MRNA Therapeutics Contract Development & Manufacturing Market Size Analysis:

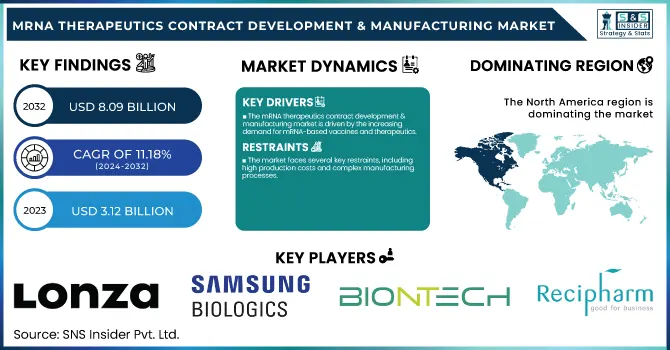

The MRNA Therapeutics Contract Development & Manufacturing Market Size was valued at USD 3.12 billion in 2023 and is expected to reach USD 8.09 billion by 2032 and grow at a CAGR of 11.18% over the forecast period 2024-2032. This report points out the changing prescription and commercialization trends for mRNA-based therapies due to increasing demand for personalized medicine and novel vaccine development. The research delves into outsourcing trends, highlighting the growing dependence by pharma and biotech firms on contract development and manufacturing organizations (CDMOs) to drive efficiency in production and scalability. It further offers a cost and pricing analysis of mRNA production, determining the economic drivers impacting the efficiency of production and affordability. Trends in investment and funding are discussed, highlighting growing capital flows and strategic collaborations driving market growth. The report further explores the compliance and regulatory environment, reaching the pivotal nature of global policies in providing market access and assuring safety, as technological evolution in mRNA production continues to boost innovation and efficacy in the industry.

To Get more information on MRNA Therapeutics Contract Development & Manufacturing Market - Request Free Sample Report

MRNA Therapeutics Contract Development & Manufacturing Market Dynamics

Drivers

-

The mRNA therapeutics contract development & manufacturing market is driven by the increasing demand for mRNA-based vaccines and therapeutics.

The success of COVID-19 vaccines, including those from Pfizer-BioNTech and Moderna, demonstrated the capabilities of mRNA technology, resulting in increased investment in mRNA research. The increasing pipeline of mRNA-based therapies for cancer, infectious diseases, and genetic disorders is further driving demand for dedicated CDMO services. Government support and collaborations between biotech companies and CDMOs are also driving market growth. For instance, in 2023, the U.S. government pledged USD 1.5 billion for investment in mRNA technology to enhance pandemic readiness. Furthermore, innovations in lipid nanoparticle (LNP) delivery systems have enhanced the stability and potency of mRNA medicines, enhancing their commercial appeal. CDMOs are also increasing their production capacity, with Lonza and Catalent investing heavily in new facilities to accommodate demand. Furthermore, the move toward personalized medicine and mRNA-based cancer immunotherapies is yielding long-term growth opportunities. Since pharmaceutical companies increasingly outsource the development and manufacture of mRNA, CDMOs are seeing revenues grow considerably, and the market is becoming increasingly competitive and dynamic.

Restraints

-

The market faces several key restraints, including high production costs and complex manufacturing processes.

mRNA therapeutics are manufactured in specialized facilities, using raw materials and expertise, hence the cost of manufacturing is high. The instability of mRNA also presents challenges that need ultra-cold storage at -70°C and special transportation logistics, thus raising the cost of the supply chain. Moreover, the scarcity of high-quality raw materials, e.g., nucleotides and lipid nanoparticles (LNPs), is a key bottleneck in bulk manufacturing. Regulatory issues also stifle market development, as mRNA treatments need to be subjected to rigorous quality control and approval from authorities such as the FDA and EMA, which results in delays in commercialization. Additionally, intellectual property (IP) restrictions can curtail innovation, with large players such as Moderna and BioNTech possessing key patents for mRNA technology. Small biotech companies tend to face challenges with funding and compliance with regulations, making it challenging for them to scale up manufacturing. Also, public uncertainty surrounding novel mRNA-based therapies outside of COVID-19 vaccines could hinder the adoption rate, especially in indications such as oncology and orphan diseases. All these factors cumulatively limit the widespread commercialization of mRNA therapeutics, which impacts the speed of market growth.

