Microprocessor Market Key Insights:

Get More Information on Microprocessor Market - Request Sample Report

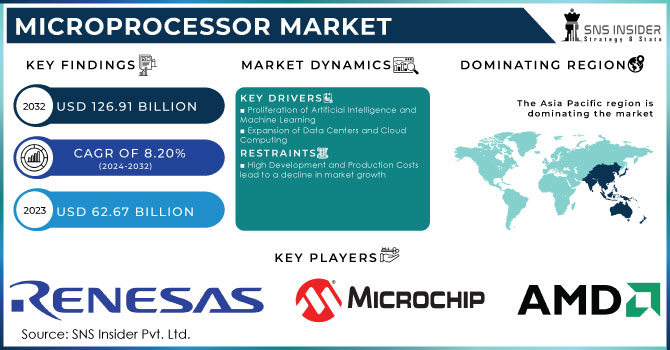

The Microprocessor Market Size was valued at USD 62.67 Billion in 2023 and is expected to reach USD 126.91 Billion by 2032 and grow at a CAGR of 8.20% over the forecast period 2024-2032.

The microprocessor market is important to the development of modern technology, whose influences can be observed throughout various fields, spanning from consumer electronics to automotive systems and industrial machinery. The growth of such a market is primarily explained by the trending developments in high-performance computing, artificial intelligence, and the Internet of Things. NVIDIA acquired ARM Holdings to combine “NVIDIA’s world-leading AI computing platform with ARM’s vast ecosystem to create the premier computing company for the age of artificial intelligence”. Moreover, the acquisition of Xilinx could also elevate the status of AMD and facilitate the further development of high-performance computing in microprocessors.

The adoption of IoT and, devices can be considered a major driver of the microprocessor market. IoTs range and application are vast, spanning from smart houses to industrial and agricultural concerns, as well as diverse formations of healthcare. Smart houses, for instance, make use of smart thermostats, security cameras, and home assistants where the microprocessors are used a lot. The smart home market already has almost $140 billion in value in 2023. The most demanded smart home instrument to this day is a smart speaker, which is rather undemanding for application and operation, while the variety of smart home products gets only greater.

Industrial automation involves IoT devices, which monitor and control the manufacturing process and supply chain, facilitate the shipment of goods across long distances, and optimize industrial operational efficiency. There is also a great push for the development of Industry 4.0, which augments initial concerns about IoT adoption and prompts operational environments to implement even more microprocessors to keep up with emerging needs. Another example of microprocessor usage is seen in automotive technology. For example, Tesla motors are certainly impossible without an advanced microprocessor. It helps to ensure safer and better driving by processing a large amount of data in real-time. The function of autonomous navigation is impossible without advanced microprocessors since the car must orient its location and decide on further steps based on the analysis of the surrounding sources of data.

Microprocessor Market Dynamics

Drivers

Proliferation of Artificial Intelligence and Machine Learning

Artificial intelligence and machine learning have been a massive driver for the microprocessor market. AI and ML systems demand a considerable amount of computational power for processing large data sets, doing complex computations, and coming up with up-to-the-minute decisions. Additionally, the development of autonomous vehicles is highly dependent on AI and ML for instantaneous decision-making and driving. These vehicles require sophisticated microprocessors to process the data of sensors, cameras, and lidar systems, ensuring flawless driving patterns. Designed by uAF8-specialized microprocessors to perform parallel computations efficiently, GPUs, TPUs, and NPUs are a good example of implementations of AI and ML microprocessors.

Expansion of Data Centers and Cloud Computing

Data center and cloud data expansion is another vital factor that has an impact on the development of the microprocessor market. The growth and widespread use of online services, social media networks, and IoT devices generate the expansion of digital data. Moreover, the intensive development of the Internet and its global use generate an increased need for its processing and storage. That is, data are stored in special facilities, and data centers, that form a basis for cloud computing use. They are large warehouses that are servers that have accumulated vast amounts of data. Therefore, a great number of businesses and individual clients use cloud computing services that rely on microprocessors. Some of the best-known cloud computing facilitators are Amazon Web Services, Microsoft Azure, and Google Cloud. These institutions provide users with the necessary amount of computing power to store, process, and implement data in accordance with the peculiarities of their use. Thus, it is evident that the development of cloud computing services will impact the development of the microprocessor market.

Restraints

High Development and Production Costs lead to a decline in market growth

One of the main restraints on the microprocessor market includes the high costs involved in both the development and production of advanced microprocessor technology. Advanced tools of simulation and design must be purchased to develop tools that will work under the advanced architecture and material used to design the processor. Moreover, the high complexity of modern processors means that they are being developed by a multidisciplinary team of scientists specializing in various fields. As for the production of microprocessors, it involves an extremely expensive facility where microprocessors are being produced. These facilities, commonly called fabs, cost an enormous amount of money and may take billions to build and maintain. Such facilities must be provided with a balanced flow of fresh clean air throughout the facility to prevent any contamination.

