Water Bus Market Report Scope & Overview:

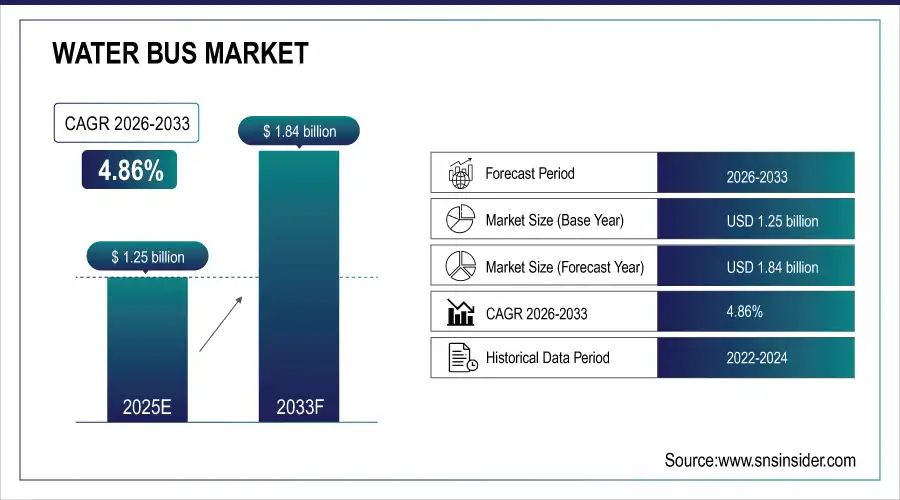

The Water Bus Market was valued at USD 1.25 billion in 2025E and is expected to reach USD 1.84 billion by 2033, growing at a CAGR of 4.86% from 2026-2033.

The Water Bus Market is growing rapidly due to increasing urbanization, rising traffic congestion, and demand for sustainable transport solutions. Expansion of smart city initiatives, government investments in waterway infrastructure, and adoption of eco-friendly electric and hybrid vessels are driving market growth. Rising tourism and waterfront development projects further boost demand, supporting long-term revenue expansion and widespread adoption globally.

To Get more information on Water Bus Market - Request Free Sample Report

Vilnius, Lithuania: In September 2025, Vilnius introduced fully electric passenger boats into its scheduled river transport network, claiming the service to be the first of its kind in Europe.

Rotterdam, Netherlands: The Waterbus in Rotterdam is an efficient and fast solution to improve the connectivity between the north and the south of the city. The Waterbus transports 1.9 million passengers annually, making it the largest public transport provider by water in the Netherlands.

Market Size and Forecast

-

Market Size in 2025: USD 1.25 Billion

-

Market Size by 2033: USD 1.84 Billion

-

CAGR: 4.86% from 2026 to 2033

-

Base Year: 2025E

-

Forecast Period: 2026–2033

-

Historical Data: 2022–2024

Water Bus Market Trends

-

Growing focus on sustainable and eco-friendly public transportation is driving the water bus market.

-

Rising adoption of electric and hybrid propulsion systems is transforming water bus operations.

-

Increasing congestion in urban roadways is pushing cities to integrate water buses into smart mobility networks.

-

Expanding tourism activities and waterfront developments are creating demand for modern water bus services.

-

Governments are investing in green maritime infrastructure and water-based mass transit solutions.

-

Advancements in lightweight materials and energy-efficient designs are improving performance and cost-effectiveness.

-

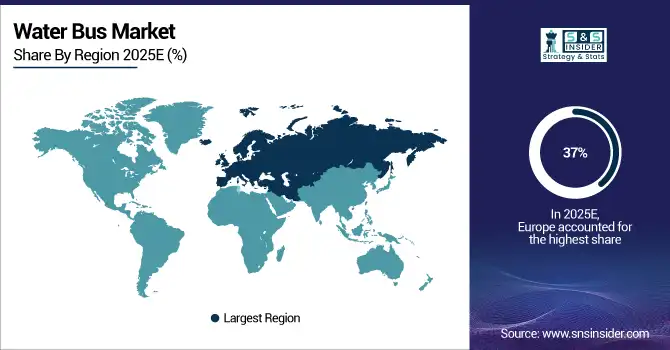

Asia-Pacific and Europe are emerging as major regions due to rising urbanization and strong water transport initiatives.

