Inverter Duty Motor Market Size & Trends:

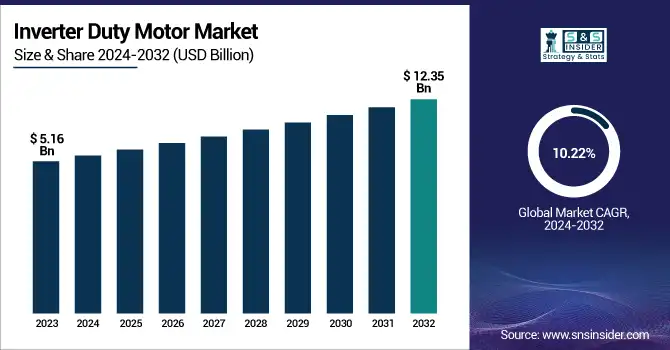

The Inverter Duty Motor Market Size was valued at USD 5.16 billion in 2023 and is expected to reach USD 12.35 billion by 2032, growing at a CAGR of 10.22% from 2024-2032. This report includes key trends in product development, such as advanced motor technologies and enhanced efficiency. Supply chain analysis reveals growing demand from industries like manufacturing and HVAC. Consumer adoption is rising due to energy efficiency benefits, while regulatory impacts are pushing for stricter compliance. The focus on energy efficiency metrics is crucial for growth, making Inverter Duty Motors an essential solution for modern applications.

To Get more information on Inverter Duty Motor Market - Request Free Sample Report

Inverter Duty Motor Market Dynamics

Drivers

-

Inverter Duty Motor Market Growth Driven by Industrial Automation, Energy Efficiency, and Technological Advancements

The increasing application of automation and control systems across industries such as manufacturing, energy, and utilities significantly boosts the demand for inverter duty motors. Inverter duty motors must regulate motor speed, exhibit optimum energy efficiency, and ensure consistent performance under variable conditions. With more emphasis on energy efficiency, industries are turning towards motors that can readily be utilized with variable frequency drives to reduce operating costs and environmental impact. Apart from this, technological advancements in smart motor technologies, expansion of the renewable energy sector, and rising demand for high-performance motors in HVAC systems further propel the market towards expansion. All these factors combined give rise to the booming demand for inverter duty motors.

Restraints

-

High Initial Costs and Maintenance Complexity Limit Adoption of Inverter Duty Motors in Price-Sensitive Industries

The high initial expense involved in using inverter duty motors, combined with the complexities involved in their installation and maintenance, constitutes a key market expansion constraint. Small-scale companies or industries with budgetary constraints may be challenged by the cost of entry, especially in price-sensitive sectors. Moreover, the necessity of having specialized technicians to install, run, and service these motors adds to the cost of operations. The necessity of higher technical expertise to service and repair these motors can render them less viable for companies lacking the requisite resources or skilled manpower. These aspects, combined with possible downtime as a result of maintenance requirements, can hinder the adoption of inverter duty motors in different industries.

Opportunities

-

IoT Integration and Smart Technologies Drive Growth in Inverter Duty Motor Market by Enabling Predictive Maintenance and Optimization

Growing IoT and smart technologies integration in industrial processes offers strong potential for inverter duty motors. As industries implement predictive maintenance systems and remote monitoring systems, there is a growing demand for motors that can be interfaced with sophisticated control systems. Inverter duty motors, with the ability to track performance in real time and perform diagnostics, allow operators to monitor motor condition, anticipate failures, and optimize performance, reducing downtime and maintenance expense. This technology improves operational efficiency and motor lifespan. As industries further adopt digital transformation, the need for intelligent, networked motor systems will further fuel the use of inverter duty motors, opening up new growth prospects in industries like manufacturing, energy, and HVAC.

Challenges

-

Energy Loss, High Costs, and Compatibility Issues Pose Challenges to Inverter Duty Motor Market Adoption

In lower operating loads, inverter duty motors may incur greater energy losses, which could lower their overall efficiency in some applications. This can be worrisome for applications looking to achieve maximum energy saving in all loading conditions. Moreover, the expense of purchasing inverter duty motors and the complicated installation process can discourage companies, especially small and medium-sized ones, from adopting these new technologies. Maintenance can also be challenging since the motors need specialized personnel, causing higher operational expenses and more downtime. Compatibility problems with older systems can also slow their implementation, since high investments would be needed to upgrade or replace existing machinery to support inverter duty motors.

