Card-Based Electronic Access Control Systems Market Report Scope & Overview:

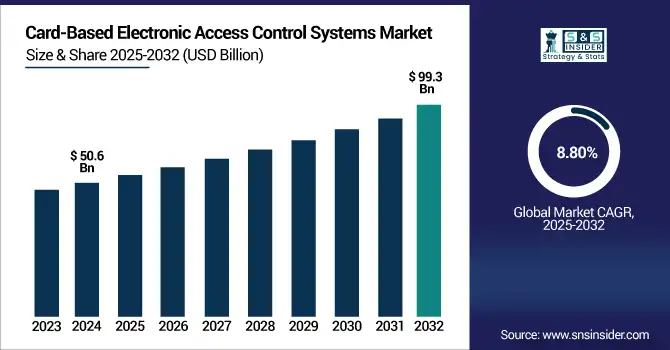

The card-based electronic access control systems market size was valued at USD 50.6 billion in 2024 and is expected to reach USD 99.3 billion by 2032, growing at a CAGR of 8.80% during 2025-2032.

To Get more information on Card-Based Electronic Access Control Systems Market - Request Free Sample Report

Card-Based Electronic Access Control Systems Market growth is driven by the growing demand for identifiable, trackable, and efficient electronic locks for controlling access on premises in residential, commercial, and government. Such systems as those underpinned by magnetic stripe cards, proximity cards, and smart cards enable authentication, meaning they lower the security risks posed by unauthorized access, and they also provide for audit trails. The demand is also being propelled due to factors such as rapid urbanization, increasing adoption of smart building technology, and security concerns in sectors such as BFSI, healthcare, education, and defense. The combination of biometric and IoT technologies makes the system more functional and gives opportunities for innovation. with the shift to mobile-enabled and touchless solutions, deployment has also picked up pace. The market was dominated by North America, due to strict regulations, whereas the growth rate was highest in Asia-Pacific, as infrastructure development and smart cities initiatives are on the rise. The market is expected to grow broadly until 2032, and the growth impetus will stem from ongoing technological advancements and cloud-based solutions.

Card-based electronic Access Control Systems Market trend in the U.S. is projected to grow from USD 15.2 billion in 2024 to approximately USD 29.1 billion by 2032, reflecting a robust 8.50% CAGR. Key growth factors are a high level of security and compliance required in commercial, government, and residential, and increasing adoption of cloud‑based, contactless, and biometric card access solutions in this field.

Market Dynamics:

Drivers;

-

Increasing Security Threats Across Sectors Are Driving Widespread Adoption of Card-Based Electronic Access Systems

A rise in the occurrence of theft, intrusions, and workplace violence has increased the need for strong access control. Due to their reliability, security, efficiency, and auditability, card-based solutions work perfectly for controlling access to sensitive areas within commercial offices, government buildings, and data centers. They have centralized control access and provide fast control in crises. Moreover, regulatory mandates such as HIPAA in healthcare and FISMA for the federal agencies also create a compelling need for enhanced access control. Card-based systems are a core component of enterprise-wide risk management strategies because their scalability and flexibility support organizations as they reposition security policies to be data-driven.

In 2024, 68% of data breaches involved a non-malicious human element (like phishing), and a swift phishing click often occurs in under a minute, amplifying risk across all sectors

Restraints:

-

Susceptibility to Card Cloning and Duplication Is Reducing Trust in Legacy Card Technologies

Traditional card-based systems, particularly those over magnetic stripe or low-frequency proximity cards, while still beneficial in terms of security, cannot stave off security breaches from things like cloning or skimming of the card. Access tokens to high-security areas can theoretically be duplicated by criminals with a piece of cheap hardware. Such vulnerabilities could be highly troubling in industries that manage sensitive information, like finance or healthcare. Even though smart cards and keys provide some level of added security, the lack of ubiquitous legacy infrastructure at many institutions has stalled the broader roll-out of improved systems. The expense to migrate and the operator impact of moving to new card technologies disincentivise operators from making their systems truly secure and hinder the growth of the market.

In 2024, RFID tag cloning cases increased by 50% between 2021 and 2023, highlighting the widespread success of cloning attacks against MIFARE and similar systems

Opportunities:

-

Rising Integration with Biometrics and Mobile Access Is Creating Advanced Multi-Factor Authentication Capabilities

The intersection of access on a card with mobile and biometric can create the opportunity to really upgrade security and user manual credibility. Two-factor authentication: Combining biometric types, e.g., fingerprint, iris, or facial-based identifiers, with card-based access control credentials boosts security. Furthermore, mobile access control is on the rise, enabling users to use their smartphones as a digital key, which changes the way we experience the system. Modern management platforms that are cloud-based now support remote credential provisioning, provide real-time monitoring and detailed audit trails, which is ideal for any modern enterprise. This unique model caters to industries that want scalable, contactless, and secure solutions, providing a source of revenue for vendors eager to innovate while expanding their portfolios.

