Milking Robots Market Size Analysis:

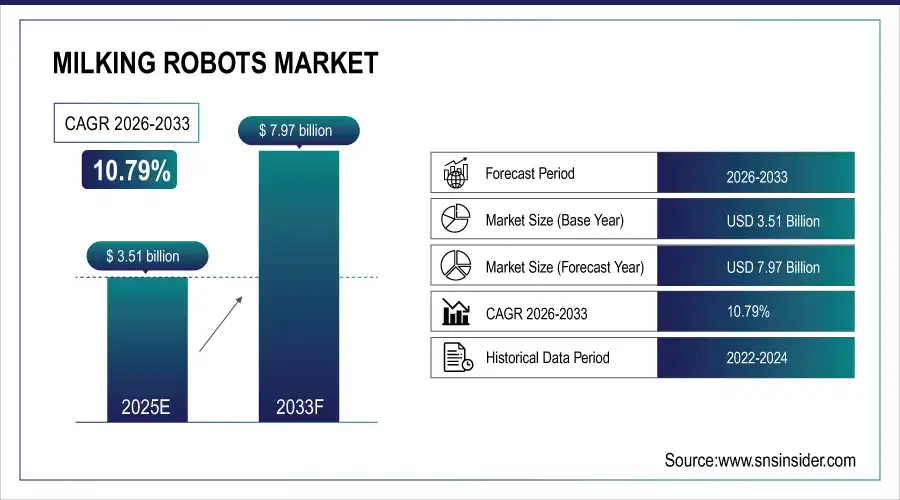

The Milking Robots Market Size was valued at USD 3.51 billion in 2025E. It is estimated to grow to USD 7.97 billion by 2033 and grow at a CAGR of 10.79% over the forecast period of 2026-2033.

The milking robot market is set to experience significant growth, driven by the growing dairy sector according to the USDA’s Dairy Global Market Analysis report. The main reasons for this growth are rising milk output, expanding cheese needs, and lack of workforce. The report predicts that fluid milk production in Australia will rise by 1% in 2024, reaching 8.5 Billion tonnes, mostly because more workers are available and beef cattle prices are falling. Milk production in the United States is anticipated to grow by 1%, while cheese production is projected to rise by 2% to reach 466,000 tonnes, driven by an increase in demand. Processing capacity and higher milk output. The expected increase in cheese production is projected to raise exports by 8% to major markets such as Japan, China, Mexico, South Korea, and the Philippines. In addition, it is expected that the production of skim milk powder will increase by 11% to reach 1.30 Billion tonnes in 2024, while exports are projected to grow by 3% to 838,000 tonnes. These patterns together suggest a growing dairy sector, providing an ideal environment for the implementation of robotic milking devices. As dairy farms grow to keep up with increasing global demand, the importance of effective and automated milking solutions becomes more vital. Milking robots provide various benefits such as better milk quality, improved animal well-being, and reduced labor costs.

Milking Robots Market Size and Forecast:

-

Market Size in 2025E: USD 3.51 Billion

-

Market Size by 2033: USD 7.97 Billion

-

CAGR: 10.79% from 2026 to 2033

-

Base Year: 2025E

-

Forecast Period: 2026–2033

-

Historical Data: 2022–2024

Get more information on Milking Robots Market - Request Free Sample Report

Milking Robots Market Trends Highlights:

-

Industry 4.0 and Dairy 4.0 adoption is driving demand for milking robots by improving operational efficiency, milk quality, and real-time data collection

-

Rising labor costs and shortages make automated milking solutions increasingly attractive for dairy farmers globally

-

Early detection of subclinical mastitis is enabled by milking robots with sensors and data analytics, improving herd health, productivity, and reducing antibiotic usage

-

Economic and policy constraints such as fluctuating milk prices, inflation, input costs, and regulatory requirements hinder investment in milking robots in some regions

-

High initial investment and technology barriers including integration challenges and need for skilled personnel limit adoption, especially for small and medium-sized farms

-

Technological limitations and safety concerns regarding operational efficiency in diverse farm conditions and potential job loss remain obstacles for widespread deployment

The growing worldwide dairy market offers a substantial chance for the milking robot market. The need for effective and automated milking solutions is increasing as annual milk production reached 881 Billion tonnes in 2019 and is expected to grow by just over 2% in 2021. The growing dairy industry, due to population increase, higher incomes, and shifting consumption habits, requires advanced technologies for improved productivity and animal well-being. With rising labor costs and shortages, milking robots are becoming a practical solution for the industry. Additionally, cow's milk production accounts for 81% of the global market with Asia emerging as the top region, indicating a significant potential market for milking robots in this industry. These factors together are responsible for the positive trajectory of growth in the milking robot market.