Inverter Duty Motor Market Segment Analysis

By Material

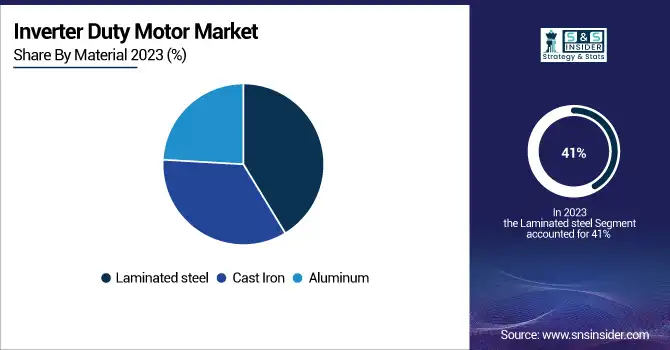

The laminated steel segment led the Inverter Duty Motor Market in 2023 with the largest share in revenue of approximately 41%. This is because laminated steel can minimize eddy current losses, hence it is very efficient in inverter duty motors. It offers superior electrical conductivity and magnetic attributes, thereby leading to reduced energy consumption and enhanced motor performance. Its prevalent usage in industrial uses, wherein efficiency and resistance are paramount, further establishes itself as the premium material for such motors.

The cast iron category is anticipated to grow at the fastest CAGR of approximately 11.33% during 2024 to 2032. This increase is due to the durability, strength, and affordability of cast iron, resulting in its increasing popularity for applications that are heavy-duty. Cast iron also provides improved thermal conductivity and corrosion resistance, which increases the overall reliability and lifespan of inverter duty motors. These benefits, along with its growing use in applications such as HVAC and manufacturing, fuel its swift market growth.

By Application

The pumps segment led the Inverter Duty Motor Market with the largest revenue share of approximately 37% in 2023. This is fueled by the critical function pumps have in industries such as water treatment, oil & gas, and chemicals. Inverter duty motors are vital in pump systems because they enable accurate speed control and energy efficiency, particularly in applications that need to vary flow rates. The increasing demand for energy-efficient solutions and stable operations in these sectors has made pumps the dominant segment.

The fans segment is anticipated to expand at the fastest CAGR of approximately 11.91% during the period 2024-2032. This is primarily attributed to the growing demand for energy-efficient solutions in HVAC systems, industrial ventilation, and cooling systems. Inverter duty motors are best suited for fans since they provide variable speed control, which ensures maximum performance and energy savings. With industries becoming more energy-conscious and sustainable, the use of inverter duty motors in fan applications will gain momentum.

By Industry Vertical

The chemicals industry led the Inverter Duty Motor Market with the largest revenue contribution of approximately 40% in 2023. The reason behind this leading position is the prominent role played by inverter duty motors in the chemicals sector, where there is a high need for motor speed control and energy efficiency. Motors in chemical processing plants need to operate under varying conditions, and inverter duty motors provide the reliability and performance needed for processes like mixing, pumping, and grinding, contributing to the segment's leading market share.

The paper & pulp industry is anticipated to expand at the fastest CAGR of approximately 13.86% during the period from 2024 to 2032. This growth is due to the growing demand for energy-saving solutions in the production of paper, where inverter duty motors can achieve optimum speed control and minimize energy use. In addition, the necessity for greater reliability and automation of paper mills motivates the implementation of inverter duty motors that enhance efficiency while in operation and minimize downtime, propelling growth in the market for this product.

