Game Engines Market Report Scope & Overview:

Get More Information on Game Engines Market - Request Sample Report

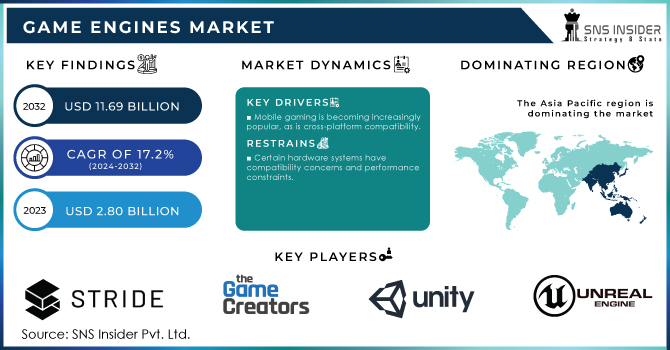

The Game Engines Market size is anticipated to be worth USD 2.80 billion in 2023 and is expected to reach USD 11.69 billion by 2032, growing at a CAGR of 17.2% over the forecast period 2024-2032.

The rising popularity of e-sports and online gaming is fueling the game engine market growth. In addition to gaming, game engine platforms are largely used for several non-gaming purposes, which include training simulations, architectural visualization, and virtual reality experiences. AR technology covers the digital information onto the reality, whereas VR technology creates a completely immersive virtual environment. Both technologies highly depend on the advanced platforms for rendering and development digital content, making them critical market components. Game engines, which have VR and AR features are becoming vital for developers that are seeking to create next-generation games.

Cross-platform development is a major factor driving growth in the game engine market. Gamers are predicting to play games on various devices, including mobile, consoles, and PCs, which make the game engines with seamless cross-platform compatibility and highly desirable. This feature not only expands the game's potential audience but also streamlines development by enabling creators to use a single codebase for multiple platforms. The surging cross-platform gaming demand is responsible for boosting the flexible game engines' adoption catering various gaming environments.

Game Engines Market Dynamics:

Drivers:

- Rising demand for games on PC, console, and mobile platforms.

- Adoption of cloud engines for real-time teamwork.

- Increased demand for creating immersive experiences.

The augmented demand for generating immersive experiences is substantially driving the game engine market growth. The growth is also propelled by the surge of augmented reality (AR), virtual reality (VR), and mixed reality (MR), developers need sophisticated game engines, capable of interpreting complex and realistic environments. These engines are important for creating engaging and interactive environments that captivate users, whether in simulations, gaming, or training applications. The push for more immersive content has increased the demand for advanced features including physics simulations, real-time ray tracing, and AI-driven character behaviors within the game engines. As industries and consumers are looking more immersive digital experiences, require powerful and versatile game engines continues to grow, reinforcing their importance as a key element in the market.

The acceptance of cloud-based game engines is converting the development process by allowing real-time partnership among team members, irrespective of their physical location. These engines enable artists, developers, and designers to work simultaneously on the same project, further accessing shared resources and tools via cloud. This shift to cloud-based platforms streamlines workflows and decreases the time required for updates, reduces the version conflicts’ risks. Furthermore, the cloud engines enable more efficient repetition and testing, as these changes are instantly reflected in the team. By consolidating on the development process, the cloud engines boost productivity, enable remote work, and accelerate development cycle, contributing to the rising popularity of game engines in the fast-paced and competitive market for game engine.

Restraints:

- Significant investment is required to create advanced game engines.

- Lack of skilled developers proficient in advanced game engine technologies.

- Difficulty in optimizing engines across multiple platforms and devices.

The optimization of game engines for different devices and platforms is hampering the market owing to the large range of software and hardware configurations. The developers have to ensure that their engines function efficiently across various systems, such as mobile, PCs, and consoles, each with its constraints and specifications and constraints. This also involves deep testing and fine-tuning to account for differences processing power, screen resolutions, and memory. Maintaining the quality for both high-end and low-end devices is a complex task, which extensively extends the development time and costs. Hence, cross-platform optimization is an important and demanding element for the development of game engine.

The scarcity of skilled developers with expertise in advanced game engine technologies presents a major challenge for the industry. Development of the state-of-the-art game engines require specialized skills in graphics programming, integration of complex systems, and real-time physics. However, there are very less professionals that have the required knowledge to manage these advanced technologies. This lack of skilled professionals can result in development delays, surged recruitment costs, and challenges in maintaining and updating engine features. Owing to the high need for sophisticated game engines rises, securing and keeping qualified developers becomes vital for staying competitive and driving innovation.

Game Engines Market Segmentation Analysis:

By Component

In 2023, the solution segment held the largest game engines market share of 71.5% due to the soaring popularity of multi-user game applications in competitive gaming tournaments, such as Counter-Strike: Global Offensive Major Championships, Evolution Championship Series, eSports World Convention, Evolution Championship Series, and more. In recent years, the market has progressed due to the growing demand for premium gaming experiences on various platforms, such as mobile, PC, and consoles.

The services segment is anticipated to expand at the highest CAGR of 19.6% over the forecast period, because of their role in enabling developers to emphasize product engagement and boost AR experience popularity. Game engines are complex software systems that require specialized knowledge and technical expertise to implement, customize, and maintain. Subsequently, the leading players in the market offer different services to assist their customers, such as technical support, training, custom development, and consulting.