Milking Robots Market Drivers:

-

Industry 4.0 serves as the main driver for the incorporation of milking robots into the market.

The rise of Dairy 4.0, a part of the larger Industry 4.0 movement, is a key factor in the growing use of milking robots. The dairy products industry is going through a significant change by incorporating technologies like robotics, artificial intelligence, and the Internet of Things. Milking robots, serving as a foundation for this transformation, provide numerous benefits. They boost operational efficiency by automation, enhance milk quality by minimizing human involvement, and facilitate real-time data collection for precision agriculture. In addition, the labor-intensive traditional milking methods, combined with rising labor expenses and deficiencies, create a strong appeal for milking robots. The significant roles played by countries such as China, Australia, the UK, India, and the USA in Industry 4.0 dairy research indicate that milking robots are poised for global adoption due to the advantages provided by Dairy 4.0 technologies.

-

Detecting subclinical mastitis early can accelerate the adoption of milking robots.

The urgent need for effective prevention strategies is emphasized by the estimated €100 opportunity cost per cow, showcasing the substantial economic losses caused by subclinical mastitis. Detecting and intervening early are essential in reducing the effects of this common condition. The research results show that machine learning models have the potential to forecast subclinical mastitis with reasonable accuracy up to 7 days in advance, even when data collection is less frequent, providing a hopeful solution to this issue. Robots that milk cows, which have high-tech sensors and data analysis abilities, are crucial for gathering and evaluating data needed for predictive models. Milking robots can offer beneficial information for early detection and intervention in cow health through continuous monitoring of parameters such as milk yield, composition, and somatic cell count, leading to improved herd health, higher productivity, and decreased antibiotic usage.

Milking Robots Market Restraints:

-

Challenges in economy and policy are hindering the adoption of milking robots.

The dairy sector is encountering a combination of economic hurdles and regulatory demands that present substantial obstacles to implementing milking robots. Decreasing prices for milk at the farm, along with continuous inflation and increasing input expenses, are putting pressure on the profitability of dairy farmers. This decrease in the economy limits the funds for investing in state-of-the-art technologies such as milking robots. Moreover, the decreasing number of dairy cattle in areas such as New Zealand, along with the EU's initiatives to lower nitrogen emissions and promote the slaughter of dairy cows, cause an atmosphere of unpredictability and hinder investments in the long run. The suggested optional payment plan in Ireland may result in fewer herds and farm shutdowns, affecting the market for milking robots. Moreover, the change in product emphasis to premium items such as cheese, observed in areas like New Zealand and the EU, could lead to a preference for investing in equipment for cheese production rather than milking robots in the near future. The challenging landscape caused by these combined factors hinders milking robot manufacturers and the widespread adoption of this technology.

-

High levels of initial investment and challenges with technology serve as obstacles preventing the widespread implementation of automated machinery.

Even though there is a strong demand for automation in agriculture to combat labor shortages and increase efficiency, there are major obstacles preventing widespread implementation. The significant initial expenses of purchasing and installing sophisticated equipment pose a significant challenge for numerous companies, especially small and medium-sized businesses. In addition, incorporating these intricate systems into current processes necessitates specific skills that may be hard to find and costly. Challenges are also presented by technological limitations, including machines' capability to function efficiently in varied and uncertain surroundings. Furthermore, worries about losing jobs and the risk of accidents could cause opposition to automation from both employees and the general public. Conquering these challenges requires significant funding for research and development, along with specific support initiatives to help companies shift to automated processes.

Milking Robots Market Segment Analysis:

By Robotic System Type

Based on Robotic System Type, Multi-Stall Unit dominated the Milking robots with 44% of share in 2025. This prevailing position is projected to persist in the upcoming years because of the increasing worldwide need for milk and dairy products. Multi-stall units are created to carry out the milking process at the same time for numerous cows, which speeds up operational processes and reduces expenses. Small and medium-sized enterprises (SMEs) prefer these units to quickly see a return on investment, lower capital expenses, and improve efficiency. For example, the Lely Astronaut A5 multi-stall system enables the simultaneous milking of several cows, resulting in higher efficiency and ensuring each cow is milked in line with its natural rhythm. This ability not only boosts milk output but also cuts labor expenses and enhances animal well-being. The multi-stall units' design, including automated teat cleaning, real-time milk quality analysis, and data-driven herd management systems, is appealing to dairy farmers seeking to update their operations. Farmers can meet the increasing consumer demand for dairy products and still be profitable by effectively handling more cows with less resources. The increasing capabilities of multi-stall units due to technological advancements are projected to lead to higher adoption rates, establishing them as a top choice in the milking robots market.

