USB Devices Market Size and Overview:

USB Devices Market Size was valued at USD 39.42 billion in 2025E and is expected to reach USD 87.76 billion by 2033 and grow at a CAGR of 10.52 % by 2033.

The USB devices market has seen consistent growth due to rising needs for effective data transfer and power supply solutions in various sectors. The USB technology has advanced greatly since it was first introduced, moving through different versions like USB 1.0 all the way to the most recent USB4. This development has led to increased data transfer speeds, enhanced power delivery capabilities, and greater compatibility among devices, encouraging widespread usage. The market consists of a variety of USB-compatible devices like flash drives, external hard drives, keyboards, mice, printers, cameras, and smartphones. The market has been strengthened by the growing dependence on external storage options like USB flash drives and external SSDs, which provide quick, trustworthy data storage and easy portability.

Market Size and Forecast: 2025E

-

Market Size in 2025E USD 39.42 Billion

-

Market Size by 2033 USD 87.76 Billion

-

CAGR of 10.52% From 2026 to 2033

-

Base Year 2025E

-

Forecast Period 2026-2033

-

Historical Data 2021-2024

Get more information on USB Devices Market - Request Sample Report

USB Devices Market Trends:

-

Increasing adoption of USB Type-C and USB4 interfaces to support faster data transfer and higher power delivery in consumer electronics.

-

Rising demand for high-capacity and high-speed USB storage devices to manage growing volumes of digital content.

-

Growing integration of USB connectivity across smartphones, laptops, smart TVs, wearables, and smart home devices.

-

Expansion of multi-functional USB devices combining data storage, charging, and connectivity features.

-

Continuous product innovation by manufacturers to enhance durability, security, and compatibility with evolving consumer electronics ecosystems.

The U.S. USB devices market with USD 12.6 billion in 2025E is driven by high consumer electronics adoption, widespread internet penetration, and continuous technology upgrades. Strong demand for smartphones, laptops, gaming systems, and smart home devices supports steady growth. Rapid transition toward USB Type-C and USB4 standards, along with increasing need for high-speed data transfer and charging solutions, further accelerates market expansion across consumer and enterprise segments.

USB Devices Market Growth Drivers:

-

Rising Demand for Consumer Electronics Fuels Growth in the USB Devices Market

The surge in consumer electronics usage is playing a pivotal role in driving the expansion of the USB devices market, with devices like smartphones, tablets, and digital cameras becoming essential parts of everyday life. USB devices, commonly known as USB sticks or keys, provide a seamless interface for data storage and transfer across a wide array of devices. From webcams and memory card readers to digital audio players, USB technology offers connectivity solutions that are indispensable in modern consumer electronics. The global rise in demand for these electronics is particularly evident as more people across all age groups adopt mobile devices, smart TVs, and laptops, creating a fertile ground for the USB devices market to thrive. As consumer electronics technologies rapidly evolve, the need for efficient data transfer solutions, such as USB devices, becomes increasingly critical. According to a Pew Research Center survey conducted from May to September 2023, 95% of U.S. adults now use the internet, 90% own a smartphone, and 80% subscribe to high-speed internet at home. This digital penetration underscores the critical role of USB devices as a primary method of exchanging data between end devices like laptops, PCs, and digital cameras.

USB Devices Market Restraints:

-

Increasing security concerns are limiting the growth of the global USB devices market.

As the USB devices Market grows, increasing security concerns pose a major obstacle to its expansion. Despite being appreciated for their mobility, cost-effectiveness, and ease of data transfer, USB devices are attractive to cyber attackers due to these very characteristics. Malware infections pose a high risk because attackers can exploit vulnerabilities with malicious USB drives that activate upon connection to a computer, potentially compromising sensitive data. According to a report from the Cybersecurity and Infrastructure Security Agency (CISA), malware can quickly spread via USB devices, resulting in extensive data breaches and critical information loss. Additionally, attackers can utilize USB devices to extract data from computers, presenting a significant security threat to individuals and organizations alike. The concerns are further heightened by the risks of misplacing or losing USB drives, which can inadvertently lead to the exposure of confidential information.

