Robotic Glass Installation Market Size Analysis:

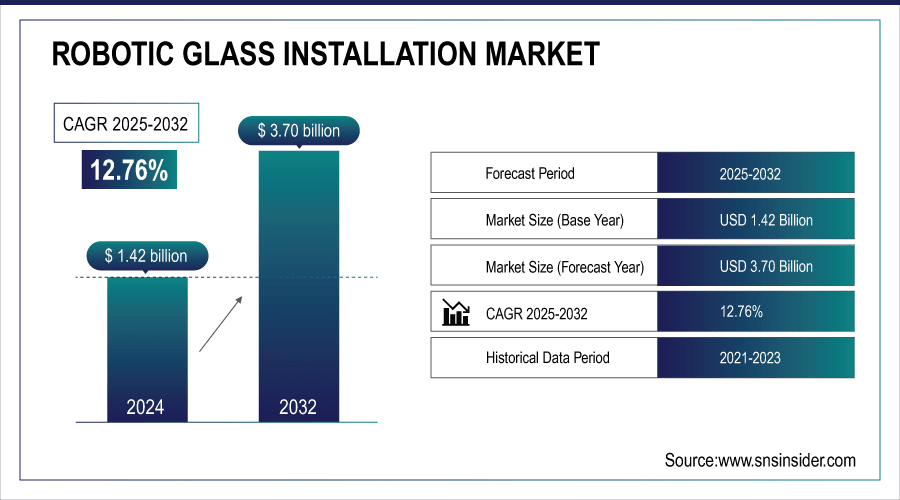

The Robotic Glass Installation Market size was valued at USD 1.42 billion in 2024 and is expected to reach USD 3.70 billion by 2032 and grow at a CAGR of 12.76% over the forecast period 2025-2032.

The global market report provides a broad-level segmentation of the market, including detailed robotic glass installation market analysis by product type, application, automation level, and end-user, and regional insights. Factors such as the growing automation in construction processes, increasing emphasis on worker safety, and the demand for precision and effective installation of glass are fueling this trend. Today, we see construction workers globally implementing robotic solutions to supplement their build—enhancing precision, minimizing reliance on manual labor, and aligning with the demands of modern architectural design and performance.

For instance, robotic handling has reduced glass breakage rates by nearly 80% in some industrial trials compared to manual setups.

To Get More Information On Robotic Glass Installation Market - Request Free Sample Report

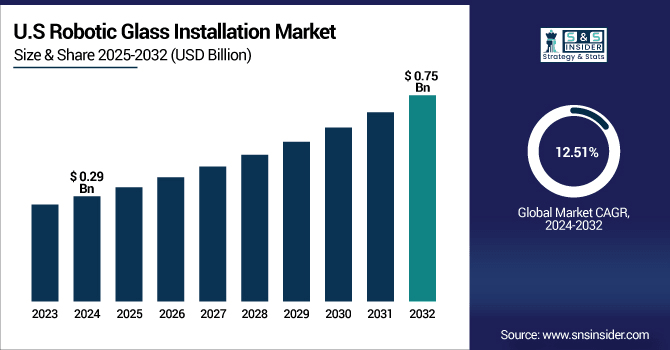

The U.S. Robotic Glass Installation Market size was USD 0.29 billion in 2024 and is expected to reach USD 0.75 billion by 2032, growing at a CAGR of 12.51% over the forecast period of 2025–2032.

The U.S. market is experiencing robust robotic glass installation market growth, driven by increasing labor costs, strong trends toward smart and automated construction, and growing demand for robotic integration in high-rise and commercial glazing applications. This, along with the presence of industry-leading robot manufacturers, is accelerating the adoption for not only renovation projects but new construction projects as well. The change is indicative of the industry's increase towards better efficiency, safety, and accuracy in the implementation of glass in metropolitan regions in the U.S.

