Laser Processing Market Size:

Get more information on Laser Processing Market - Request Sample Report

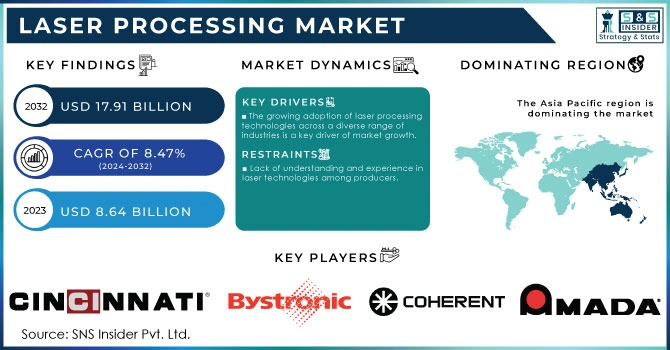

The Laser Processing Market Size was valued at USD 8.64 Billion in 2023. It is estimated to reach USD 17.91 Billion by 2032, growing at a CAGR of 8.47% during 2024-2032.

The laser processing market has witnessed remarkable growth, propelled by advancements in laser technology and its diverse applications across various industries. A primary driver of this expansion is the surging demand for automation and efficiency in manufacturing. Around 76% of manufacturers are adopting automation strategies to enhance productivity on the factory floor, which is projected to boost productivity by 0.8% to 1.4% annually. This shift enables manufacturers to respond more effectively to customer demands. Industries such as automotive, aerospace, electronics, and medical devices are increasingly leveraging laser technologies to refine production processes and improve product quality. In the automotive sector, for instance, laser cutting is extensively utilized to create intricate designs in lightweight materials, essential for enhancing fuel efficiency and overall vehicle performance. Additionally, laser welding offers robust and durable joints, making it a preferred choice for assembling vehicle components.

The electronics industry also benefits immensely from laser processing, especially in the fabrication of printed circuit boards (PCBs) and semiconductor components. The Consumer Technology Association (CTA) forecasts a 2.8% increase in U.S. retail sales of consumer technology, projecting a rise to USD 512 billion in 2024, rebounding from a 3.1% decline to USD 498 billion in 2023. The precision of laser technologies enables the creation of fine features that are crucial for modern electronic devices, facilitating the production of smaller and more efficient components. With the rapid evolution of consumer electronics, the demand for innovative and miniaturized products continues to rise, further driving the adoption of laser processing methods.

Laser Processing Market Dynamics

Drivers

-

The growing adoption of laser processing technologies across a diverse range of industries is a key driver of market growth.

Sectors like automotive, electronics, aerospace, and medical devices are increasingly realizing the benefits of using laser processing for their manufacturing and material handling needs. Laser processing is utilized in a variety of tasks in the automotive industry, such as cutting, welding, and surface treatment. The technology enables quicker production times and enhanced weld quality, enhancing the efficiency of automotive manufacturing overall. With the increasing demand for electric vehicles, laser processing becomes an appealing choice due to the requirements for lightweight materials and efficient manufacturing. Within the aerospace sector, laser processing is employed for creating important components like turbine blades and structural parts. The technology allows manufacturers to produce lightweight parts that adhere to rigorous safety and performance criteria. Moreover, the healthcare sector is also adopting laser processing for creating surgical tools and implants, emphasizing the importance of accuracy.

-

The demand for high-precision manufacturing is a critical driver of the laser processing market.

In sectors like aerospace, medical devices, and electronics, precision and attention to detail are essential in manufacturing components. Laser technology provides unparalleled accuracy, enabling manufacturers to achieve precise tolerances and detailed designs that are difficult to reproduce using traditional machining techniques. As industries progress and technologies improve, there is a growing focus on making things smaller and creating intricate shapes. In the field of electronics, the shift towards smaller, more effective devices requires the use of accurate manufacturing methods. Laser processing, which is capable of concentrating energy on a small surface, is well suited for cutting, etching, and drilling detailed designs on a range of materials such as metals, plastics, and ceramics. Moreover, the rising automation in manufacturing processes is in line with the abilities of laser processing. Automated laser systems are capable of operating with great speed and accuracy, guaranteeing uniform quality and minimizing human mistakes. This blend of accuracy and automation addresses the increasing need for effectiveness and excellence in production, driving forward the laser processing industry.