Microprocessor Market Segmentation Overview

By Architecture

The Reduced Instruction Set Computer segment has registered a market share of over 42% in 2023 which makes the segment dominating. Increasing adoption of RISC in various sectors is the key drive for the segment. RISC microprocessor has better pipe lining and relies on operations leading to a good performance. Influentially, the RISC architecture is used in all categories of high-performance as well as low-power computers such as embedded systems and mobile devices among many others in the marketplace.

The CISC is the fastest-growing segment with a stable CAGR of 10.24% during the forecast period. CISC microprocessor uses a complex instruction set, and this allows the performance of a wide range of operations in a single instruction form.

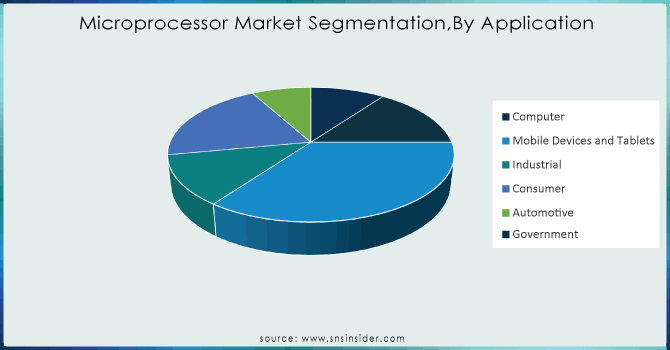

By Application

The industrial sector led the segment with a market share of 35% in 2023, due to the rising use of advanced and quick processing applications such as conversational Artificial Intelligence, cloud computing, and IoT. The MI300X accelerator, a part of the MI300 series, is intended to enhance Microsoft Research’s BigGANs at Revenge of the Common Warrior scale and will be a competitive threat to NVIDIA for lead in generative AI tasks and workloads processing.

The automotive sector is the fastest-growing segment by application with a CAGR of 10.39% during the forecast years. The use of MPUs has grown significantly in the automotive sector. These processors are used to facilitate the Advanced Driver Assistance Systems, infotainment systems, and other such driving and autonomous systems.

Need any customization research on Microprocessor Market - Enquiry Now

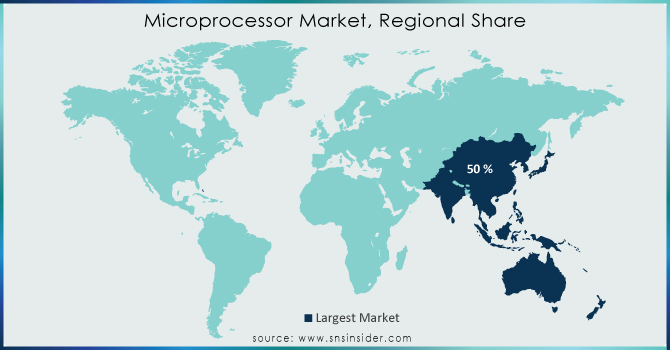

Microprocessor Market Regional Analysis

Asia Pacific has captured a market share of over 50% in 2023 and is currently dominating the market. The growth is driven by the increasing utilization of smartphones and other electronics, including laptops, mobiles, desktops, and tablets, in the region. Moreover, the market growth is supported by developing economies such as China and India. According to the report by Interos Inc., Taiwan companies owned more than 62% of the market share. In addition, the rising implementation of the Internet of Things, huge IT spending indicated by the government of China, and enhancing demand for cloud-based services are also expected to support the growth of the regional market during the forecast period.

North America, the segment experiencing the fastest growth with a 20% market share, is extremely competitive due to factors like digital technology adoption, IoT growth, autonomous vehicles, and high-performance computing needs. In comparison to other areas, North America is highly advanced in technology, offering market opportunities for companies like Tesla Motors Inc. and Rivian Automotive Inc. to introduce electric vehicles with self-driving capabilities and lane assist, necessitating strong performing MPUs. The demand for microprocessors in this region is increasing due to factors like the presence of major market players such as Intel Corporation and AMD Inc.

Key Players

Some of the major Players in Microprocessor Market with their product:

-

Advanced Micro Devices (AMD) (Processors, Graphics Cards)

-

Intel Corp (Microprocessors, Chipsets)

-

STMicroelectronics (Microcontrollers, Sensors)

-

Microchip Technology (Microcontrollers, Analog Semiconductors)

-

NXP Semiconductors (Automotive ICs, Processors)

-

Renesas Corp (Microcontrollers, Power Semiconductors)

-

Qualcomm Inc. (Mobile Processors, Modems)

-

Texas Instruments (Analog ICs, Embedded Processors)

-

NVIDIA Corp (Graphics Processing Units, AI Solutions)

-

Analog Devices (Analog ICs, Sensors)

-

Broadcom (Network Switches, Wireless Components)

-

Samsung Electronics (Memory Chips, Smartphones)

-

Nuvoton Technology (Microcontrollers, Audio Solutions)

-

The Western Design Center (Microprocessors, System-on-Chip Solutions)

-

SiFive (RISC-V Processors, Custom Chips)

-

Infineon Technologies (Automotive ICs, Power Management ICs)

-

Micron Technology (Memory Chips, Storage Solutions)

