Vehicle Control Unit Market Report Scope & Overview:

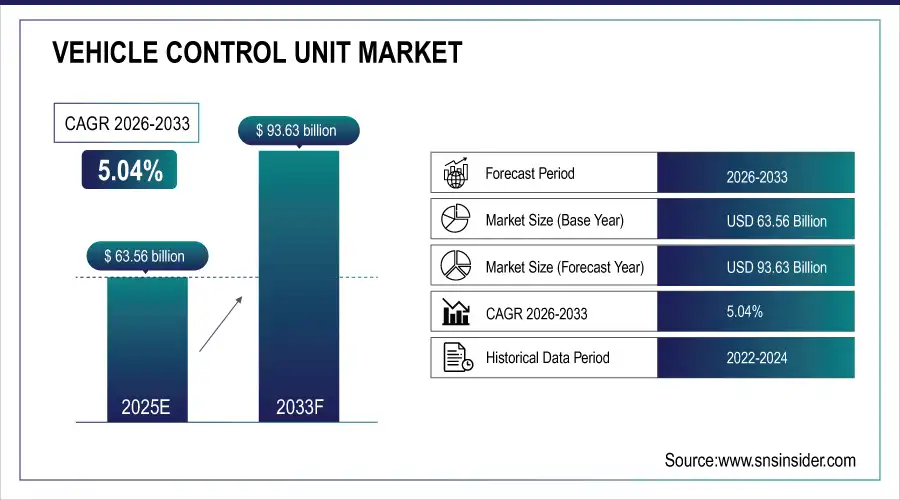

Vehicle Control Unit Market was valued at USD 63.56 billion in 2025E and is expected to reach USD 93.63 billion by 2032, growing at a CAGR of 5.04% from 2026-2033.

The Vehicle Control Unit Market is growing due to increasing adoption of electric and hybrid vehicles, rising demand for advanced driver assistance systems (ADAS), and expanding integration of autonomous driving technologies. Rapid urbanization, government regulations on vehicle safety and emissions, and the shift toward connected and smart vehicles are driving investments in sophisticated ECUs. Growing focus on vehicle electrification, predictive technologies, and infotainment systems requires robust hardware and software solutions, further accelerating the demand for high-performance vehicle control units globally.

The U.S. Department of Transportation has developed the Automated Vehicles 4.0 (AV 4.0) policy to unify efforts in automated vehicles across federal departments, promoting the safe testing and deployment of autonomous driving technologies.

Qualcomm has partnered with BMW to develop the Snapdragon Ride Pilot, a hands-free driver-assist system for the BMW iX3, enabling drivers to take their hands off the steering wheel on approved roads, meeting EU Level 2+ safety standards.

Market Size and Forecast

-

Market Size in 2025: USD 63.56 Billion

-

Market Size by 2033: USD 93.63 Billion

-

CAGR: 5.04% from 2026 to 2033

-

Base Year: 2025E

-

Forecast Period: 2026–2033

-

Historical Data: 2022–2024

To Get more information On Vehicle Control Unit Market - Request Free Sample Report

Vehicle Control Unit Market Trends

-

Rising demand for advanced driver-assistance systems (ADAS) and autonomous driving is driving the vehicle control unit (VCU) market.

-

Growing adoption in electric and hybrid vehicles is boosting market growth.

-

Integration with sensors, ECUs, and AI-driven software is enhancing vehicle performance, safety, and energy efficiency.

-

Expansion of connected and smart vehicles is fueling demand for centralized control systems.

-

Focus on reducing emissions, optimizing powertrain, and improving battery management is shaping market trends.

-

Advancements in microcontrollers, communication protocols, and software platforms are improving VCU reliability and functionality.

-

Collaborations between automotive OEMs, semiconductor providers, and software developers are accelerating innovation and deployment.

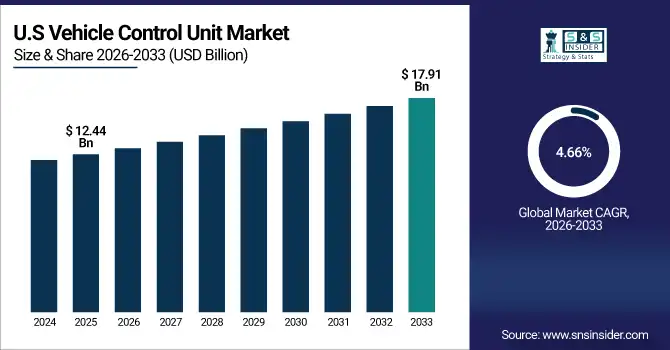

U.S. Vehicle Control Unit Market was valued at USD 12.44 billion in 2025E and is expected to reach USD 17.91 billion by 2032, growing at a CAGR of 4.66% from 2026-2033.