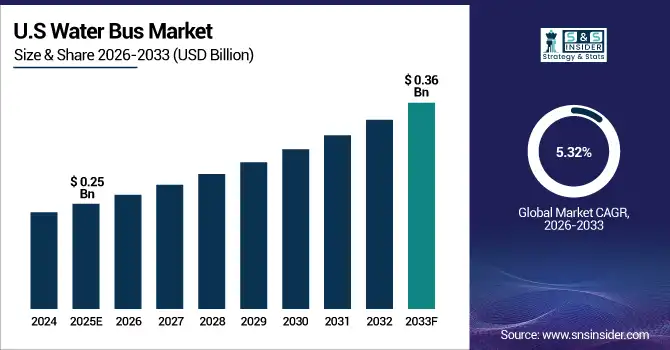

U.S. Water Bus Market was valued at USD 0.25 billion in 2025E and is expected to reach USD 0.36 billion by 2033, growing at a CAGR of 5.32% from 2026-2033.

The U.S. Water Bus Market is growing steadily due to urban traffic congestion, increasing tourism, government investments in water transport infrastructure, and adoption of eco-friendly vessels, supporting moderate but consistent demand and gradual expansion of waterborne mobility solutions across key cities.

Water Bus Market Growth Drivers:

-

Rising urban congestion and traffic issues encourage governments and operators to adopt water buses as efficient alternative transportation

Rising urban congestion and traffic issues are compelling cities to invest in water buses as reliable mobility alternatives. With road and rail systems increasingly burdened by population growth and daily commuters, authorities are prioritizing waterborne transport to reduce delays and improve accessibility. Water buses provide quick and eco-friendly movement across waterways, easing traffic bottlenecks. Their integration into multimodal networks further strengthens their role in efficient urban transport planning. This trend is driven by increasing environmental concerns, infrastructure development, and demand for cost-effective solutions that lower dependency on fossil-fuel-based road vehicles.

-

Hangzhou, China – The No. 7 water bus line’s upgrade with larger boats to handle passenger demand and ease congestion during the Asian Games directly reflects cities investing in water buses to improve accessibility.

-

Tokyo, Japan – Tokyo exploring integration of water buses into its urban transport network to alleviate congestion and promote sustainable mobility directly aligns with urban planning efforts to reduce traffic bottlenecks.

-

Osaka, Japan – Implementation of water bus services connecting key tourist destinations to reduce road traffic and provide eco-friendly transport mirrors the emphasis on eco-friendly alternatives and multimodal integration.

Water Bus Market Restraints:

-

Seasonal dependency and geographical limitations reduce consistent demand for water buses, restricting long-term scalability across certain urban areas

Seasonal dependency and geographical limitations hinder consistent utilization of water buses in many cities. Harsh weather conditions, flooding, frozen waterways, or extreme tides often disrupt operations, reducing service reliability. Not all urban regions have navigable waterways suitable for water buses, restricting their deployment to select coastal or riverine areas. These limitations impact passenger confidence, discourage long-term planning, and restrict revenue opportunities for operators. As a result, adoption remains highly uneven, with cities possessing favorable geographical conditions driving most growth. This seasonal and location-based dependency creates an imbalance in market expansion, making scalability a persistent restraint.

Water Bus Market Opportunities:

-

Integration of water buses into smart city initiatives enhances connectivity, last-mile solutions, and eco-friendly mobility infrastructure development worldwide

Integration of water buses into smart city initiatives opens vast opportunities for enhanced connectivity and sustainable transportation. Governments are actively aligning water buses with digital ticketing, real-time tracking, and multimodal integration to improve efficiency. Smart mobility systems ensure seamless last-mile connections, reducing dependence on private vehicles while strengthening public transport networks. Coupled with green energy policies, cities are positioning water buses as part of climate-friendly infrastructure, attracting both public and private investment. The global push for smart urban planning ensures strong growth potential, as water buses contribute to sustainability goals, tourism development, and modernized mobility ecosystems.

