Multivitamin for Women Market Report Scope & Overview:

Get more information on Multivitamin for Women Market - Request Free Sample Report

The Multivitamin for Women Market Size was valued at USD 9.05 Billion in 2023, and is expected to reach USD 13.64 Billion by 2032, and grow at a CAGR of 4.83% over the forecast period 2024-2032.

Multivitamins are among the most popular supplements globally and in recent years there has been a rise in demand for multivitamin products that target age-related health needs, including bone, cognitive, and heart health as the global population ages. This trend is even more relevant given government statistics showing that the U.S. Census Bureau estimates 98 million adults will be aged 65 and older by 2060; a portion of the population with unique nutritional needs. As a result, health agencies and institutions are paying more attention to dietary supplements to help patients deal with age-related diseases. According to the National Institute on Aging (NIA), older adults need additional vitamin D and calcium, for their bone density and osteoporosis not to progress. Likewise, the American Heart Association (AHA) recognizes omega-3s and other nutrients as necessities for heart health into older age. Example: The National Institutes of Health (NIH) says that, as part of a new focus on cognitive health, increasing evidence shows dietary supplements with nutrients such as B vitamins and antioxidants could support normal brain function and even delay the onset of neurodegenerative diseases. The guidelines and report are indicative of a greater appreciation by governmental bodies of the potential effects on health through tailored formulation vitamins for mature adults. With the aging of the population, there is an increased demand for multivitamins with specific health concerns arising in various shapes and textures.

MARKET DYNAMICS:

KEY DRIVERS:

-

Advances In Personalized Nutrition Are Driving the Development of Multivitamins Tailored to Individual Health Profiles and Specific Needs, Enhancing Consumer Interest and Demand.

-

As The Population Ages, There Is a Rising Demand for Multivitamins Designed to Support Specific Needs Associated with Aging, Such as Bone Health, Cognitive Function, And Heart Health.

RESTRAINTS:

-

The Dietary Supplements Market is Subject to Stringent Regulations Regarding Labelling, Claims, And Quality, Which Can Pose Challenges for Manufacturers and Affect Market Dynamics.

-

The Multivitamins Market Is Highly Competitive, With Numerous Brands and Products. Market Saturation Can Make It Difficult for New Entrants to Establish a Foothold and For Existing Brands to Differentiate Themselves.

OPPORTUNITY:

-

The Increasing Trend Towards Holistic Health and Wellness Programs Presents an Opportunity for Multivitamins to Be Integrated into Broader Health Management Solutions, Including Fitness Regimes and Dietary Plans.

-

There is a Growing Preference for Natural and Organic Ingredients in Multivitamins, Driven by Increasing Health Consciousness and Environmental Concerns.

KEY MARKET SEGMENTATION:

By Type

Tablets and capsules dominated the female multivitamin market, which took a 41% share in 2023. Tablets and capsules are the most convenient, stable, and accurately dosed form for daily supplementation. These are also very popular with consumers as this type has a long shelf life and comfortable storage. According to the National Institutes of Health (NIH), more than half of U.S. adults take a multivitamin or other dietary supplement, mostly in tablet and capsule form. Likewise, regulatory frameworks are equally important for fostering consumer trust. The US Food and Drug Administration (FDA) regulates dietary supplements under the Dietary Supplement Health & Education Act - DSHEA, which sets standards strict enough to guarantee that what is in tablets is precisely contained on their label. The assurance of regulatory compliance gives consumers added peace of mind when using these products. Tablets and capsules offer accurate dosage control for greater adherence to recommended daily intakes based on customized nutritional needs.

Tablets and Capsules to Retain Core Position Backed by Regulatory Enforcements & Consumer Choices Demand for Convenient and Reliable Supplement Form: The National Institute of Health (NIH) prescribes the supplementation of essential vitamins and minerals which reinforces the requirement for convenient, relatable supplement forms among individuals especially females as pollen involves everything that our body needs to fulfill its nutritional requirements. This advocacy plus strong regulatory backing and belief among consumers guarantees that tablets and capsules continue to rule the women's multivitamin market.

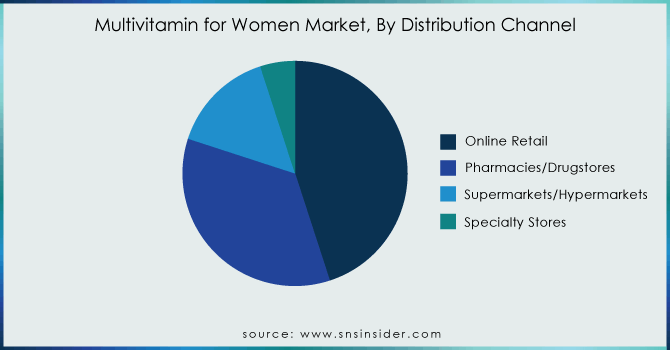

By Distribution Channel

By 2023, online retail hold 43% of the market share with key factors driving this dominance including consumer convenience and wider product choice related to evolving purchasing behavior. This trend is supported by government statistics and industry reports. E-commerce sales have long been on the rise, and by 2023 are projected to make up more than 15% of total retail dollars spent in US markets according to data from the U.S. Census Bureau with health & personal care products as a very large driver of this growth sought out demographic researchers anticipate increased interest for supplemental immunity support post-pandemic efforts.

