Walking Aids Market Size Analysis:

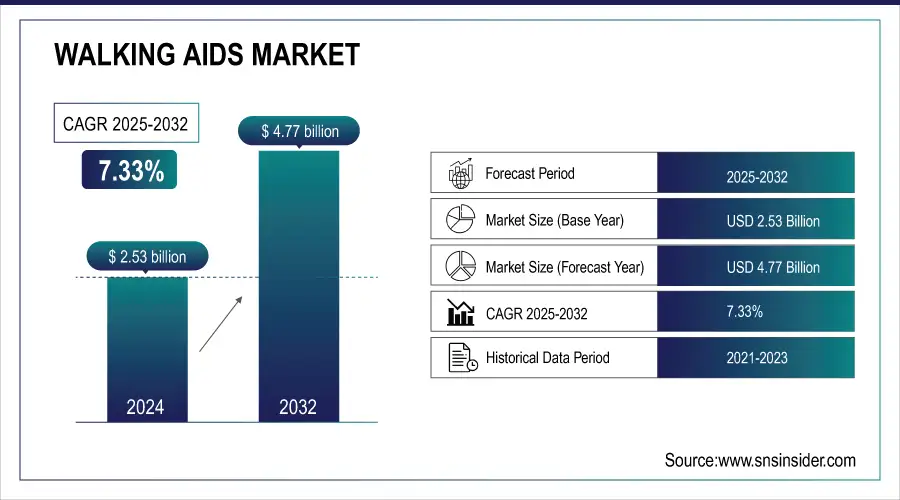

The Walking Aids Market Size was valued at USD 2.53 Billion in 2023 and is expected to reach USD 4.77 Billion by 2032, growing at a CAGR of 7.33% over the forecast period 2024-2032.

To Get more information on Walking Aids Market - Request Free Sample Report

This report includes key statistical data and trends in the Walking Aids Market, with a focus on the incidence and prevalence of mobility impairments in 2023, and the rising need for walking aids among the elderly and mobility-challenged populations. The report also looks at the forecast rate of growth in device volumes, which varies widely by region. It also analyzes healthcare spending data and dissects government, commercial, and out-of-pocket expenditures on mobility aids. Regulatory Compliance and Safety Standards Provide Insight into the Market's Evolving Safety Landscape The walking aids market is driven mainly by the increasing geriatric population across the globe, changing lifestyles leading to the growing incidence of mobility disorders, improvement in assistive technologies, and growth in reimbursement policies.

The Walking Aids Market in the U.S. has been growing steadily from USD 0.88 billion in 2023 to USD 1.65 billion by 2032, displaying a Compound Annual Growth Rate (CAGR) of 7.25%. The aging population and growing awareness about healthcare are primarily driving this growth with the increasing adoption of mobility aids including canes, walkers, and rollators. More and more elderly people need mobility solutions, and healthcare coverage is improved. According to the Centers for Disease Control and Prevention (CDC), approximately 19.4 million adults in the U.S. faced difficulty walking a quarter-mile, while 40.7 million adults reported at least one physical function disability in 2023.

Walking Aids Market Dynamics

Drivers

-

Increasing Incidence of Disabilities and Injuries Fueling Growth in Walking Aids Market.

The increasing incidence of disabilities and injuries especially among middle-aged and geriatric populations is fueling the demand for walking aids. A decline in mobility due to conditions such as multiple sclerosis, spinal cord injuries, and severe illness poses an ongoing challenge that in turn feeds the demand for assistive devices that empower users to regain independence. Moreover, increasing injuries such as accidents, sports, or surgeries are causing a burgeoning demand for mobility aids, particularly in rehabilitation centers, hospitals, and homes. As more people are aware of rehabilitation and the need to properly fit the mobility aids for recovery, patients are more willing to invest in a walking aid or mobility aid to increase their mobility and prevent complications. For example, the World Health Organization (WHO) estimates that over 1 billion people live with disabilities and many of them rely on assistive devices to maintain their quality of life. This universal trend also augments the sustained development of the walking aid market.

Restraints

-

High Cost of Advanced Mobility Aids May Limit Market Growth.

