Travel Insurance Market Report Scope & Overview:

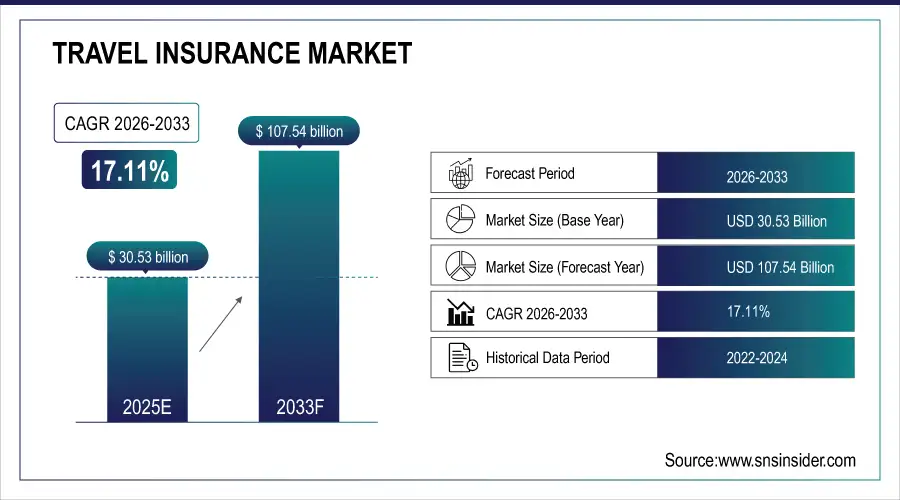

The Travel Insurance Market was valued at USD 30.53 billion in 2025E and is expected to reach USD 107.54 billion by 2033, growing at a CAGR of 17.11% from 2026-2033.

The Travel Insurance Market is growing due to increasing international and domestic travel, rising awareness of medical and trip-related coverage, and the demand for financial protection against unforeseen events. Technological advancements, digital policy platforms, and easy claim processes are enhancing adoption. Additionally, growing risks from pandemics, natural disasters, and travel disruptions are driving travelers to secure comprehensive insurance solutions.

According to the U.S. Bureau of Economic Analysis, the travel and tourism industry in the United States saw a 7.0% increase in real output in 2023, following a 20.8% rise in 2022.

Various state insurance departments, such as the Washington State Office of the Insurance Commissioner, provide annual market information reports that include data on travel insurance providers and market share, aiding in understanding consumer adoption trends.

Market Size and Forecast

-

Market Size in 2025: USD 30.53 Billion

-

Market Size by 2033: USD 107.54 Billion

-

CAGR: 17.11% from 2026 to 2033

-

Base Year: 2025E

-

Forecast Period: 2026–2033

-

Historical Data: 2022–2024

To Get more information on Travel Insurance Market - Request Free Sample Report

Key Travel Insurance Market Trends

-

Rising global travel and outbound tourism are driving demand for travel insurance.

-

Increasing awareness of health, trip cancellation, and emergency coverage is boosting adoption.

-

Growth of online platforms and aggregators is making policy purchase faster and more convenient.

-

Expansion of coverage options for seniors, students, and long-stay travelers is widening market reach.

-

Integration of digital claims processing and AI-based risk assessment is enhancing customer experience.

-

Regulatory requirements and partnerships with airlines and travel agencies are promoting insurance uptake.

-

Rising demand for comprehensive protection against pandemics, natural disasters, and travel disruptions is accelerating growth.

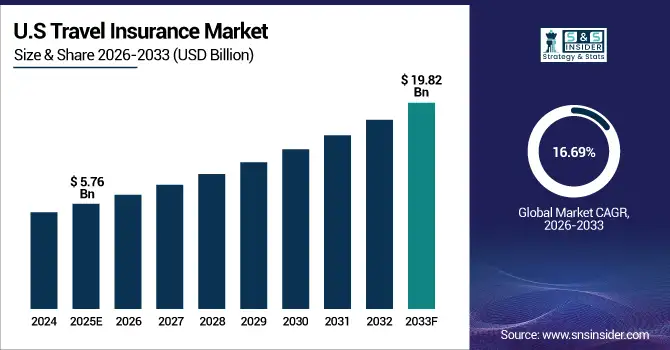

U.S. Travel Insurance Market was valued at USD 5.76 billion in 2025E and is expected to reach USD 19.82 billion by 2033, growing at a CAGR of 16.69% from 2026-2033.

The U.S. Travel Insurance Market is growing due to rising domestic and international travel, increased awareness of medical and trip protection, digital policy adoption, and the need for financial security against trip cancellations, delays, and unforeseen emergencies.