Opportunities

-

The growing adoption of mRNA technology beyond vaccines presents lucrative opportunities for the CDMO market.

mRNA cancer immunotherapies are becoming a key area of interest, with developers such as BioNTech and Moderna working on personalized cancer vaccines against individual tumor mutations. The increasing incidence of rare genetic disorders also presents opportunities for mRNA-based protein replacement therapy, driving demand for bespoke CDMO capabilities. In addition, public and private investments in mRNA R&D are driving innovation, with more than USD 5 billion in investments announced for future-generation mRNA technology in 2023. Another major opportunity is the development of self-amplifying mRNA (siRNA), which has lower doses and longer-duration effects. Growing manufacturing alliances in up-and-coming biotech hotspots and rising CDMO capacity expansions like Lonza's new mRNA plant are anticipated to keep pace with growing demand. The scope for oral and inhalable mRNA products is also gaining momentum, with easier delivery and wider applications. A further boost to market expansion could come from growing applications in cardiovascular and metabolic disorders. As pharmaceutical firms continue to outsource to CDMOs, companies that provide end-to-end solutions for mRNA development will be the ultimate beneficiaries, becoming players of choice for this growing market.

Challenges

-

The market faces significant challenges, particularly in scaling up mRNA manufacturing while maintaining quality and cost efficiency.

In contrast to traditional biologics, mRNA manufacturing is extremely precise, and even slight deviations in synthesis or purification can result in batch failure, raising the costs of operations. Supply chain disruption is still a significant challenge since the world is dependent on limited suppliers for raw materials such as capping enzymes, nucleotides, and LNPs, making procurement unpredictable. For instance, in 2023, lipid nanoparticle shortages caused production slowdowns in several CDMOs. Another significant challenge is intellectual property (IP) disputes since top companies like Moderna, Pfizer, and BioNTech are locked in disputes over mRNA-related patents, restricting entry for new players. Further, shortages of workers in advanced mRNA manufacturing processes cause bottlenecks with demand outstripping the availability of trained workers. Another challenge is regulatory complexity since approval procedures in regions vary and are cumbersome for mRNA-based therapeutics, complicating global commercialization. Lastly, long-term efficacy and safety issues are an issue, especially for mRNA therapies beyond infectious diseases. Overcoming these challenges will take strategic partnerships, supply chain diversification, and innovation in scalable manufacturing technologies to support sustainable market expansion.

MRNA Therapeutics Contract Development & Manufacturing Market Segmentation Analysis

By Application

The viral vaccines category dominated the mRNA therapeutics contract development & manufacturing market in 2023, with over 64.7% share of the overall revenue. Its dominance is the result of increased adoption of mRNA-based vaccines for COVID-19, influenza, and infectious diseases. Government subsidies, expedited regulatory clearances, and success in demonstrating mRNA vaccine efficacy further bolstered the market position of this category.

The protein replacement therapies segment is expected to be the most rapidly growing segment. The rising incidence of rare genetic and metabolic disorders, combined with advances in mRNA technology that allow for targeted protein expression, is driving demand for mRNA-based protein replacement therapies. Also, collaborations among biotech companies and CDMOs to create next-generation therapies are propelling swift market growth.

By Indication

The infectious diseases category led the market in 2023 with 61.3% of total revenue. This was driven mainly by the strong demand for mRNA-based vaccines against viral infections like COVID-19, RSV, and influenza. The efficacy, speed of development, and responsiveness of mRNA vaccines against new pathogen emergence have entrenched this segment as the market leader.

