Dental X-ray Market Size Analysis

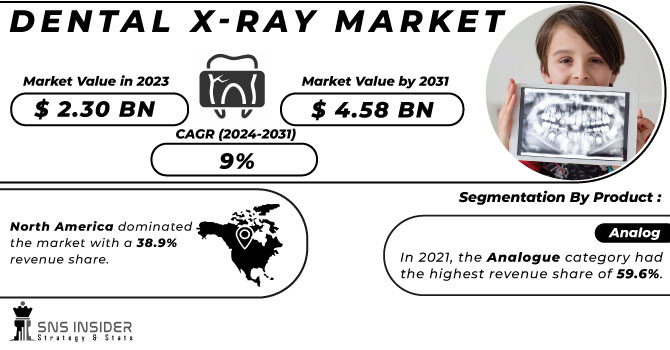

The Dental X-ray Market size was valued at USD 2.9 billion in 2023 and is expected to reach USD 5.9 billion by 2032, growing at a CAGR of 8.4% over the forecast period 2024-2032.

Get more information on Dental X-Ray Market - Request Sample Report

Rising number of oral diseases across the globe and government support to reduce dental care accessibility are driving the market for dental X-ray across the world. An approximately 3.5 billion people across the globe suffer oral diseases, and 75% of this burden is carried by people in low-and middle-income countries (LMICs), according to the World Health Organization (WHO). As a response, governments are developing policies and funding to include oral health. As more than 40% of the adults aged 30 and above shows some signs of periodontal disease according to report the U.S. Centers for Disease Control and Prevention (CDC), this factor further accelerates the demand for early diagnostic tools. Rising dental imaging demand and favorable government initiatives promoting oral health.

Different governments particularly in North America and Europe have started policies to increase services to early services dental health to counter this problem. For example, in 2024, USD 1.2 billion was dedicated by the U.S. government to the Department of Health and Human Services specifically for oral health programs, highlighting the significance of dental care accessibility.

Dental radiographs play an important role in examining a variety of dental problems, such as cavities, infections, and structural abnormalities. In addition to these initiatives, regulations have also been passed by governments for newer and modern diagnostic imaging technologies currently available, with dental X-rays being made more widely available in both medical and dental practices. Recently, the government of India infused paramount importance to dental health with the implementation of a new program namely the "National Oral Health Program" to mitigate the burden of dental/oral diseases in rural populace. This is a government program that hopes to provide access to dental care and diagnostic services, such as dental X-rays, for more people, particularly those who may have, until now, been unable to access services. Moreover, rising concern and awareness regarding dental health is bolstering demand for dental X-ray systems for preventive care, which is a part of global government initiatives focused on minimizing healthcare costs and enhancing wellness in general. Advancement in technology like digital X-ray further strengthens this trend by providing better and quicker results than analog systems.

Dental X-ray Market Dynamics

Drivers

-

Increased awareness of the importance of oral health is driving demand for dental X-rays. Regular check-ups with X-ray examinations are becoming standard practice.

The advancements in sensor material, software, image processing techniques, digital radiography, and wireless systems have accelerated the growth of the dental X-ray equipment market. One of the most significant of these advances in recent years has been the advent of digital radiography, wherein digital sensors take the place of film. Advantages include quicker processing of images, less radiation exposure, and electronic storage and immediate sharing of images, which enhances the efficiency of dental practices. Digital X-ray technology offers patients up to 80% lower radiation exposure than traditional X-ray methods, according to the American Dental Association. This reduction is important to ensure that patients may most effectively be protected from radiation, a concern that may be growing further. Also, the digital image can be improved to be clearer, thus helping with a more accurate diagnosis.

Another significant innovation that is transforming dental imaging. These devices are especially beneficial for dental practices with limited space or mobile clinics. Annual growth in the handheld X-ray device market has been between 10–12%, owing to the ease and flexibility it provides to the dentists, who offer their services in private clinics, remote or distant areas. In addition, technological innovations such as 3D Cone Beam Computed Tomography (CBCT) have improved diagnostic features. This gives high-scale 3D images and is an essential requirement for accurate planning in various procedures including implants and orthodontics. Recent studies show that CBCT usage in dental practices has increased by 15% in the last two years, reflecting its growing role in complex dental diagnostics.

