Vascular Closure Devices Market Size Analysis:

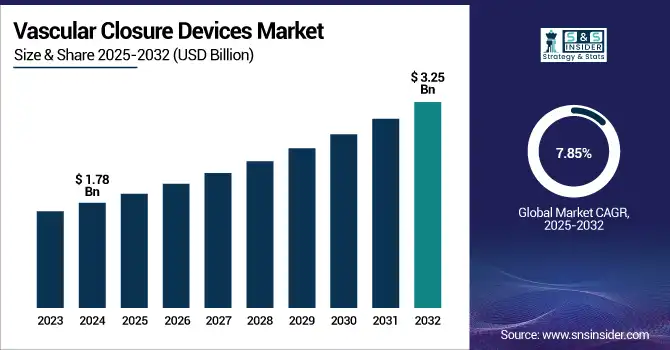

The Vascular Closure Devices Market size was valued at USD 1.78 billion in 2024 and is expected to reach USD 3.25 billion by 2032, growing at a CAGR of 7.85% over 2025-2032.

A robust global vascular closure devices market is on its way, partly due to the increased prevalence of interventional and diagnostic cardiovascular procedures. Considering that there are more than 1,500 PCI-treated individuals per million people in countries such as Germany (ESC Atlas), there is an increasing requirement for fast and effective hemostasis following the procedure. This increase is further accentuated by the escalating burden of cardiovascular disease, still the number one propelling factor of the world’s population, being responsible for 17.9 million deaths each year (WHO). Adoption has been accelerated in the U.S. market for vascular closure devices due to favorable reimbursement policies, such as those under Medicare Advantage, and growing procedural volumes.

To Get more information on Vascular Closure Devices Market - Request Free Sample Report

For instance, Vivasure Medical achieved a key milestone with more than 100 patients now treated with the PerQseal system, highlighting performance and clinical safety.

The R&D activities, including the PATCH IDE study on the PerQseal vascular closure device of the company, together support the growth of the vascular closure devices market, at the technological forefront and with enhanced clinical outcomes. Elevated number of regulatory approvals, including FDA approval for Cordis’ Mynx Control Venous device and the CE mark for PerQseal Elite, highlight a favorable regulatory scenario. On the other hand, companies specializing in vascular closure devices, including Haemonetics, Vasorum, and Vivasure, are receiving significant investments, USD 34.35 million from Haemonetics for the development of the PerQseal, and they have recently introduced to the market the Vascade MVP XL. Such trends will favor the vascular closure devices market size, expanding vascular closure devices market share, particularly in developed regions.

For instance, Vascade MVP XL was introduced in a limited U.S. release by Haemonetics Corporation, and it speaks to growing comfort and growth prospects in the vascular closure devices market. Both these developments underscore the continued development and investment within the global vascular closure devices market and illustrate future demand going forward in line with advancing vascular closure devices market trends.

Vascular Closure Devices Market Dynamics:

Drivers:

-

Advancing Interventional Techniques and Favorable Regulatory Backing Fueling Demand

The vascular closure devices market is growing, owing to the growing preference for interventional cardiology and radiology procedures with minimal incisions, which require prompt and safe hemostasis after the procedure. Globally, more than 2,000,000 cardiac catheterizations are performed each year, and as the trend continues toward increasing numbers of outpatient-based interventions, the demand for effective closure systems has grown. With expedited approvals from the U.S. FDA of devices, such as Medtronic’s FemoSeal and Abbott’s ProGlide systems, the regulatory environment works to facilitate innovation. Furthermore, healthcare facilities are spending heavily on infrastructure to support same-day discharge processes, which is driving product demand.

The technological innovations, such as bioabsorbable closure devices, extravascular closure devices that are coming through, are also influencing the quick adoption supported by the rise in R&D investments, especially by players such as Cardinal Health and Terumo, and growing clinical data supporting device safety.