The U.S. Vehicle Control Unit Market is growing due to increasing adoption of electric and hybrid vehicles, rising integration of ADAS, and government regulations promoting vehicle safety, efficiency, and advanced automotive technologies.

Vehicle Control Unit Market Growth Drivers:

-

Integration of ADAS and autonomous driving technologies propelling demand for intelligent vehicle control units across applications

The rising incorporation of advanced driver assistance systems (ADAS) and autonomous driving functionalities in modern vehicles is fueling demand for vehicle control units. ECUs enable precise control of braking, powertrain, infotainment, body electronics, and predictive technologies, ensuring safety and efficiency. Growing consumer awareness of vehicle safety, alongside regulatory mandates for collision avoidance and lane-keeping assistance, is encouraging OEMs to integrate multiple high-performance ECUs. The proliferation of connected vehicles, smart mobility solutions, and over-the-air updates requires robust hardware and software architectures, further driving the need for advanced vehicle control units that can handle complex data processing and real-time decision-making effectively.

|

Company |

Key Features |

Technology / Product |

|

Bosch |

- Scalable, modular vehicle computer for assisted and automated driving and parking up to SAE Level 2 |

ADAS Integration Platform |

|

Continental |

- Scalable ADAS/AD system integrating control units, sensors, and software |

Xelve |

|

Renesas |

- Supports automated driving, connected gateways, in-vehicle infotainment, cockpit, and dashboard applications |

R-Car V3H SoC |

|

NXP Semiconductors |

- Designed for service-oriented gateways and domain control applications |

S32G3 Vehicle Networking Processor |

|

Infineon Technologies |

- Designed for next-generation e-mobility and ADAS applications |

AURIX™ TC4x Microcontroller |

|

Ecotron |

- Monitors real-time traffic for automatic emergency braking and lane departure warnings |

ADAS Controller |

|

ADLINK Technology |

- Integrates AI processing capabilities for ADAS applications |

ADM-TJ30 Integrated AI-ADAS Vehicle ECU |

Vehicle Control Unit Market Restraints:

-

Dependency on semiconductor supply and global chip shortages restraining vehicle control unit production and deployment

Vehicle control units rely heavily on semiconductors, sensors, and high-performance processors, making them vulnerable to global chip shortages. Supply chain disruptions, geopolitical tensions, and limited manufacturing capacity impact production timelines for ECUs. These constraints lead to delayed vehicle deliveries, project cost escalations, and reduced availability of advanced electronics, affecting OEMs and suppliers. Additionally, specialized components such as high-speed microcontrollers and memory chips are difficult to procure in large quantities, creating bottlenecks. Automotive manufacturers face difficulties maintaining production schedules, meeting safety standards, and delivering connected vehicle features, which restrains the market's growth despite increasing demand for advanced automotive electronic systems.

Vehicle Control Unit Market Opportunities:

-

Technological advancements in software and communication protocols enabling next-generation vehicle control solutions

The evolution of vehicle communication technologies, including CAN, LIN, FlexRay, and Ethernet, along with software innovation, creates opportunities for intelligent vehicle control units. Modern vehicles require ECUs capable of handling large data volumes from sensors, ADAS, and infotainment systems. Enhanced software architectures and real-time processing enable predictive maintenance, over-the-air updates, and vehicle-to-everything (V2X) connectivity. OEMs increasingly seek ECUs that integrate hardware and software efficiently, reducing system complexity while improving reliability. The growing emphasis on cybersecurity, energy efficiency, and autonomous functionalities amplifies demand for innovative ECU solutions, allowing manufacturers to differentiate their vehicles in a competitive automotive market.