-

Innovations like portable and handheld dental X-ray devices make imaging more accessible. These advancements enhance mobility and usability in dental practices.

Restraints

-

The high initial cost of dental X-ray equipment and its maintenance can be prohibitive. This affects affordability, especially in resource-limited settings.

Major restriction of dental X-ray market is high cost of dental X-ray devices. More Information The adoption of state-of-the-art imaging systems, such as digital X-rays or Cone Beam Computed Tomography (CBCT) machines, entails considerable financial hurdles for both small and large dental practices alike. The American Dental Association reported that digital X-ray systems can run between USD 6,000 and USD 12,000 a unit and that many CBCT machines can run over USD 100,000. Also, maintenance, software updates, and imaging system integration contribute to the overall spending. Budget-headed small dental practices who belong to developing regions may be particularly affected by these costs. Additionally, one research from The National Center for Biotechnology Information (NCBI) states that despite its advantages, device implementation has been slow due to its high up-front costs. Therefore, cost is still the greatest impediment to widespread market penetration and penetration in competitive cost environments.

-

Ionizing radiation exposure raises health and safety concerns. Regulatory guidelines to ensure radiation safety may restrict equipment usage.

Dental X-ray Market Segmentation Insights

By Product

The analog segment held the largest revenue share of 58% in 2023, driving the market due to the cost-effective and well-developed infrastructure specifically in the developing regions. However, the governments of countries such as India and Brazil have to maintain balance between reasonable price and sound diagnosis, so in terms of public health program still analog system of choice. For instance, India’s Ministry of Health stated that 65% of the dental clinics in rural areas rely on analog X-rays because the maintenance cost is lower, and analog X-ray machines can be used without any alteration to the existing workflow. But high-resolution images need several exposures, which makes their adoption slower in the more advanced markets because they are still analog systems.

By Type

Intraoral held the largest revenue share in 2023, owing to its high usage in routine diagnostics. The use of intraoral X-rays is consistent with preventive care mandates that require accurate cavity, root infection, and bone loss diagnosis. According to the American Dental Association (ADA), intraoral imaging is used by 90% of U.S. dental practices as a first-line diagnostic tool. The demand for dental services is supported by government campaigns, such as the “CheckUp” initiative, which subsidises preventive dental visits in Australia. In 2024, the U.K. National Health Service (NHS) reported a 22% increase in intraoral imaging referrals for pediatric patients, emphasizing early intervention in public health strategies.

By Application

In 2023, the medical segment accounted for the largest share of this market since dental X-rays are essential for the diagnosis of diseases such as caries, abscesses, and oral cancers. With 27% of U.S. adults suffering from untreated dental caries, the need for imaging to plan effective treatment has been identified in the CDC's 2024 Oral Health Surveillance Report. Japan has also announced a yearly increase of 15% in oral cancer screenings, with X-rays being an essential step in the early identification, as permanent damage develops within the lesions. The segment is also backed by government-funded initiatives, including Brazil's 'Smiling Brazil' program that gave more than 2.3 million dental X-rays in 2023.