|

City / Country |

Key Features / Description |

Initiative / Project |

|

Oslo, Norway |

Integration of city bikes, e-scooters, and public transport; enables planning and purchasing of multimodal journeys for enhanced connectivity and sustainable mobility. |

Ruter App Integration |

|

Las Palmas, Spain |

Development of multimodal hubs integrating bike-sharing, e-scooters, and key bus routes; provides real-time info, improves last-mile connectivity, reduces reliance on private vehicles. |

SPINE EU-funded Project |

|

Columbus, Ohio, USA |

Implemented Mobility on Demand (MOD) application targeting underserved groups; enhances first-mile/last-mile connectivity and integrates multiple transport modes. |

Smart Columbus |

|

Colorado Springs, Colorado, USA |

Emphasis on multimodal corridors and integration of water buses; enhancing street connectivity, implementing multimodal hubs for seamless transport transitions, reducing dependence on private vehicles. |

City Transportation Plan |

Water Bus Market Segment Highlights

-

-

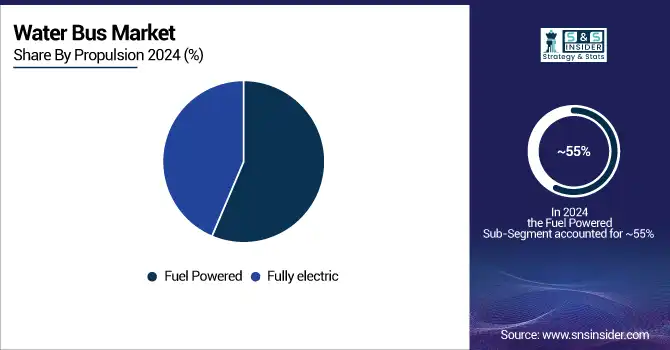

By Propulsion, Fuel Powered dominated with ~55% share in 2025; Fully Electric fastest growing (CAGR).

-

By Operation, Intercity dominated with ~55% share in 2025; Intracity fastest growing (CAGR).

-

By Vessel Type, Catamaran Vessel dominated with ~46% share in 2025; Hydrofoil Vessel fastest growing (CAGR).

-

By Capacity, 50–100 Passengers dominated with ~43% share in 2025; Above 100 Passengers fastest growing (CAGR).

-

Water Bus Market Segment Analysis

By Propulsion, Fuel-powered water buses dominated in 2025; fully electric buses expected fastest growth

Fuel-powered water buses dominated the market in 2025 because of their established infrastructure, lower initial costs, and ease of operation. Widespread availability of fuel and proven reliability made them the preferred choice for operators, ensuring efficient services on both urban and intercity routes, supporting large-scale adoption and consistent revenue generation.

Fully electric water buses are expected to grow fastest from 2026-2033 due to increasing environmental awareness, stricter emission regulations, and government incentives. Operators are shifting toward sustainable transport solutions, while advances in battery technology and charging infrastructure make electric water buses more viable, efficient, and attractive for urban waterways and eco-conscious passenger services globally.

By Operation, Intercity water buses led in 2025; intracity operations to grow fastest

Intercity operations dominated the market in 2025 as they provide long-distance connectivity between cities, offering higher passenger capacity and reliable scheduling. These routes generate greater revenue and demand robust, durable vessels. Operators prefer intercity services for efficiency, profitability, and meeting commuter needs across rivers and coastal areas, reinforcing intercity water buses’ market dominance.

Intracity water buses are expected to grow fastest from 2026-2033 due to rising urbanization, increasing congestion, and demand for last-mile connectivity. Integration with smart city mobility networks enhances adoption, making water buses an efficient solution for intra-urban travel. Short-distance, frequent services cater to commuters, supporting rapid growth in intracity water transport solutions.

By Vessel Type, Catamaran vessels dominated in 2025; hydrofoil vessels projected fastest growth

Catamaran vessels dominated the market in 2025 due to superior stability, higher passenger capacity, and fuel efficiency. Their design allows safe, comfortable long-distance travel while reducing operational costs. These advantages make catamarans suitable for daily commuters and tourists alike, providing reliable services across rivers and coastal routes, ensuring strong adoption by operators globally.