USB Devices Market Segment Analysis:

By Type

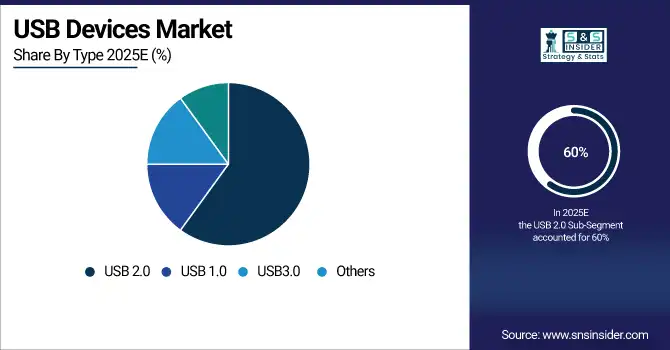

In the USB devices market, USB 2.0 captured a significant 60% revenue share in 2025E, cementing its status as the dominant technology for data transfer and connectivity. This widespread adoption can be attributed to USB 2.0's robust performance, compatibility with a vast range of devices, and cost-effectiveness, making it ideal for consumer electronics, peripherals, and automotive Product Types. Many manufacturers continue to leverage USB 2.0 technology in products due to its established reliability and support across various platforms, ensuring seamless integration with older and newer devices alike.

By Application

In 2025E, Consumer Electronics dominated the USB devices market, accounting for a substantial 39% revenue share, underscoring the critical role that USB technology plays in modern electronic devices. This category encompasses a wide range of products, including smartphones, laptops, tablets, and gaming consoles, all of which rely heavily on USB interfaces for charging and data transfer. Major companies have responded to this demand with innovative product launches; for instance, Apple introduced its latest line of iPhones equipped with advanced USB-C ports, enhancing charging speeds and compatibility with various accessories. Similarly, Samsung unveiled its new Galaxy series smartphones, emphasizing USB connectivity for faster data transfers and synchronizing.

USB Devices Market Regional Analysis:

Asia Pacific USB Devices Market Insights

In 2025E, the Asia-Pacific region captured the largest revenue share in the USB devices market, accounting for 40% of the total market, driven by robust consumer electronics demand, rapid technological advancements, and a growing middle class. Countries like China, Japan, South Korea, and India are at the forefront of this growth, with their substantial investments in research and development fostering innovation in USB technologies.China, as a global manufacturing hub, continues to lead the charge in USB devices production. Notably, companies such as Huawei and Xiaomi have introduced devices equipped with advanced USB-C technology, promoting faster data transfer and charging capabilities. Huawei's latest smartphones integrate USB-C connectors, enhancing compatibility with a wide range of accessories.In Japan, tech giants like Sony and Panasonic are also developing high-performance USB devices.

Get Customized Report as per your Business Requirement - Request For Customized Report

North America USB Devices Market Insights

In 2025E, North America emerged as the second fastest-growing region in the USB devices market, fueled by advancements in technology, increasing demand for consumer electronics, and a focus on innovation. The United States and Canada lead the charge, with major companies like Apple, Microsoft, and SanDisk launching new USB products tailored for both consumer and enterprise Product Types. Apple introduced updated USB-C accessories for its latest MacBook lineup, enhancing data transfer speeds and compatibility with a wider range of devices, while Microsoft launched a series of USB hubs aimed at improving connectivity for remote work setups, acknowledging the growing trend of hybrid working environments.

Europe USB Devices Market Insights

The European USB devices market is driven by high adoption of consumer electronics, laptops, and smart devices, alongside robust digital infrastructure. Rapid transition to USB Type-C and USB4 standards, increasing demand for high-speed data transfer, and strong e-commerce and retail distribution channels support market growth in countries like Germany, the U.K., and France.

Latin America (LATAM) and Middle East & Africa (MEA) USB Devices Market Insights

The LATAM and MEA USB devices market is growing steadily due to rising smartphone and PC adoption, expanding internet penetration, and increased awareness of digital storage solutions. Emerging markets in Brazil, Mexico, Saudi Arabia, and UAE are driving demand for affordable, high-speed, and multi-functional USB devices, supported by expanding retail networks and government digital connectivity initiatives.

