Video Conferencing Systems Market Report Scope & Overview:

To get more information on Video Conferencing Systems Market - Request Sample Report

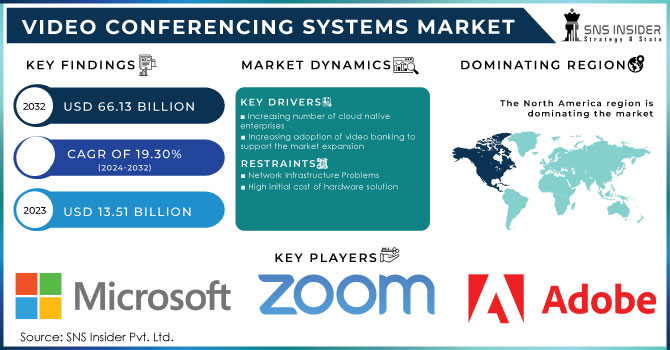

The Video Conferencing Systems Market was valued at USD 13.51 billion in 2023 and is expected to reach USD 66.13 billion by 2032, growing at a remarkable CAGR of 19.30% during the forecast period of 2024-2032.

The main drivers of market growth are the growing number of cloud native businesses, as well as an increasing appetite for eLearning and remoteness. The growth in business spending on videoconferencing systems has been driven by the need to involve employees in defining strategic objectives, reduced travel time and costs, and growing demand for virtual meeting rooms. The main drivers that influence market growth positively are the increasing demand for videoconferencing, virtual administrative management and cloud technology-based collaboration tools. In order to make decisions more quickly and effectively, companies and organisations are using video collaboration technologies with a view to avoiding the high costs of travel.

Market Dynamics

Key Drivers:

-

Increasing number of cloud native enterprises

The information received from face to face and directly with several business divisions, clients, distributors, suppliers or customers, organisations can operate their businesses more effectively. Therefore, enterprises invest more money in the use of cloud services. Expenditure on videoconferencing is expected to rise during the forecast period, in terms of cloud conferencing, Infrastructure as a Service and Business Intelligence Software.

-

Increasing adoption of video banking to support the market expansion

Restraints:

-

Network Infrastructure Problems

In spite of the fact that most advanced countries have extensive communications infrastructures, few developing and underdeveloped nations lack adequate communication infrastructure to allow high quality video transmissions. In these countries, the majority of people are relying on audio communication in order to prevent annoyances from poor video and occasional disconnection. Audio based communication, compared to video communication.

-

High initial cost of hardware solution

Opportunities:

-

Growing preference for remote learning and e-learning

The distance learning as opposed to traditional classroom teaching, business, educational institutions and K–12 institutions have introduced conference calling systems. More schools are using video communication technology to increase remote learning as a result of the pandemic.

-

The hardware market for video conferencing is booming.

-

A variety of data-intensive applications are emerging, including augmented reality (AR) & virtual reality (VR), and video apps.

Challenges:

-

The market for nonagile products is difficult to tap

Video conferencing systems are not as easy to use for some users compared with old technology or audio conference. 23% of respondents said they were not comfortable with videoconferencing, and 75% still preferred audio conferencing according to a survey conducted by West Unified Communications that included more than 230 Full Time American employees. Many businesses are struggling to adopt videoconferencing technology and increase employee utilisation.

Impact of Economic Slowdown:

A number of factors, such as increasing demand for Unified Communication, the transformation of the workforce around the world and a focus on digitalisation in organisations contribute to this growth. In view of the growing importance of conferencing and collaboration by these companies, it is projected that SMEs segment will have a considerable growth with an expected compound annual growth rate of approximately 15.1% over the next few years. Moreover, due to the high demand for conference video endpoints, the enterprise segment continues to be dominated by larger organisations and accounts for a significant share of revenues. On the regional level, North America has been dominant and is expected to continue its dominance due to its advanced telecommunications infrastructure, the presence of large technology companies and a highly innovative culture.

Impact of Russia Ukraine War:

The specific details of this sector are not directly addressed in the information available, the crisis in Russia Ukraine has had a significant impact on various global markets, including the potential impact on the video conferencing systems market. As the crisis has led to a sharp rise in Russian government supported cyber-attacks, countries close to Russia and Ukraine are increasing their defence spending with major implications for cyber security. As organisations and governments increasingly prioritise cybersecurity in their communication tools to respond to the threat environment, this climate of increased security concerns could indirectly affect the video conferencing systems market by encouraging a higher demand for safe communications channels. In order to avoid waste of precious resources, a confirmatory recce will be carried out after target analysis and determination of the target, which could be a Russian command and control centre or a vehicle, etc.

The impact of the war, including a huge investment requirement to rebuild Ukraine and changes in Europe's energy dependency, could have far reaching effects on market dynamics, as well as technology sectors. As businesses adapt to the new realities of economics and security, changes in business operations and communications needs could be driven by changing energy supply patterns and increased emphasis on safety, which might affect demand for video conferencing services.