Hydrofoil vessels are expected to grow fastest from 2026-2033 because of their speed, reduced water resistance, and ability to cover longer distances efficiently. Operators prefer hydrofoils for premium and rapid services, offering faster transit times and appealing to commuters and tourists seeking quick and efficient water transport, supporting market expansion.

By Capacity, 50–100 passengers led in 2025; above 100-passenger vessels expected fastest growth

50–100 passengers segment dominated the market in 2025 as it balances operational cost and passenger demand effectively. These vessels provide sufficient capacity for urban and intercity routes, ensuring profitability and manageable maintenance. Their size makes them ideal for both daily commuter and tourist operations, supporting consistent utilization and revenue generation for operators.

Above 100 passengers segment is expected to grow fastest from 2026-2033 due to rising urban populations and increasing tourism demand. Large-capacity vessels allow efficient transport of more passengers on busy routes, reducing trip frequency, increasing operational efficiency, and accommodating future urban mobility growth, driving adoption of above 100-passenger water buses globally.

Water Bus Market Regional Analysis

Europe Water Bus Market Insights

Europe dominated the Water Bus Market with the highest revenue share of about 37% in 2025 due to its well-developed waterways, extensive government investments, and strong adoption of sustainable and smart transport solutions. Advanced infrastructure, stringent eco-friendly policies, and growing tourism in major riverine and coastal cities have significantly increased the utilization of water buses, reinforcing Europe’s leadership and contributing substantially to the market’s overall revenue growth in 2025.

Get Customized Report as per Your Business Requirement - Enquiry Now

North America Water Bus Market Insights

North America is expected to grow at the fastest CAGR of about 6.31% from 2026-2033 due to rising urbanization, increasing traffic congestion, and strong government initiatives promoting waterborne transport. Growing investments in modern infrastructure, widespread adoption of electric and hybrid water buses, and expanding tourism along rivers and coastal areas are driving rapid market expansion. These factors position North America as the fastest-growing water bus market by 2033.

Asia Pacific Water Bus Market Insights

Asia Pacific is expected to witness significant growth in the Water Bus Market due to rapid urbanization, expanding population, and increasing traffic congestion in major cities. Rising government investments in water transport infrastructure, adoption of eco-friendly electric and hybrid vessels, and growing tourism along rivers and coastal regions are driving market expansion. Favorable policies and rising commuter demand further support the region’s accelerated growth and increasing share in the global market.

Middle East & Africa and Latin America Water Bus Market Insights

Middle East & Africa and Latin America are expected to grow steadily in the Water Bus Market due to increasing urbanization, rising tourism, and investments in waterfront infrastructure. Government initiatives promoting sustainable, efficient water transport and growing adoption of fuel-efficient and electric vessels are driving market expansion. Rising commuter demand, urban congestion, and efforts to improve connectivity further support gradual revenue growth and strengthen the regions’ presence in the global market.

Water Bus Market Competitive Landscape:

Damen Shipyards Group

Damen Shipyards Group, founded in 1927 and headquartered in Gorinchem, Netherlands, is a global shipbuilding company specializing in the design and construction of commercial vessels, naval ships, and specialized maritime solutions. The company emphasizes sustainability, innovation, and modular shipbuilding to meet evolving environmental and operational demands. Damen focuses on electric and hybrid propulsion technologies, advanced ferry systems, and eco-efficient designs, supporting the maritime sector in reducing emissions, enhancing passenger experience, and promoting compliance with international environmental standards.

-

January 2024: Damen secured a contract to deliver four fully electric passenger ferries to BC Ferries in Canada.

-

February 2025: Damen introduced the Hybrid Waterbus 2907 E3, a lightweight, low-wash catamaran designed to reduce fuel consumption and minimize wave disruption, aligning with SDG 14.

Incat Crowther

Incat Crowther, headquartered in Sydney, Australia, is a leading naval architecture and marine engineering firm specializing in high-speed ferries, workboats, and commercial vessels. The company focuses on advanced propulsion systems, hybrid and electric technologies, and lightweight vessel design. Incat Crowther provides innovative solutions for passenger, cargo, and tour vessels globally, combining efficiency, sustainability, and performance. Its designs emphasize reduced fuel consumption, low emissions, and improved passenger comfort, addressing the growing demand for eco-friendly maritime transport solutions.

