Insights:

The Latin America Transmission Immersion Probe market is steadily expanding, driven by growing industrialization, increasing adoption of real-time monitoring solutions, and rising investments in energy, manufacturing, and environmental sectors. Focus on process optimization and efficiency is supporting gradual market growth across the region.

Brazil Transmission Immersion Probe Market Insights:

Brazil is generally considered the dominant country for the Transmission Immersion Probe market, driven by its large industrial base, energy sector investments, and adoption of advanced monitoring technologies.

Middle East & Africa Transmission Immersion Probe Market Insights:

The Middle East and Africa Transmission Immersion Probe market is witnessing moderate growth, supported by increasing industrial automation, investments in energy and utilities, and adoption of real-time monitoring solutions. Rising demand for process optimization, efficiency improvements, and technological integration across key sectors is driving steady market expansion in the region.

Saudi Arabia Transmission Immersion Probe Market Insights:

Saudi Arabia is the dominant country in the Transmission Immersion Probe market, driven by its strong industrial infrastructure, energy sector investments, and adoption of advanced monitoring and automation technologies.

Transmission Immersion Probe Market Competitive Landscape:

Metrohm, established in 1943 and headquartered in Riverview, Florida, is a leading manufacturer of analytical instruments specializing in titration, spectroscopy, and process analytics. The company develops user-friendly, automated solutions for chemical analysis across industries, offering fast, non-destructive, and reliable measurement technologies, including its OMNIS platform with integrated NIR, Raman, and multi-parameter analyzers.

-

In April 2024, Metrohm expanded its OMNIS platform with OMNIS NIRS, adding near-infrared spectroscopy for liquid, solid, and mixed samples, offering fast, non-destructive analysis with automation.

Thorlabs, established in 1989 and headquartered in Newton, New Jersey, is a vertically integrated photonics company specializing in lasers, electro-optics, and optical components. Serving research, industrial, life science, medical, and defense markets, Thorlabs designs and manufactures advanced photonics products, including lasers, fibers, modulators, spectroscopy systems, and optomechanical and optoelectronic solutions.

-

In June 2024, Thorlabs released textured Surface-Enhanced Raman Spectroscopy (SERS) substrates for highly sensitive, non-destructive analysis of chemical, pharmaceutical, food, and biosensing applications

Transmission Immersion Probe Market Key Players:

-

Sarspec

-

Anglia Instruments

-

Ocean Insight

-

StellarNet

-

Process Insights

-

Kaplan Scientific

-

Unice EO

-

Fiberdesign

-

Thorlabs

-

Spectrecology

-

Avantes

-

Metrohm (Metrohm Process Analytics)

-

Endress+Hauser

-

Mettler Toledo

-

Anton Paar

-

PerkinElmer

-

Shimadzu

-

Bruker

-

Thermo Fisher Scientific

-

ABB

| Report Attributes | Details |

|---|---|

| Market Size in 2025E | USD 1.30 Billion |

| Market Size by 2033 | USD 2.58 Billion |

| CAGR | CAGR of 14.53% From 2026 to 2033 |

| Base Year | 2025 |

| Forecast Period | 2026-2033 |

| Historical Data | 2022-2024 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type of Probe (Standard Immersion Probes, Customized Immersion Probes, High-Temperature Immersion Probes and Low-Temperature Immersion Probes) • By Functionality (Temperature Measurement, pH Level Measurement, Electrical Conductivity Measurement and Fluid Level Measurement) • By Technology Integration (Wireless Transmission Probes, Smart Probes with IoT Capabilities, Analog Interface Probes and Digital Interface Probes) • By End-User Industry (Manufacturing, Agriculture, Energy and Utilities and Environmental Monitoring) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

| Company Profiles | Sarspec, Anglia Instruments, Ocean Insight, StellarNet, Process Insights, Kaplan Scientific, Unice EO, Fiberdesign, Thorlabs, Spectrecology, Avantes, Metrohm (Metrohm Process Analytics), Endress+Hauser, Mettler Toledo, Anton Paar, PerkinElmer, Shimadzu, Bruker, Thermo Fisher Scientific, ABB |