Ultomiris Drug Market Report Scope & Overview:

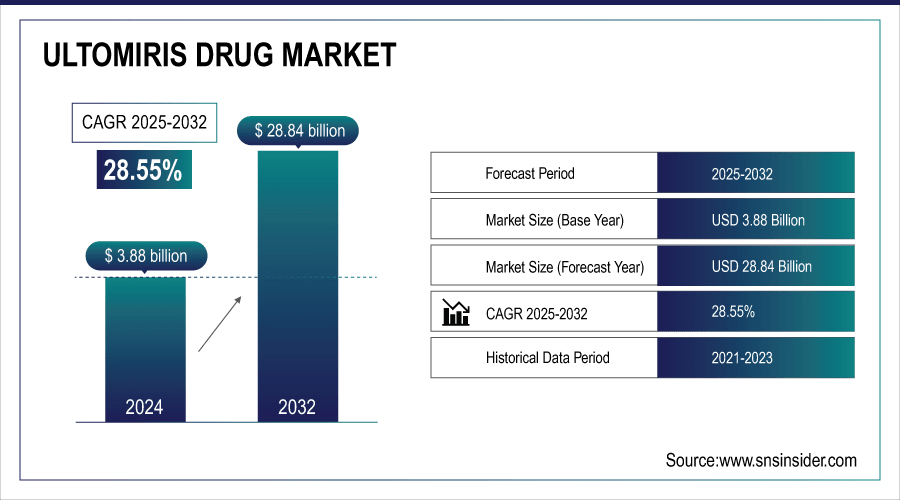

The Global Ultomiris Drug Market size was valued at USD 3.88 billion in 2024 and is expected to reach USD 28.84 billion by 2032, growing at a CAGR of 28.55% over the forecast period of 2025-2032.

One of the key reasons behind the rapid growth of the ultomiris drug market is its significant dosing advantage over Soliris, its predecessor. Ultomiris is designed as a long-acting C5 complement inhibitor that requires infusions only once every eight weeks, whereas Soliris must be administered every two weeks indefinitely. This extended dosing interval offers substantial benefits for both patients and healthcare providers. For patients, fewer infusions mean improved convenience, reduced travel and hospital visits, and better overall quality of life. This leads to higher treatment adherence and satisfaction, especially for those with chronic, lifelong conditions, including PNH and AHA.

For instance, Alexion (AstraZeneca) reported in its Q4 2023 earnings that over 85% of PNH and aHUS patients in the U.S. who were previously on Soliris have now transitioned to Ultomiris.

From a healthcare system perspective, the reduced infusion frequency lowers administrative and operational costs, such as staff time, facility usage, and infusion-related expenses. As a result, Ultomiris is often the preferred treatment option for physicians and payers. Furthermore, the manufacturer, Alexion Pharmaceuticals (a part of AstraZeneca), has actively promoted the conversion of patients from Soliris to Ultomiris, accelerating its adoption globally.

For instance, May 15, 2024- The percentage of employees in the general U.S. workforce whose drug test showed signs of tampering increased by more than sixfold in 2023 versus the prior year, the highest rate ever in more than 30 years of annual reporting.

To Get More Information On Ultomiris Drug Market - Request Free Sample Report

Market Size and Forecast:

-

Market Size in 2024: USD 3.88 Billion

-

Market Size by 2032: USD 28.84 Billion

-

CAGR: 28.55% from 2025 to 2032

-

Base Year: 2024

-

Forecast Period: 2025–2032

-

Historical Data: 2021–2023

Ultomiris Drug Market Trends

-

Clinical advancements and therapy diversification by researchers strengthen Ultomiris adoption and patient trust.

-

Digital platforms and healthcare advocates increase awareness of Ultomiris-based treatments, supporting wider acceptance.

-

Development of novel formulations, delivery mechanisms, and treatment regimens extends applications beyond rare diseases.

-

Strategic alliances, distribution networks, and patient-assistance programs expand reach and treatment availability worldwide.

-

Ongoing studies to improve efficacy, durability, and safety profiles encourage long-term use and therapeutic integration globally.