Travel Insurance Market Growth Drivers:

-

Growing international tourism and rising business travel demand drive the increasing adoption of comprehensive travel insurance coverage globally

Growing international tourism and business travel demand is a major factor boosting the travel insurance market. With rising disposable incomes, expanding middle-class populations, and increasing globalization, individuals and corporations are traveling more frequently for leisure and work. This trend has heightened the need for protection against uncertainties such as medical emergencies, trip cancellations, lost baggage, and accidents abroad. Travel insurance providers are responding by offering tailored and flexible plans to meet diverse needs, including multi-trip policies and specialized coverage. As international travel continues to expand, travel insurance adoption will see significant growth worldwide.

-

According to the World Tourism Organization (UNWTO), international tourism rebounded strongly in 2023, with an estimated 1.3 billion international arrivals, about 89% of pre-pandemic levels. This resurgence is attributed to factors such as pent-up demand and increased air connectivity.

Travel Insurance Market Restraints:

-

High cost of travel insurance premiums discourages budget-conscious travelers from purchasing policies, limiting market penetration and adoption

High premiums on travel insurance policies create affordability challenges, especially for budget-conscious travelers and families. While comprehensive coverage offers strong protection, many consumers perceive travel insurance as an additional financial burden on already expensive trips. For travelers from low- and middle-income countries, these costs often deter purchase. Moreover, premium variations based on age, destination, or pre-existing conditions add complexity, making it difficult for individuals to find affordable options. This price sensitivity limits penetration in emerging markets where travel is increasing but discretionary spending remains constrained, restricting broader adoption of travel insurance globally.

Travel Insurance Market Opportunities:

-

Integration of digital platforms and AI-driven solutions enhances accessibility and personalization of travel insurance for global consumers

Integration of digital platforms, mobile apps, and AI-driven solutions is creating new opportunities in the travel insurance market. Travelers now expect quick, seamless, and customized services, which digital innovations make possible. Insurers are offering real-time quotes, instant claims processing, and policy management via online portals and mobile applications. Artificial intelligence further enables personalized recommendations, fraud detection, and predictive risk assessments. The convenience of purchasing policies during flight bookings or through travel apps enhances accessibility. These digital transformations not only increase customer satisfaction but also expand market reach by making insurance more relevant to modern travelers.

-

For instance, Allianz Partners has collaborated with Singapore Airlines to offer travel insurance during flight bookings, simplifying the process for travelers and enhancing accessibility.

-

Allianz Partners has also introduced the allyz mobile app, a digital platform that provides travelers with trusted advice and expertise, as well as access to the full suite of insurance benefits available to customers. This platform simplifies the insurance process, offering real-time quotes and instant claims processing, thereby enhancing the overall customer experience

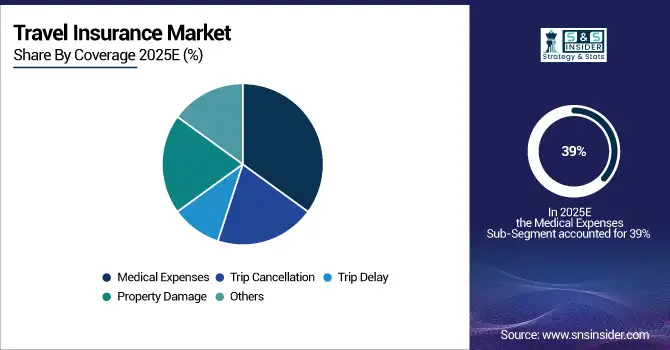

Travel Insurance Market Segment Highlights

-

By Coverage, Medical Expenses dominated with ~39% share in 2025; Trip Cancellation fastest growing (CAGR 19.37%).

-

By End User, Senior Citizens dominated with ~30% share in 2025; Business Travelers fastest growing (CAGR 18.34%).

-

By Distribution Channel, Insurance Companies dominated with ~30% share in 2025; Banks fastest growing (CAGR 19.37%).

-

By Insurance Type, Single-trip Travel Insurance dominated with ~59% share in 2025; Annual Multi-trip Travel Insurance fastest growing (CAGR 18.17%).

Travel Insurance Market Segment Analysis

By Coverage, Medical Expenses led while Trip Cancellation is expected to grow fastest

Medical expenses segment dominated the travel insurance market in 2025 due to rising healthcare costs abroad and increasing cases of medical emergencies during international travel. Travelers prioritize coverage for hospitalization, treatments, and emergency evacuations, making this segment essential for financial security and peace of mind while traveling internationally.