Vehicle Control Unit Market Segment Highlights

-

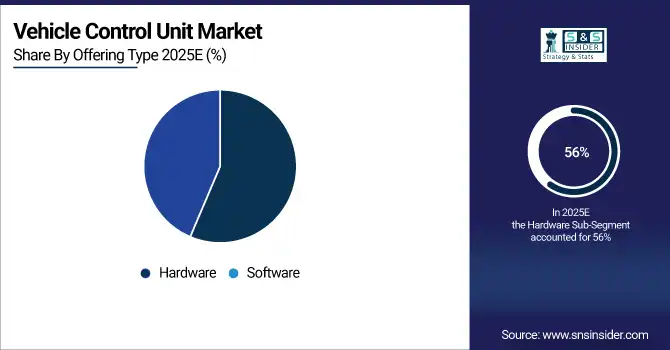

By Offering Type, Hardware dominated with ~56% share in 2025; Software fastest growing (CAGR).

-

By Communication Technology, CAN (Controller Area Network) dominated with ~34% share in 2025; Ethernet fastest growing (CAGR).

-

By Vehicle Type, Passenger Vehicle dominated with ~43% share in 2025; Electric Two-Wheeler fastest growing (CAGR).

-

By Application, ADAS dominated with ~31% share in 2025; Powertrain fastest growing (CAGR).

-

By Function, Autonomous Driving/ADAS dominated with ~58% share in 2025; fastest growing (CAGR).

-

By Propulsion Type, BEV dominated with ~48% share in 2025; fastest growing (CAGR).

Vehicle Control Unit Market Segment Analysis

By Offering Type, Hardware segment dominated in 2025; Software segment projected fastest growth 2026–2033

The hardware segment dominated the Vehicle Control Unit Market in 2025 with the largest revenue share due to strong demand for physical controllers, sensors, and processors integrated into vehicles. Automakers prioritize robust, high-performance hardware platforms to ensure safety, reliability, and seamless communication across various systems, securing consistent revenue contribution during the year.

The software segment is expected to grow at the fastest CAGR from 2026 to 2033 as vehicles become increasingly software-defined. Advanced control algorithms, real-time data processing, and frequent over-the-air updates enable enhanced functionality and customization. Growing adoption of ADAS, predictive technologies, and electrification trends will drive higher software integration across all vehicle platforms.

By Communication Technology, CAN segment led in 2025; Ethernet segment expected fastest growth 2026–2033

The CAN segment dominated the Vehicle Control Unit Market in 2025 with the largest revenue share, owing to its proven reliability, cost-effectiveness, and widespread adoption in automotive networks. Its capability to handle communication between multiple ECUs efficiently ensures robust system performance, making it the industry’s preferred communication protocol during the year.

The Ethernet segment is expected to grow at the fastest CAGR from 2026 to 2033 as modern vehicles demand high-speed, secure, and scalable communication solutions. Increasing complexity of ADAS, autonomous driving, and infotainment systems requires higher bandwidth, making Ethernet the most suitable choice to meet data-intensive applications and next-generation vehicle requirements.

By Vehicle Type, Passenger Vehicle segment dominated in 2025; Electric Two-Wheeler segment projected fastest growth 2026–2033

The passenger vehicle segment dominated the Vehicle Control Unit Market in 2025 with the highest revenue share due to rising consumer demand, increasing production volumes, and integration of advanced electronics. Automakers emphasize safety, comfort, and connected features in passenger cars, driving higher adoption of vehicle control units compared to other vehicle categories during the year.

The electric two-wheeler segment is expected to grow at the fastest CAGR from 2026 to 2033 as urbanization, affordability, and government incentives accelerate EV adoption. Growing focus on sustainable mobility, expanding charging infrastructure, and demand for cost-efficient personal transportation will boost integration of control units in scooters, mopeds, and motorcycles globally.

By Application, ADAS segment led in 2025; Powertrain segment expected fastest growth 2026–2033

The ADAS segment dominated the Vehicle Control Unit Market in 2025 with the largest revenue share, driven by growing regulatory mandates and consumer demand for safety features. Widespread deployment of systems like adaptive cruise control, lane-keeping assistance, and automated emergency braking has elevated ADAS as a critical application area for control units.

The powertrain segment is expected to grow at the fastest CAGR from 2026 to 2033 due to increasing electrification, hybridization, and demand for efficient propulsion technologies. Vehicle control units optimize battery performance, energy distribution, and drivetrain efficiency. Rising global investments in EVs and hybrid powertrains will significantly boost control unit adoption in this segment.

