Video as a Service Market Report Scope & Overview:

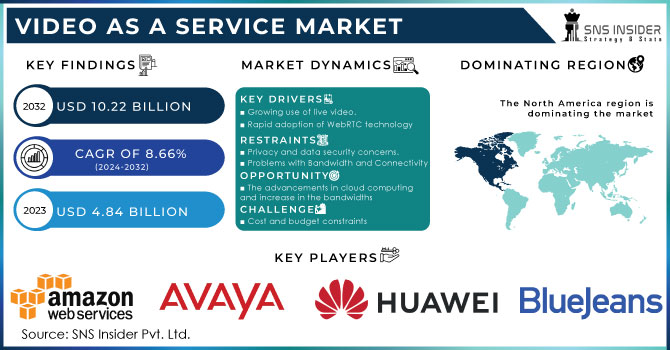

Video as a Service Market Size was valued at USD 5.53 Billion in 2023 and is expected to reach USD 20.35 Billion by 2032 and grow at a CAGR of 15.58% over the forecast period 2024-2032. Our research report indicated adoption rates per industry, organisations using cloud video services, a growth in a number of videos streamed on respective platforms, as well as a revenue per the average user obtained from Video as a Service (VaaS) solutions. Others include statistics which show the actual retention rate concerning customers and various consumption patterns from video-on-demand.

Get more information on Video as a Service (VaaS) Market - Request Sample Report

Market Dynamics

Drivers:

-

High-performance, scalable video solutions with optimal cost are seen to drive market demand in this VaaS landscape.

The demand for video-as-a-service (VaaS) is mainly driven by the growing need for cost-effective, scalable, and high-quality video solutions. Due to the flexibility and reduced infrastructure costs, businesses are opting for cloud-based VaaS platforms. Cloud-based solutions are also more reliable, offering high-definition video streaming and improved user experience. With the rapid adoption of remote work, online education and virtual events, VaaS is amplifying demand for such service - per government sources, increased customer engagement for business using VaaS platforms to such an extent that almost half of them now use video conferencing and live streaming in their daily operations.

Advancements in 5G networks are helping push VaaS adoption through enhanced streaming quality and expanding access to real-time video collaboration. The need for seamless integration of video with other enterprise systems, including CRM and marketing automation tools, also fuels this trend. As businesses shift to more flexible and remote models, VaaS is integral to staying competitive.

Restrain:

-

High initial setup costs and integration complexity may restrict Video as a Service Market growth.

The most significant challenges in the Video as a Service Market are high initial setup costs and integration complexity. Organizations face barriers when adopting cloud-based video solutions because of substantial upfront investments in technology infrastructure and training. Integration with legacy systems, such as CRM tools and content management systems, requires a lot of time, effort, and resources. Organizations generally also experience challenges with respect to the transition of their on-premise video systems to the cloud.

According to U.S. Department of Commerce reports, around one third of SMEs consider the solutions offered by cloud-based providers to be too expensive for deployment. VaaS platforms are also complex, and implementing them can prove challenging for large organizations, particularly when integrating them with other business applications. Despite these hurdles, however, vendors are trying to streamline the adoption process with much more user-friendly solutions; overcoming these hurdles is critical for broad market growth.

Opportunities:

-

The rising demand for remote collaboration and virtual events offers significant opportunities.

The revolution in remote work, telecommuting, and virtual events opens up a tremendous growth opportunity for the Video as a Service (VaaS) market. Because of flexible work environments and distributed workforces, the demand for cloud-based video solutions has increased much faster than ever. Governments around the world note that the workforce is now heading toward remote and dispersed positions, with the U.S. Bureau of Labour Statistics shows upto 25% rise in telecommuting during the past three years.

Virtual events, webinars, and online training will remain on the rise as organizations increasingly seek to engage employees and customers remotely. VaaS has become necessary for businesses that seek scalable, high-quality video streaming solutions to stay productive, collaborate, and engage with customers in a virtual setting. The Video as a Service Market is projected to grow fast as demand for virtual events and online learning rises. Education, healthcare, and professional services sectors are expected to be the greatest beneficiaries of such growth. Thus, this presents an opportunity for vendors to innovate and capture more market share.

Challenges:

-

Network latency and bandwidth limitations are significant challenges for VaaS platforms.

One of the key challenges facing the Video as a Service Market is network latency and bandwidth constraints, which are critical in the quality of video streaming and collaboration. Because VaaS depends significantly on internet connectivity for real-time communication, any disruption or degradation in network performance can result in poor video quality, interruptions, or delays. In a study of the government, one can see that broadband infrastructure remains inadequate in rural and underserved areas, which affects the reliability of cloud-based services such as VaaS.

The Federal Communications Commission (FCC) estimated that close to 7 million Americans lack access to high-speed broadband. Network congestion is also common, especially in urban centers at peak usage times. VaaS providers are working on optimizing content delivery through edge computing and regional data centers to address this challenge, but overcoming this issue is still a significant hurdle. These challenges are expected to be mitigated in the future with better internet infrastructure and the rollout of 5G technology.