Market Segmentation:

By Component

-

Hardware

-

Solution

-

Services

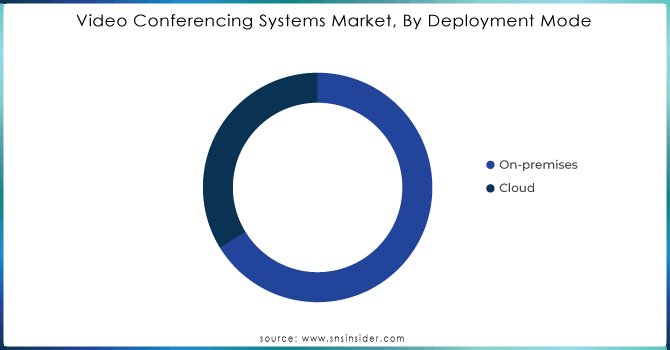

By Deployment Mode

-

On-premises

-

Cloud

In terms of deployment, the on-premise segment accounted for around 59.9% of revenue in 2023 and dominated the market as a whole. In particular, this is due to an increase in the adoption of such a deployment model by major organisations as data security concerns become more serious. Nevertheless, growth in the segment is expected to moderate over the next few years as more and more people embrace cloud technologies.

Need any customization research on Video Conferencing Systems Market - Enquiry Now

By Enterprise:

-

Large Enterprises

-

Small and Medium Enterprises

By Application

-

Corporate Communications

-

Training and Development

-

Marketing and Client Engagement

REGIONAL ANALYSIS:

As a result of broad adoption of advanced communication technologies and the presence of major players on the market, North America is leading the video conferencing systems market. The US, for instance, has seen a surge in remote working culture and requires robust video conferencing solutions. Market expansion is strongly supported by a growing emphasis on cost effective and efficient communication tools in this region.

In Europe, the growing adoption of unified communication and collaboration tools in businesses is giving rise to a thriving market. The demand for high-definition videoconferencing solutions is also being driven by the EU's focus on digital transformation and increasing flexibility of working conditions. The Asia Pacific region is becoming a promising market for videoconferencing systems, driven by rapidly advancing technologies and the increasing number of businesses that have embraced digital communications.

REGIONAL COVERAGE:

North America

-

US

-

Canada

-

Mexico

Europe

-

Eastern Europe

-

Poland

-

Romania

-

Hungary

-

Turkey

-

Rest of Eastern Europe

-

-

Western Europe

-

Germany

-

France

-

UK

-

Italy

-

Spain

-

Netherlands

-

Switzerland

-

Austria

-

Rest of Western Europe

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Vietnam

-

Singapore

-

Australia

-

Rest of Asia Pacific

Middle East & Africa

-

Middle East

-

UAE

-

Egypt

-

Saudi Arabia

-

Qatar

-

Rest of Middle East

-

-

Africa

-

Nigeria

-

South Africa

-

Rest of Africa

-

Latin America

-

Brazil

-

Argentina

-

Colombia

-

Rest of Latin America

KEY PLAYERS:

The key players in the Video Conferencing Systems Market are Microsoft Corporation (Microsoft), Zoom Video Communications, Inc. (Zoom), Cisco Systems, Inc. (Cisco), Adobe Systems Incorporated (Adobe), Huawei Technologies Co. Ltd (Huawei), Avaya, Inc. (Avaya), Amazon Web Services, Inc. (AWS), Google, LLC (Google), Plantronics, Inc. (Poly), LogMeIn, Inc. (LogMeIn)

Recent Developments:

- Cisco and Microsoft entered into a partnership in October 2022 that would bring Microsoft Teams to meeting room equipment at Cisco. For Cisco Room and Desk devices, it allows customers to select Microsoft Teams as the default.

- The acquisition of Solvvy was announced by Zoom in May 2022, with a view to delivering an enhanced customer service experience to a global company base and to rapidly seize new opportunities for contact centers and customer support.

- In January 2022, Cisco and Lockheed Martin and Amazon worked together to integrate new human machine interface technologies that would allow future astronauts to take advantage of farfield voice, artificial intelligence, and tablet video communication technologies.

| Report Attributes | Details |

| Market Size in 2023 | USD 13.51 Bn |

| Market Size by 2032 | USD 66.13 Bn |

| CAGR | CAGR of 19.3% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • by Component (Hardware and Software) • by Deployment Mode (Cloud and On-premises) • by Application (Corporate Communications, Training and Development, Marketing and Client Engagement) • by Enterprise (Large Enterprises and Small and Medium Enterprises) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Microsoft Corporation, Zoom Video Communications, Inc., Cisco Systems, Inc., Adobe Systems Incorporated, Huawei Technologies Co. Ltd, Avaya, Inc., Amazon Web Services, Inc., Google, LLC, Plantronics, Inc., LogMeIn, Inc. |

| Key Drivers | • Post-pandemic, applications like Microsoft Teams, an in-built Office 365 solution already in use by most organizations for end-to-end productivity with email and storage capabilities, saw tremendous growth. |

| Market Opportunities | • 5G networks give a 1 Gbps and 10ms better internet experience, as well as a platform for cloud and AI-based video applications. |