WASHING MACHINE MARKET KEY INSIGHTS:

Get More Information on Washing Machine Market - Request Sample Report

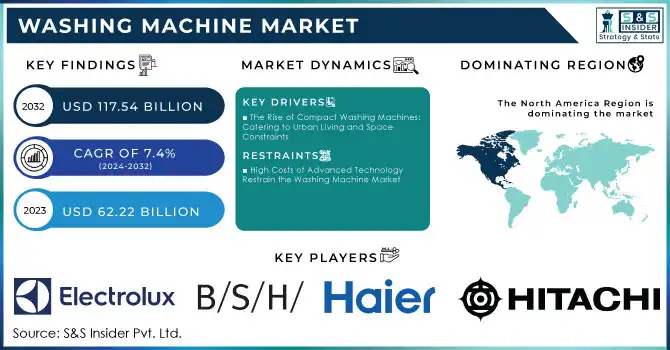

The Washing Machine Market Size was valued at USD 62.22 Billion in 2023 and is expected to reach USD 117.54 Billion by 2032 and grow at a CAGR of 7.4% over the forecast period 2024-2032.

The washing machine market has shown consistent growth driven by the rising demand for efficient and high-tech home appliances, particularly in both developed and emerging economies. Increasing disposable incomes have allowed consumers to invest in appliances that simplify daily chores, fueling interest in innovative solutions like fully automatic and semi-automatic machines, as well as top-load and front-load designs. The product variety meets diverse consumer needs, making washing machines a staple in modern households globally.

In line with this trend, advancements in technology have led to highly integrated appliances that offer multifunctional solutions, as evidenced by the latest developments at CES 2024. Eureka introduced the Dual Washing Bot, an all-in-one appliance combining washing, drying, vacuuming, and mopping, setting a new benchmark for convenience. Featuring a robot vacuum dock, self-cleaning mopping function, and a powerful 8000Pa suction system, the Dual Washing Bot reflects a strong consumer demand for high-efficiency, smart appliances that streamline home cleaning. This push toward innovation and multifunctionality highlights a robust future for the washing machine market, as manufacturers focus on providing consumers with versatile, time-saving solutions that enhance modern living standards.

MARKET DYNAMICS

KEY DRIVERS

-

The Rise of Compact Washing Machines: Catering to Urban Living and Space Constraints

The rise of small living rooms in urban areas creates a demand among consumers for compact washing machines. Compact washing machines are ideally suited to apartments and low-size housing, where the space of the room is expensive. This has put quite a challenge on the manufacturers to offer smaller and multi-functional appliances without compromising washing performance. The rising trend in the market of washing machines may primarily be attributed to the ever-progressing levels of urbanization and patron changes in consumer behaviour. With more people moving into cities, the demand for Space-Saving Models, which are smaller in size, increases. "Projected Rise in Urban Population," the total world population is supposed to increase, with 68 percent of the world's population expected to live within urban areas by 2050. This then results in a huge demand for appliances tailored for small-sized living spaces, especially those in heavily populated cities. The development trends necessitate manufacturers to come up with innovations in terms of production, such as a multifunctional washing machine that will reflect maximum efficiency without losing anything it originally had. Growth in sales is shared and altered almost uniformly with an overwhelming change in the market preference toward energy-friendly and compact models.

-

Growing environmental awareness is compelling consumers to prefer more energy-efficient washing machines.

Manufacturers are catching up and designing models that are less in water and energy usage while still highly performing at washing. This is another area where, according to Statista, a significant shift has been observed by consumers preferring sustainable appliances, keeping in line with the rest of the world in the reduction of energy consumption and carbon footprint. The washing machine industry is changing in terms of its shift to sustainability, driven by the increase in environmental awareness and the establishment of energy efficiency standards. According to new initiatives from the U.S. Department of Energy, new energy efficiency standards for home appliances, like clothes washers and dryers, are going to save a total of more than 3.4 billion kilowatt-hours per year which is enough to power about 316,000 homes. This much-cut will align with the governmental objective of encouraging greener appliances that help lower carbon footprints.

RESTRAIN

-

High Costs of Advanced Technology Restrain the Washing Machine Market

While consumers are becoming increasingly willing to pay for more energy-efficient and smart appliances, price-sensitive customers who incur higher costs initially may be turned off. For instance, Smart Washing Machines with Wi-Fi connectivity and advanced sensors usually sell at a premium price in contrast to their counterparts. While the price of washing machines has risen with the introduction of smart features and energy-efficient technologies, many more price-sensitive consumers cannot afford these products. After imposing the tariffs on importing washing machines, for certain models, retail prices increased by 20-30%. This spike makes it hard for price-conscious shoppers to commit to up-market models featuring such connectivity options with advanced sensors, which usually come with a premium price.