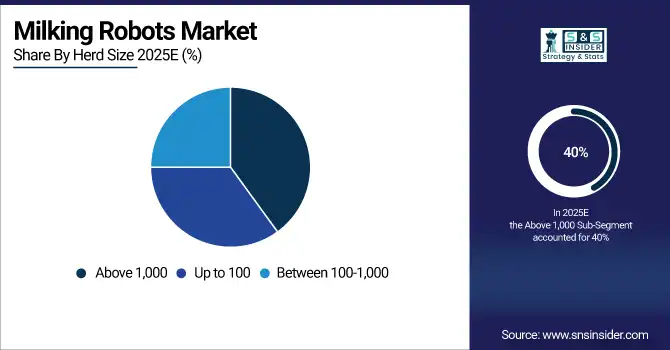

By Herd Size

Based on Herd Size, Above 1,000 dominated the milking robots with 40% of share in 2025. Robotic milking systems offer substantial benefits to large dairy farms, mainly by improving labor productivity and realizing cost reductions. Automating milking helps to minimize the necessity for a large workforce, which is advantageous due to the current shortage of labor on big farms. Using milking robots helps reduce the significant expenses related to recruiting, training, and keeping dependable workers by allowing for consistent milking without much human involvement. This process automation results in significant improvements in operational efficiency and cost savings. In the case of DeLaval, the Voluntary Milking System VMS™ V300 is created for effectively managing big herds, offering instant information and evaluation to enhance milk yield and herd well-being. Big farms gain advantages from these systems since they make the milking process more efficient, guarantee a consistent milk quality, and decrease the physical burden on farm employees. Another prominent illustration is the GEA Dairy Robot R9500, providing cutting-edge functions such as in-line milk analysis and automated teat preparation, meeting the requirements of extensive operations.

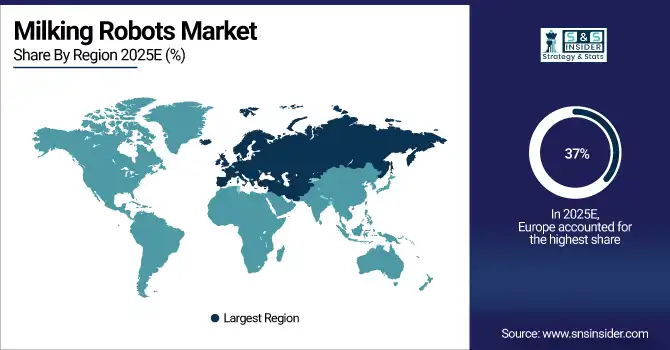

Milking Robots Market Regional Analysis:

Europe Milking Robots Market Trends:

Europe hold the largest market for milking robots with 37% of share in 2025. The widespread use of automation in dairy farms throughout Western Europe has transformed the sector, greatly improving efficiency, productivity, and overall profitability for farmers. The use of milking robots comes with various advantages including higher milk production, better animal care, and lower labor expenses, making them a desirable option for dairy farmers. For example, the Lely Astronaut A5 and DeLaval VMS V300 are two automated milking systems that have gained popularity. The advantages of using milking robots are widely known. As per research conducted by the European Dairy Association, farms that utilize robotic milking systems have seen a rise in milk production of approximately 10-15% and a decrease in labor expenses of about 20-30%. For instance, the high labor costs in Germany have led dairy farmers to implement automated options in order to stay competitive and profitable within the EU. For instance, the Lely Astronaut A5 is created to offer farmers with insight based on data and improve operational efficiencies, resulting in significant labor savings and enhanced herd management.

Need any customization research on Milking Robots Market - Enquiry Now

Asia-Pacific Milking Robots Market Trends:

Asia Pacific is fastest growing segment in milking robots with 29% of share in 2025. The significant expansion is mainly caused by the rising need for dairy items, driven by a growing population and changing dietary habits towards more dairy intake. To keep up with the growing need, dairy farms in the area are more and more using milking robots that make milking easier, cut labor expenses, and increase productivity. The trend towards updating agricultural practices is clear as automated systems are replacing traditional manual milking methods. Technologically advanced milking robots such as the GEA Dairy Robot R9500 and Lely Astronaut A5 improve productivity and ensure better hygiene and animal welfare, which are increasingly important to consumers. In countries such as China and India, the use of milking robots is increasing rapidly as dairy farms expand to keep up with rising consumer needs.

