Virtual Studio Market Report Scope & Overview:

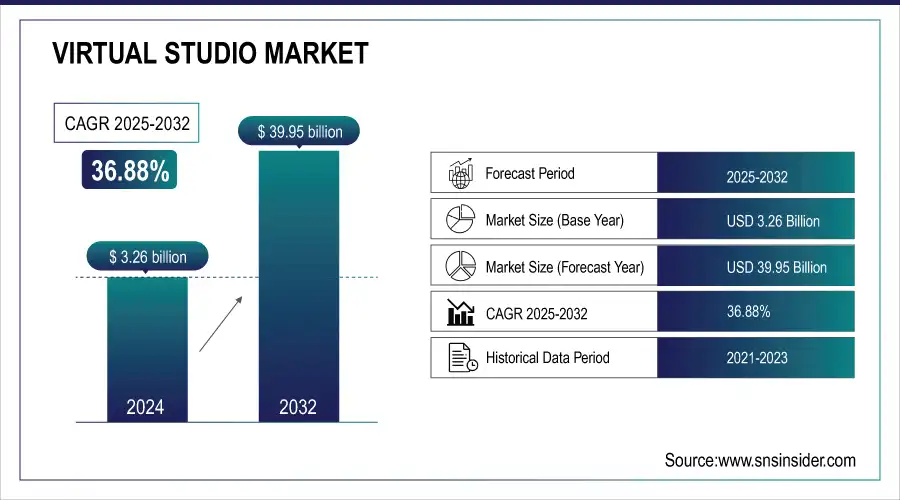

The Virtual Studio Market size was valued at USD 4.46 billion in 2025 and is expected to reach USD 103.03 billion by 2035, growing at a CAGR of 36.88% over 2026-2035.

The Virtual Studio Market growth is increasing as production of content in real-time but at a cost-effective price is on the rise throughout the media and entertainment industries. Improvements in real-time rendering engines, virtual production tools, and camera tracking technology have given studios the ability to really create great-looking visuals without having to shoot on physical sets. Rapid adoption has also been spurred by the increased need for more immersive content in films, television shows, live events, and streaming online.

Virtual Studio Market Size and Forecast:

-

Market Size in 2025: USD 4.46 Billion

-

Market Size by 2035: USD 103.03 Billion

-

CAGR: 36.88% from 2026 to 2035

-

Base Year: 2025

-

Forecast Period: 2026–2035

-

Historical Data: 2022–2024

To Get more information on Virtual Studio Market - Request Free Sample Report

Key trends in the Virtual Studio Market:

-

Rising adoption of virtual production technologies in film, TV, and media industries.

-

Increasing integration of real-time rendering and LED wall technologies.

-

Growing demand for immersive content in broadcasting, gaming, and live events.

-

Expansion of AR/VR tools for virtual production and studio automation.

-

Rising investments in cloud-based rendering and collaborative production platforms.

-

Strategic partnerships between technology providers and entertainment studios to enhance production efficiency.

-

Rapid adoption of AI-driven content creation and virtual asset management systems.

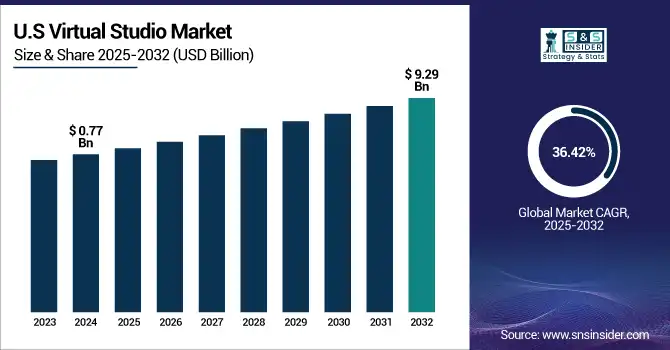

The U.S. Virtual Studio Market size was valued at USD 0.77 billion in 2024 and is expected to reach USD 9.29 billion by 2032, growing at a CAGR of 36.42% over 2025-2032.

The growth of the U.S. Virtual Studio Market is due to the increasing adoption of scalable-source real-time production tools, rising demand for remote production and content creation, increased investment in many advanced broadcast technologies across entertainment, advertising, and even live events which continue to be strong in the post-pandemic era against the backdrop of Digital Transformation.

Virtual Studio Market Drivers

-

Growing Demand for Real-Time Content Creation Is Accelerating the Adoption of Advanced Virtual Production Tools and Environments Globally

As the need for real-time content generation in film, TV and streaming increases, the production houses are moving to virtual studios. By utilizing real-time integrated CGI with live-action imagery, these studios are able to provide greater flexibility, cost savings, and faster turnaround on content. Growing demand that is especially in entertainment and broadcast sectors where speed and quality are key factors. In addition to this, virtual studios are used by gaming and eSports industries to provide a more engaging experience. Such a shift allows for smooth remote collaboration, easy post-production, and increases efficiency, making real-time content generation, a formidable market-fuelling engine.