By Function, Autonomous Driving/ADAS segment dominated in 2025 and projected to grow fastest 2026–2033

The autonomous driving/ADAS segment dominated the Vehicle Control Unit Market in 2025 with the highest revenue share due to increasing regulatory mandates, rising safety concerns, and consumer demand for advanced driver assistance features. The segment is also expected to grow at the fastest CAGR from 2026 to 2033 as automakers accelerate investments in self-driving technologies, AI integration, and sensor fusion. Continuous advancements in predictive analytics and connectivity further drive widespread adoption, making this segment central to the future of mobility solutions.

By Propulsion Type, BEV segment dominated in 2025 and expected fastest growth 2026–2033

The BEV segment dominated the Vehicle Control Unit Market in 2025 with the largest revenue share, driven by the global shift toward electrification, government incentives, and stringent emission regulations. It is also projected to grow at the fastest CAGR from 2026 to 2033 as charging infrastructure expands and battery technologies advance. Automakers are focusing on integrating intelligent vehicle control units to enhance energy management, power distribution, and system efficiency, making BEVs the most attractive propulsion type in the forecast period.

Vehicle Control Unit Market Regional Analysis

North America Vehicle Control Unit Market Insights

North America held a significant position in the Vehicle Control Unit Market in 2025, driven by advanced automotive technologies, high adoption of electric and autonomous vehicles, and robust R&D investments. Presence of leading OEMs and semiconductor manufacturers, stringent safety regulations, and growing demand for ADAS and predictive technologies support market growth. Strong infrastructure, government incentives for EVs, and technological innovations further reinforce North America’s competitive advantage and steady market expansion.

Get Customized Report as per Your Business Requirement - Enquiry Now

Asia Pacific Vehicle Control Unit Market Insights

Asia Pacific dominated the Vehicle Control Unit Market in 2025 with the highest revenue share of about 39% due to rapid industrialization, increasing automotive production, and strong adoption of electric and connected vehicles. High consumer demand for advanced safety and driver-assistance systems, presence of major OEMs and component manufacturers, and supportive government policies promoting EVs and smart mobility solutions contribute to the region’s leading market position and sustained growth.

Europe Vehicle Control Unit Market Insights

Europe held a notable share in the Vehicle Control Unit Market in 2025, supported by strict vehicle safety regulations, rising adoption of electric and hybrid vehicles, and growing integration of ADAS and autonomous driving technologies. Presence of leading automotive manufacturers, continuous R&D investments, and focus on sustainable mobility solutions drive market growth. Government incentives for EV adoption, expansion of smart infrastructure, and technological advancements further strengthen Europe’s position in the global Vehicle Control Unit Market.

Middle East & Africa and Latin America Vehicle Control Unit Market Insights

The Middle East & Africa and Latin America contributed significantly to the Vehicle Control Unit Market in 2025, driven by increasing automotive production, rising adoption of electric and hybrid vehicles, and growing investments in smart mobility and infrastructure. Expansion of ADAS technologies, government initiatives for road safety, and rising consumer awareness about vehicle efficiency and safety are supporting market growth, creating opportunities for global and regional vehicle control unit suppliers in these regions.

Vehicle Control Unit Market Competitive Landscape:

Bosch GmbH

Bosch is a leading global technology and engineering company, offering solutions in mobility, industrial technology, consumer goods, and energy. In the automotive sector, Bosch develops integrated control units, ADAS systems, and electric vehicle components, focusing on reducing system complexity and improving energy efficiency. The company leverages advanced electronics, software, and AI to deliver safer, more connected, and cost-efficient vehicle solutions worldwide.

-

2025: Bosch showcased integrated vehicle controllers at IAA Munich 2025, combining ADAS and infotainment functions into a single control unit, reducing overall system cost by ~30%.

-

2024: Bosch introduced a new 2 kW drive control unit integrating inverter, engine management, and vehicle control for smaller electric vehicles, with features like cruise control and energy recuperation.

Continental AG

Continental is a global automotive supplier specializing in tires, vehicle electronics, and autonomous driving solutions. The company focuses on developing advanced driver assistance systems, electronic control units, and software solutions for connected and electric vehicles. By leveraging cloud technologies and virtual platforms, Continental enhances ECU development efficiency, accelerates time-to-market, and supports the transition to smarter, safer, and more sustainable mobility solutions.

-

2023: Continental and AWS launched a virtual Electronic Control Unit (vECU) Creator, enabling developers to simulate and debug ECU software in the cloud, cutting development time by up to 12 months.