North America Milking Robots Market Trends:

North America is witnessing steady growth in the adoption of milking robots, driven by labor shortages, high labor costs, and the focus on improving farm efficiency. Automated systems like DeLaval VMS V300 and BouMatic VMS are increasingly used. Farms implementing robotic milking report improvements in milk yield, labor savings, and better herd health monitoring. Enhanced milking hygiene and operational efficiency are key benefits motivating further adoption across the U.S. and Canada.

Latin America Milking Robots Market Trends:

Latin America is an emerging market for milking robots, driven by modernization of dairy farms and rising demand for milk and dairy products. Countries like Brazil and Argentina are leading adoption, with farms exploring automation to reduce labor dependency and improve production efficiency. Robotic milking systems such as Lely Astronaut A5 and GEA DairyRobot R9500 help improve milk quality, enhance animal welfare, and streamline operations. The region is gradually embracing smart dairy solutions to increase farm productivity and profitability.

Middle East & Africa Milking Robots Market Trends:

The Middle East & Africa is gradually adopting milking robots due to investments in modern dairy infrastructure and the need for efficient milk production. Countries including UAE, Saudi Arabia, and South Africa are implementing automated systems to reduce reliance on manual labor and enhance milk yields. Milking robots such as DeLaval VMS and Lely Astronaut A5 support better herd management, improved hygiene, and operational efficiency. The region is slowly embracing automation as awareness of technology-driven farming grows.

Top Milking Robots Companies are:

-

DeLaval, Inc.

-

Lely

-

BouMatic

-

Fullwood Ltd.

-

Fullwood Packo

-

Hokofarm Group B.V.

-

Milkwell Milking Systems

-

System Happel

-

SAC (Skandinavisk Alkalisk Cooperative)

-

Milkline S.r.l.

-

Afimilk Ltd.

-

Fancom B.V.

-

Dairymaster USA

-

Waikato Milking Systems

-

VMS (Voluntary Milking Systems – Lely brand segment)

-

AMS Galaxy (BouMatic brand)

-

Nedap N.V.

-

Pearson Milking Technology

Milking Robots Market Competitive Landscape:

DeLaval, Inc. (Established 1883): A global leader in dairy farming solutions, DeLaval develops advanced milking technologies and herd management systems. The company focuses on robotic milking innovations, including VMS Batch Milking, enhancing farm efficiency, reducing labor, and providing actionable cow data to improve productivity, udder health, and operational precision worldwide.

-

In Jan 2024: DeLaval launched VMS Batch Milking, a robotic system that divides herds into groups for efficient large‑scale milking, reducing labor and improving cow data tracking.

GEA Group AG (Established 1881): A global leader in dairy and food processing technology, GEA develops innovative solutions for milking, feeding, and herd management. Its DairyRobot R9500 and automated systems enhance efficiency, hygiene, and productivity on farms, reflecting the company’s commitment to advanced, sustainable, and stress-free dairy farming worldwide.

-

In Nov 2025: GEA introduced its DairyRobot R9500 and automated feeding systems into Farming Simulator 25, showcasing real-world dairy farming technology to a global gaming audience and highlighting innovation in stress-free, hygienic milking and efficient herd management.

| Report Attributes | Details |

|---|---|

| Market Size in 2025E | USD 3.51 Billion |

| Market Size by 2033 | USD 7.97 Billion |

| CAGR | CAGR of 10.79% From 2026 to 2033 |

| Base Year | 2025E |

| Forecast Period | 2026-2033 |

| Historical Data | 2022-2024 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Robotic System Type (Single-Stall Unit, Multi-Stall Unit, and Automated Milking Rotary System) • By Herd Size (Up to 100, Between 100-1,000, and Above 1,000) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

| Company Profiles | GEA Group AG, DeLaval, Inc., Lely, BouMatic, Fullwood Ltd., Fullwood Packo, DAIRYMASTER, Hokofarm Group B.V., Milkwell Milking Systems, System Happel, SAC (Skandinavisk Alkalisk Cooperative), Milkline S.r.l., Afimilk Ltd., Fancom B.V., Dairymaster USA, Waikato Milking Systems, VMS (Voluntary Milking Systems – Lely brand segment), AMS Galaxy (BouMatic brand), Nedap N.V., Pearson Milking Technology. |