LED Chip Market Report Scope & Overview:

Get more information on LED Chip Market - Request Sample Report

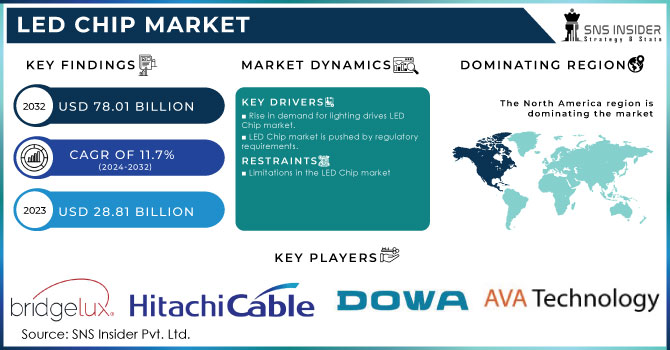

The LED Chip Market Size was valued at USD 28.81 billion in 2023. It is expected to grow to USD 78.01 billion by 2032 and grow at a CAGR of 11.7% over the forecast period of 2024-2032.

Rapid growth in the LED Chip market is being fueled by a higher need for energy-efficient and durable lighting options. These chips are leading the lighting revolution as a fundamental part of LED bulbs. LED chips are in high demand in the United States due to the widespread use of LED lighting, which is expected to result in significant energy conservation. In 2035, LED technology is expected to take over the lighting sector, saving an estimated 569 terawatt-hours of energy per year, which is equal to the power produced by over 92 1,000 MW power plants. This impressive number highlights the huge possibility of LED chips in aiding a sustainable energy future. Homeowners are at the forefront of the trend towards using LED bulbs, specifically those that are ENERGY STAR approved and use 75% less energy while lasting 25 times longer than standard incandescent bulbs. The growth of the LED Chip market is being driven directly by this increase in demand. With advancements in technology leading to better light quality, efficiency, and durability, the LED Chip is projected to become a cornerstone in the lighting industry as the market continues to grow.

Government policies are driving the surge in the LED Chip market. Nations such as China and India have put in place strong measures to encourage the use of LED lights, such as tax benefits, requirements for government purchases, and standards for energy efficiency. The US is playing a proactive role by updating lighting regulations and encouraging the use of LEDs in federal purchases. International initiatives such as the IEA's 4E SSL Annex and SEAD Initiative are establishing worldwide standards for LED quality and performance. These measures, along with the growing focus on energy saving and environmental responsibility, are establishing a conducive atmosphere for the LED sector. With energy conservation as a top priority for governments globally, and a decrease in reliance on traditional lighting technologies, the market for LED chips is predicted to experience a significant increase in demand, leading to overall market growth.

Market Dynamics

Drivers

-

Rise in demand for lighting drives LED Chip market.

The increasing need for lighting solutions is a key factor driving the LED chips market. The rise in the world's population is causing a growth in both residential and commercial constructions. Furthermore, the shift towards bigger residential and commercial areas has greatly increased the overall space in need of lighting. Over the last twenty years, the amount of space to be illuminated has increased by around 60%, and it is expected to rise by a further 20% in the next decade, adding another 45 billion square meters of space. The growing wealth, particularly in developing economies, has also led to a rise in the need for lighting. Consumers are spending more on lighting services and purchasing higher-quality products as their disposable income increases. The increase in population, urbanization, and improving living conditions is fueling a strong need for lighting options, which in turn is boosting the LED Chip industry.

-

LED Chip market is pushed by regulatory requirements.

The global regulatory push for energy-efficient lighting is providing strong support for the LED Chip market. The quick shift to LEDs, with sales increasing from 5% in 2013 to around 50% in 2022, proves this pattern. Governments globally are enacting strict measures to eliminate outdated lighting technologies such as incandescent and fluorescent bulbs. An example is the European Union taking the lead by implementing the Eco design regulation and RoHS Directive, which require the elimination of mercury-containing fluorescent lamps by 2023. In the same vein, Africa is suggesting a worldwide prohibition on fluorescent lamps, with countries such as South Africa, the United Kingdom, and the East African Community implementing rigorous efficiency requirements for lighting goods. These regulatory efforts, along with the growing energy efficiency of LEDs, which have improved by 4 lm/W each year since 2010, are pushing a significant move towards LED technology. Therefore, there is anticipation that the need for LED chips will increase significantly as producers work to satisfy the rising demand for energy-saving lighting options.

-

Efficiency and policy drive a promising future for the LED chip market.