NXP Semiconductors

NXP Semiconductors is a global leader in automotive and industrial semiconductor solutions. The company provides microcontrollers, processors, and integrated vehicle control architectures for electric and connected vehicles. NXP emphasizes performance, efficiency, and simplification of electronic systems, enabling automakers to consolidate ECUs, enhance safety features, and accelerate the adoption of electric and software-defined vehicles.

-

June 12, 2025: NXP and Rimac Technology co-developed a centralized vehicle architecture consolidating over 20 ECUs into three, enhancing performance and reducing complexity for electric vehicles.

Valeo Group

Valeo is a global automotive supplier focusing on smart mobility, ADAS, and electrification solutions. The company develops scalable software-defined systems and integrated vehicle electronics to improve safety, efficiency, and user experience. Valeo collaborates with technology partners to accelerate the adoption of autonomous and connected vehicle solutions worldwide, emphasizing innovation and system integration in its automotive offerings.

-

September 8, 2025: Valeo and Qualcomm announced a partnership to accelerate the global shift to software-defined vehicles with scalable ADAS and safety-centric systems for automakers worldwide.

Magneti Marelli (Marelli)

Marelli is a global automotive supplier providing advanced electronics, lighting, and powertrain solutions. The company develops AI-powered electronic control units for engine and vehicle management across various propulsion types. Marelli emphasizes innovation in motorsport and production vehicles, integrating electronics and software to enhance performance, efficiency, and control in high-demand automotive applications.

-

November 13, 2024: Marelli launched its AI-based Electronic Control Unit, VEC_480, for engine and vehicle control in motorsport applications, designed for all types of vehicle propulsion

Hella KGaA Hueck & Co.

Hella specializes in automotive lighting, electronics, and sensor solutions. The company develops advanced control modules and integrated electronic systems for modern vehicles, focusing on safety, connectivity, and energy efficiency. Hella works closely with OEMs to deliver scalable vehicle electronics solutions that support ADAS integration and the transition to electrified and automated mobility.

-

May 12, 2025: FORVIA HELLA secured a major contract for the development and production of an "Advanced Control Module," which will enter series production in 2028.

Key Players

Some of the Vehicle Control Unit Market Companies

-

Robert Bosch GmbH

-

Continental AG

-

DENSO Corporation

-

ZF Friedrichshafen AG

-

Hitachi Astemo Ltd.

-

Mitsubishi Electric Corporation

-

STMicroelectronics

-

NXP Semiconductors

-

Delphi Technologies (now part of BorgWarner)

-

Valeo Group

-

Visteon Corporation

-

Aptiv PLC

-

Magneti Marelli (now part of Marelli)

-

Hella KGaA Hueck & Co.

-

Sensata Technologies

-

Mitsubishi Heavy Industries (MHI)

-

Autoliv Inc.

-

BorgWarner Inc.

-

Panasonic Automotive Systems

-

Huawei Technologies Co., Ltd.

| Report Attributes | Details |

|---|---|

| Market Size in 2025E | USD 63.56 Billion |

| Market Size by 2033 | USD 93.63 Billion |

| CAGR | CAGR of 5.04% From 2026 to 2033 |

| Base Year | 2025 |

| Forecast Period | 2026-2033 |

| Historical Data | 2022-2024 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Vehicle Type (Passenger Vehicle, Commercial Vehicle, Electric Two-Wheeler, Off-Highway Electric Vehicle) • By Propulsion Type (BEV (Battery Electric Vehicle), HEV (Hybrid Electric Vehicle), PHEV (Plug-in Hybrid Electric Vehicle)) • By Communication Technology (CAN (Controller Area Network), LIN (Local Interconnect Network), FlexRay, Ethernet) • By Function (Autonomous Driving/ADAS, Predictive Technology) • By Application (Powertrain, Braking System, Body Electronics, ADAS, Infotainment) • By Offering Type (Hardware, Software) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

| Company Profiles | Robert Bosch GmbH, Continental AG, DENSO Corporation, ZF Friedrichshafen AG, Hitachi Astemo Ltd., Mitsubishi Electric Corporation, STMicroelectronics, NXP Semiconductors, Delphi Technologies (now part of BorgWarner), Valeo Group, Visteon Corporation, Aptiv PLC, Magneti Marelli (now part of Marelli), Hella KGaA Hueck & Co., Sensata Technologies, Mitsubishi Heavy Industries (MHI), Autoliv Inc., BorgWarner Inc., Panasonic Automotive Systems, Huawei Technologies Co., Ltd. |