-

Abertay University has used 5G-enabled virtual production in a project - collaborating with other UK partners to allow actors filmed 280 miles apart in Dundee and Manchester to connect and interact in a shared virtual environment in real-time, demonstrating the power of remote collaboration without requiring physical co-location.

Virtual Studio Market Restraints

-

High Initial Investment in Virtual Studio Infrastructure Limits Adoption Among Small-Scale Studios and Independent Content Creators

High-res LED walls, accurate camera tracking systems, rendering engines, and bespoke software requires an expensive initial capital investment for virtual studios. Costs such as these are often prohibitive and a barrier to entry for smaller studios and indie producers. Moreover, high ongoing maintenance and upgrade costs further deter adoption. Large media houses can presumably justify the cost owing to a higher production run, while independent creators typically need to work with conventional setups. Financial constraints limit mass market penetrance, mainly in developing regions, where a lack of access to funding, in addition to budget restrictions, leads to impediments when scaling up virtual studio deployments.

Virtual Studio Market Opportunities

-

Integration With AI And Real-Time Rendering Engines is Unlocking Next-Gen Creativity and Automation in Virtual Production

The pace, creativity and direction that artificial intelligence and real-time rendering technologies such as Unreal Engine has for how virtual studios create content is changing. With the help of AI for generating scenes, changing lighting, and tracking objects, repetitive tasks will be completed through tools thus releasing human resources for creative work. Real-time rendering is a high-quality rendering technique that provides photorealistic outputs in no time, which adds life to the virtual environments. It shortens production time and enhances storytelling skill. This integration is a key opportunity to take the market to the next level of technology, as these technologies mature, virtual studios can provide more customization, smarter and more adaptive workflows.

-

Epic Games announced full integration of MetaHuman 5.6 to Unreal Engine, provides the access for real-time animation and expressiveness to be compatible directly within the Unreal Engine in 2025. Additionally, new MetaHuman Animator can create high-fidelity facial animation from audio or camera input alone.

Virtual Studio Market Challenges

-

Managing Large Data Volumes in Real-Time Places Pressure on Network Infrastructure and Storage Capabilities in Virtual Studio Setups

Virtual studios need to render, process and store enormous amounts of high-resolution visual data in real-time. These data loads require powerful computing and ultra-fast network connections that are not always available or affordable. Poor bandwidth means dips, frame drops or delayed renders that can break a live production. Large files for big projects, particularly render outputs, need scalable storage, which means costs to the infrastructure also grow. For studios that do not have high-performance IT environments, the operational risks of data are significant. Meeting these needs is crucial to deliver high quality, reliable virtual experiences.

Virtual Studio Market Segmentation analysis:

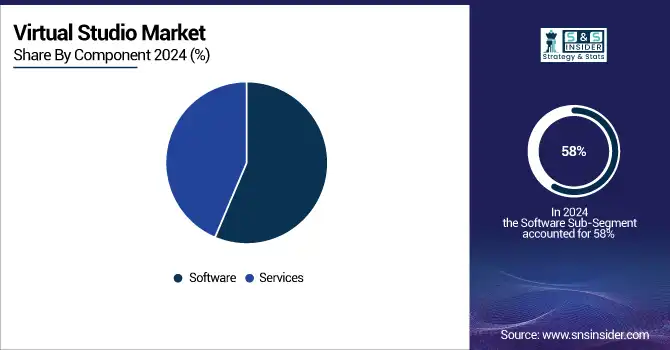

By Component

The software segment dominated the Virtual Studio Market share of a 58% in 2025 owing to the high demand for real-time rendering, VFX tools, and virtual production platforms including Unreal Engine and more. Ideal for studios using digital production techniques across the film, television, and live media industries, these software solutions create artistic production freedom, integrate seamlessly with hardware, and streamline content creation workflows.

The services segment is projected to grow at the fastest CAGR of 38.23% over 2026 to 2035 due to growing demand for consulting, integration and managed services With more companies coming into the production office requiring virtual studio setups that come with intricate configurations, execution of real-time collaboration, and constant maintenance, such companies need expertise in their corner. The stickiness here is especially pronounced with first time users who are looking for end-to-end service support for seamless implementation and operations.