Trip cancellation segment is projected to grow at the fastest CAGR from 2026–2033 as global travel faces heightened risks from pandemics, natural disasters, and unforeseen disruptions. Increasing awareness of financial losses from canceled trips, coupled with flexible travel plans, has driven demand for comprehensive cancellation coverage worldwide.

By End Use, Senior Citizens dominated while Business Travelers are projected to grow fastest

Senior citizens segment held the largest share in 2025 as older travelers face higher health risks and require extensive medical coverage during international trips. Insurers provide specialized plans catering to age-related illnesses, hospitalization, and emergency evacuation, making this group a major driver of demand in the travel insurance market.

Business travelers segment is expected to grow rapidly as globalization fuels corporate travel. Rising frequency of international meetings, conferences, and client engagements increases exposure to risks like cancellations, lost baggage, and medical emergencies. Employers and employees are increasingly opting for travel insurance to ensure uninterrupted business operations and safety abroad.

By Distribution Channel, Insurance Companies led while Banks are expected to grow fastest

Insurance companies dominated the market in 2025 due to their established distribution networks, strong product portfolios, and ability to provide tailored coverage options. Their direct engagement with customers, competitive pricing, and reliability in claim settlements ensured higher adoption compared to intermediaries, strengthening their leadership in the travel insurance landscape.

Banks are projected to grow at the fastest CAGR as bancassurance partnerships expand travel insurance accessibility. With large customer bases, trusted relationships, and bundled offerings with credit cards or travel loans, banks provide convenient purchase channels. This integrated model enhances market penetration and drives significant adoption among frequent travelers globally.

By Insurance Type, Single-Trip Travel Insurance dominated while Annual Multi-Trip Travel Insurance is projected to grow fastest

Single-trip travel insurance dominated in 2025 due to its affordability, simplicity, and popularity among occasional leisure travelers. With flexible coverage for medical emergencies, cancellations, and baggage loss during a single journey, it appeals to budget-conscious consumers who prefer customized protection without long-term policy commitments, driving its widespread demand.

Annual multi-trip travel insurance is expected to grow quickly as frequent travelers, including business professionals and avid tourists, seek cost-effective and hassle-free solutions. This segment offers year-round protection for multiple trips, reducing the need to purchase separate policies. Rising international mobility is fueling strong adoption of multi-trip insurance globally.

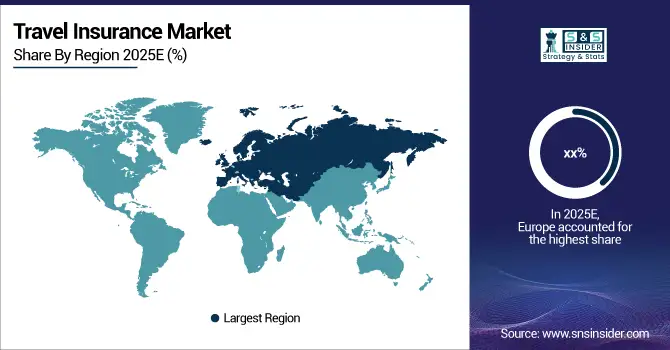

Travel Insurance Market Regional Highlights

-

By Region, Europe dominated with ~37% share in 2025; Asia Pacific fastest growing (CAGR 18.70%).

Travel Insurance Market Regional Analysis

Europe Travel Insurance Market Insights

Europe dominated the travel insurance market in 2025 with the largest revenue share due to its high outbound tourism, well-established travel infrastructure, and mandatory insurance requirements in several countries. The region’s aging population, frequent cross-border travel within the EU, and strong consumer awareness of travel-related risks further fueled adoption. Additionally, collaborations between insurers, airlines, and travel agencies ensured seamless accessibility, strengthening Europe’s leadership in the global travel insurance market.

Get Customized Report as per Your Business Requirement - Enquiry Now

North America Travel Insurance Market Insights

North America holds a significant share in the travel insurance market driven by high international travel frequency, strong consumer awareness, and advanced insurance penetration. The region’s well-established healthcare system costs abroad, coupled with demand for comprehensive trip protection, fuel adoption. Extensive availability of customized policies through insurers, banks, and digital platforms further strengthens market growth, making North America a key contributor to the global travel insurance industry.

Asia Pacific Travel Insurance Market Insights

Asia Pacific is projected to grow at the fastest CAGR from 2026–2033 owing to rising disposable incomes, expanding middle-class populations, and increasing international travel. Countries such as China, India, and Southeast Asian nations are witnessing rapid growth in outbound tourism and business travel. Improved awareness of travel-related risks, expanding digital insurance platforms, and strong government initiatives promoting tourism are driving significant demand, making Asia Pacific the fastest-growing regional market for travel insurance.