KEY SEGMENTATION ANALYSIS

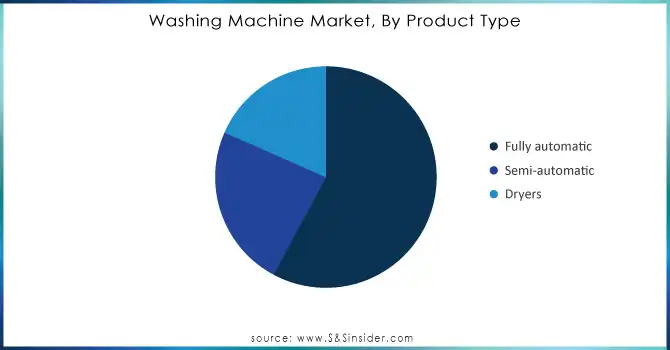

BY PRODUCT TYPE

In 2023, the automatic segment high revenue share of 57% of the market, for consumers in the fully automatic and semi-automatic segments, convenience and efficiency are key, so these machines are especially attractive to busy families. The top brands here are LG, Samsung, and Whirlpool. Among the top-rated fully automatic models, LG WM4000HWA is full of praise for smart technology and efficient cleaning power. Again, Samsung WF45R6100AW is appreciated for friendliness in use and performance. LG model comes with 5.2 cubic feet, which means the user can accommodate more laundry in fewer cycles, whereas the Samsung model comes with 4.5 cubic feet, contributing toward efficient laundry loads.

Dryers of home appliances have been growing at the fastest CAGR in the forecasted period, this growth can be attributed to energy-efficient appliances that simplify laundry processes. Innovations in dryer technology are also making them more attractive; for instance, Whirlpool recently introduced the Smart All-in-One Washer and Dryer, which can perform the task of a washer and a dryer in one box, attracting the space-conscious.

Need Any Customization Research On Washing Machine Market - Inquiry Now

BY CAPACITY TYPE

The 6.1 to 8 kg segment of washing machines accounted for a substantial 39% revenue share in the market, highlighting its popularity among consumers. This growth is largely attributed to the increasing demand for machines that can handle sufficient laundry loads efficiently. According to the survey, high-efficiency models in this range not only provide superior cleaning performance but also utilize approximately 30% less water than traditional washers. Additionally, nearly 50% of consumers surveyed prioritize energy efficiency when selecting a washing machine, further underscoring the segment's appeal.

The above 8 kg segment's largest market share is growing with the highest CAGR of 9.1% in 2024-2032. This growth can be mainly attributed to the fact that there is a growing demand for larger capacity machines, which accommodate more users in larger households. The popularity of larger family units, ease of doing online shopping, and awareness of increasing sustainability issues are some of the factors driving such demand. Better-capacity washing machines allow for the washing of many clothes at one time, thereby saving time and energy. Trend The trend also caters to the demands of the consumer in the 21st century but also to wider tendencies toward energy efficiency and convenience in appliances.

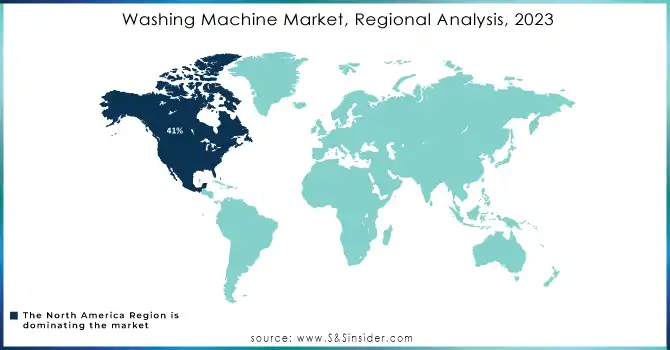

REGIONAL ANALYSIS

In 2023, the North American washing machine market dominated with a revenue share of 41%, driven by the increasing adoption of smart and energy-efficient appliances. Consumer demand for sustainability has led to investments in washing machines with technology, such as load sensing and water efficiency as well as programmable settings. 72% of consumers say that one reason for purchasing a washing machine is energy efficiency. Moreover, 61% claim that "appliances which will help me reduce energy costs are preferred in a house". With these factors in place, it is then clear that the region has the disposable income to match the cost of newer conveniences and time-saving home solutions.

The Asia Pacific region is expected to grow at the fastest CAGR of 9.25% during the forecast period. The rapid urbanization in the region is driving the market growth of washing machines. Increasing urbanization has led to smaller living spaces and an increased reliance on time-saving appliances, including washing machines. Due to limited space, compact and efficient washing machines are becoming increasingly popular in urban areas. Moreover, individuals and families in urban areas are busier with work and need time-saving solutions. With their automated and time-efficient features, washing machines cater to the growing demand for convenience, contributing to the expansion of the market.