USB Devices Market Key Players:

-

Corsair Memory (Corsair Flash Voyager GTX, Corsair Survivor Stealth)

-

Sandisk Corporation (SanDisk Ultra Flair USB 3.0 Flash Drive, SanDisk Extreme Pro USB 3.2 Solid State Flash Drive)

-

Toshiba Corporation (Toshiba TransMemory USB Flash Drive, Toshiba Canvio Basics Portable Hard Drive)

-

Micron Consumer Products Group (Micron 5100 Series SSD, Micron 1100 Series SSD)

-

Transcend Information (Transcend JetFlash 790, Transcend StoreJet 25M3)

-

Adata Technology (Adata UV350 USB Flash Drive, Adata DashDrive Elite HE720)

-

Kingston Technology Corporation (Kingston DataTraveler 100 G3, Kingston IronKey D300)

-

Samsung Electronics (Samsung Bar Plus USB 3.1 Flash Drive, Samsung Portable SSD T7)

-

Verbatim Americas (Verbatim Store 'n' Go USB Flash Drive, Verbatim V3 USB 3.0 Flash Drive)

-

Intel Corporation (Intel Optane Memory H10 with Solid State Storage, Intel USB 3.0 Flash Drive)

-

Teclast Electronics Co. Ltd. (Teclast USB Flash Drive, Teclast 256GB USB 3.0 Drive)

-

Netac Technology Co Ltd. (Netac N900S USB Flash Drive, Netac USB 3.0 Flash Drive)

-

Zebronics (Zebronics ZEB-Rush USB Flash Drive, Zebronics ZEB-FS100 USB Flash Drive)

-

Imation Corporation (Imation Flash Drive, Imation Secure USB Drive)

Competitive Landscape for USB Devices Market:

Samsung Electronics is a leading player in the USB devices market, offering a wide range of high-speed flash drives, portable SSDs, and storage solutions. Known for innovation, reliability, and advanced technology, Samsung’s products cater to consumers, businesses, and tech enthusiasts, supporting seamless data transfer, enhanced performance, and compatibility across devices, driving strong adoption globally in personal and professional digital ecosystems.

-

August 6, 2024, Samsung Electronics America has introduced new 512GB capacities for its BAR Plus and FIT Plus USB 3.2 Gen1 Flash Drives. These latest drives maintain the sleek designs while offering ample storage for your favorite music, irreplaceable photos and videos, as well as essential work or school documents, ensuring quick data backup and wide devices compatibility.

Legrand is a global leader in electrical and digital building infrastructures, offering innovative connectivity and data management solutions. In the USB devices market, Legrand provides integrated charging ports, data hubs, and smart connectivity products for residential, commercial, and industrial applications, enhancing user convenience, efficiency, and compatibility across devices while supporting the growing demand for seamless digital integration and smart building ecosystems.

-

In June 2024, Legrand | AV's C2G brand introduced a significant new product to their range of Superbooster USB extenders. C2G is introducing seven new models that are compatible with USB devices like high-bandwidth PTZ cameras, solid-state drives, interactive whiteboard printers, and touchscreen displays.

| Report Attributes | Details |

|---|---|

| Market Size in 2025E | USD 39.42 Billion |

| Market Size by 2033 | USD 87.76 Billion |

| CAGR | CAGR of 10.52% From 2026 to 2033 |

| Base Year | 2025E |

| Forecast Period | 2026-2033 |

| Historical Data | 2021-2024 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (USB 1.0, USB 2.0, USB3.0, Others) • By Product (Webcam, Memory Card Readers, Computer Peripherals, USB Flash Drives, Digital Audio Players, Scanners & Printers, Others) • By Connector Type (Type A, Type B, Type C, Lightning Connector) • By Application (Consumer Electronics, Automotive, It & Telecommunication, Healthcare & Medical Devices, Others) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

| Company Profiles | Corsair Memory, Sandisk Corporation, Toshiba Corporation, Micron Consumer Products Group, Transcend Information, Adata Technology, Kingston Technology Corporation, Samsung Electronics, Verbatim Americas, Intel Corporation, Teclast Electronics Co., Ltd., Netac Technology Co., Ltd., Zebronics, Imation Corporation & Others |