For instance, fewer vascular complications and early walking times with manual compression are further fostering physician confidence. Increasing need for improved procedural efficiency and patient comfort is expected to drive the vascular closure devices market, and rising collaboration between device manufacturers and hospitals provides them with better supply chain integration.

Restraints:

-

High Costs and Procedure-Specific Limitations Hampering Wider Adoption

Advanced closure devices, including suture-mediated devices, are often more expensive than manual compression by far (prices range USD 150–300 per unit) and place a significant economic burden on the smaller-sized health care facility that has low procedural volume. In addition, anatomic limitations, such as small and calcium femoral arteries, in some cases, prohibit the utilization of certain devices and result in procedural failure or complications. Reimbursement discrepancies in developing countries subsequently restrict the market growth, where cost-effectiveness is still a major focus. As per JACC, there could be elevated complications with closure devices for peripheral procedures compared to standard compression, especially in those with peripheral artery disease.

Furthermore, supply-chain uncertainty and device recalls, including the 2022 voluntary recall of a primary closure system because of a deployment failure, affect price stability and physician confidence. There is a lack of knowledge among interventionalists in resource-poor settings, acting as a practical barrier to its uptake. These constraints are projected to hinder the otherwise rising demand for vascular closure devices, particularly in price-sensitive healthcare settings.

Vascular Closure Devices Market Segmentation Analysis:

By Product

Among the types, the active approximators held the largest share in the global vascular closure devices market in 2024, contributing 65.7% of the market. These devices, which utilize clip- and suture-based mechanisms, are extensively preferred for their excellent hemostatic control and faster time of ambulation, particularly in the context of high-risk and complex interventions. Their favorable clinical results and higher surgeon preference have led to increasing hospital utilization. On the other hand, passive approximators, collagen plugs, and sealants held the highest CAGR over the forecast period as these are easy to use, require less operator experience, and growing usage of these in the outpatient and ambulatory settings justifies the focus on the procedural lab and operating room efficacies and safeties.

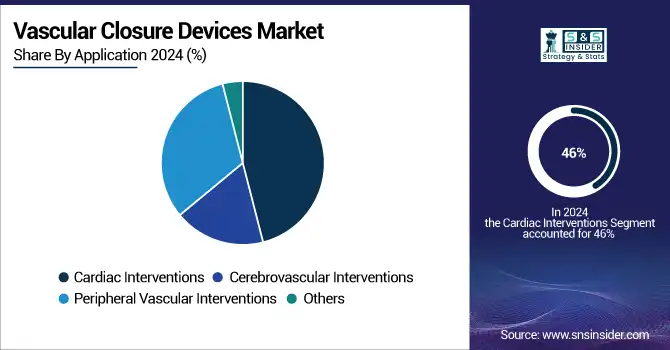

By Application

Cardiac Interventions dominated the application segment in 2024 due to the global burden of cardiovascular diseases and the growing incidence of percutaneous coronary interventions (PCIs) being performed annually. Increased closure device use to decrease the rates of post-procedure complications in large-volume cardiac catheterization procedures further perpetuates this dominance. The peripheral vascular interventions segment is projected to witness the second-highest growth, propelled by the increasing incidence of peripheral artery disease and growing adoption of endovascular procedures, which in turn requires the need for efficient vascular access site management.

By End Use

In 2024, hospitals & clinics retained the largest share of revenue due to greater procedural volumes and the established cardiac care infrastructure. Active closure devices are still the first preference for complex interventional procedures at these sites. Nevertheless, Ambulatory Surgical Centers (ASCs) are one of the fastest-growing segments of the market, driven by the trend in healthcare toward less invasive surgery, lower procedure costs, and faster patient turnover. The convenience and cost effectiveness of the operating room provided by ASCs make them well suited for elective vascular operations for which rapid return of function and ready discharge on the same day can be accomplished.

Regional Insights:

North America held the largest share of the vascular closure devices market in 2024, primarily due to the large number of cardiovascular procedures performed, well-established healthcare infrastructure, and favorable reimbursement scenario in the U.S. and Canada.