Segment Analysis:

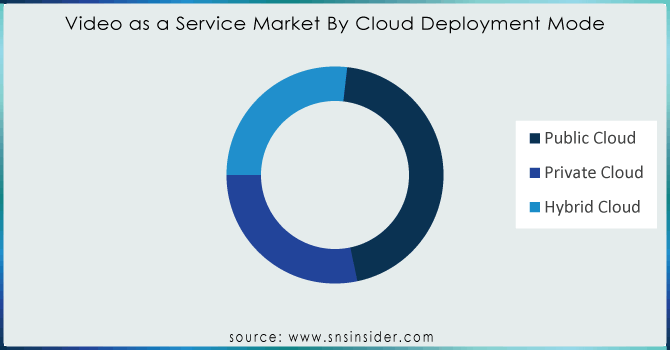

By Cloud Deployment Mode

The Public Cloud was the dominant segment for Video as a Service Market in 2023 with around 44% market share. Public Cloud solutions offer scalability, cost efficiency, and accessibility, which is a strong draw for businesses that wish to avoid the overhead of on-premise infrastructure. In an ongoing trend towards cloud-based services in every industry, Public Cloud solutions will likely remain on top. The segment is expected to grow with the fastest CAGR of 15.67% in the forecast period from 2024 to 2032. The growth is attributed to factors such as increasing demand for flexible and scalable video solutions, remote work, and seamless content delivery.

With the growth in cloud services, this means that various cloud providers are looking to improve their service to better meet the needs of businesses, such as streaming high-quality videos and making real-time communication more robust. Many companies will also be highly likely to shift to public cloud services considering the reduction of costs in infrastructure management and its increase in security measures for SMEs. Private and Hybrid Cloud deployments also make up some portion of the market, mainly due to businesses with unique security or compliance requirements. However, the entire market is still heavily skewed towards the segment of the public cloud, which most businesses opt for VaaS solutions.

By Vertical

The Education segment dominated the Video as a Service Market in 2023, commanding 21% of the market share. Distance learning and virtual classrooms are considered essential to today's education delivery. VaaS platforms provide schools with an effortless way of having online classes, webinars, and virtual collaboration, hence holding a great significance for K-12 as well as higher educational institutions. There has been a rise in the adoption of video-based learning tools, particularly with added interactive elements to promote engagement and bring education closer to more minds.

The Media & Entertainment segment is projected to grow with the fastest CAGR of 16.82% in the forecast period from 2024 to 2032. Rising demands for video streaming services, live events, and content creation tools have been accelerating this growth. Media and entertainment businesses use VaaS to provide High-Definition Video Streaming, deliver personal content in real-time broadcast. Over the Top (OTT) platforms as well as various social media outlets also add their fair share into creating the scalability video infrastructure of OTT which makes VaaS even more on demand in fulfilling consumers' ever increasing expectations regarding on-demand video contents worldwide. Other things being equal, video content production through AI/AR integration would have a profound growth impact, which would emerge as a high-potential area for VaaS.

By Application

The Corporate Communications segment showed the highest share of the market in 2023 at 29%, driven by the increasing demand for seamless communication and collaboration tools across enterprise-sized organizations. VaaS solutions facilitate video conferences, webinars, and internal communication, allowing organizations to improve employee engagement, productivity, and decision-making. That said, this segment has seen much adoption, particularly driven by the trend of hybrid and remote work, which actually requires much virtual face-to-face interaction.

On the other hand, the Broadcast Distribution segment is expected to grow with the fastest CAGR of 16.48% in the forecast period from 2024 to 2032. With the rapid expansion of live streaming services, sports broadcasts, and real-time video distribution, the demand for reliable broadcast infrastructure has surged. This facilitates the delivery of high-quality video to global audiences with minimal latency, opening new opportunities for both broadcasters, news agencies, and event organizers. With the proliferation of platforms like YouTube, Twitch, and more live-streaming services, demand for video distribution solutions is rapidly growing. In addition, with the development of 5G networks and cloud technology, the Broadcast Distribution segment is expected to continue its growth, enabling providers to offer more services and satisfy consumer demand for instant, high-definition video content.

Need any customization research/data on Video as a Service (VaaS) Market - Enquiry Now

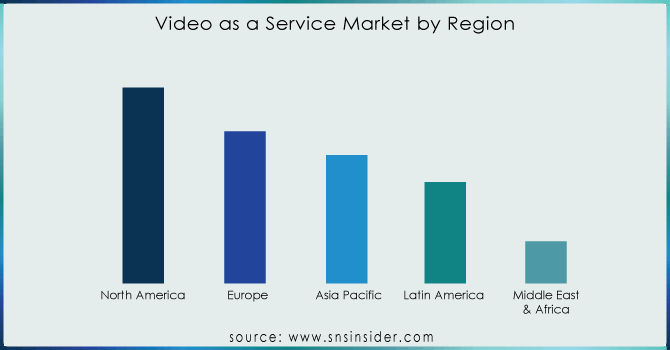

Regional Analysis

The Video as a Service (VaaS) market is growing rapidly across various geographies, with North America and Asia Pacific emerging as the dominant regions. North America region is leading the pack in 2023, and this is with a 40% market share. This comes about as the region is fast embracing cloud-based video solutions. The United States contributes highly towards the Video as a Service Market because the country hosts significant technology companies along with advanced digital infrastructure. North American businesses, including media, education, healthcare, and corporate sectors, are increasingly using VaaS solutions to improve collaboration, enhance customer engagement, and streamline operations. Advanced cloud services and high-speed internet are also contributing to the region's dominance in the Video as a Service Market.