The high cost associated with advanced walking aids and mobility devices, such as powered wheelchairs, electronic scooters, and customized walkers, may pose a significant barrier to the market’s expansion. Many advanced mobility devices come with a hefty price tag, which can be prohibitive for individuals, especially in low-income regions. Some simple walking aids may be cheap, but more advanced solutions that provide better functionality, comfort, and ease of use involve a significant financial commitment in terms of the initial acquisition and running costs. Some of these devices also need continuous servicing and support, which adds up to the overall cost. Thus, unprivileged people from economically weak backgrounds or developing countries do not have enough money to purchase these devices, restricting them from being used on a wide scale. In some regions, the high out-of-pocket costs associated with these devices can hinder the growth of the walking aid market, even with insurance coverage options available.

Opportunities

-

Technological Innovations in Walking Aids Present Growth Potential.

Innovations in the design and functionality of walking aids are opening new avenues for market growth. Modern walking aids now feature enhanced technologies such as shock-absorbing materials, built-in sensors, and ergonomic designs to improve comfort and usability. Some of these innovations include smart walkers and canes with integrated health monitoring features, which track users' vital signs and movements. These technologies not only improve the performance of walking aids but also help individuals maintain their health and well-being. As consumers increasingly look for personalized, high-tech solutions, manufacturers are investing in research and development to create advanced mobility aids that cater to the evolving needs of users. The growing interest in wearable technologies and the integration of mobility aids with the Internet of Things (IoT) are driving new product offerings in the market. This trend towards smart and tech-enabled devices presents significant growth opportunities for companies in the walking aids sector.

Challenges

-

Regulatory Barriers and Compliance Challenges for Manufacturers.

The walking aids market stakeholders include manufacturers that are exposed to significant challenges as they are required to comply with regulatory requirements and standards that might differ in many regions. In many countries, walking aids are categorized as medical devices, subject to approval by regulatory agencies including the U.S. Food and Drug Administration (FDA) or European Medicines Agency (EMA). Obtaining certification for walking aids can be a lengthy and costly process, as manufacturers must meet stringent safety, quality, and performance standards. Moreover, the constantly changing regulatory landscape in various markets can pose risks, particularly for global players seeking to expand their footprint. Compliance with these regulations is significant to guarantee product safety and efficacy, but it raises production costs and restricts time-to-market for innovations. Therefore, managing regulatory challenges remains a persistent difficulty for companies operating in the walking aids sector.

Walking Aids Market Segment Analysis

By Type

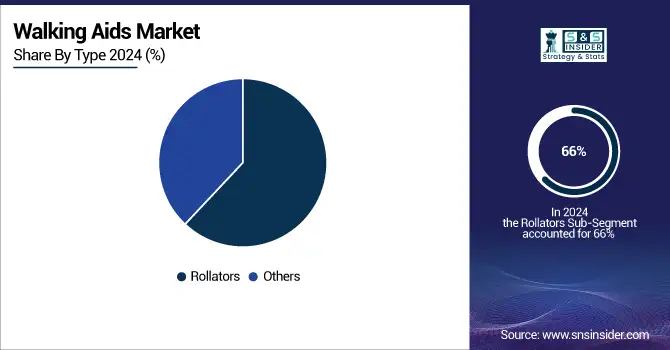

In 2023, rollators accounted for 66% of revenue share in the walking aids market. This fact is attributed to their multifunctionality, ease of use, and admissibility by a broad audience, particularly senior citizens and the ones undertaking rehabilitation. Unlike traditional walkers, rollators are equipped with wheels, brakes, and often a built-in seat, offering convenience and stability. These features are attractive on their own but are also attractive for individuals with limited mobility who require support, but also want independence. The growing old-age population around the world is one of the key factors boosting the mainstream acceptance of the rollators. The global population aged 65 years or older surpassed 761 million in 2023, and this demographic is anticipated to double by 2050, according to the United Nations. Age-related conditions such as arthritis, osteoporosis, and Parkinson’s disease significantly impair mobility, making rollators an essential solution for maintaining an active lifestyle. Rollators are also very common in rehabilitation settings, which aid patients recovering from temporary illnesses and surgeries by giving them balance.

Technological advancements have also played a pivotal role in rollators' market leadership. Manufacturers are increasingly incorporating lightweight materials like aluminium and carbon fibre to enhance portability. Tech-savvy consumers have embraced smart rollators with IoT-enabled features like health monitoring sensors, GPS tracking, and fall detection systems. Other innovations include electric rollators with powered assistance, designed for people with severe mobility limitations.