The U.S. vascular closure devices market size was valued at USD 0.52 billion in 2024 and is expected to reach USD 0.84 billion by 2032, growing at a CAGR of 6.19% over 2025-2032. The U.S. vascular closure devices market is poised to emerge as the leading regional industry with more than 1.5 million cardiac catheterizations performed per annum, rapid regulatory approvals, and adoption of new devices. The market is dominated by its country and supported by large R&D investments by major players, such as Abbott and Medtronic. Canada comes next, with a rising number of procedures and a move towards minimally invasive therapies. In Mexico, the phenomenon is better known, and health infrastructure is improving; however, it is still limited.

Europe is one of the leading regions in the global market for vascular closure devices, and in this region, Germany has the highest rate of percutaneous coronary intervention (PCI) procedures performed per million inhabitants, at more than 1,600 annually (ESC Atlas). The domination of Germany is due to strong cardiovascular care systems and early adoption of newer closure devices.

Eastern Europe, especially Poland and Turkey, is the fastest-growing region in Europe, owing to the growing number of investments in the healthcare infrastructure and the increasing burden of cardiovascular diseases. France and the U.K. are also large contributing countries with established markets, while Italy and Spain are developing quickly as a result of increasing procedural adoption and reimbursement.

Asia-Pacific is growing at a rapid rate on account of growing burdens of cardiovascular diseases, health expenditures, and procedure volumes in countries such as China and India. Large patient pool suffering from cardiovascular disorders, government funding to provide improved cardiovascular treatment, and increasing interventional cardiology procedure volume are some key factors responsible for the dominance of the Chinese regional market. India is second due to increasing patient awareness and improving investments in healthcare infrastructure.

Japan continues to be a mature market that experiences decent growth due to the aging population. The largest and fastest-growing markets in the region are India and the Southeast Asian states, where advanced vascular closure products are becoming more widely available, and outpatient procedures are rising.

Get Customized Report as per Your Business Requirement - Enquiry Now

Vascular Closure Devices Market Key Players:

Leading vascular closure devices companies in the market include Abbott, Medtronic, Terumo Medical Corporation, Cardinal Health, Teleflex Incorporated, Merit Medical Systems, Haemonetics Corporation, Boston Scientific Corporation, Vivasure Medical, and Vasorum Ltd.

Recent Developments in the Vascular Closure Devices Market:

In August 2024, Haemonetics announced the full market release of its VASCADE MVP XL mid-bore venous closure system in the U.S. The device features an innovative collapsible disc technology and a proprietary resorbable collagen patch designed to promote rapid hemostasis.

In July 2024, Cordis received FDA approval for its MYNX CONTROL VENOUS Vascular Closure Device, designed for procedures with access sites from 6F–12F. The device leverages GRIP TECHNOLOGY, based on hydrophilic, bioinert polyethylene glycol (PEG), and resorbs 3x faster than collagen-based sealants, providing the quickest time to hemostasis of any venous closure device on the market.

| Report Attributes | Details |

|---|---|

| Market Size in 2024 | USD 1.78 billion |

| Market Size by 2032 | USD 3.25 billion |

| CAGR | CAGR of 7.85% From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Product (Passive Approximators (Collagen Pugs, Sealant or Gel-based Devices, and Compression-assist Devices), Active Approximators (Suture-based Devices, Clip-based Devices, and External Homeostatic Devices)) • By Application (Cardiac Interventions, Cerebrovascular Interventions, Peripheral Vascular Interventions, and Others) • By End Use (Hospitals and Clinics, Ambulatory Surgical Centers, and Cardiac Catherization Laboratories) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, Poland, Turkey, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Rest of Latin America) |

| Company Profiles | Abbott, Medtronic, Terumo Medical Corporation, Cardinal Health, Teleflex Incorporated, Merit Medical Systems, Haemonetics Corporation, Boston Scientific Corporation, Vivasure Medical, and Vasorum Ltd. |