Inverter Duty Motor Market Regional Outlook

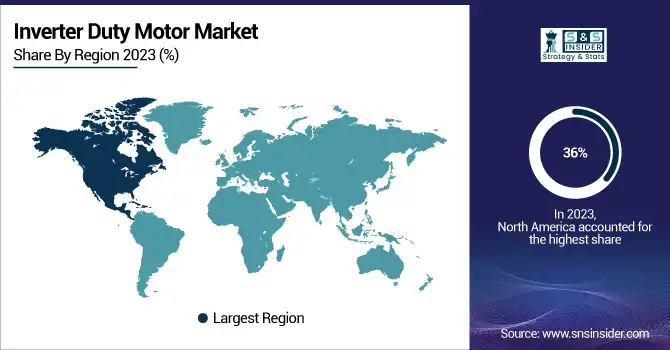

North America led the Inverter Duty Motor Market with a maximum revenue share of approximately 36% in 2023. This leadership is mainly ascribed to the region's industrialized infrastructure that fuels the adoption of high-end, energy-conserving motors. North America's leadership in manufacturing, oil & gas, and chemical industries, where inverter duty motors play a pivotal role in operational effectiveness, further reinforces its market position. Moreover, energy efficiency and sustainability-oriented government policies promote the uptake of these motors, reinforcing its market leadership.

The Asia Pacific is expected grow at the fastest CAGR of nearly 11.88% between 2024 and 2032. It is driven by increasing industrialization, enhanced development of infrastructure, and expanding use of energy-saving technologies in countries such as China, India, and Japan. Growing manufacturing and automotive industries within the region coupled with the green technologies-promoting efforts by the governments are driving the demand for inverter duty motors. The need for effective, affordable solutions in these sectors will further propel the market's fast growth.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players

-

ABB (Baldor-Reliance Inverter Duty Motors, ACS880 Industrial Drives)

-

Adlee Powertronic Co., Ltd. (Inverter Duty Induction Motors, Variable Frequency Drives)

-

AES Electronic Services (Inverter Duty AC Motors, Motor Repair Services)

-

Bodine Electric Company (Variable Speed AC Motors, Inverter Duty Gearmotors)

-

Elmech Industries (Three-Phase Inverter Duty Motors, High-Efficiency Induction Motors)

-

FUKUTA ELEC. & MACH. CO, LTD. (Inverter Duty Synchronous Motors, High-Torque AC Motors)

-

KEB Automation KG (Combivert F5 Inverter Duty Motors, Servo Motors)

-

Nidec Motor Corporation (U.S. MOTORS Inverter Duty Motors, HURST Inverter Motors)

-

Regal Rexnord Corporation (Marathon Inverter Duty Motors, Leeson Variable Speed Motors)

-

Veikong (Inverter Duty AC Motors, Frequency Inverters)

-

Watertronics (Pump Motors with Inverter Duty Rating, Variable Speed Pump Drives)

-

WEG (W22 Inverter Duty Motors, CFW11 Variable Frequency Drives)

-

Rockwell Automation (Allen-Bradley Inverter Duty Motors, PowerFlex Drives)

-

Bison Gear & Engineering (Inverter Duty Gearmotors, Permanent Magnet AC Motors)

-

Nanyang Harward Ex Machinery And Electronics Co., Ltd. (High-Efficiency Inverter Motors, Variable Speed Motors)

-

Crompton Greaves (Inverter Duty Induction Motors, IE3 Premium Efficiency Motors)

-

Havells India Ltd. (Crane Duty Motors, IE2 Inverter Duty Motors)

Recent Developments:

-

ABB's 2024 release of the IE5 liquid-cooled SynRM motor demonstrates up to 40% improved energy efficiency compared to conventional motors, supporting advanced performance in space-constrained applications.

-

In 2024, Fukuta Electric & Machinery Co., Ltd. introduced its high-efficiency inverter duty motors with improved coil insulation, designed for use with inverters. These motors offer enhanced energy savings, reliability, and easy maintenance, while achieving a precision of 1:50 or more.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 5.16 Billion |

| Market Size by 2032 | USD 12.35 Billion |

| CAGR | CAGR of 10.22% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Material (Laminated Steel, Cast Iron, Aluminum) • By Application (Pumps, Fans, Conveyors, Extruders, Others) • By Industry Vertical (Chemicals, Oil & Gas, Metal & Mining, Paper & Pulp, Food & Beverage, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | ABB, Adlee Powertronic Co., Ltd., AES Electronic Services, Bodine Electric Company, Elmech Industries, FUKUTA ELEC. & MACH. CO, LTD., KEB Automation KG, Nidec Motor Corporation, Regal Rexnord Corporation, Veikong, Watertronics, WEG, Rockwell Automation, Bison Gear & Engineering, Nanyang Harward Ex Machinery And Electronics Co., Ltd., Crompton Greaves, Havells India Ltd. |