The Asia Pacific region is projected to lead in terms of growth, with the highest CAGR of 16.18% during the forecast period from 2024 to 2032. For instance, this region has highly developed countries such as China, India, and Japan that have internet penetration at a rapid pace; therefore, the demand for video content surges. The growing middle class in the region, increased access to the internet, and increased demand for on-demand video services are driving the demand for VaaS platforms. The increasing number of remote workers, educational institutions shifting to e-learning, and the rise of streaming platforms further boost the market in this region. The Asia Pacific governments also are encouraging the development of digital initiatives and investment in broadband infrastructure, which should help increase adoption of cloud-based video solutions.

Key Players

Some of the Major Players in the Video as a Service Market Are

-

Zoom Video Communications (Zoom Meetings, Zoom Video Webinars)

-

Vimeo (Vimeo Live, Vimeo OTT)

-

Cisco Systems, inc (Webex, Cisco Video Surveillance)

-

Microsoft (Microsoft Teams, Skype for Business)

-

Amazon web service, inc (Amazon Chime, AWS Media Services)

-

Google Cloud (Google Meet, YouTube Live)

-

IBM (IBM Watson Media, IBM Cloud Video)

-

Brightcove (Brightcove Video Cloud, Brightcove Live)

-

Kaltura (Kaltura Video Platform, Kaltura Live)

-

Vonage (Vonage Video Conferencing, Vonage Business Communications)

-

Adobe (Adobe Connect, Adobe Primetime)

-

Logitech (Logitech MeetUp, Logitech Rally)

-

Pexip (Pexip Infinity, Pexip Cloud)

-

Panasonic (Panasonic Video Conferencing Solutions, Panasonic Live Streaming)

-

Vidyo (VidyoConnect, Vidyo.io)

-

PandaStream (PandaStream Cloud Video, PandaStream Live)

-

Wowza Media Systems (Wowza Streaming Engine, Wowza Cloud)

-

BlueJeans (BlueJeans Meetings, BlueJeans Events)

-

Tencent (Tencent Cloud, Tencent Meeting)

-

Alibaba Cloud (Alibaba Cloud Video, Aliyun Video Streaming)

Major Suppliers (Components, Technologies)

-

Intel (Semiconductors, Processors)

-

NVIDIA (Graphics Processing Units, AI Technology)

-

Qualcomm (Chipsets, Networking Solutions)

-

Broadcom (Networking Components, Communication Chips)

-

Microsoft (Cloud Infrastructure, Azure Data Centers)

-

Amazon (AWS Servers, Storage Solutions)

-

Akamai Technologies (CDN Services, Security Solutions)

-

Cisco Systems (Network Routers, Switches)

-

Arista Networks (Switching Technology, Cloud Networking Solutions)

-

Hewlett Packard Enterprise (HPE) (Servers, Storage Devices)

Major Clients

-

Amazon

-

Microsoft

-

Tesla

-

Google

-

Apple

-

IBM

-

Deloitte

-

Accenture

-

University of California

-

HSBC

Recent Trends

December 2024: Zoom is enabling its channel partners through the release of its new video SDK resale service. The Zoom Video SDK is now available, and the company is positioning it as a fully programmable software development kit that allows customers to integrate Zoom's core technologies—video, audio, screen sharing, and chat—into their products.

July 2024: Vimeo releases AI video translation for business users. The new feature will reportedly translate videos into any of up to 29 languages, recreating the voice and patterns of speech of the people shown.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 5.53 Billion |

| Market Size by 2032 | US$ 20.35 Billion |

| CAGR | CAGR of 15.18 % From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Application (Corporate Communications, Training & Development, Marketing & Client Engagement, Broadcast Distribution, Content Creation & Management, Other), • By Cloud Deployment Mode (Public Cloud, Private Cloud, Hybrid Cloud), • By Vertical (BFSI, Healthcare & Life Sciences, Retail & E-Commerce, IT & Telecom, Education, Government and Public Sector, Media and Entertainment, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Zoom Video Communications, Vimeo, Cisco Systems, Microsoft, Amazon Web Services (AWS), Google Cloud, IBM, Brightcove, Kaltura, Vonage, Adobe, Logitech, Pexip, Panasonic, Vidyo, PandaStream, Wowza Media Systems, BlueJeans, Tencent, Alibaba Cloud. |