Restraints

-

Lack of understanding and experience in laser technologies among producers.

Despite the advantages of laser processing, some companies may not have the expertise needed to utilize these advanced technologies successfully. Specialized knowledge is necessary for operating, programming, and maintaining laser systems due to their complexity. Businesses who are not well-versed in laser technology may struggle to incorporate these systems into their current manufacturing procedures. This absence of skill may result in inefficiencies, mistakes, and longer periods of downtime, ultimately diminishing the potential advantages of laser processing. Moreover, the training needed to use laser systems may take a significant amount of time and money. Businesses might have to dedicate funds to training initiatives for their staff to guarantee they can utilize the machinery securely and efficiently. Smaller manufacturers with limited resources may find this investment in training to be especially challenging. The lack of skilled workers in the manufacturing sector worsens the problem even more. The need for skilled professionals to operate and maintain laser processing systems is growing due to its increasing popularity. Nevertheless, the supply of such skilled individuals is restricted, posing challenges for businesses in their search for suitable staff.

Laser Processing Market Segmentation

by Product

Fiber lasers led the laser processing market in 2023 with a 40% market share because of their high efficiency, adaptability, and small size. They use optical fibers for the gain medium, enabling increased power density and enhanced beam quality. This technology is especially popular in sectors like manufacturing, automotive, and aerospace for tasks such as cutting, welding, and marking. IPG Photonics and nLIGHT are dominant players in this field, offering top-notch fiber laser systems that improve manufacturing capabilities.

Solid lasers are expected to have the quickest-growing CAGR during 2024-2032, due to progress in laser tech and increased use in different industries. These lasers use solid-state gain media made of either crystalline or glass materials to generate intense laser beams. In industries like healthcare for laser surgery and manufacturing for precision cutting and engraving, they are commonly utilized. Coherent and TRUMPF are important contributors in this sector, developing solid laser solutions that improve both speed and accuracy in processing.

by Process

The magnetic resonance segment held a market share of over 30% in 2023 and led the market because of its extensive use in medical imaging and diagnostics. This method utilizes laser technology to boost the resolution and quality of images in magnetic resonance imaging (MRI). Siemens Healthineers and GE Healthcare incorporate high-tech laser systems in their MRI machines to enhance tissue distinction and expedite imaging processes. Moreover, incorporating lasers into MRI systems enhances real-time observation and enhances patient results, which is crucial in clinical settings.

Marking and engraving are supposed to experience a rapid growth rate during 2024-2032 in the laser processing market due to rising needs for customization and branding in industries such as automotive, electronics, and consumer goods. Laser marking and engraving are suitable for producing long-lasting, high-quality marks on various materials like metals, plastics, and glass due to their precision, versatility, and speed. Epilog Laser and Trotec Laser are two examples of companies that have created sophisticated systems for various purposes, such as product identification or detailed design projects.

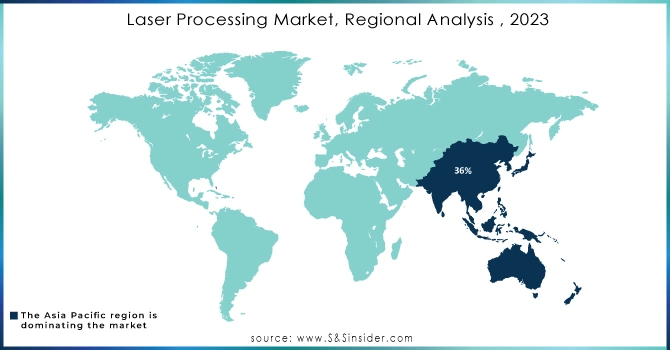

Laser Processing Market Regional Analysis

The Asia-Pacific region dominated the laser processing market in 2023 with a 36% market share, accounting for the largest market share due to the rapid industrialization and growing manufacturing base in countries like China, Japan, and India. The area exhibits a significant need for laser processing in industries like electronics, textiles, and metal manufacturing. Companies such as Han's Laser Technology and TRUMPF have built a significant presence by providing advanced laser cutting and engraving systems designed for various industries. The growing emphasis on automation and efficiency in manufacturing is leading to the use of laser technology to enhance production quality and cut operational expenses.

