Veterinary MRI Market Size Analysis:

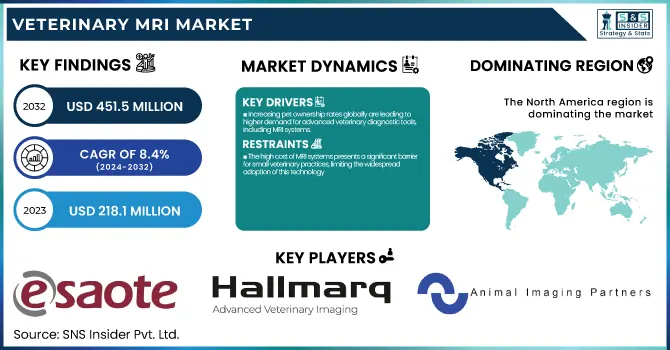

The Veterinary MRI Market Size was valued at USD 218.1 Million in 2023 and is expected to reach USD 451.5 Million by 2032, growing at a CAGR of 8.4% over the forecast period 2024-2032.

To Get more information on Veterinary MRI Market - Request Free Sample Report

The report includes key statistical insights and trends in the Veterinary MRI Market including the incidence and prevalence of neurological and musculoskeletal disorders in animals. The report discusses veterinary healthcare expenditure on MRI diagnostics, providing analysis of where pet owners, insurers, and clinics are contributing. Explains the adoption rates by practice type, including specialty hospitals and private clinics It also analyzes regulatory and compliance trends, highlighting regional standards impacting the market. The study assesses technological advancements with special attention to AI integration, automation, and image enhancement specific to veterinary-based MRI. This perspective provides an overview of market expansion and potential growth in the future.

The growth of the veterinary MRI market is attributed to growing pet ownership and technology development in imaging. Pet ownership is still on the rise, with nearly 68% of U.S. households owning a pet as of the most recent government statistics. This trend is driven by increased awareness of animal health and rising expenditures on veterinary care. Additionally, the veterinary MRI market was discovered by the US because of its superior healthcare devices, high usage of advanced veterinary imaging technology, and excessive investments in animal healthcare. The US market size has grown consistently from USD 84.43 million in 2023, showcasing a strong upward trend. Additionally, the rising pet ownership and increased spending on veterinary diagnostics further fuel market growth, with an impressive 8.31% CAGR driving expansion.

Veterinary MRI Market Dynamics

Drivers

-

Increasing pet ownership rates globally are leading to higher demand for advanced veterinary diagnostic tools, including MRI systems.

The growing popularity of pets worldwide is one of the key factors bolstering the growth of the market for advanced veterinary diagnostic instruments, particularly Magnetic Resonance Imaging (MRI) systems. North America held the largest veterinary MRI market share. This dominance can partly be attributed to the high rate of pet ownership in the U.S. and Canada, which is complemented by a growing demand for advanced veterinary healthcare services including MRI diagnostics. The pet population in the United Kingdom reached 34 million in 2023, with most consisting of dogs or cats. As the number of pets has increased, the prevalence of conditions such as osteoarthritis has also risen, affecting between 2.5% and 6.6% of dogs of all breeds and ages, and affecting up to 20% of dogs over one year old. These health issues highlight the need for accurate diagnostic imaging, which is boosting the demand for veterinary MRI systems.

A range of conditions, including growing pet adoption and humanization, increased health concerns, and increasing livestock population are driving the growth of the market in Asia Pacific. The Rising counts of companion animals across the globe paired with higher public awareness of their overall health and welfare is pushing veterinary practitioners toward advanced diagnostic methods such as MRI systems. Such a trend guarantees through care and accurate treatment, and emphasizes the significant contribution of MRI technology in contemporary veterinary medicine.

Restraint:

-

The high cost of MRI systems presents a significant barrier for small veterinary practices, limiting the widespread adoption of this technology.

MRI systems are very costly, which is a major barrier to their adoption in veterinary practices, especially in smaller clinics. Veterinary MRI machines themselves can cost between one million and three million US dollars depending on the model and features. Refurbished units are less expensive and typically range from $150,000 to 1 million USD. The Veterinary 0.35T MRI Scan Machine Equipment (Approx. USD 250,000 to 400,000) In addition to the purchase itself, installation costs can be significant with the need for specialized infrastructure to house the equipment's physical size and magnetic field requirements. Ongoing maintenance, such as liquid helium and upkeep of the cooling systems, adds to the financial burden. These significant expenditures pose a challenge for many veterinary clinics, especially smaller ones, in integrating MRI technology into their diagnostic services.