Ultomiris Drug Market Growth Drivers:

Ultomiris was originally approved by the U.S. FDA in April 2024 as an intravenous infusion for adults with paroxysmal nocturnal hemoglobinuria (PNH) and represents an important step forward in the product’s commercial journey. The WCB approved this subcutaneous (sc) version, rather than the original intravenous (IV) version, for a self-injection format that can be self-administered at home every two months with an on-body injector. This development gives significant advantages to every patient for their lifestyle, independence, and patient choice, especially those living in rural areas and/or those with challenging access to infusion centers. Market-wise, the sc formulation fits with the increasing market migration toward home-based care models in the U.S., spurred by the COVID-19 pandemic. It also relieves the workload of infusion centers and helps reduce the cost of healthcare by eliminating costs for in-clinic administration. Consequently, the U.S. payers, including Medicare and private insurers, are providing growing support for reimbursement of this formulation under both the medical and pharmacy benefits.

For instance, 25 June 2024, Crovalimab, a novel C5 inhibitor, allows for low-volume, every-4-week, subcutaneous self-administration. COMMODORE 1 (NCT04432584) is a phase 3, global, randomized trial evaluating crovalimab versus eculizumab in C5 inhibitor-experienced patients with paroxysmal nocturnal hemoglobinuria (PNH).

Ultomiris Drug Market Restraints:

One of the major factors that restricts the development of the market for the Ultomiris drug is the very high cost of the treatment. Ultomiris, a monoclonal antibody indicated for rare and severe diseases, such as paroxysmal nocturnal hemoglobinuria (PNH), atypical hemolytic uremic syndrome (aHUS), and generalized myasthenia gravis (GMG), is priced at a price of more than USD 500,000 per patient annually in the U.S. This means it is one of the priciest treatments on the planet. While high-income countries having strong insurance systems, such as the U.S., Germany, and Japan can handle those costs using public and private reimbursement schemes, many developing and middle-income nations cannot. Even in developed countries, healthcare payers and government agencies are becoming more cautious about spending on ultra-high-cost therapies. This is especially true as even more high-priced drugs enter the market as healthcare budgets tighten up.

For instance, according to GaBI, Biosimilar medicines offer an effective and economical alternative to biotechnological medicines, with a rapidly expanding global market. However, Latin America still faces several significant challenges.

Ultomiris Drug Market Segmentation Analysis

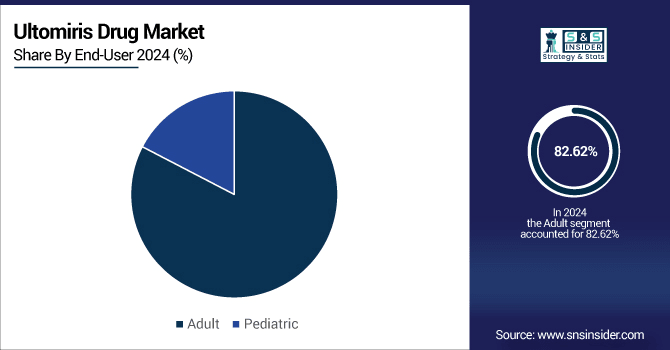

By End-user

The adult segment dominates the Ultomiris drug market owing to a greater level of disease awareness and a better diagnostic rate for adults compared with children. Diseases, including Paroxysmal Nocturnal Hemoglobinuria (PNH), Atypical Hemolytic Uremic Syndrome (aHUS), and Generalized Myasthenia Gravis (gMG) are much easier to identify in disproportionate populations owing to the severity of symptoms and access to healthcare services away from home. Children may suffer or present symptoms associated with these diseases, but they do not seek treatment at the same rate as adults. Adults are more likely to seek treatment after the onset of symptoms, or are more likely to receive annual exams from hematologists, nephrologists, or neurologists - the specialists who diagnose and write for ultomiris.

In the ultomiris drug market growth, the pediatric segment plays a vital role, registering the fastest-growing CAGR of 29.01% during the forecast period. because of recent regulatory approvals, extension of treatment indications, and a high medical need for efficacious treatments in children with life-threatening complement-mediated diseases. Ultomiris was initially approved for adults only, and recently received approval to use the drug in pediatric patients with certain indications like PNH and aHUS in the U.S., Europe, and Japan. These approvals are quickly unlocking a patient base that had not been reached before. One of the key drivers for this expansion is the absence of safe and long-acting therapies for children suffering from these rare conditions. It’s also likely to have meaningful clinical benefits for pediatric care, particularly its longer interval between doses, as compared with other treatments, including Soliris, thereby easing treatment burden for those young patients and their caregivers.