North America is anticipated to witness a rapid growth rate during 2024-2032 in the laser processing market, primarily driven by advancements in technology and increasing demand across various industries such as automotive, aerospace, and electronics. Significant investments in laser technology, combined with a strong research and development infrastructure in the region, are driving market expansion. IPG Photonics and Coherent are leading the way by offering cutting-edge laser solutions for cutting, welding, and marking tasks. The automobile industry is seeing significant advantages from using laser processing for accurate material cutting and creating lightweight design solutions.

Get Customized Report as per your Business Requirement - Request For Customized Report

Key Players

The key players in the Laser Processing Market are:

-

Trumpf (TruLaser Series, TruLaser Weld)

-

Cincinnati Incorporated (Laser Cutters, Fiber Laser Technology)

-

bystronic (byStar Fiber, bySprint Fiber)

-

Amada (FOL Series, ENSIS Series)

-

Lumentum (Photonics Solutions, Laser Diodes)

-

Coherent (INNOVA Lasers, META 2D Laser Processing)

-

Mazak (OPTIPLEX Series, FABRI GEAR Series)

-

Han’s Laser (Laser Cutting Machine, Laser Marking Machine)

-

IPG Photonics (YLR Series, Fiber Laser Systems)

-

Mitsubishi Electric (ML3015eX Series, Fiber Laser Cutting System)

-

JPT Opto-electronics (JPT MOPA Lasers, JPT QCW Lasers)

-

Nikon (Nikon Laser Processing Systems, Nikon Precision Laser Systems)

-

Sisma (Laser Marking Systems, Laser Cutting Systems)

-

Epilog Laser (Zing Laser Series, Fusion Pro Series)

-

Keyence (IL Series Laser Marker, ML Series Laser Marker)

-

Trotec Laser (Speedy Series, SP Series)

-

EKSPLA (PL-503D Series, EKSPLA Laser Systems)

-

Laserline (LDF Series, Fiber Laser Modules)

-

FANUC (FANUC Laser Cutting System, FANUC Robotics)

-

GSI Group (GSI Fiber Lasers, Laser Marking Systems)

Suppliers of Components to Key Players

-

Coherent

-

Thorlabs

-

Opto Engineering

-

Hamamatsu Photonics

-

Laser Components

-

ROFIN-SINAR Technologies

-

Optics Balzers

-

Lumenis

-

Vescent Photonics

-

Newport Corporation

Recent Development

-

October 2024: Coherent Corp., a top player in industrial laser technology worldwide, introduced a new 2D laser cutting head that provides a great combination of performance, versatility, and value to the global flat sheet cutting market.

-

October 2024: HIKMICRO, a top player in thermal imaging laser technology, has unveiled the much-awaited STELLAR 3.0 and THUNDER 3.0 series, setting new standards in hunting optics.

-

October 2024: Solukon launched the SFM-AT1500-S, a depowdering system that caters to the increasing need for a depowdering solution in the heavy load category at the top tier.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 8.64 Billion |

| Market Size by 2032 | USD 17.91 Billion |

| CAGR | CAGR of 8.47% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Product (Gas Lasers, Solid Lasers, Fiber Lasers, Others) • By Process (Magnetic Resonance, Cutting, Welding, Drilling, Marking and Engraving, Micro Processing, Advanced Processing, Others) • By Discrete Industry (Fixed, Moving, Hybrid) • By Industry Applications (Machine Tools, Microelectronics, Automotive, Medical, Aerospace, Architecture, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Trumpf, Cincinnati Incorporated, Bystronic, Amada, Lumentum, Coherent, Mazak, Han’s Laser, IPG Photonics, Mitsubishi Electric, JPT Opto-electronics, Nikon, Sisma, Epilog Laser, Keyence, Trotec Laser, EKSPLA, Laserline, FANUC, GSI Group |

| Key Drivers | • The growing adoption of laser processing technologies across a diverse range of industries is a key driver of market growth. • The demand for high-precision manufacturing is a critical driver of the laser processing market. |

| RESTRAINTS | • Another important barrier in the laser processing industry is the lack of understanding and experience in laser technologies among producers. |