Data Historian Market Report Scope & Overview:

Get More Information on Data Historian Market - Request Sample Report

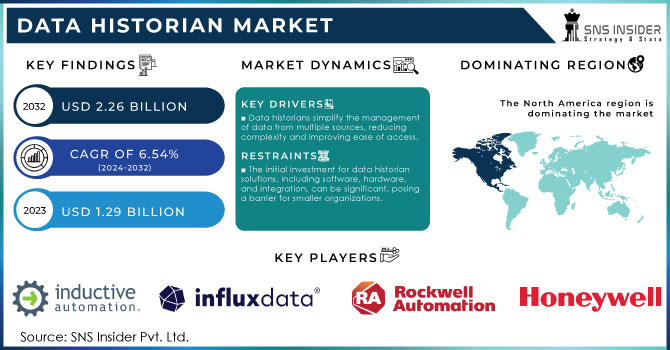

Data Historian Market was worth USD 1.29 billion in 2023 and is predicted to be worth USD 2.26 billion by 2032, growing at a CAGR of 6.54% between 2024 and 2032.

The expanding data generation by various sources, such as IoT devices, cloud applications, and social media, is generating demand for data historians. Numerous industries must adhere to regulations and compliance standards that mandate the storage of historical data. Data historians offer a solution to fulfill these requirements while enabling organizations to analyze the data effectively.

The data historians market is driven by the increasing need for real-time analytics and process optimization across industries. As industries adopt more advanced technologies, such as IoT and Industry 4.0, the demand for robust data historians that can handle large volumes of time-series data is rising. These systems help organizations achieve better operational efficiency, regulatory compliance, and informed decision-making by providing insights into historical performance and trends.

The growth of the data historian market is significantly influenced by several key factors. The rapid expansion of Industry 4.0 and the Internet of Things (IoT) has led to an explosion of data generated by industrial processes and equipment, driving the need for advanced data historians who can efficiently manage and analyze this data. Primarily, the increasing emphasis on real-time analytics and data-driven decision-making is propelling demand for robust data historian solutions that offer real-time insights and historical data analysis. The adoption of cloud computing is also contributing to market growth by providing scalable and cost-effective solutions for data storage and management. Moreover, regulatory compliance requirements in sectors such as oil and gas, pharmaceuticals, and utilities necessitate accurate data recording and reporting, further boosting the demand for data historians. Technological advancements, including improvements in data storage, processing capabilities, and integration with machine learning algorithms, are enhancing the functionality and appeal of data historian systems. Generally, these factors are driving significant growth in the data historian market, positioning it as a critical component of modern industrial data management strategies.

Market Dynamics

Drivers

-

Data historians simplify the management of data from multiple sources, reducing complexity and improving ease of access.

-

Rising demand for consolidated data for process and performance enhancement.

-

Advancements in data processing, integration, and storage, with machine learning, enhance the functionality and appeal of data historian solutions.

Due to rapid business expansions, it has become necessary for businesses to provide the right information to the right person at the right time. Despite challenges, consolidating data has become essential for focusing on business activities such as improving customer experience, optimizing operational processes, and enhancing overall business performance. Data historian solutions are crucial for gathering, storing, and making data accessible across enterprises. These solutions synchronize data, simplifying the management of multiple connections across various locations. As a result, plant managers and engineers can more easily analyze and adjust control loops, investigate incidents, and monitor changes in equipment behavior. The need for real-time decision-making and advanced analytics is anticipated to fuel the adoption of data historian solutions.

Improved data processing techniques facilitate the swift and efficient management of large time-series datasets. Enhanced integration capabilities ensure seamless connectivity and synchronization of data from various sources, creating a cohesive overview. Innovations in data storage offer scalable and cost-effective methods for handling extensive historical data. The incorporation of machine learning provides advanced analytical features, including predictive insights and automated anomaly detection. These technological advancements collectively boost the performance of data historians, making them increasingly valuable for real-time analysis and informed decision-making across different industries.

Restraints

-

The initial investment for data historian solutions, including software, hardware, and integration, can be significant, posing a barrier for smaller organizations.