The LED chip market is set to experience significant growth due to the worldwide move towards energy-saving lighting options. Despite an increase in overall electricity usage for lighting in 2022, the continued adoption of LEDs and enhancements in lighting efficiency are helping to reduce the effects on CO2 emissions. The trend is speeding up due to the replacement of incandescent and fluorescent lamps by LEDs. Around 50% of all residential lighting sales on a global scale currently make use of LED technology, showing a substantial presence in the market. In order to reach Net Zero Emissions by 2050, the rapid adoption of LED technology needs to be sustained. Governments around the globe are implementing measures to aid in this shift. As an example, the United Kingdom has set strict energy efficiency guidelines for lighting, with a minimum requirement of 120 Lumens per Watt (lm/W) by 2023 and 140 lm/W by 2027. In the same way, the East African Community has implemented a regional standard for discontinuing traditional and fluorescent light bulbs. In South Africa, General Service Lamps must be at least 90 lm/W efficient. The combination of regulatory measures and growing consumer demand for energy-efficient lighting is leading to a strong market for LED chips. With the increasing need for better efficiency and performance, the LED Chip market is projected to experience substantial growth in the future.

Restraints

-

Limitations in the LED Chip market

The LED Chip market is growing substantially but is dealing with various obstacles. Intense competition and industry overcapacity serve as a major limitation. With 142 LED fabs globally, as reported by SEMI, the industry has reached a point of saturation, resulting in price competitions and lower profit margins for producers. Meeting the DOE's goal of USD 2 per thousand lumens will be challenging, necessitating significant investments in research and development and enhancements in operational efficiency, leading to heightened competition. Manufacturers outside of Asia face obstacles due to the high concentration of LED die and package production in the region. This concentrated geography may affect the stability of the supply chain, lead times, and expenses. Although the United States is strong in manufacturing LED luminaires, it will need to make substantial investments in domestic LED Chip and package production to increase its share of the value-added supply chain. Global supply chains have been disrupted by the COVID-19 pandemic and current geopolitical tensions, resulting in higher costs, lack of components, and delays in production. These conditions have caused doubts for manufacturers of LED chips and slowed down the expansion of the market.

-

Dependency on rare earths poses a barrier to growth in the LED Chip market

The LED Chip market is challenged by scarcity and political risks linked to rare earth materials. China, which dominates more than 80% of the worldwide supply, is the main source of crucial elements such as gallium, indium, and yttrium needed for optimal LED functioning. This excessive dependence leads to weaknesses in the supply chain and fluctuations in prices, affecting the total cost and stability of LED Chip manufacturing. Competition for rare earth elements is growing due to the increasing demand in the clean energy sector, including electric vehicles and renewable energy technologies. The need for these materials is expected to increase in the future, possibly worsening supply limitations and raising costs for manufacturers of LED chips. The industry is facing a significant challenge due to the growing scarcity and expense of rare earth elements, requiring creative solutions to decrease dependence on these crucial resources.

Segment Analysis

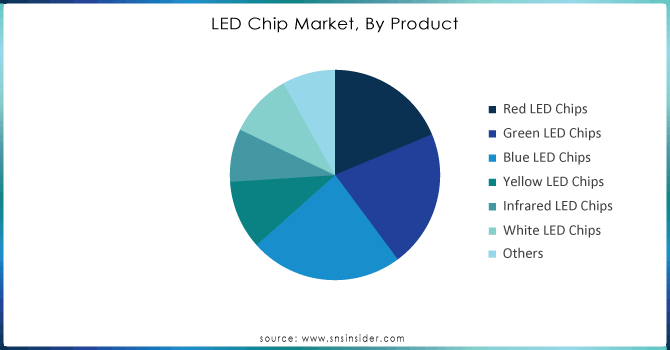

By Product

Based On Product, Blue LED Chips dominated the LED Chip Market with 29% of share in 2023. Their crucial function in producing white light via phosphor conversion has led to their extensive use in various lighting purposes. The superior performance of blue LEDs in creating white light has played a key role in pushing the transition to energy-saving lighting options. The upcoming change is expected to bring significant advantages, potentially leading to a saving of 6.9 trillion kWh of electricity by 2035 with the use of advanced lighting systems, as estimated by the DOE. These energy savings result in important economic and environmental benefits, such as decreased energy expenses and carbon emissions. As advancements are made in the industry to enhance LED efficiency, the opportunity for increased energy savings and a more sustainable future becomes more evident.

Need any customization research on LED Chip Market - Enquiry Now

By Application

Based on Application, Automotive dominated the LED Chip Market with 32% of share in 2023.High-quality diodes have a sizeable metal plate that enables improved heat regulation. The diode can carry more current due to better heat dissipation, resulting in increased light emission area and higher light output. The heat resistance of a basic 5 mm LED is one-tenth less compared to a simple 5 mm LED. Practically speaking, this indicates that a high-performance diode like the Luxeon Rebel has an emission area of around 1 mm squared and an efficiency of approximately. 40-100 units of luminous flux. The strength of this far exceeds that of a regular 5 mm standard LED. Measuring 0.25 mm and with power under 0.1 W and 20-30 mA, the efficiency of only 1-2 Lumen is achieved by LEDs. Their compact and flat structure allows for innovative product designs, such as the "LEDayFlex" daytime running light module for vehicles.