Walking Aids Market Regional Insights

North America dominated the walking aids market with a revenue share of 44% in 2023, largely due to high demand from the U.S., but several factors must be considered for this dominance. The first is the fact that the region has an advanced healthcare infrastructure supporting advanced rehabilitation services and home care solutions. Increasing incidences of age-related mobility disorders have also driven the demand for walking aids. In 2023, the U.S. Census Bureau estimates that roughly 54 million Americans were aged 65 or older and that number is consistently and rapidly increasing. Government initiatives have played a critical role in driving market growth in North America. Medicare and Medicaid programs provide substantial financial assistance for purchasing durable medical equipment (DME), including walkers and rollators. For example, Medicare Part B covers 80% of the cost of medically necessary walking aids when prescribed by healthcare professionals. The policy has also helped greatly disabled individuals and old people.

The Asia-Pacific is expected to experience the highest compound annual growth rate (CAGR) during the forecast period owing to the aging population and improving healthcare infrastructure. According to the United Nations Economic and Social Commission for Asia and the Pacific (UNESCAP), one in four individuals in Asia-Pacific will be aged 60 or older by 2050 a trend already visible in countries like Japan, China, India, and South Korea. The economic growth of countries in this region has also resulted in growth in healthcare spending and increased access to assistive devices including working aids. Healthcare services are widely encouraged by governments to boost mobility solutions for the elderly.

Get Customized Report as per Your Business Requirement - Enquiry Now

Walking Aids Market Key Players

-

Drive DeVilbiss Healthcare (Drive Medical Walker, Folding Walker)

-

Invacare Corporation (Deluxe Walker, Invacare Rollator)

-

Ottobock (Genium X3, C-Leg)

-

Karman Healthcare (Ergo 115, Rollator Walker)

-

Zimmer Biomet (NexGen Knee, ActivMotion Knee Walker)

-

Sunrise Medical (Gemino 30 Rollator, Quickie Pulse)

-

Pride Mobility Products Corporation (Go-Go Folding Scooter, Jazzy Air Power Chair)

-

Handicare (Rollator Walker, Walking Frame)

-

Medline Industries, Inc. (Walker with Seat, Bariatric Rollator)

-

Guardian Healthcare Products (Rollator Walker, Folding Walker)

-

Matsunaga Manufacturing Co., Ltd. (Support Walking Stick, Four-Legged Cane)

-

Patterson Medical (Nova Ortho-Med Rollator, Drive Medical Folding Walker)

-

Invacare Corporation (XPO2 Portable Oxygen Concentrator, Walkers & Rollators)

-

PaceSaver (Scout 3-Wheel, Victory 10 4-Wheel Scooter)

-

Duro-Med Industries (Medline Walker, Folding Walker with Wheels)

-

Rehabmart (Dual Handle Walker, Walker with Armrests)

-

Carex Health Brands (Rollator Walker with Seat, Folding Walker)

-

Nova Medical Products (Rollator with Loop Locks, Compact Folding Walker)

-

Comodita Healthcare (Deluxe Rollator Walker, Homecare Walker)

-

Becker Orthopedic (ProCare Walker, Walker Brace)

Recent Development in the Walking Aids Market

-

Cionic launched bionic clothing designed for patients with neurological conditions such as Parkinson’s disease and cerebral palsy. This innovation aims to improve mobility through wearable technology.

-

In July 2022, CAN Mobilities introduced "CAN Go," a smart walking cane equipped with GPS tracking and fall detection features for enhanced safety

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 2.53 Billion |

| Market Size by 2032 | USD 4.77 Billion |

| CAGR | CAGR of 7.33 From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (Rollators {Premium Rollators, Low-cost Rollators}, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Drive DeVilbiss Healthcare, Invacare Corporation, Ottobock, Karman Healthcare, Zimmer Biomet, Sunrise Medical, Pride Mobility Products Corporation, Handicare, Medline Industries, Inc., Guardian Healthcare Products, Matsunaga Manufacturing Co., Ltd., Patterson Medical, PaceSaver, Duro-Med Industries, Rehabmart, Carex Health Brands, Nova Medical Products, Comodita Healthcare, Becker Orthopedic. |