By Indication

Paroxysmal nocturnal hemoglobinuria (PNH) was the dominant segment in the Ultomiris drug market analysis, with a 49.54% market share in 2024. AS it is the drug’s first and most established use case, supported by compelling clinical data, early regulatory approval, and broad global use. Ultomiris was purpose-built as a longer-acting follow-on to Soliris, the recommended treatment for PNH prior to 2018, and received its first-ever FDA approval for the treatment of PNH. It was ahead of many indications in terms of market penetration with this early access. Ultomiris appears to be at least as effective, if not more so, than Soliris in the clinical suppression of intravascular haemolysis and avoidance of blood transfusion. Its less frequent dosing (8-weekly) clearly enhances patient QoL compliance to treatment.

Generalized myasthenia gravis (GMG) plays a very important role in the Ultomiris drug market growth as it is the fastest-growing segment with a CAGR of 29.36%. As a result of the larger patient population, high unmet medical need, and positive clinical results of Ultomiris in this population. Globally, gMG is a more common disease than ultra-rare diseases like PNH and aHUS, which makes for a bigger commercial opportunity. Patients with gMG frequently experience long-term, debilitating muscle weakness that significantly affects their quality of life. Conventional treatments such as corticosteroids, immunosuppressive agents, or IVIG are typically only partially efficacious and short-lived, with serious side effects. The growing need for more advanced and targeted biologic therapies that offer improved efficacy and lowered treatment burden. By blocking the activity of the complement C5 protein, Ultomiris works to block one of the pathways at the core of the autoimmune attack in gMG.

By Distribution Channel

In 2024, the hospital pharmacies segment dominated the Ultomiris drug market analysis with a significant market share of 72.20%. Partly due to the complexity in the administration of the drug, cost, and the need for specialist supervision during treatment. Ultomiris is an ultra-rare, highly innovative biologic delivered intravenously (IV), usually under the supervision of healthcare professionals in a hospital or clinic. For this reason, most doses are administered in an inpatient or outpatient hospital setting, where monitored, trained healthcare providers can look for possible side effects, manage infusion reactions, and verify dose delivery. Hospitals also typically are more likely to have the specialists who treat rare diseases such as PNH, aHUS, and gMG, including hematologists, nephrologists, and neurologists, who prescribe and manage Ultomiris.

The online pharmacies segment is the fastest-growing in the Ultomiris drug market trend. One of the unique aspects related to the exceptionally rapid growth of the Ultomiris market is the fact that Ultomiris was specifically designed as a next-generation version of Soliris, a blockbuster product that had been used for life-threatening rare diseases, such as paroxysmal nocturnal hemoglobinuria (PNH) and atypical hemolytic uremic syndrome (aHUS). Soliris is an extremely effective treatment option; however, one of the drawbacks of using Soliris is that it is infusion-based, and this treatment requires infusions every 2 weeks, which is a very burdensome process for patients and hospitals alike. Ultomiris provides an entirely different paradigm with one infusion every 8 weeks, with a longer half-life. Ultomiris provides much more convenience, far fewer trips to the hospital, lower administration costs, and equal or better clinical efficacy.

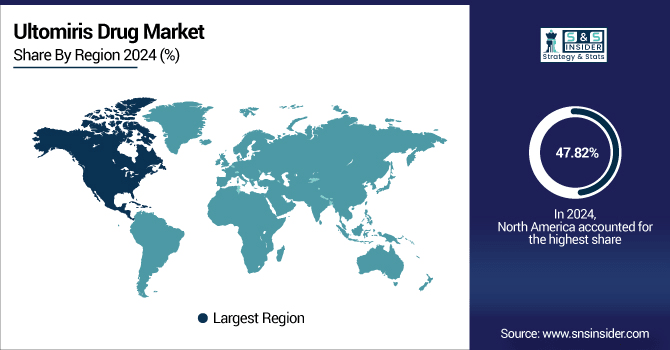

Ultomiris Drug Market Regional Analysis:

North America Ultomiris Drug Market Insights

In 2024, the North American region dominated the ultomiris drug market and accounted for 47.82% of the overall revenue share owing to a combination of early regulatory approvals, high disease awareness, robust reimbursement systems, and large treated patient populations. Ultomiris received early FDA approval in the U.S. for multiple indications, including paroxysmal nocturnal hemoglobinuria (PNH), atypical hemolytic uremic syndrome (aHUS), and generalized myasthenia gravis (GMG), allowing the U.S. market to get a leg up on adoption and commercialization. The North American region also enjoys a well-established infrastructure enabling the diagnosis and treatment of rare diseases, where an overall supportive rare disease landscape helps facilitate faster and broader uptake of the drug via access to specialist care, educational centers, and patient registries.