For instance, use of robotic lifting arms has helped some U.S. companies reduce glass breakage rates by over 75%.

Robotic Glass Installation Market Dynamics:

Key Drivers:

-

Rising Demand for Labor-Saving and Precision Installation in the Construction Industry

Driving the robotization of construction is the increasing need of labor-saving solutions and high precision glass installation in complicated construction environments. Conventional approaches are labor-intensive, prone to mistakes and become costly as skilled labor dwindles. The benefits of robotic glass fabrication include improved quality, fewer ergonomics-related injuries, and faster project completion. The precision millimetre handling of large glass panels is increasingly attractive to commercial developers and infrastructure planners, and thus driving deployment of the technology across advanced construction sites globally, most notably in urban high-rise development and automated building systems.

For instance, implementation of robotic solutions has reduced glass misalignment and breakage incidents by more than 70% in pilot studies.

Restraints:

-

High Initial Cost and Integration Barriers Across Mid-Sized Enterprises in Emerging and Developed Regions

The initial expenditure of robotic glass systems and relevant infrastructure are rather costly, and therefore, a major entry barrier for many mid-sized construction and renovation companies. Acquisition, training, and retrofitting associated with automation add to CAPEX. Not only does this also lead to a smooth integration for robotic solutions, but also lack of technical expertise. These systems are, then, often considered unnecessary in price-sensitive markets, specifically in developing regions, and tend to slow down their widespread adoption. Unless there are scalable and cost-effective solutions, this market penetration will be limited to large enterprises and high-end projects.

Opportunities:

-

Integration of AI, IoT, and Vision Systems to Enable Smart Glass Installation Processes

AI, IoT and advanced vision systems represent a huge opportunity to increase the intelligence and autonomy of robotic glass installers. By employing real-time object detection and machine learning algorithms that interact with adaptive path planning, systems can operate effectively in unpredictable or dynamic jobsite environments. Feedback loops that can proactively anticipate objectives and discrepancies will only help in further minimizing production downtimes and maintenance costs. This could allow full automation from transportation to placement, creating novel use cases across smart cities, automated building and sustainable construction practices.

For instance, over 65% of advanced construction robots now feature real-time vision systems for object detection and obstacle avoidance.

Challenges:

-

Operational Downtime and Maintenance Complexity in Harsh and Unpredictable Jobsite Conditions

The efficiency of robotic systems is greatly reduced by forced operational downtimes due to maintenance issues or jobsite environmental exposure. Sensors, actors or navigation commonly interrupted by dust, moisture and the uneven terrain. These machines must also avoid accidental collisions and damage in construction environments with other heavy equipment, workers, many barriers, and ever-present danger. The expectation is that frequent recalibration, part replacement, and diagnostics will push projects out-of-schedule and ultimately increase the total cost of ownership. Several market players are also focused on making these systems more durable, modular and easier to maintain and replace via plug-and-play, which has become a crucial engineering & logistical challenge.

Robotic Glass Installation Market Segmentation Analysis:

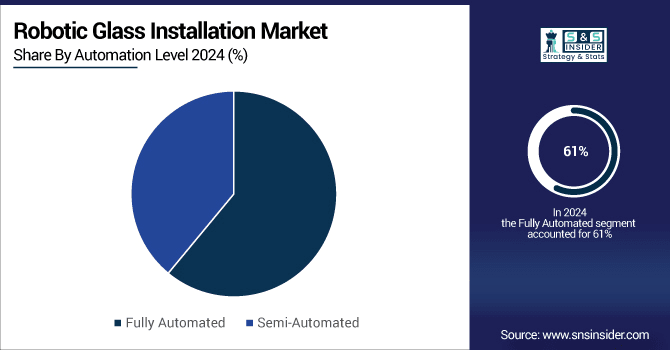

By Automation Level

The Fully Automated segment dominated the market and accounted for 61% share in 2024 and is projected to be the fastest growing with a CAGR of 13.01% during 2024-2032. It earns its dominance due to the fact that it is deployed on a large scale with very little human intervention needed. There are fully integrated systems built for glass automation by automation firms such as KUKA AG, in which all operations related to glass lifting and positioning to its placement have been automated. Such solutions are absolutely the best-suited outlooks for contemporary construction purposes where accuracy, velocity, and round-the-clock operation are major KPIs.