By Deployment

The on-premises segment captured 53% of the Virtual Studio Market revenue in 2025 as a result of larger media houses that prefer high-performance, secured, and customizable production environments. On the other hand, for big-budget projects in which speed, security, and quality are existential pillars, on-premises configurations give enhanced control over sensitive material and low-latency operation and alignment with studio-owned, proprietary infrastructure.

The cloud-based segment is expected to grow at the fastest CAGR of 38.51% over 2026 to 2035, driven by the demand for production solutions that are more flexible, scalable, and suitable for remote use. Cloud platforms decrease hardware dependence, allow collaboration across the globe, and easily offer access to high-grade virtual production equipment. Such on-demand, pay-as-you-go resources at a low-cost without a major capital investment is particularly appealing to SMEs and content creators.

By Enterprise Size

Large enterprises held a 60% revenue share in the Virtual Studio Market in 2025, owing to their larger capacity for investing in technology, skillful personnel, and in-house production capacity over SMBs. Quality and scale are also critical for these organizations, which tend to create high-budget content that benefits from cutting-edge virtual production tools, and thus, can be expected to maintain their dominance throughout the spectrum.

SMEs are expected to grow at the fastest CAGR of 38.55% over 2026 to 2035 owing to rising adoption of low-cost virtual studio solutions. Thus cloud-based platforms, subscription-based models, and modular software tools are enabling smaller businesses and content creators to participate in the virtual production arena. Further democratization of technology allows small and medium enterprises (SMEs) to innovate and cost-effectively scale what they offer in digital content.

By Application

The post-production editing segment held a 28% revenue share in 2025, driven by its high emphasis on merging CGI, virtual environments & compositing with live action footage. Virtual studios vastly increase how much one can change the original material instantly, which is a dream come true for an editor. It is a market-leading application among higher budgeted films and TV, with the vast majority of it produced using virtual editing workflows.

Live streaming and broadcasting is forecasted to grow at the fastest CAGR of 40% over 2026 to 2035, primarily on account of the increasing demand for immersive, real-time visual content through sports analytics and eSports events. Dynamic backgrounds and interactive backdrops with live graphics can increase viewer response thanks to virtual studios. These setups are becoming increasingly popular with broadcasters as a way to stand out from the competition, and offer rapid remote production elasticity.

By End Use

The online videos segment accounted for 33% of the Virtual Studio Market revenue in 2025 due to high demand for creative content from platforms such as YouTube, Tiktok and Instagram. The proliferation and democratization of virtual production tools have become the latest trend for content creators, influencers, and the brands they serve to inject a new level of creativity into visual storytelling, improve post-production efficiencies, and compete in an ever-evolving digital media landscape.

Commercial ads are anticipated to grow at the fastest CAGR of 38.95% over 2026 to 2035 as virtual studios are increasingly being used to create visually appealing and more cost-effective advertisements. Real-time rendering and virtual environments allow brands to create the most personalized, experiential campaigns possible. The prospect of cutting down on shoot costs, time and visual aesthetics makes advertising sector adopts it fast.

Virtual Studio Market Regional Analysis

North America held the largest revenue share of 34% in the Virtual Studio Market in 2025 as most of the leading studios launched the advanced production technologies across the U.S. and Canada. Support from leading technology providers, solid infrastructure and a developed media and entertainment industry have been encouraging ongoing investment in virtual production solutions, hence the Middle East stakes a strong claim as global vanguards of virtual studio adoption.

Get Customized Report as per Your Business Requirement - Enquiry Now

The U.S. is dominating the Virtual Studio Market in North America due to its advanced media infrastructure and early adoption of virtual production technologies.

Asia Pacific is expected to grow at the fastest CAGR of 39.32% over 2026 to 2035, due to solid digital transformation processes boosting content creation across developing economies such as China, India, and South Korea and growing need of immersive media market. Increased government backing for creative industries, the rise of OTT platforms, growing knowledge about cost-effective virtual production tools and a fragmented media environment are all enabling quicker adoption in dynamic studios across the region.

China is the leader of the Virtual Studio Market in Asia Pacific owing to large scale investments in Digital media, grown infrastructure and a rise of entertainment sector with potential.

Europe is experiencing strong growth in the Virtual Studio Market, due to the high demand for virtual production in film, advertising, and broadcasting. Technological innovation and government-backed creative industry initiatives are leading adoption by countries such as the UK, Germany and France.

The U.K. is dominating the Virtual Studio Market in Europe, owing to the presence of established and well-served film production hubs, the high adoption of advanced technology and government support.

Emerging markets such as Middle East & Africa and Latin America are driven by digital transformation, expanding media sectors, and digital content creators investing in virtual production, fueling key Virtual Studio Market trends among broadcasting, advertising and entertainment applications.

Virtual Studio Market Companies are:

-

Adobe Inc.

