Truck Rental Market Report Scope & Overview

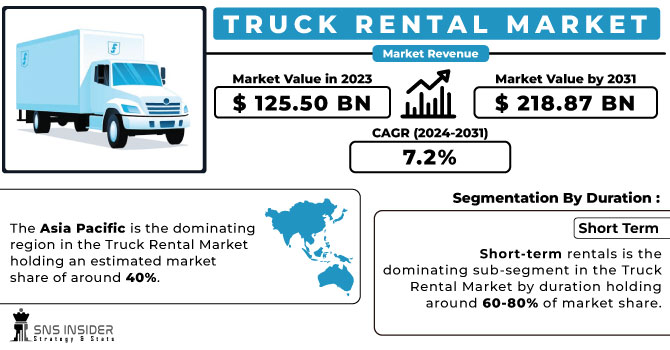

The Truck Rental Market Size was valued at USD 125.50 billion in 2023 and is expected to reach USD 218.87 billion by 2031 and grow at a CAGR of 7.2% over the forecast period 2024-2031.

The truck rental market is growing due to its ability to offer cost-effective and adaptable solutions for transporting goods. Businesses can avoid the commitment and expense of owning and maintaining a fleet of trucks by renting vehicles for short-term use.

Get More Information on Truck Rental Market - Request Sample Report

This is particularly beneficial in the growing e-commerce industry, where companies require trucks to move products efficiently between warehouses, distribution centres, and customers. Renting trucks allows for flexible fleet scaling based on fluctuating demand, eliminating the burdens of long-term ownership associated with maintenance, insurance, and depreciation. The construction and infrastructure projects with varying durations benefit from renting heavy-duty trucks to transport materials, eliminating the need for permanent fleet investment.

MARKET DYNAMICS:

KEY DRIVERS:

-

Digitalization Boosts Truck Rentals with Instant Booking and Electric Truck Growth

The truck rental market is poised for further growth due to advancements in technology and environmental concerns. The rise of digitalization has made booking rental trucks incredibly convenient through user-friendly platforms. Additionally, government efforts to lower emissions are driving the development of electric trucks. As lithium-ion battery technology improves, electric trucks become more capable of long-distance hauls. This rise in electric truck adoption within rental services is expected to create significant growth opportunities in the coming years.

RESTRAINTS:

-

High fuel prices and tough regulations threaten truck rental market growth.

Rising fuel costs and complex regulations hinders the truck rental market. Fuel prices significantly impact profits, while regulations on emissions, safety, driver qualifications, and driving hours necessitate investments in upgrades, training, and administration. Stricter standards like Euro VI and Tier 4 further increase these burdens. These challenges can hinder fleet expansion, customer acquisition, and overall growth. The industry is countering this with alternative fuels, fuel-efficient tech, and digitalization, but the fight against high costs and regulations remains.

OPPORTUNITIES:

-

Technological advancements can unlock growth through user-friendly online booking platforms for truck rentals.

-

Construction and infrastructure projects with fluctuating needs can benefit from the cost-effective solutions offered by the truck rental market.

CHALLENGES:

-

Fluctuating demand across industries makes fleet management challenging.

-

Maintaining a modern fleet with ever-evolving technology requires ongoing investment.

IMPACT OF RUSSIA-UKRAINE WAR

The war in Russia-Ukraine has disrupted the truck rental market, causing issues across Europe with potential global ramifications. Sanctions and economic instability have hampered business activity, leading to a drop in demand for trucks to move goods. The war itself has also directly damaged or destroyed rental trucks in Ukraine, hindering companies' ability to meet existing contracts and shrinking overall fleet sizes. Furthermore, global sanctions on Russia have restricted access to materials and parts needed for truck manufacturing and maintenance, potentially limiting the availability of new rental vehicles. The war has worsened the global rise in fuel prices, significantly increasing operating costs for rental companies and potentially discouraging customers from renting trucks altogether.

IMPACT OF ECONOMIC SLOWDOWN

Economic slowdowns disrupt the truck rental market, potentially causing a 15-20% drop in demand. Businesses limit their budgets, reducing spending on goods and consequently the need for transportation. This translates to fewer rentals for trucks used in construction, manufacturing, and retail sectors. It causes in lowering the consumer’s confidence leading to decreased spending and a decline in demand for goods. This translates to fewer deliveries and a drop in truck rentals needed for e-commerce and last-mile deliveries. The businesses may delay infrastructure projects and equipment purchases, reducing demand for the heavy-duty trucks typically used in these sectors, further impacting rental companies catering to such needs.

KEY MARKET SEGMENTS:

By Duration:

-

Short Term

-

Long Term

Short-term rentals is the dominating sub-segment in the Truck Rental Market by duration holding around 60-80% of market share. This dominance is driven by the flexibility and cost-effectiveness they offer. Businesses can rent trucks for specific projects or fluctuating needs, eliminating the burden of ownership and associated expenses like maintenance and depreciation.