-

Handling large volumes of sensitive and critical data raises concerns about data security and privacy.

-

Ongoing maintenance, updates, and support requirements can be resource-intensive, potentially leading to higher operational costs.

Maintaining these systems requires regular attention to ensure they function correctly and remain secure. This includes applying software updates, managing hardware components, and addressing any technical issues. Regular updates are essential for fixing bugs, enhancing features, and ensuring compatibility with other technologies, but they often require dedicated IT resources and can disrupt normal operations. Support services, whether provided in-house or by vendors, can add to operational expenses. These continuous requirements can accumulate significant costs over time, making the overall management of data historian systems resource-intensive. Organizations must budget for these ongoing expenses to ensure their data historian solutions' effective performance and reliability.

Managing large volumes of sensitive and critical data introduces significant data security and privacy challenges. The sheer scale of data increases the risk of unauthorized access, breaches, or leaks, making robust security measures essential. Securing this data necessitates the implementation of rigorous security measures, including encryption, access controls, and periodic audits, to prevent unauthorized access and adhere to privacy regulations. Furthermore, protecting sensitive information from cyber threats demands ongoing vigilance, including continuous monitoring and frequent updates to security systems. privacy concerns also arise from ensuring that data handling practices align with legal requirements, such as GDPR or HIPAA, to protect individuals' personal information. Overall, the complexity and importance of securing large datasets make data protection a critical concern for organizations managing sensitive information.

Segment Analysis

By Type

With 51.4% of the global revenue in 2023, the services segment dominated the market. A data historian is a specialized software solution designed to efficiently collect, manage, and access extensive time-series data from industrial equipment and processes. Essentially used in sectors like utilities, manufacturing, and energy, a data historian captures real-time data from sensors, control systems, and other data originators. This service ensures high-speed data collection and is optimized for handling the large volume of data typical in industrial environments. Furthermore, contemporary data historians frequently connect with advanced analytics and IoT platforms, enabling predictive maintenance and optimizing operations. This integration enhances decision-making by offering actionable insights from both historical and real-time data, resulting in greater efficiency, minimized downtime, and cost reductions.

The software segment is anticipated to experience significant growth over the forecast period. Software in a data historian system is engineered to Manage the complex requirements of time-series data handling in industrial environments.

By Deployment

In 2023, The cloud segment held the largest market share. The growth of cloud development has resulted in an adaptable and scalable cloud system capable of managing vast amounts of data, making it perfect for data historians. Moreover, advancements in cloud development have enabled data historians to integrate seamlessly with other cloud-based tools and services, including data analysis and visualization, boosting the demand for these solutions. The growing use of cloud services for storing and managing consumer data has also increased significantly, driven by the broader adoption of cloud deployment.

The On-premises segment is anticipated to grow gradually over the forecast period. On-premises deployment for data historians offers Substantial control and security advantages for organizations. By storing data within their own infrastructure, companies retain complete ownership and can more effectively safeguard sensitive information from external threats. This method is especially beneficial for industries with stringent compliance regulations or those handling proprietary data.

By Enterprise Size

With the largest revenue share in 2023, the large enterprises segment dominated the market. Large enterprises gain from centralized data management systems that aggregate and organize historical data from diverse industrial sources. Typically cloud-based, these systems provide scalable, cost-effective, and secure solutions for managing substantial amounts of both historical and real-time data. Utilizing cloud technology allows enterprises to conduct trend analysis, detect patterns, and extract insights, leading to optimized processes, improved product quality, and greater operational efficiency.

The Small and medium-sized enterprises (SMEs) segment is expected to grow substantially over the forecast period. Small and medium-sized enterprises (SMEs) can significantly benefit from implementing data historians, particularly with the advent of open technology and the Automation Revolution, which have made these systems more budget-friendly. Data historians allow SMEs to collect, store, and analyze large amounts of both historical and real-time data from various industrial processes, providing insights that were previously accessible only to large corporations.

By End-User

In 2023, The oil & gas segment dominated the market with the largest market revenue share. Data historians play an important role in the oil and gas industry, providing a holistic solution for capturing, storing, and analyzing vast amounts of operational data from exploration to production and distribution. these systems facilitate real-time monitoring of vital metrics like good pressure, flow rates, and equipment performance, enabling optimized production and early identification of potential problems.