Get Customized Report as Per Your Business Requirement - Enquiry Now

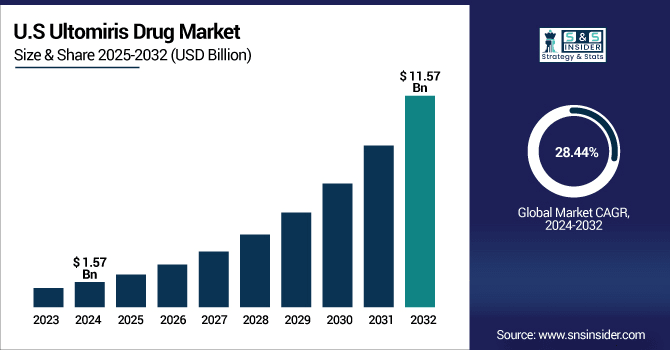

U.S. Ultomiris Drug Market Insights

The U.S. Ultomiris drug market was valued at USD 1.57 billion in 2024 and is expected to reach USD 11.57 billion by 2032, growing at a CAGR of 28.44% over 2025-2032.

One of the most critical factors driving the dominance of Ultomiris in the U.S. market is its strong reimbursement framework. Ultomiris is a very high-cost, orphan-designated biologic, and the U.S. healthcare systems have well-established mechanisms to support the coverage of such drugs. It is reimbursed under major public health programs such as Medicare and Medicaid, as well as by private insurance companies, making it widely accessible to eligible patients despite its high price point

In addition, the healthcare landscape in the U.S. embraces robust reimbursement mechanisms in the public program space and through private insurers, facilitating access to high-cost biologics, including Ultomiris. Ultomiris's orphan status allows it to enjoy market exclusivity, which supports pricing well above traditional drugs, especially in a tertiary/mature pharmaceutical market, such as the U.S. North america also has a large, and growing, confirmed number of patients, with disorders including pnh, ahus, and gmg, which drives further demand.

Europe Ultomiris Drug Market Insights

Europe accounts for a significant proportion of the Ultomiris drug market in light of the early adoption of ultomiris, well-established rare disease infrastructure, and regulatory and reimbursement processes in the major markets, including Germany, France, the U.K., Italy, and Spain. The European Medicines Agency (EMA) approved Ultomiris soon after its U.S. launch, allowing Ultomiris timely access to market across the continent with various indications for paroxysmal nocturnal hemoglobinuria (PNH), atypical hemolytic uremic syndrome (aHUS), and generalized myasthenia gravis (GMG). European countries have established and operable orphan drug policies that provide incentives, such as market exclusivity, expedited approvals, and pricing support. Ultomiris benefits from these policies and can be included in each country's national formularies and be reimbursed by Universal healthcare systems (the NHS [U.K.], Sécu [France], and GKV [Germany]). Universal healthcare systems extend patient access to Ultomiris while providing a stable, high-value market for specialty biologics, such as Ultomiris.

Asia-Pacific Ultomiris Drug Market Insights

The Asia Pacific region is projected to grow with the fastest CAGR of 29.58% over the forecast period. Due to new regulatory approvals, the increased awareness of patients, healthcare spending is increasing, and access to therapies for rare diseases is improving. Ultomiris has approved multiple indications including PNH, aHUS, and gMG, in countries such as Japan, South Korea, Australia, and China, taking advantage of previously unmet and underserved patient populations.

The Asia-Pacific region is also seeing increasing awareness and diagnosis of rare diseases across the region through government-led health initiatives, wider genetic and immunologic screening, and specialty treatment centers. Due to improving health-care infrastructure in countries in the region, especially Japan, Australia, and Singapore, biologics are being more frequently and effectively utilized. Many public insurance programs have also begun to cover high-cost orphan drugs, providing better access for patients. Furthermore, the rising middle class and private health care in the Asia-Pacific region seem to create an appetite for innovative treatments including Ultomiris.

