Gas Turbine Services Market Report Scope & Overview:

The Gas Turbine Services Market size was valued at USD 19.96 billion in 2023 and is expected to grow to USD 27.12 billion by 2031 and grow at a CAGR of 3.9 % over the forecast period of 2024-2031.

In the heart of a power plant, a gas turbine is a combustion engine that converts mechanical energy from liquid fuels, such as natural gas, into electrical energy. This force then drives a generator, which produces the electricity that flows through power lines to homes and businesses. Maintenance, inspection, upkeep, repair, overhaul, and replacement services are available for gas turbines. Producing and cleaning up rotors. prolongation of the rotor's life. production and part restoration.

.png)

Get Sample Copy of Gas Turbine Services Market - Request Sample Report

The power output of gas turbines is typically measured at sea level, in 80°F of ambient air (some European designs are rated at 60°F), and when burning a particular fuel. For those fuels that create higher quantities of combustion products, power output, and efficiency will be higher since the compressor doesn't have to work as hard to compress more volume.

Burning Gas Typically, turbines are chosen to power huge pumps, compressors, and generators. They are chosen from 1000 to 270,000 horsepower ranges. Utilizing waste heat recovery systems can increase their efficacy. Where electric power is unavailable, crude oil pumps and vapor recovery compressors have been run by lesser horsepower turbines from the previous range. They might also be employed in situations when extra power from a Getting a utility company to the location could be pricey.

MARKET DYNAMICS

KEY DRIVERS:

-

Increases safety and life of components

-

Increasing Demand for Spare Parts

-

Increasing power consumption

The demand for electricity has increased as a result of growing industrialization and an increase in the usage of electrical equipment in emerging nations. Thus, with natural gas' lower carbon dioxide emissions and industrialized countries' tight emission regulations, natural gas power plant installation is anticipated to increase.

RESTRAIN:

-

The increased effectiveness of fuel-based power generation

OPPORTUNITY:

-

The growing popularity of dispersed power-generating

Electricity supply and mechanical work (producing torque to move objects) may both be accomplished through distributed generating. Gas turbines have an advantage over other distributed generation technologies for meeting onsite generating demands and backup power needs due to their better efficiency and dependable generation capacity. Consequently, the market for gas turbines is presented with a significant potential by the growth of distributed power generation.

CHALLENGES:

-

Shifting focus towards renewable energy

IMPACT OF RUSSIA-UKRAINE WAR

Russia's invasion of Ukraine has had a significant impact on people, the economy, and industry. Supply networks, industries, and economies have all been disrupted, in addition to lives and livelihoods. Like many other industries, the energy sector is currently undergoing uncertainty. Even before the battle really escalated, oil prices were increasing all across the world. But after Russia invaded Ukraine, the cost of crude oil on the international market soared, rising from around $76 per barrel at the beginning of January 2022. Because of increased demand brought on by the world economies' recovery from the COVID-19 pandemic and insufficient investment in the oil and gas sector, the price of crude oil was already high even before the conflict.

KEY MARKET SEGMENTATION

By Design Type

-

Heavy duty (frame)

-

Aeroderivative

By Backing Material

-

Power Generation

-

Oil & gas

-

Other industrial (mechanical drive processes in the steel, aluminum, and manufacturing industries)

By Technology

-

Open Cycle

-

Combined Cycle

By Rated Capacity

-

1-40 MW

-

40-120 MW

-

120-300 MW

-

Above 300 MW

.png)

Get Customized Report as per Your Business Requirement - Enquiry Now

REGIONAL ANALYSIS

Asia Pacific will control the worldwide gas turbine market. The development of the Asia Pacific gas turbine market is anticipated to be fuelled by investments in new, big coal- and gas-fired combined cycle power generating facilities. The construction of new power plants in several rising economies is another factor contributing to the rise, along with the fast regional urbanization, industrialisation, and economic expansion.