By Product Type

Automated Glass Handling Robots dominated the market with a share of 41% in 2024. As they are widely used in major commercial and industrial applications where accuracy and safety are paramount. Lifting and placing oversized glass panels made possible with SmartLift handling solution. These robots minimize human effort and improve productivity in construction, thus developed into an essential machine for modern construction operations globally.

The Glass Installation Drones segment is expected to grow at the highest CAGR of 14.40% during 2024–2032. The growing use of Abatement Robots for high-rise and architecturally complex projects is paving the way for adoption. On the Aerial Robotics side, firms such as FBR Ltd. are advancing robotics for glass installation with the ability to work high above where traditional equipment stops working. These are much safer drones that are less setup intensive and are designed for modern, vertical urban construction scenarios.

By Application

The Commercial segment held highest market share of 38% in 2024, owing to the extensive utilization of glass façades in commercial buildings and shopping complexes. For big commercial glazing projects, firms which provide customized robotic systems such as AGT Robotics. They enhance operational productivity, deliver consistent installation quality, and decrease on-site labor dependency in malls, offices, and hospitals in developed and emerging nations significantly.

The Infrastructure segment embraces smart city projects and mass transit hubs and is anticipated to grow with a 13.17% CAGR until 2032. Glass installation for infrastructure contractors now depends on scalable, repeatable robotic systems. Through robotics-enabled building solutions, Saint-Gobain enables infrastructure developers to deliver energy-efficient and visually intricate designs with greater speed and accuracy of installation, thus advancing the use of robotics in public construction projects.

By End-User

Construction Companies accounted for the highest robotic glass installation market share by 44% in 2024, driven by the extensive use of robotics for new building projects. Construction contractors increasingly partner with companies such as Hilti to offer semi- and fully-automated robotic glass solutions tailored to ensure quicker and safer installations. These enhancements to safety, time, and unprofessionalism incorporate these tools and are sure to become norms for high-end construction developments on a global scale.

Renovation & Maintenance Service Providers are expected to witness the highest CAGR of 14.06% during 2024–2032. The need for cosmetic and energy upgrades in older buildings is pushing the acceptance of robotics for retrofitting glass. The need for hassle-free replacements in operational buildings is driving the growth of the maintenance segment with companies such as GlasLift providing smaller, portable robotic systems that can be set up quickly on renovation sites with tight confines and making high-accuracy replacements.

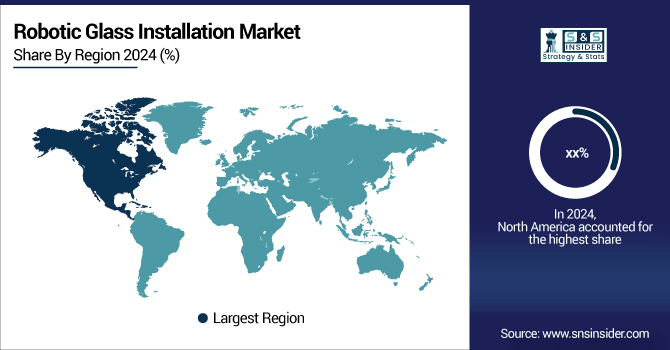

Robotic Glass Installation Market Regional Analysis:

In North America, Robotic Glass Installation market is increasing at a steady pace, owing to high labor costs, advanced construction practices and high automation adoption. In the US, the region is fueled by the presence of key robotics manufacturers and a high demand for industrial precision in commercial projects. Rising emphasis on worker safety and productivity is still responsible for robotic incorporation throughout construction and refurbishment industries.