The segment of metabolic & genetic diseases is anticipated to experience the most rapid growth. The escalating incidence of rare genetic disorders, together with advancements in mRNA-based therapies for enzyme and protein replacement, is propelling segment growth. Furthermore, growing investments in gene editing technologies and precision medicine are also fuelling market growth.

By End-use

The biotech companies segment dominated the market in 2023 and accounted for more than 74.5% of the overall revenue. This leadership is due to the prominent position of biotech companies in establishing mRNA therapeutics, raising funds to support research, and offshoring manufacturing to CDMOs. Moreover, the nimbler nature of biotech companies in embracing new technologies has been a key driver of the mRNA CDMO market.

The government & academic research institutes segment is expected to be the fastest growing. Growing public sector investments in mRNA research, government-sponsored programs for creating pandemic preparedness plans, and academic institution partnerships with CDMOs are the primary drivers of high growth. The growth of government-funded R&D programs is also likely to increase contract development and manufacturing demand in this segment.

MRNA Therapeutics Contract Development & Manufacturing Market Regional Insights

North America led the mRNA therapeutics contract development & manufacturing market in 2023, capturing more than 34.3% of the revenue. This is due to the dominance of major mRNA CDMOs, developed biopharmaceutical infrastructure, and heavy investment in the development of mRNA-based drugs. The U.S. specifically has witnessed increased demand for mRNA therapeutics and vaccines, backed by government initiative programs like Operation Warp Speed. Moreover, the availability of major biotech companies and pharmaceutical organizations outsourcing their production processes has further consolidated the market in this region.

Europe is another prominent market, fueled by rising government support, robust regulatory backing, and the availability of established biopharmaceutical clusters in Germany, the U.K., and France. The region has seen a boom in mRNA-based vaccine manufacturing, with CDMOs increasing their production capacity to address rising demand.

Asia-Pacific is likely to emerge as the fastest-growing regional market, driven by increasing investments in biopharmaceutical production, government efforts toward establishing domestic mRNA manufacturing capabilities, and the concentration of new-generation biotech companies. China, Japan, and South Korea are rapidly building CDMO capabilities to decrease their dependence on Western vendors.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players in MRNA Therapeutics Contract Development & Manufacturing Market

-

BioNTech SE

-

Recipharm AB

-

TriLink BioTechnologies

-

Kaneka Eurogentec S.A.

-

Novo Holdings (Catalent, Inc.)

-

Danaher (Aldevron)

-

Biomay AG

-

Bio-Synthesis, Inc.

-

ethernet

-

ApexBio Technology

-

Biocina

Recent Developments in the MRNA Therapeutics Contract Development & Manufacturing Market

In Feb 2025, TriLink BioTechnologies, a Maravai LifeSciences company, entered a non-exclusive License and Supply Agreement with Aldevron, a global CDMO. This collaboration grants Aldevron customers access to TriLink’s CleanCap mRNA capping technology for non-commercial use, supporting the advancement of mRNA-based therapeutics and vaccines.

In Jan 2025, Meiji Seika Pharma received approval to add domestic manufacturing sites in Japan for KOSTAIVE, its self-amplifying mRNA COVID-19 vaccine. This amendment to its manufacturing and marketing approval aims to enhance local production capacity.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 3.12 billion |

| Market Size by 2032 | USD 8.09 billion |

| CAGR | CAGR of 11.18% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Application [Viral Vaccines, Protein Replacement Therapies, Cancer Immunotherapies] • By Indication [Infectious Diseases, Metabolic & Genetic Diseases, Cardiovascular & Cerebrovascular Diseases] • By End-use [Biotech Companies, Pharmaceutical companies, Government & Academic Research Institutes] |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Lonza, Samsung Biologics, BioNTech SE, Recipharm AB, TriLink BioTechnologies, Kaneka Eurogentec S.A., Novo Holdings (Catalent, Inc.), Danaher (Aldevron), Biomay AG, Bio-Synthesis, Inc., eTheRNA, ApexBio Technology, Biocina. |