-

Xilinx (FPGA, Adaptive Computing)

-

On Semiconductor (Power Solutions, Sensors)

-

Maxim Integrated (Analog ICs, Power Management Solutions)

List of Suppliers wide range of raw materials and components, which are supplied by various suppliers across the semiconductor supply chain. Below is a list of key raw material and component suppliers for microprocessors:

1. Silicon Wafer Suppliers

-

GlobalWafers Co. Ltd. (Silicon Wafers)

-

SUMCO Corporation (Silicon Wafers)

-

Siltronic AG (Silicon Wafers)

-

MEMC Electronic Materials (now part of SunEdison) (Silicon Wafers)

2. Photomask Suppliers

-

Photronics Inc. (Photomasks for photolithography)

-

Toppan Photomasks, Inc. (Photomasks for semiconductor manufacturing)

3. Chemical Suppliers for Semiconductor Manufacturing

-

Air Products and Chemicals, Inc. (Specialty gases and chemicals)

-

BASF (Photoresists, chemical solutions)

-

Dow Inc. (Semiconductor processing chemicals)

-

Merck Group (Chemicals for semiconductor fabrication)

4. Substrate Suppliers

-

Unimicron Technology Corporation (Printed Circuit Boards, substrates)

-

Ibiden Co., Ltd. (PCB substrates)

-

Daeduck Electronics Co., Ltd. (Substrates for microprocessors)

5. Packaging and Assembly Suppliers

-

ASE Group (Assembly and packaging solutions for semiconductors)

-

Amkor Technology (Semiconductor packaging)

-

SPIL (Siliconware Precision Industries) (Packaging and testing of semiconductors)

6. Copper and Gold Suppliers for Interconnects

-

Freeport-McMoRan Inc. (Copper, used in semiconductor interconnects)

-

Johnson Matthey (Gold, used for bonding and interconnects in microprocessors)

-

Southern Copper Corporation (Copper for interconnects)

7. Rare Earth Material Suppliers

-

China Northern Rare Earth Group High-Tech Co. Ltd. (Rare earth materials used in semiconductor production)

-

Molycorp (Rare earth metals)

-

Lynas Corporation (Rare earth elements used in electronics)

8. Silicon Dioxide and Oxide Layers

-

Saint-Gobain (Silicon dioxide, used for insulating layers in microprocessors)

-

Heraeus (High-purity materials for semiconductor manufacturing)

9. Epitaxial Materials

-

Qorvo, Inc. (Epitaxial wafers for semiconductor applications)

-

IQE plc (Epitaxial wafers for advanced semiconductors)

10. Advanced Materials for Lithography

-

Tokyo Ohka Kogyo Co., Ltd. (Photoresist materials)

-

Shin-Etsu Chemical Co., Ltd. (Silicon products and photoresist materials)

-

DuPont (Photoresists, photomasks)

11. Lithography Equipment Suppliers

-

ASML (Extreme ultraviolet lithography equipment)

-

Nikon (Photolithography equipment)

-

Canon (Lithography equipment)

12. Dielectric and Conductive Materials

-

KEMET Corporation (Capacitors and other electronic components)

-

Murata Manufacturing Co., Ltd. (Dielectric materials)

-

TDK Corporation (Dielectric and magnetic materials)

Recent Development

- In March 2024, NVIDIA introduced the Blackwell Platform, designed to power the next generation of AI, Blackwell introduces six transformative technologies for accelerated computing. It focuses on reducing the cost and energy consumption of running large language models by up to 25x compared to predecessors.

- In September 2023, Intel launched Meteor Lake, a new naming scheme for Intel Core processors that utilizes Intel 3D Packaging Technology for improved performance and efficiency. The processors also feature AI Boost capabilities to enhance AI-related tasks.

- In June 2023, Qualcomm launched Snapdragon 4 Gen 2, an entry-level smartphone processor built on a 4nm process. It offers enhanced AI capabilities, improved GPU and CPU performance, and better connectivity for streaming and gaming.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 62.57 Billion |

| Market Size by 2032 | USD 126.91 Billion |

| CAGR | CAGR of 8.20% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Architecture (RISC, CISC, Hybrid, Others) • By Application (Computer, Mobile Devices and Tablets, Industrial, Consumer, Automotive, Government) • By Size (Less than 10nm ,10nm - 22nm ,More than 28nm) • By Bit Size (4, 8, 16 bits ,32 bits ,64 bits ) • By Core Count (Less than 4 Cores ,8 Cores ,16 Cores ,More than 32 Cores) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Advanced Micro Devices, Intel Corp, STMicroelectronics, Microchip Technology, NXP Semiconductors, Renesas Corp, Qualcomm Inc., Texas Instruments, NVIDIA Corp, Analog Devices, Broadcom, Samsung, Nuvoton Technology, The Western Design Center, SiFive, Analog Devices, & Other Players. |

| Key Drivers | • Proliferation of Artificial Intelligence and Machine Learning. • Expansion of Data Centers and Cloud Computing. |

| RESTRAINTS | • High Development and Production Costs lead to a decline in market growth. |