By Truck Type:

-

Light-duty

-

Medium-duty

-

Heavy-duty

Light-duty trucks is the dominating sub-segment in the Truck Rental Market by truck type holding around 60-65% of market share. This segment thrives due to its widespread use in personal moves, local deliveries, and small business operations. Their movability and fuel efficiency make them ideal for urban environments and everyday tasks.

By Service Provider:

-

OEM captive

-

Commercial banks

-

NBFCs

NBFCs (Non-Banking Financial Companies) is the dominating sub-segment in the Truck Rental Market by service provider. Their established financial networks and expertise in loan structuring enable them to offer competitive rates and financing options to a wider range of customers.

By Propulsion

-

ICE

-

Electric

Internal Combustion Engine (ICE) trucks is the dominating sub-segment in the Truck Rental Market by propulsion. Their established infrastructure, lower upfront costs, and wider availability make them the go-to choice for most businesses. However, electric trucks are a promising segment with growing adoption due to environmental concerns and government incentives.

REGIONAL ANALYSES

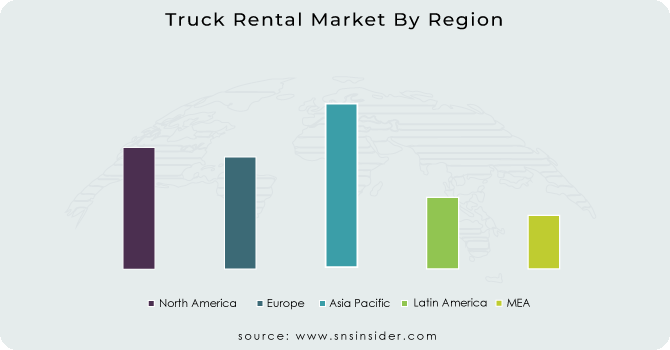

The Asia Pacific is the dominating region in the Truck Rental Market, holding an estimated market share of around 40%. The region boasts flourishing economies with a rapidly expanding industrial and commercial sector. This translates to a high demand for robust trucking networks, necessitating a large fleet of rental trucks to support logistics and transportation needs.

North America is the second highest region in this market. This strong presence is driven by a well-established trucking industry with a high replacement demand for trucks. Companies in North America frequently utilize rental trucks to manage fluctuations in freight volume or for short-term projects, creating a consistent demand for rental services.

Europe is experiencing the fastest growth within the Truck Rental Market. This surge is propelled by two key factors. Stringent emission regulations in Europe are pushing companies to rent newer, compliant trucks rather than incurring the expense of upgrading their existing fleets.

Get Customized Report as per Your Business Requirement - Request For Customized Report

REGIONAL COVERAGE:

North America

-

US

-

Canada

-

Mexico

Europe

-

Eastern Europe

-

Poland

-

Romania

-

Hungary

-

Turkey

-

Rest of Eastern Europe

-

-

Western Europe

-

Germany

-

France

-

UK

-

Italy

-

Spain

-

Netherlands

-

Switzerland

-

Austria

-

Rest of Western Europe

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Vietnam

-

Singapore

-

Australia

-

Rest of Asia Pacific

Middle East & Africa

-

Middle East

-

UAE

-

Egypt

-

Saudi Arabia

-

Qatar

-

Rest of Middle East

-

-

Africa

-

Nigeria

-

South Africa

-

Rest of Africa

-

Latin America

-

Brazil

-

Argentina

-

Colombia

-

Rest of Latin America

KEY PLAYERS

The major key players are AMERCO (US), Avis Budget Group Inc. (US), PACCAR Leasing Company (US), MAX Rental.lu AG (Luxembourg), Ryder System, Inc. (US), Penske Truck Leasing Co., United Rentals, Inc. (US) Sixt SE (Germany), Almano (US), Advantage Rent-a-car (US) and other key players.

Avis Budget Group Inc.(US)-Company Financial Analysis

RECENT DEVELOPMENTS:

-

In March 2022: Fetch secures $3.5M to expand its on-demand van and truck rental platform. Users can rent vehicles via app, including those from Fetch's fleet or individual owners who partner with the service.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 125.50 Billion |

| Market Size by 2031 | US$ 218.87 Billion |

| CAGR | CAGR of 7.2% From 2024 to 2031 |

| Base Year | 2023 |

| Forecast Period | 2024-2031 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • by Duration (Short Term, Long Term) • by Truck Type (Light-duty, Medium-duty, Heavy-duty) • by Service Provider (OEM captive, Commercial banks, NBFCs) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | AMERCO (US), L.P. (US), Avis Budget Group Inc. (US), PACCAR Leasing Company (US), MAX Rental.lu AG (Luxembourg), Ryder System, Inc. (US), Penske Truck Leasing Co., United Rentals, Inc. (US) Sixt SE (Germany), Almano (US), Advantage Rent-a-car (US), Budget Car Rental (US), and Europcar (UK) |

| Key Drivers | •The Market Key Players' outstanding rental offers and extensive promotion. •The Truck Rental Industry will benefit from outsourcing. |

| RESTRAINTS | •Truck rental services aren't readily available in several parts due to economic development. •Another factor limiting the market's expansion is a general lack of knowledge. |