The main actors in this region are the United States and Canada. By 2030, the North American gas turbine servicing industry is anticipated to generate more than $12 billion in revenue. The market outlook is anticipated to be positively impacted by the abundance and affordability of natural gas as well as a shift in emphasis towards the production of clean energy.

REGIONAL COVERAGE:

North America

-

US

-

Canada

-

Mexico

Europe

-

Eastern Europe

-

Poland

-

Romania

-

Hungary

-

Turkey

-

Rest of Eastern Europe

-

-

Western Europe

-

Germany

-

France

-

UK

-

Italy

-

Spain

-

Netherlands

-

Switzerland

-

Austria

-

Rest of Western Europe

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Vietnam

-

Singapore

-

Australia

-

Rest of Asia Pacific

Middle East & Africa

-

Middle East

-

UAE

-

Egypt

-

Saudi Arabia

-

Qatar

-

Rest of Middle East

-

-

Africa

-

Nigeria

-

South Africa

-

Rest of Africa

-

Latin America

-

Brazil

-

Argentina

-

Colombia

-

Rest of Latin America

RECENT DEVELOPMENTS

-

In July 2022, Gas Turbine Services, a provider of industrial equipment located in Europe, and International Energy Resources, a utility contractor based in the United Arab Emirates, announced their partnership to "enter new markets" and "further strengthen their positions in the global market."

-

OPRA Turbines and Quanta agreed to a contract in June 2021. Through this cooperation, Quanta was able to represent OPRA Turbines in the North Sea offshore oil and gas market.

-

In October 2019, GE Power implemented its MXL2 upgrade solution on two GE 13E2 gas turbines to improve the operational effectiveness and performance of ADNOC Refining's Ruwais General Utilities Plant.

KEY PLAYERS

The Major Players are General Electric, Siemens Energy, Mitsubishi Power, Ltd., Kawasaki Heavy Industries, Ltd., Solar Turbines Inc., Ansaldo Energia, Bharat Heavy Electricals Ltd., OPRA Turbines, Man Energy Solutions, Centrax Gas Turbines, and other players

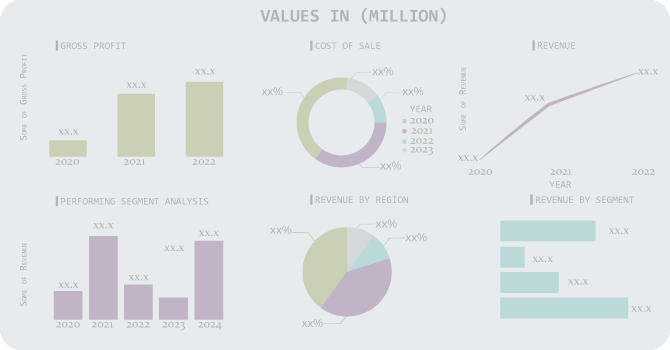

Siemens Energy-Company Financial Analysis

| Report Attributes | Details |

| Market Size in 2023 | US$ 19.96 Bn |

| Market Size by 2031 | US$ 27.12 Bn |

| CAGR | CAGR of 3.9 % From 2024 to 2031 |

| Base Year | 2023 |

| Forecast Period | 2024-2031 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Design Type (Heavy duty (frame), Aeroderivative) • By Backing Material (Power Generation, Oil & gas, Others) • By Technology (Open Cycle, Combined Cycle) • By Rated Capacity (1-40 MW, 40-120 MW, 120-300 MW, above 300 MW) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]). Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia Rest of Latin America) |

| Company Profiles | General Electric, Siemens Energy, Mitsubishi Power, Ltd., Kawasaki Heavy Industries, Ltd., Solar Turbines Inc., Ansaldo Energia, Bharat Heavy Electricals Ltd., OPRA Turbines, Man Energy Solutions, Centrax Gas Turbines |

| Key Drivers | • Increases safety and life of components • Increasing Demand for Spare Parts • Increasing power consumption |

| Market Restraints | • The increased effectiveness of fuel-based power generation |