Opportunity:

-

Technological advancements, such as the development of high-field MRI systems specifically designed for animals, are enhancing diagnostic capabilities and improving patient care in veterinary medicine.

Technical advancement in veterinary MRI systems is greatly improving the diagnostic capabilities in animal healthcare. High-field magnetic resonance imaging (MRI) systems, such as 3-tesla (3T) scanners, give both improved image quality and shorter scan times. For example, Michigan State University’s Veterinary Medical Center announced in early 2024 that it had installed a Philips MR 7700 3T MRI system that offers sharper pictures and employs artificial intelligence to streamline the scanning process and amplify image quality. Likewise, the Virginia-Maryland College of Veterinary Medicine upgraded to a Siemens 3T MRI scanner in September 2023, doubling the strength of their previous 1.5T model. This feature has accelerated scan times and improved diagnostic accuracy, especially in neurology, oncology, and orthopedics.

These advancements are crucial given the rising prevalence of conditions like osteoarthritis among pets. In the U.S., osteoarthritis has been diagnosed in an estimated 14 million adult dogs and studies show that up to 90% of cats over the age of 12 have signs of the condition on X-rays. This advancement is made possible with the best MRI machine for dogs which allows veterinarians to diagnose the condition better and treat them accordingly. With advanced MRI systems making their way into new areas of veterinary practice, it emphasizes a recognition of technological advancement to benefit animal health care.

Challenge:

-

The complexity of operating MRI systems requires specialized training, and the limited availability of skilled veterinary professionals proficient in MRI technology poses a challenge to its widespread adoption.

The widespread usage of Magnetic Resonance Imaging (MRI) in veterinary is limited only by the shortage of professionals who are trained to operate these highly sophisticated systems. MRI machines require specific expertise to interpret diagnostic results correctly and prevent patient injury. Many veterinary curricula do not include extensive training on MRI, meaning practitioners require further education. To bridge this, initiatives such as Esaote SPA's MRI VET Academy provide free online courses, introducing general practitioners to their assessment of neurological patients and common spinal and brain diseases. But, even with these efforts, the shortage of skilled personnel remains a challenge in the widespread adoption of MRI technology in a hospital and the availability of high-quality healthcare services for animals.

Veterinary MRI Market Segmentation Analysis

By Solutions

The MRI scanner segment accounted for the highest share of 40% in the veterinary MRI market in 2023. This is primarily due to the growing need for accurate diagnostic imaging services in veterinary practices. This has also been helped by government initiatives improving animal health infrastructure and allowing for advanced MRI scanners. As an example, MRI scanners have benefitted the U.S. Department of Agriculture's Animal and Plant Health Inspection Service (APHIS) stressing the need for advanced diagnostic tools in veterinary care. Technological improvements in MRI systems like AI-prompted imaging upgrades are boosting the diagnostic features, making them attractive to the veterinary staff. MRI scanners are undergoing continuous improvements and innovations in the veterinary imaging solutions industry to ensure precise imaging to get an effective diagnosis. This margin for error diminishes with the use of advanced technologies, including high-field MRI systems, which improve diagnostic accuracy and support the segment's expansion.

By Animal Type

In 2023, small animals accounted for the largest share, at 71%. This is mainly because of the humanization of pets, which is causing pet owners to spend more on pet health. The majority of pet owners think their pets are part of the family and that is what drives the demand for more advanced veterinary care, including MRI diagnostics, as indicated by government data. The growing incidence of neurological and musculoskeletal disorders in companion animals further requires accurate diagnostic imaging to ensure proper treatment, thus leading to increased adoption of MRI systems for small animals. Additionally, technical development in portable imaging solutions leads to broader acceptability in field environments leading to segment growth. The focus on improving diagnostic capabilities for small animals is expected to continue, driven by technological innovations and growing pet ownership rates.

By End Use

The veterinary hospitals segment accounted for the largest share of 54% in 2023. These healthcare facilities already provide a wide range of diagnostics and treatment services, thus increasing the need for advanced MRI technology. Government support to improve veterinary healthcare infrastructure has helped the veterinary hospital market, where MRI systems are appropriated. In addition, the growing pet population fuels growth in this segment, along with the availability of specialized veterinary professionals. They work in places that have imaging modalities available, which helps in diagnosing and planning treatment. This is anticipated to hold a high demand for advanced diagnostic tools in hospital settings, driving segment growth, as veterinary care continues to evolve.

Veterinary MRI Market Regional Insights

The North America veterinary MRI market held the highest share of 49% of revenue in 2023. Some of the factors attributing to this dominance include a large pet population, a well-set veterinary healthcare infrastructure, high adoption rate for advanced imaging technologies. The U.S. government's commitment to utilizing new diagnostic tools for animal health has bolstered this trend as well. For instance, initiatives by the U.S. Department of Agriculture and the American Animal Hospital Association have highlighted the importance of advanced imaging in veterinary care, contributing to the widespread adoption of MRI systems.