Get Customized Report as per Your Business Requirement - Enquiry Now

-

The U.S. dominates the North American market due to high investment in smart construction, rapid adoption of robotic automation, and presence of key manufacturers. Large-scale commercial projects and labor efficiency demands further drive robotic glass installation adoption.

Asia Pacific dominates the global market with a 32% market share as of 2024 and is the fastest-growing region, estimated to grow at a 13.70% CAGR between 2024 and 2032. This dominance is the result of rapid urbanization, increasing construction investments, and increasing adoption automation automated solutions in nations such as China, India, and Japan. Large-scale infrastructure development, a rising number of smart city projects, and government support make the region attractive. Asia Pacific is dominating the present market due to the construction boom and economical robotic solutions.

-

China leads in the Asia Pacific market due to its massive infrastructure development, urban high-rise construction boom, and government-backed smart city initiatives. Local manufacturing capabilities and increasing demand for construction automation reinforce its dominant position in robotic glass installation.

Europe’s Robotic Glass Installation industry is growing steadily, supported by strong emphasis on construction automation, worker safety, and energy-efficient buildings. Countries including Germany, France, and the UK are leading adopters due to advanced infrastructure and smart building initiatives. Strict labor regulations and high safety standards further encourage the integration of robotic systems for precise and efficient glass installation across the region.

-

Germany dominates Europe’s Robotic Glass Installation Market due to its advanced construction practices, strong robotics industry, and focus on automation. High labor costs, strict safety standards, and growing smart infrastructure projects further boost its leadership over France, UK, Italy, and Spain.

The Middle East & Africa market is led by the UAE, driven by smart city developments and high-rise construction in cities such as Dubai. In Latin America, Brazil dominates due to increasing commercial infrastructure, urbanization, and growing adoption of automation technologies in construction, placing it ahead of Argentina and other regional countries.

Robotic Glass Installation Companies are:

Major Key Players in Robotic Glass Installation Market are SmartLift, KUKA AG, ABB Ltd., FBR Ltd., AGT Robotics, Saint-Gobain, FANUC Corporation, Jekko S.p.A., GlasLift, Hilti Group, Schmalz GmbH, Hird Ltd., Bohle AG, Vitrum Glass Group, Z-Lift, GGR Group, Wood's Powr-Grip, Vacuworx, Baubot and Kranlyft Group and others.

Recent Developments:

-

In May 2024, KUKA robotics systems were deployed by Schüco International for autonomous loading and unloading of aluminum and glass profiles at their production facility, demonstrating expanded application beyond typical industrial uses.

-

In March 2024, SmartLift introduced its SL 1009 Outdoor glazier robot, enhancing heavy glass panel handling with extended boom and vacuum lift capabilities—ideal for large-scale façade projects.

| Report Attributes | Details |

|---|---|

| Market Size in 2024 | USD 1.42 Billion |

| Market Size by 2032 | USD 3.70 Billion |

| CAGR | CAGR of 12.76% From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Product Type (Automated Glass Handling Robots, Glass Installation Drones, Collaborative Robots and Others) • By Application (Residential, Commercial, Industrial and Infrastructure) • By Automation Level (Fully Automated and Semi-Automated) • By End-User (Construction Companies, Glass Manufacturers, Renovation & Maintenance Service Providers and Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, Poland, Turkey, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Singapore, Australia,Taiwan, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Rest of Latin America) |

| Company Profiles | SmartLift, KUKA AG, ABB Ltd., FBR Ltd., AGT Robotics, Saint-Gobain, FANUC Corporation, Jekko S.p.A., GlasLift, Hilti Group, Schmalz GmbH, Hird Ltd., Bohle AG, Vitrum Glass Group, Z-Lift, GGR Group, Wood's Powr-Grip, Vacuworx, Baubot and Kranlyft Group. |