The power & utility segment is anticipated to get significant growth in the forecast period. Data historians are crucial in the Power & Utility sector, delivering substantial advantages for enhancing operational efficiency and decision-making. In this billion-dollar industry, the demand for process optimization is continuous. Data historians facilitate the gathering and analysis of extensive data produced by modern technology, offering critical insights that improve process and asset performance monitoring, ultimately driving revenue growth.

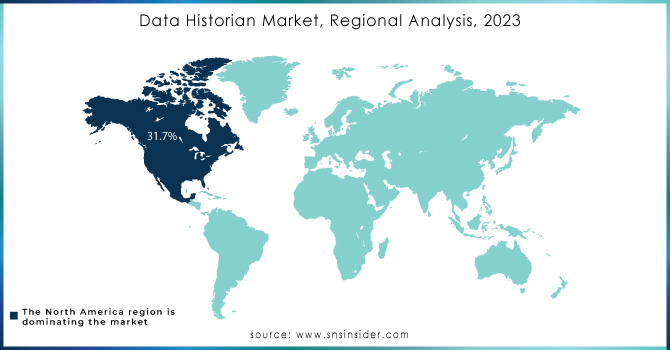

Regional Analysis

With a 31.7% revenue share, North America dominated the market in 2023. It's due to significant investments in research and development propelling innovation in the market. The region hosts key industry players who are consistently investing in this sector. The demand for data historians is steadily increasing, fueled by the growing need for industrial automation data to improve performance, the widespread adoption of Big Data analytics across different economic sectors, and the expanding IoT infrastructure that produces large volumes of data for collection and analysis, alongside other technological advancements.

The Asia-Pacific region is experiencing rapid digitalization, mainly in countries like Australia, New Zealand, China, Japan, and Singapore, giving rise to the production of large volumes of unstructured data. This has created a significant demand for enterprise data management solutions, including data historians.

In Europe, the uptake of data historian solutions is notably high in industries like manufacturing, energy, and utilities, where there is a heightened focus on process optimization and meeting regulatory requirements. Additionally, European companies are increasingly utilizing data historian technologies to boost operational efficiency, minimize downtime, and enhance decision-making processes

Need any customization research on Data Historian Market- Enquiry Now

KEY PLAYERS

The major key players in the Data Historian Market are Inductive Automation, Inductive Automation, LLC, ABB, InfluxData Inc., SORBA.ai,, AVEVA, Rockwell Automation, PTC, Honeywell, Siemens, IBM, Emerson, Open Automation Software, and other players.

RECENT DEVELOPMENTS

In June 2024, Honeywell launched the Honeywell Batch Historian, a digital software solution that offers manufacturers contextualized data history for enhanced reporting and analytics, thereby improving operational efficiency and cost-effectiveness. This move towards digitizing manufacturing processes highlights Honeywell's dedication to the automation trend.

In October 2023, IBM unveiled the IBM Storage Scale System, a cutting-edge global data platform built to handle data-intensive tasks and AI workloads.

| Report Attributes | Details |

| Market Size in 2023 | USD 1.29 Bn |

| Market Size by 2032 | USD 2.29 Bn |

| CAGR | CAGR of 6.54% From 2024 to 2032 |

| Base Year | 2022 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (Software, Services) • By Deployment (Cloud, On-premises) • By Enterprise Size (Small And Medium Sized Enterprises (SMEs), Large Enterprises) • By End-use (Oil & Gas, Marine, Chemicals And Petrochemicals, Metal and Mining, Power & Utility, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia Rest of Latin America) |

| Company Profiles | Inductive Automation, ABB, AVEVA, Rockwell Automation, PTC, Honeywell, Siemens, IBM, Emerson, Open Automation Software |

| Key Drivers | • The growing importance of historian data process among oil, gas, and utilities Sectors. • The increase in demand for software in the industrial sector for recording and saving production and process data. |

| Market Restraints | • Data security concerns. • High cost of implementation and maintenance. |