Asia-Pacific is expected to grow at the highest CAGR from 2024 to 2032. Factors such as growing pet ownership rates, awareness about pet health, and increased veterinary services contribute to this growth. Investments in veterinary healthcare infrastructure, including the uptake of sophisticated imaging methods, are being seen in countries including China and Japan. Growing initiatives taken by governments to boost animal health and welfare in these countries are expected to further contribute to the growth of the veterinary MRI market. For instance, advances in technology have helped increase veterinary care in China such as the tendency of veterinary systems to utilize MRI systems. In 2023, the Asia-Pacific region had a significant market share due to collaborations between veterinary clinics and imaging providers. These collaborations enable access to state-of-the-art diagnostic tools, which further propels the uptake of MRI systems across the region. Additionally, the growing demand for high-quality veterinary care and the increasing availability of specialized veterinary professionals are expected to continue supporting the rapid growth of the veterinary MRI market in the Asia-Pacific region.

Get Customized Report as per Your Business Requirement - Enquiry Now

Veterinary MRI Market Key Players

-

Esaote (Vet-MR, Magnifico Vet)

-

Hallmarq Veterinary Imaging (MIRA Small Animal 1.5T MRI, Standing Equine MRI)

-

Animal Imaging Partners (Magnus AIP Vet MRI, Veterinary Imaging Solutions)

-

GE Healthcare (Brivo MR355, Optima MR360)

-

Siemens Healthineers (MAGNETOM Sempra, MAGNETOM Skyra)

-

Philips Healthcare (Ingenia 1.5T, Achieva 3.0T)

-

Canon Medical Systems (Vantage Elan 1.5T, Vantage Galan 3T)

-

Hitachi Medical Systems (Echelon Smart, Oasis 1.2T)

-

Fujifilm Healthcare (Aperto Lucent, ECHELON Smart Plus)

-

Mediso Medical Imaging Systems (nanoScan PET/MRI, nanoScan SPECT/MRI)

-

MR Solutions (MRS 7000 series, MRS 9000 series)

-

Aspect Imaging (M3 Compact MRI, Embrace Neonatal MRI)

-

Time Medical Systems (Vet-MR Grande, Vet-MR Mini)

-

Alltech Medical Systems (EchoStar 1.5T, EchoStar 0.5T)

-

Neusoft Medical Systems (NeuMR 1.5T, NeuMR 0.5T)

-

Paramed Medical Systems (MRJ 7000, MRJ 14000)

-

Shenzhen Anke High-tech Co., Ltd. (ANKER 1.5T, ANKER 0.5T)

-

United Imaging Healthcare (uMR 570, uMR 780)

-

Aurora Imaging Technology (Aurora 1.5T Dedicated Breast MRI System, Aurora 3D MRI)

-

Elekta (Elekta Unity, Elekta Synergy)

Recent Developments in the Veterinary MRI Market

-

In June 2024, Hallmarq installed its first zero-helium small animal 1.5T MRI in the United States. This machine aims to mitigate varied environmental and financial concerns posed by conventional liquid helium-based MRI systems.

-

Esaote introduced the Magnifico Vet MRI system, an open MRI solution targeted at use in veterinary hospitals, in January 2023. The system is based on sustainable green permanent-magnet technology which is cryogen free.

-

In December 2024, GE HealthCare launched Deutsche Effortless Recon DL for enhanced DL image processing and reconstruction into its Ehf portfolio. While not specific to veterinary use, advances in imaging can play a role in where veterinary diagnostics may go moving forward.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 218.1 Million |

| Market Size by 2032 | USD 451.56 Million |

| CAGR | CAGR of 8.4% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Animal Type (Small Animals {Dogs, Cats, Others}, Large Animals) • By Solutions (MRI Scanner, Accessories/ Consumables, Software & Services) • By End-use (Veterinary Clinics, Veterinary Hospitals, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Esaote, Hallmarq Veterinary Imaging, Animal Imaging Partners, GE Healthcare, Siemens Healthineers, Philips Healthcare, Canon Medical Systems, Hitachi Medical Systems, Fujifilm Healthcare, Mediso Medical Imaging Systems, MR Solutions, Aspect Imaging, Time Medical Systems, Alltech Medical Systems, Neusoft Medical Systems, Paramed Medical Systems, Shenzhen Anke High-tech Co., Ltd., United Imaging Healthcare, Aurora Imaging Technology, Elekta |