Organizations using biometrics for physical access control are set to rise from 35 % in 2024 to 48 % by 2025, highlighting growing reliance on biometric-enabled card systems for stronger authentication.

Challenges:

-

High Initial and Maintenance Costs for SMEs Are Hindering Large-Scale Adoption in Budget-Constrained Environments

Though card-based electronic access control systems provide years of security and convenience, the high initial investment for deployment, such as hardware, software licensing, and installation, can be prohibitive for small and medium enterprises (SMEs). Total ownership costs are compounded by maintenance, system updates, and technical training. In these cash-strapped times, SMEs will often find that the return on investment remains elusive, particularly where basic security measures appear to offer the desired protection. Also, the integration of access systems with existing IT and physical infrastructure is quite complicated, and this makes people not prefer to use it. Vendors can tackle this challenge by providing more modular, affordable, and scalable solutions designed for smaller deployments.

Segmentation Analysis:

By Component:

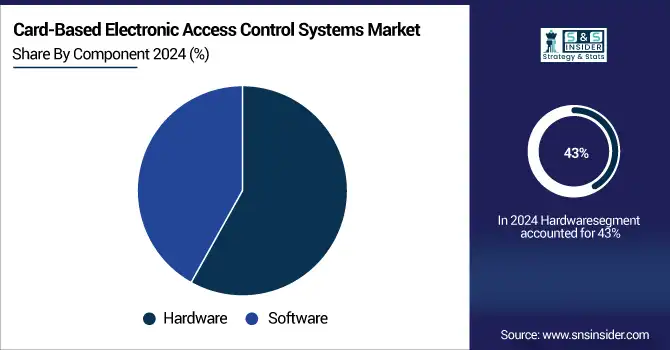

The hardware segment dominated the market in 2024 and accounted for 43% of the card-based electronic access control systems market share, due to the large-scale installation of card readers, control panels, and access cards in various commercial and institutional establishments. Steady demand is underpinned by increasing security investments, modernization of fraud/smart card readers, and continued upgrades. Hardware will still remain ahead as installations overall in all the most at-risk zones and at large-scale enterprises continue to rise through 2032.

The software segment is expected to register the fastest CAGR due to the Rising adoption of cloud-based access management platforms and real-time monitoring tools. Centralized credential management, integration with biometric systems, and growing demand for data analytics in access control environments are further spurring the growth. Smart building automation and AI-enabled access insights propel future expansion.

By Type:

Networked access control systems dominated the card-based electronic access control systems market in 2024 and accounted for 79% of revenue share, as networked access control systems provide scalable, centralized control, and ease of integration with surveillance and building management systems. These are favored for real-time monitoring and remote access in enterprise and government applications. Networked systems will continue to dominate by 2032 as smart infrastructure investments and cybersecurity features expand, found primarily in multi-site organizations.

Standalone access control systems are expected to register the fastest CAGR owing to their low-cost, easy installation and best suited for small sized businesses and home applications. The increasing demand for rapid-deployment security solutions in SMBs and temporary installations are strongly propelling the growth upexcitation. More persistent adoption, with better offline capabilities and easier user management interfaces.

By Application:

The commercial segment dominated the card-based electronic access control systems market in 2024 and accounted for a significant revenue share, due to strong demand for framed and traceable access in offices, retail spaces, hotels, and corporate buildings. Adoption is fueled by increasing concerns about data security, employee safety, and compliance. Businesses will continue to seek scalable, integrated access solutions to protect assets and people, and as such, this segment will remain the leader through 2032.

The residential segment is expected to register the fastest CAGR, due to A growing number of consumers have become aware of home security, and with the growing integration of mobile applications and IOT devices, have been able to accelerate the speed of adoption. As it continues to evolve, homeowners will continue to look for the convenience and automation that comes with smart technology, as well as ever-greater security capabilities at the perimeter.

By End-Use:

Government & defense dominated the card-based electronic access control systems market in 2024 and represented a significant revenue share, as stringent security regulations and a requirement for multi-layered access control and protection of sensitive infrastructure established high demand. This leads to mass rollouts where national security or high-security clearance areas need to be administered. Strong progress is expected with further digitization of public infrastructure and border control, an increasing blend of biometric verification with card-based systems, where adoption continues through to 2032.