By Type

The 3D game engine segment held the largest market share of over 76% in 2023, as a result of high visual quality, asset store management, intriguing gameplay, and intuitive design. The segment's share has expanded in response to the rising demand for high-quality, immersive gaming experiences. As virtual reality and augmented reality gain popularity, game developers are seeking robust tools to build engaging and lifelike environments that captivate players fully. These technologies require sophisticated 3D engines, which can offer complex environments and interactions in real-time that contributed to the development of advanced 3D engines for VR and AR.

The game engine market is varied and rapidly advancing, fueled by the evolving demands and preferences of game developers, publishers, and players. The "other game engines" segment encompasses 4D and 5D game engines, among other types. this segment is expected to expand with the highest CAGR during the forecast period, due to the trend of gamers demanding modern video games with significantly more immersion than regular 3D video games.

By Genre

In 2023, The action and adventure games segment recorded the highest market share of around 21%. Due to the popularity of open-world games, the action and adventure game genre is rapidly expanding. These games enable players to navigate expansive virtual worlds and engage with a range of characters and objects. The surge in popularity of the open-world games has been propelled by the gaming consoles and computers' capabilities that can manage the intricate physics and graphics required for these experiences.

The global surge in esports popularity is the main driving factor responsible for the strong growth of the MOBA games, such as League of Legends and Dota 2, which have played substantial role in increasing the popularity of esports industry. Several major professional leagues and tournaments are attracting a large number of audiences and provide substantial prize pools, which fosters a competitive gaming environment, which consistently draws both professional and casual gamers globally.

The growth of mobile gaming has also enhanced the appeal of the action and adventure genre. Many mobile games in this genre are designed to be played in short bursts, making them well-suited for portable gaming. On the other hand, the multiplayer online battle arena (MOBA) genre segment is predicted to expand at a significant CAGR of 18.9% from 2024 to 2032.

By Platform

The mobile segment recorded the highest market revenue share of more than 41% in 2023 and is also anticipated to expand at the highest CAGR during the forecast period. For gaming on iOS and Android systems, it's crucial to have a platform optimized for performance and capable of running smoothly across various devices, which differ in shape, size, and hardware specifications. Therefore, a lightweight and efficient platform is necessary to provide a consistent and positive user experience for all.

The gaming console platform segment is expected to grow at a rate of 17.6% during the forecast period as it is a dependable software quality and user-friendly features. Console platforms including Xbox, PlayStation and Nintendo need gaming engines, which offer high-quality graphics and performance and provide support for advanced functionalities including multiplayer gaming, streaming, and virtual reality. Recently, many game engines are developed to meet the requirements of console game developers, which include Unity, CryEngine, Unreal Engine, and Frostbite.

Do You Need any Customization Research on Game Engines Market - Enquire Now

Game Engines Market Regional Overview:

In 2023, the Asia Pacific game engine market captured the largest share of 43% due to its expansive and rapidly expanding gaming population. China, Japan, and South Korea are at the forefront, investing heavily in mobile game development. Game engines including Unreal Engine and Unity are the most popular engines owing to their high-quality graphics and cross-platform capabilities that are necessary for the diverse devices and operating systems across Asia Pacific. In addition, the rising smartphone market and widespread internet access of Asia Pacific boosts the demand for innovative mobile games, which further positions the region an important growth area for game engine providers.

China stands out as a major player in the game engine market, thanks to its large and active gaming community. The country's swift digital growth and extensive smartphone usage create substantial demand for mobile game engines that can handle advanced graphics and effective monetization strategies.

Key Players:

The major players are Buildbox, Clickteam, Cocos, Crytek GmbH, GameSalad, (Construct 3), Stencyl LLC, Stride, The Game Creators Ltd. (AppGameKit), Marmalade Technologies Ltd., Phaser (Photon Storm Ltd.), and other players.

Recent Developments:

- In February 2024, Gideros collaborated with Unity Technologies to enhance cross-platform abilities and enhance the development process for mobile games.

- In April 2024, Godot announced a merger with Blender Foundation to create a unified platform for game development and 3D modeling.

| Report Attributes | Details |

| Market Size in 2023 | USD 2.80 Bn |

| Market Size by 2032 | USD 11.69 Bn |

| CAGR | CAGR of 17.2% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Component (Solution, Services) • By Platform (Mobile, Console, Computer, Others) • By Type (2D Game Engines, 3D Game Engines, Others) • By Genre (Action & Adventure, Multiplayer Online Battle Arena, Real-time Strategy, Role-playing Games, Sandbox, Shooter, Simulation and Sports, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Stride, The Game Creators Ltd. (AppGameKit), Unity Software Inc., Unreal Engine (Epic Games), YoYo Games Ltd. (GameMaker Studio 2), Buildbox, Clickteam, Cocos, Crytek GmbH, GameSalad, Marmalade Technologies Ltd., Phaser (Photon Storm Ltd.), RPG Maker, Scirra Ltd. (Construct 3), Stencyl LLC |

| Key Drivers |

• Rising demand for games on PC, console, and mobile platforms. • Adoption of cloud engines for real-time teamwork. • Increased demand for creating immersive experiences. |

| Market Restraints | •Significant investment is required to create advanced game engines. •Lack of skilled developers proficient in advanced game engine technologies. •Difficulty in optimizing engines across multiple platforms and devices. |