Latin America (LATAM) and Middle East & Africa (MEA) Ultomiris Drug Market Insights

The Middle East & Africa (MEA) region captures only 4.30% of the global Ultomiris market primarily due to limited access, a less developed rare disease infrastructure, and economic and regulatory constraints. Although the MEA region has made measured improvements with regard to healthcare, there remains exceptionally limited access to high-cost orphan drugs, such as Ultomiris in many countries and very limited access for low- and middle-income regions in Africa. The absence of supporting rare disease programs or diagnostic assessments represents another major underlying factor.

In other words, PNH, aHUS, and gMG are underdiagnosed and/or misdiagnosed due to a lack of trained medical specialists, a lack of awareness, and a lack of genetic or immunologic screening in public health systems. Similarly, a unified regulatory structure for rare diseases is simply less developed in several countries in the MEA than in the U.S. or EU, thus resulting in unclear regulatory pathways for universal recognition, approval, registration, and commercialization pathways for Ultomiris and other therapeutic options. In the pricing and reimbursement environment we currently see in MEA, there are just a few high-income countries in the Gulf region (Saudi Arabia, UAE, and Qatar) that have started approving and adopting Ultomiris, most commonly through special private health care channels or specialised tertiary hospitals.

The Latin America region experiences slow growth in the Ultomiris drug market due to systemic challenges in healthcare access, regulation, and infrastructure. First, the cost of Ultomiris is high, often exceeding USD 500,000 per patient per year. Ultomiris is largely unaffordable for public healthcare systems across the region. Reimbursement is either severely restricted or delayed, and private insurance is limited to a fraction of the population. Furthermore, regulatory approvals are often delayed in countries such as Brazil and Mexico, often taking longer than in North America or Europe which delays drug availability. Once approved, bureaucratic negotiations for pricing and formulary listing further slowed utilization.

Ultomiris Drug Market Key Players:

Some of the Ultomiris Drug Market Companies are:

-

AstraZeneca plc

-

Alexion Pharmaceuticals, Inc.

-

Roche Holding AG

-

Novartis AG

-

Pfizer Inc.

-

Amgen Inc.

-

Regeneron Pharmaceuticals, Inc.

-

Johnson & Johnson

-

Biogen Inc.

-

Horizon Therapeutics

-

Xencor, Inc.

-

Chugai Pharmaceutical

-

Argenx

-

Apellis Pharmaceuticals

-

Sanofi S.A.

-

Takeda Pharmaceutical Company Limited

-

Incyte

-

Vertex Pharmaceuticals

-

Eli Lilly and Company

-

Merck & Co., Inc.

Ultomiris Drug Market Competitive Landscape:

-

On 14 June 2025, in initial results from the late-stage ALXN1210-TMA-314 study, Ultomiris (ravulizumab) helped pediatric patients with thrombotic microangiopathy (TMA) after hematopoietic stem cell transplantation (HSCT) achieve an overall survival rate of 87.2% at the trial's 26-week mark, AZ

AstraZeneca, founded in 1999 through the merger of Sweden’s Astra AB and the UK’s Zeneca Group, is a global biopharmaceutical company headquartered in Cambridge, UK. The company is a leader in oncology, cardiovascular, renal, respiratory, immunology, and rare diseases, advancing innovative therapies through cutting-edge research, strategic partnerships, and biologics development.

-

Article by Emily Kimber,18th June 2025,AstraZeneca (AZ) has announced promising results from a late-stage study of its C5 complement inhibitor Ultomiris (ravulizumab) in paediatric patients with a life-threatening post-transplant complication.

| Report Attributes | Details |

|---|---|

| Market Size in 2024 | USD 3.88 billion |

| Market Size by 2032 | USD 28.84 billion |

| CAGR | CAGR of 28.55% From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Indication (Paroxysmal Nocturnal Hemoglobinuria (PNH),Atypical Hemolytic Uremic Syndrome (aHUS),Generalized Myasthenia Gravis (gMG),Neuromyelitis Optica Spectrum Disorder (NMOSD)) • By Distribution Channel (Hospital Pharmacies, Retail Pharmacies, Online Pharmacies) • By End-User(Adult,Pediatric) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, Poland, Turkey, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Rest of Latin America) |

| Company Profiles | AstraZeneca plc, Alexion Pharmaceuticals, Inc, Roche Holding AG, Novartis AG, Pfizer Inc., Amgen Inc., Regeneron Pharmaceuticals, Inc., Johnson & Johnson, Biogen Inc., Horizon Therapeutics, and other players. |