In addition, the COVID-19 pandemic expedited this move as consumers turned to safer and more convenient avenues for essential item purchases including dietary supplements. Even as the pandemic recedes, this change in consumer behavior appears to be here to stay with more people than ever looking for an easy way of shopping or ordering products from home. Access to products from thousands of different brands, in-depth product descriptions and reviews, as well as best-in-class pricing, make online retail a compelling proposition for multivitamin buyers. Furthermore, regulatory measures have helped foster its growth. For example, the U.S. Food and Drug Administration (FDA) has enforced standards that require online retailers to meet equivalent containment safety or warning information requirements when selling appropriate merchandise which relevant customers are guaranteed of its product integrity as it was purchased in-store.

Get Customized Report as per your Business Requirement - Request For Customized Report

REGIONAL ANALYSIS:

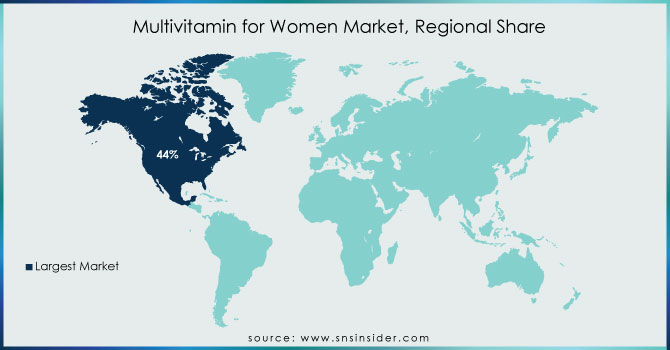

North America holds the largest share in the multivitamins market, and it is forecast to account for 44% by bulk volume during 2023. This is predominant owing to high consumer awareness, well-built healthcare infrastructure, and beneficial regulatory environments. Government statistics and industry analyses would testify to these factors. Awareness of health and wellness among consumers in North America is highly pronounced. In the US, more than half of adults use dietary supplements, and multivitamins are the most commonly used. The adoption of it is underpinned by a strong emphasis on preventive healthcare as well - supported through various public health campaigns and education drives. The strong healthcare infrastructure of the region also makes a significant contribution to this trend. The US is anticipated to witness a high growth rate due to its established healthcare facilities, pharmacies, and wellness centers which provide easy access to dietary supplements. The U.S. Food and Drug Administration (FDA) has established this to assure the integrity, efficacy, and safety of food products that are produced and labeled as such which will instill trust among consumers leading them to invariably include interchangeable food sources in their regular diet/product offerings.

Additionally, the economic factors only make North America richer in terms of market control. Higher disposable income of consumers in the U.S. and Canada is leading to increased spending on health & wellness offerings, which have benefitted premium multivitamin formulation sales overtime had a strong influence here by increasing healthcare costs at a phenomenal run over time. Its ability to improve health status, along with the large economic footprint it has because of high costs associated with poor vascular function, means there is an ongoing and very static demand. Moreover, the consolidated e-commerce industry of North America also bolsters the distribution and reach of multivitamins. By 2023 e-commerce sales constituted more than 15% of total retail sales and health as a segment was one area where the US Census Bureau had previously reported high numbers. This digital evolution is what drives the ubiquity of multivitamins in which an audience accustomed to technology and healthfulness can be marketed. All these factors add up to an environment where people will still want multivitamins.

KEY PLAYERS:

The key market players include New Chapter, Nature Made, Garden of Life, Swisse, MegaFood, Rainbow Light, Suku Vitamins, Bayer, Gaia Herbs, Ritual & other players.

RECENT DEVELOPMENTS

-

One A DayAge Factor Cell Defense with Resveratrol helps support cellular health – where aging begins, and launched in June 2024 under the One a Day multivitamin and supplement brand that has been rooted for over eighty years of supplying customers vitamins.

-

In August 2021 – MegaFood grew a new multivitamin line for the whole family with Women's, Kids', Men’s, and Prenatal Multi Gummies. Featuring key vitamins with added benefits, the new Multi Gummies are an easy and delicious gummy option for women, men, and kids ages 4+, to help an individual feel best inside & out.

| Report Attributes | Details |

|

Market Size in 2023 |

US$ 9.05 Billion |

|

Market Size by 2032 |

US$ 13.64 Billion |

|

CAGR |

CAGR of 4.83% From 2024 to 2032 |

|

Base Year |

2023 |

|

Forecast Period |

2024-2032 |

|

Historical Data |

2020-2022 |

|

Report Scope & Coverage |

Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

|

Key Segments |

•By Type (Tablets/Capsules, Liquids and Powders & Chewable and Gummies) |

|

Regional Analysis/Coverage |

North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

|

Company Profiles |

New Chapter, Nature Made, Garden of Life, Swisse, MegaFood, Rainbow Light, Suku Vitamins, Bayer, Gaia Herbs, Ritual & other players |

|

Key Drivers |

•Advances in Personalized Nutrition Are Driving the Development of Multivitamins Tailored to Individual Health Profiles and Specific Needs, Enhancing Consumer Interest and Demand. |

|

RESTRAINTS |

•The Dietary Supplements Market is Subject to Stringent Regulations Regarding Labelling, Claims, And Quality, Which Can Pose Challenges for Manufacturers and Affect Market Dynamics. |