Key Players

Some of the major players in the Washing Machine Market are:

-

AB Electrolux (Electrolux PerfectCare 7000 Series, Electrolux Washer-Dryer Combo)

-

Arcelia A.S (Arcelia Front Load Washing Machine, Arcelia Top Load Washing Machine)

-

BSH Hausgeräte GmbH (Bosch Serie 8 Washing Machine, Siemens iQ700 Washing Machine)

-

GE Appliances, a Haier company (GE Profile Front Load Washing Machine, GE Front Load Washer-Dryer Combo)

-

Haier Group Corporation (Haier Twin Tub Washing Machine, Haier Smart Front Load Washing Machine)

-

Hitachi, Ltd. (Hitachi Washing Machine with Inverter Technology, Hitachi Washer-Dryer Combo)

-

IFB Industries Limited (IFB Fully Automatic Front Load Washing Machine, IFB Semi-Automatic Top Load Washing Machine)

-

LG Electronics Inc. (LG AI Direct Drive Washing Machine, LG Twin Wash Washing Machine)

-

Midea Group Co., Ltd. (Midea Front Load Washing Machine with Inverter Technology, Midea Twin Tub Washing Machine)

-

Panasonic Holdings Corporation (Panasonic Inverter Washing Machine, Panasonic Washer-Dryer Combo)

-

Samsung Electronics Co., Ltd. (Samsung AddWash Washing Machine, Samsung Front Load Washer-Dryer Combo)

-

Sharp Corporation (Sharp Plasmacluster Washing Machine, Sharp Washer-Dryer Combo)

-

Siemens AG (Siemens iQ700 Washing Machine, Siemens VarioPerfect Washing Machine)

-

TCL Technology Group Corporation (TCL Twin Tub Washing Machine, TCL Front Load Washing Machine)

-

Whirlpool Corporation (Whirlpool Cabrio Washer-Dryer Combo, Whirlpool Duet Front Load Washing Machine)

-

Kenmore (Kenmore Elite Front Load Washing Machine, Kenmore Top Load Washing Machine)

-

Maytag (Maytag Bravos XL Front Load Washing Machine, Maytag Top Load Washing Machine)

-

Godrej Industries Ltd. (Godrej Washing Machine with Smart Inverter Technology, Godrej Washer-Dryer Combo)

-

Mirc Electronics Limited (Onida Washing Machine, Onida Washer-Dryer Combo)

-

Toshiba (Toshiba Front Load Washing Machine, Toshiba Washer-Dryer Combo)

RECENT TRENDS

-

In October 2024, Samsung is going to unveil an intelligent AI-powered washing machine in the premium appliance segment. This latest washing machine relies on artificial intelligence to change and improve the wash cycles according to user habits and fabric, thus creating a more personalized laundry experience. But the point is that at this launch, Samsung is taking a step forward in furthering the technological outlook of home appliances and claiming to be a market leader through cut-throat offerings for tech-savvy consumers

-

In July 2024, Unilever revealed that it is working with Samsung to discover new ideas in laundry innovations. The said alliance was meant to focus on sustainability and advanced technology in the washing of clothes, bringing more experience to the customers without causing negative environmental impacts. A partnership in this regard by both companies underscored their commitment to driving change within the home care sector and aligning their proposition with the growing consumer demands for ecologically friendly products.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 62.22 Billion |

| Market Size by 2032 | US$ 117.54 Billion |

| CAGR | CAGR of 7.4 % From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Product Type (Fully automatic (Front load, Top load), Semi-automatic, Dryers) • By Technology Type (Smart-connected machines, Conventional machines) • By Capacity Type (Below 6 kg, 6.1 to 8 kg, Above 8 kg) • By End-Use (Commercial, Residential) • By Application Type (Healthcare, Hospitality, Federal Government) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | AB Electrolux, Arcelia A.S, BSH Hausgeräte GmbH, GE Appliances, a Haier company, Haier Group Corporation, Hitachi, Ltd., IFB Industries Limited, LG Electronics Inc., Midea Group Co., Ltd., Panasonic Holdings Corporation, Samsung Electronics Co., Ltd., Sharp Corporation, Siemens AG, TCL Technology Group Corporation, Whirlpool Corporation, Kenmore, Maytag, Godrej Industries Ltd., Mirc Electronics Limited |

| Key Drivers | • The Rise of Compact Washing Machines: Catering to Urban Living and Space Constraints • The Shift Towards Sustainability: Why Energy-Efficient Washing Machines Are Gaining Popularity |

| Restraints | • The Price of Progress: How High Costs of Advanced Technology Restrain the Washing Machine Market |