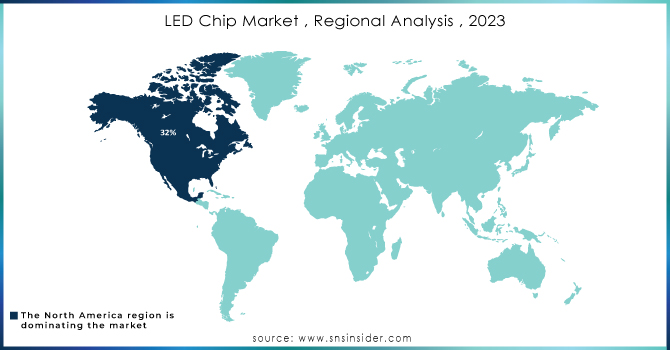

Regional Analysis

In 2023, North America, particularly the United States, has emerged as a dominant player in the LED Chip market, holding a notable 32% market share. This leadership role is credited to a mix of strong manufacturing abilities, advances in technology, and increasing demand. The United States has a strong network of LED Chip makers such as Cree, Lumileds, and Bridgelux, which contribute to innovation and quality products.Advancements in technology, like the progress made with GaN on silicon substrates, have improved the efficiency of LEDs and lowered expenses, firmly establishing the United States as a leader in technology. Additionally, the growing automotive industry in the United States, along with a high vehicle ownership rate of 73%, has increased the need for LED lighting parts. The market has expanded even more due to factors such as rising energy costs and environmental worries, which have prompted a move towards energy-efficient lighting in both commercial and residential areas. For example, LED lights can decrease energy usage by as much as 80% when compared to incandescent bulbs, leading to significant energy conservation of 28.2 billion kWh per year thanks to utility efficiency initiatives. The combination of technological skill, production capabilities, and consumer need has strengthened North America's leadership in the LED Chip sector.

Asia Pacific is the fastest growing in LED Chip Market with 28% of share in 2023, due to strong growth in consumer electronics and automotive industries. The demand for medium and high-power LEDs in this area is being driven by rising disposable incomes, fast urbanization, and a move towards more advanced technology. In India, the consumer electronics market is currently worth almost USD 10 billion in 2022 and is expected to grow twofold by 2025, showcasing this trend. Government efforts continue to speed up the adoption of LED technology. These initiatives generate a hopeful perspective for the local market. Nevertheless, the Chinese LED Chip manufacturing industry has been disturbed by the trade tensions between the US and China. Exporting semiconductor equipment has been hindered by restrictions, leading to a slowdown in production. In spite of these obstacles, a few Chinese chip makers are progressing in enhancing their abilities, indicating a possible recovery for the Chinese industry in the near future. In its entirety, the Asia-Pacific region's robust consumer electronics demand, expanding automotive industry, and government-supported programs establish it as a key growth driver for the LED Chip market.

Key Players

The major key players are Bright LED Electronics Corporation, AVA Technologies, Inc., Bridgelux, Inc., Hitachi Cable, Ltd., Dowa Electronics Materials Co., Ltd., Optek Technology, Cree LED., Nichia Corporation, Epistar Corporation, Huga Optech, Inc., and other key players mentioned in the final report.

Recent Development:

-

In Oct 2020, Cree Inc. made a significant announcement regarding a business deal. The company revealed its decision to divest its LED business unit to Smart Global Holdings for a substantial amount exceeding $300 million.

-

In April 2023, Sharp NEC introduces the LED FC Series featuring COB technology for long-lasting, high-contrast screens.

-

In January 2023, Nichia and Infineon release the first fully integrated micro-LED light engine for HD adaptive driving beams in the industry.

-

In May 2022, AMS OSRAM introduces OSLON Optimal LEDs for horticulture lighting, offering top efficiency and dependability.

| Report Attributes | Details |

| Market Size in 2023 | USD 25.8 Billion |

| Market Size by 2032 | USD 78.01 Billion |

| CAGR | CAGR of 11.7% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Product (Red LED Chips, Green LED Chips, Blue LED Chips, Yellow LED Chips, Infrared LED Chips, White LED Chips, and Others) • By Application (Signs and Signal, Backlighting, Automotive, Illumination, and Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles |

Bright LED Electronics Corporation, AVA Technologies, Inc., Bridgelux, Inc., Hitachi Cable, Ltd., Dowa Electronics Materials Co., Ltd., Optek Technology, Cree LED., Nichia Corporation, Epistar Corporation, Huga Optech, Inc., and other key players mentioned in the final report. |

| Key Drivers | • Rise in demand for lighting drives LED Chip market. • LED Chip market is pushed by regulatory requirements. • Efficiency and policy drive a promising future for the LED chip market. |

| RESTRAINTS | • Limitations in the LED Chip market • Dependency on rare earths poses a barrier to growth in the LED Chip market |