Dental X-ray Market Regional Outlook

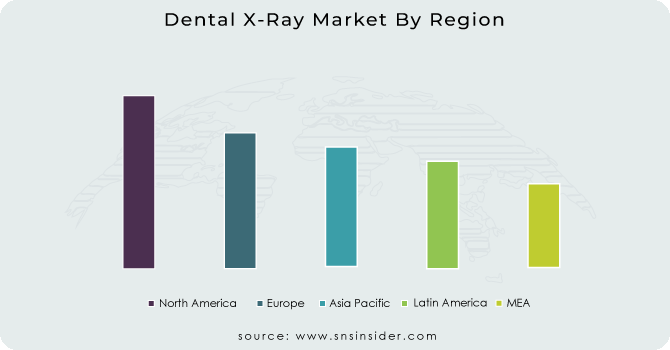

North America accounted for the largest share of the market 38% in 2023 owing to strong health care infrastructure and widespread adoption of digital technologies. In 2024, the U.S. Medicare system reimbursed over 12 million dental imaging cases, demonstrating solid institutional support. According to the U.S. Centers for Medicare & Medicaid Services (CMS), healthcare expenditure in the U.S. reached over USD 4.3 trillion in 2023, with a significant portion allocated to dental health. The growing government focus on preventive care and early detection of dental disease also supported the market for dental X-rays. The other factor is the well-developed healthcare systems in North American countries where a high degree of adoption of advanced dental imaging technologies including digital X-rays.

On the other hand, the Asia pacific region is growing with fastest compound annual growth rate (CAGR) dental X-ray market over the forecasted years. According to the World Bank, dental care is becoming a priority in countries such as China and India, where the governments have been implementing initiatives to increase access to dental services. Factors such as the expansion of urban areas, increasing middle class population and government policies regarding healthcare access in the Asia Pacific region are some of the factors that will drive dental X-ray market growth. The growing focus of government programs including the National Oral Health Program in India to facilitate dental services to rural and underserved populations is likely to bring about adoption of cost-effective dental X-ray systems. With an increasing healthcare need, governments in this region are investing in both analog as well as digital technologies.

Need any customization research on Dental X-Ray Market - Enquiry Now

Key Players in the Dental X-ray Market

Key Service Providers/Manufacturers

-

Carestream Health (Carestream Dental X-ray, CS 9300)

-

Dentsply Sirona (XIOS XG Supreme, Sirona Orthophos SL)

-

Planmeca OY (Planmeca ProMax 3D, Planmeca ProX)

-

Vatech (PaX-i3D Green, EzSensor Classic)

-

Konica Minolta (AeroDR X-ray, ImagePilot)

-

GE Healthcare (Horizon Intraoral, Definium 8000)

-

Shimadzu Corporation (TruSystem, X-ray Imaging System)

-

Hitachi (Airis Vento, Regius Nano)

-

Sirona (XG3, XIOS XG)

-

XDR Radiology (XDR 2000, XDR HD)

Key Users

-

Aspen Dental

-

Smile Direct Club

-

Pacific Dental Services

-

Heartland Dental

-

Western Dental

-

Aspen Dental Management, Inc.

-

Castle Dental

-

Midwest Dental

-

North American Dental Group

-

Affordable Dentures & Implants

Recent Developments in the Dental X-ray Market

-

BIOLASE, Inc., the global leader in dental laser technology, recently in February 2024 announced its next generation all-tissue laser system, the Waterlase iPlus Premier Edition. An adjunct to the well-established Waterlase iPlus, this newest innovation raises the bar for creating precise dental work.

-

In September 2023, Align Technology, Inc., the global medical device company that designs and manufactures the Invisalign system of clear aligners, iTero intraoral scanners, and exocad CAD/CAM software for digital orthodontics and restorative dentistry, has announced new software advancements to drive digital practice transformation.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 2.9 Billion |

| Market Size by 2032 | USD 5.9 Billion |

| CAGR | CAGR of 8.4% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (Intraoral, Extraoral) • By Product (Digital, Analog) • By Application (Medical, Cosmetic Dentistry, Forensic) • By End-User (Dental Hospitals & Clinics, Dental Diagnostic Centers, Dental Academic & Research Institutes) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Carestream Health, Dentsply Sirona, Planmeca, Vatech, Konica Minolta, GE Healthcare, Shimadzu Corporation, Hitachi, Sirona, XDR Radiology. |

| Key Drivers | • Increased awareness of the importance of oral health is driving demand for dental X-rays. Regular check-ups with X-ray examinations are becoming standard practice. |

| Restraints | • The high initial cost of dental X-ray equipment and its maintenance can be prohibitive. This affects affordability, especially in resource-limited settings. |