The healthcare segment is expected to register the fastest CAGR, driven by data privacy regulations (for instance, HIPAA), the requirement to safeguard restricted medical areas, and to preserve patient records. There is increasing demand for secure, compliant access control that works with electronic health records. Accelerated growth, as hospitals expand, digitize, and look for contactless and mobile-enabled security solutions.

Regional Analysis:

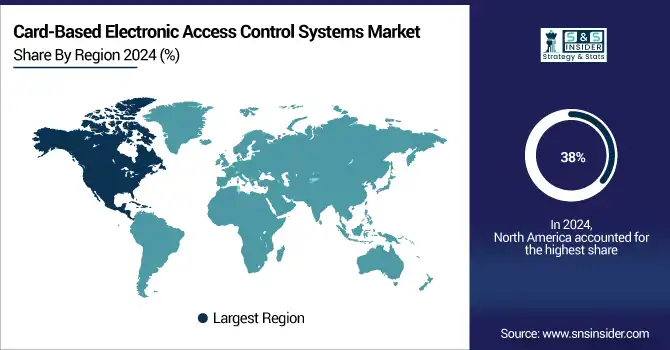

North America dominated the card-based electronic access control systems market in 2024 and accounted for 38% of revenue share, owing to early adoption of next-generation security technologies across the region, enforced stringent regulatory frameworks, and extensive deployment of card-based electronic access control systems across commercial, government, and institutional facilities. The demand continues to be supported by investments in critical infrastructure protection and smart buildings. Demand will continue to be robust through 2032 as more upgrades are made to mobile and integrated card access systems using biometric capabilities.

According to a card-based electronic access control systems market analysis, Asia-Pacific is expected to register the fastest CAGR, driven by rapid urbanization, large-scale infrastructure development, and increasing security requirements in emerging economies like India and China. The growing Government-backed smart city projects are driving adoption and an increase in the number of corporate digitization & new industry expansions. Adoption of IoT-driven access control and modernization efforts in the public sector will further propel market growth through the entire forecasting period, leading to 2032.

Europe’s market growth is driven by attributed to stringent data protection legislation (EX: GDPR), modernization of public infrastructure, along with increasing demand for secure access control for commercial and healthcare industries. Integration of cloud based platforms along with biometric access systems in developed economies will aid future growth till 2032.

Germany dominated the European market due to high security of government, industrial automation, and corporate environments. The demand has continued to grow with the increased adoption of smart building solutions and secure ID programs. Germany has been at the forefront of secure access technology and digital transformation, helping to sustain market momentum through 2032.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players:

The major card-based electronic access control systems market companies are HID Global Corporation, Identiv Inc., Allegion plc, ASSA ABLOY AB, Dormakaba Holding AG, Honeywell International Inc., Johnson Controls International plc, Bosch Security Systems GmbH, Siemens AG, Suprema Inc., IDEMIA, Gallagher Group Ltd., Nedap N.V., Tyco Security Products, Brivo Inc., Gemalto NV, Southco Inc., ZKTeco Co. Ltd., Salto Systems S.L., Kisi Inc. and others

Recent Developments:

-

November 12, 2024: HID acquired IXLA, expanding its card and passport personalization portfolio and boosting international credential issuance

-

July 10, 2025: HID acquired Calmell Group to deepen its presence in public transportation smart ticketing

|

Report Attributes |

Details |

|

Market Size in 2024 |

US$ 50.6 Billion |

|

Market Size by 2032 |

US$ 99.3 Billion |

|

CAGR |

CAGR of 8.80% From 2025 to 2032 |

|

Base Year |

2024 |

|

Forecast Period |

2025-2032 |

|

Historical Data |

2021-2023 |

|

Report Scope & Coverage |

Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

|

Key Segments |

• By Component (Hardware, Software, Services) |

|

Regional Analysis/Coverage |

North America (US, Canada), Europe (Germany, France, UK, Italy, Spain, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, ASEAN Countries, Australia, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar,Egypt, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America) |

|

Company Profiles |

HID Global Corporation, Identiv Inc., Allegion plc, ASSA ABLOY AB, Dormakaba Holding AG, Honeywell International Inc., Johnson Controls International plc, Bosch Security Systems GmbH, Siemens AG, Suprema Inc., IDEMIA, Gallagher Group Ltd., Nedap N.V., Tyco Security Products, Brivo Inc., Gemalto NV, Southco Inc., ZKTeco Co. Ltd., Salto Systems S.L., Kisi Inc. and others in the report |