Middle East & Africa and Latin America Travel Insurance Market Insights

The Middle East & Africa travel insurance market is expanding due to growing outbound tourism, rising expatriate population, and increasing awareness of medical risks abroad. Meanwhile, Latin America is witnessing steady growth driven by rising disposable incomes, regional travel integration, and demand for affordable protection. Both regions remain underpenetrated, offering significant opportunities for insurers to expand coverage through digital platforms, partnerships, and tailored policies for diverse traveler segments.

Travel Insurance Market Competitive Landscape:

Allianz

Allianz is a leading player in the Travel Insurance Market, offering comprehensive coverage for medical emergencies, trip cancellations, lost baggage, and travel delays. Known for its global presence and strong financial stability, Allianz provides flexible plans catering to individual travelers, families, and business clients. The company leverages digital platforms for easy policy purchase and claims processing, enhancing customer convenience and trust. Its extensive network of partners and innovative solutions strengthen its market leadership.

-

In 2025, Allianz Partners’ Vacation Confidence Index now spans the USA, Europe, and APAC tracking traveler intent, behavior trends, and shaping strategic innovation in travel insurance offerings.

-

In 2024, a long-term extension with Iberia was announced, with Allianz Partners continuing as the airline’s global travel insurance provider across 13 markets until December 2025, offering seamless insurance during flight bookings.

-

In 2023, in Australia, Allianz Partners shifted to crystal-clear policy language, earning the country’s first travel insurance Gold Certified Trustmark for simplified wording, transparent USD-value limits, and plain-language clarity.

World Nomads

World Nomads is a prominent player in the Travel Insurance Market, specializing in coverage for adventurous and independent travelers. The company offers flexible policies that cater to solo travelers, backpackers, and digital nomads, providing protection for medical emergencies, trip cancellations, and adventure activities. Known for its user-friendly digital platform, World Nomads ensures easy policy management and claims processing.

-

In 2024, 70% of policy purchases were for solo travelers up from 68% in 2022 and 69% in 2023 particularly popular for Europe and Asia destinations.

-

In 2024, it launched the Annual Multi-Trip (AMT) policy across the UK & Ireland via Collinson underwriting, featuring children’s coverage, age extensions, and SmartDelay airport delay benefits.

-

In 2023, World Nomads partnered with Student Beans to offer an exclusive 10% discount on travel insurance for students and post-graduates across the UK & EU, easing financial burden and supporting adventurous travel.

Key Players

Some of the Travel Insurance Market Companies

-

Allianz

-

American International Group, Inc.

-

AXA

-

Assicurazioni Generali S.p.A.

-

USI Insurance Services, LLC

-

battleface

-

Insure & Go Insurance Services Limited

-

Seven Corners Inc.

-

Travel Insured International

-

Zurich

-

Delphi Financial Group, Inc.

-

Ping An Insurance (Group) Company of China, Ltd.

-

Berkshire Hathaway Travel Protection (BHTP)

-

Chubb

-

World Nomads

-

Tokio Marine HCC

-

International Medical Group (IMG)

-

Travelex Insurance Services

-

Trawick International

-

Ingle International

| Report Attributes | Details |

|---|---|

| Market Size in 2025E | USD 30.53 Billion |

| Market Size by 2033 | USD 107.54 Billion |

| CAGR | CAGR of 17.11% From 2026 to 2033 |

| Base Year | 2025 |

| Forecast Period | 2026 to 2033 |

| Historical Data | 2022-2024 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Insurance Type (Single-trip Travel Insurance, Annual Multi-trip Travel Insurance, Long-stay Travel Insurance) • By Distribution Channel (Insurance Intermediaries, Insurance Companies, Banks, Insurance Brokers, Insurance Aggregators) • By End Use (Education Travelers, Business Travelers, Senior Citizens, Family Travelers, Others) • By Coverage (Medical Expenses, Trip Cancellation, Trip Delay, Property Damage, Others) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

| Company Profiles | Allianz, American International Group, Inc., AXA, Assicurazioni Generali S.p.A., USI Insurance Services, LLC, battleface, Insure & Go Insurance Services Limited, Seven Corners Inc., Travel Insured International, Zurich, Delphi Financial Group, Inc., Ping An Insurance (Group) Company of China, Ltd., Berkshire Hathaway Travel Protection (BHTP), Chubb, World Nomads, Tokio Marine HCC, International Medical Group (IMG), Travelex Insurance Services, Trawick International, Ingle International |