-

Autodesk, Inc.

-

Avid Technology, Inc.

-

Blackmagic Design Pty Ltd

-

Chaos Group Ltd.

-

Emerson Electric Co.

-

Epic Games, Inc.

-

Foundry Visionmongers Ltd.

-

Harmonic Inc.

-

Luxion, Inc.

-

Maxon Computer GmbH

-

Microsoft Corporation

-

Monarch Innovative Technologies Pvt. Ltd.

-

Nippon Control System Corporation

-

OTOY Inc.

-

PreSonus Audio Electronics, Inc.

-

SideFX Software Inc.

-

Unity Technologies

-

Vizrt Group

-

Pixotope Technologies AS

Competitive Landscape for the Virtual Studio Market:

Adobe Inc.

Adobe Inc. is a U.S.-based leader in creative and multimedia software solutions, specializing in video editing, visual effects, and virtual production tools. With decades of experience, the company develops industry-standard products such as Adobe After Effects, Premiere Pro, and Adobe Substance 3D. Adobe operates globally, providing software, cloud services, and support for media, entertainment, and broadcast industries. Its role in the virtual studio market is vital, as it enables content creators to produce high-quality, immersive media with advanced compositing, motion graphics, and real-time collaboration capabilities.

-

In 2025, Adobe previewed enhancements to its Creative Cloud suite, including AI-assisted video editing and real-time rendering capabilities for virtual studio productions.

Autodesk, Inc.

Autodesk, Inc. is a U.S.-based software powerhouse specializing in 3D design, animation, and simulation tools for media, entertainment, and virtual production. The company provides solutions such as Autodesk Maya, 3ds Max, and ShotGrid, which are integral to visual effects, virtual set design, and real-time content creation. Autodesk’s role in the virtual studio market is crucial, as it offers creative professionals the tools to build, simulate, and animate complex virtual environments efficiently.

-

In 2025, Autodesk launched new collaborative features in Maya and 3ds Max, enabling multi-user workflows in virtual studio projects, enhancing efficiency and real-time creative decision-making.

Avid Technology, Inc.

Avid Technology, Inc. is a U.S.-based leader in audio and video production solutions, specializing in non-linear editing, media asset management, and broadcast workflows. The company provides tools such as Media Composer, Pro Tools, and Avid NEXIS storage systems, widely used in virtual studios, film, and broadcast production. Its role in the virtual studio market is significant, supporting seamless content creation, post-production, and live production with scalable, collaborative systems.

-

In 2025, Avid introduced an integrated virtual studio workflow combining Media Composer and Pro Tools with cloud-based media collaboration, streamlining production pipelines for global content teams.

Blackmagic Design Pty Ltd

Blackmagic Design Pty Ltd is an Australia-based innovator in video technology, specializing in cameras, switchers, and post-production solutions for virtual studios. The company’s product portfolio includes the URSA Mini Pro cameras, ATEM switchers, and DaVinci Resolve software, enabling high-quality virtual production and real-time color grading. Blackmagic Design plays a pivotal role in the virtual studio market by delivering end-to-end hardware and software solutions that empower studios to produce immersive, professional-grade content efficiently.

-

In 2025, Blackmagic Design released the URSA Mini Pro 12K with advanced real-time virtual production support, paired with ATEM Mini Extreme for live virtual studio operations, enhancing creative flexibility and production quality.

| Report Attributes | Details |

|---|---|

| Market Size in 2025 | USD 4.46 Billion |

| Market Size by 2035 | USD 103.03 Billion |

| CAGR | CAGR of 36.88% From 2026 to 2035 |

| Base Year | 2025 |

| Forecast Period | 2026-2035 |

| Historical Data | 2022-2024 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Component (Software, Services) • By Deployment (On-Premises, Cloud-based) • By Enterprise Size (SMEs, Large Enterprise) • By Application (Virtual Sets and Environments, Motion Capture and Tracking, Rendering and Animation, Live Streaming and Broadcasting, Post-Production Editing) • By End Use (Movies, TV Shows, Commercial Ads, Online Videos, Others) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

| Company Profiles | Adobe Inc., Autodesk, Inc., Avid Technology, Inc., Blackmagic Design Pty Ltd, Chaos Group Ltd., Emerson Electric Co., Epic Games, Inc., Foundry Visionmongers Ltd., Harmonic Inc., Luxion, Inc., Maxon Computer GmbH, Microsoft Corporation, Monarch Innovative Technologies Pvt. Ltd., Nippon Control System Corporation, OTOY Inc., PreSonus Audio Electronics, Inc., SideFX Software Inc., Unity Technologies, Vizrt Group, Pixotope Technologies AS |