-

March 2024: Delivered the first of six new passenger fast ferries to Sun Ferry in Hong Kong, the Xin Ming Xhu VIII.

-

May 2024: Launched the first of twelve high-speed hybrid monohull ferries for Italian operator Liberty Lines, exceeding performance expectations.

-

August 2025: Designed the electric tour vessel Ocean Master, a 32-metre aluminium catamaran constructed by Austal Philippines, now en route to Perth, Australia.

Artemis Technologies

Artemis Technologies, headquartered in Belfast, UK, is a pioneer in clean maritime technologies, specializing in electric and hydrofoiling vessels. The company focuses on developing high-speed, zero-emission passenger ferries and commercial vessels, combining lightweight design with advanced propulsion systems. Artemis emphasizes sustainability, energy efficiency, and innovation, aiming to revolutionize maritime transport while reducing environmental impact. Its solutions support global initiatives for decarbonization of waterborne transport, enabling operators to meet emissions targets and improve operational efficiency.

-

May 2024: EF-24, a high-speed electric foiling passenger ferry, entered construction as a world-first in electric maritime transport.

-

February 2025: Signed a Memorandum of Understanding with Delta Marine to advance clean maritime solutions in Washington State, USA.

-

April 2025: Announced a multimillion-dollar deal with Delta Marine to electrify passenger ferries in the US, marking Artemis's expansion into the North American market.

Austal

Austal, founded in 1988 and headquartered in Henderson, Western Australia, is a global shipbuilder specializing in defense, commercial, and high-speed catamaran vessels. The company is recognized for its aluminum shipbuilding expertise, modular construction methods, and innovative naval and commercial designs. Austal serves governments and commercial clients worldwide, delivering expeditionary, patrol, and transport vessels that combine performance, durability, and operational efficiency. The company emphasizes delivering high-quality, reliable solutions for both defense and civilian maritime operations.

-

January 2024: Austal USA delivered the 14th Expeditionary Fast Transport vessel to the United States Navy.

-

November 2024: Delivered the 8th Evolved Cape-class Patrol Boat to the Australian Department of Defence.

Key Players

Some of the Water Bus Market Companies

-

Damen Shipyards Group

-

Icarus Marine

-

Mavi Deniz Çevre Hiz A.S.

-

Incat Crowther

-

Austal

-

Ares Shipyard Inc.

-

Artemis Technologies

-

Willard Marine Inc.

-

Hyke (Hydrolift Smart City Ferries AS)

-

Swimbus

-

Smart Own

-

MS Boat

-

Cool Amphibious Manufacturers International LLC

-

Sinosoon Technology Co., Ltd.

-

Haishida Emergency Equipment Co., Ltd.

-

Chongqing Dunya Industrial Co., Ltd.

-

Shandong Greenfist Industry Co., Ltd.

-

Hamaru Motor

-

Huffin City River Bus

-

Amfibus

| Report Attributes | Details |

|---|---|

| Market Size in 2024 | USD 1.25 Billion |

| Market Size by 2032 | USD 1.84 Billion |

| CAGR | CAGR of 4.86% From 2026 to 2033 |

| Base Year | 2025 |

| Forecast Period | 2026-2033 |

| Historical Data | 2022-2024 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Vessel Type (Catamaran Vessel, Monohull Vessel, Hydrofoil Vessel) • By Propulsion (Fully Electric, Fuel Powered) • By Capacity (Less than 50 Passengers, 50–100 Passengers, Above 100 Passengers) • By Operation (Intercity, Intracity) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

| Company Profiles | Damen Shipyards Group, Icarus Marine, Mavi Deniz Çevre Hiz A.S., Incat Crowther, Austal, Ares Shipyard Inc., Artemis Technologies, Willard Marine Inc., Hyke (Hydrolift Smart City Ferries AS), Swimbus, Smart Own, MS Boat, Cool Amphibious Manufacturers International LLC, Sinosoon Technology Co., Ltd., Haishida Emergency Equipment Co., Ltd., Chongqing Dunya Industrial Co., Ltd., Shandong Greenfist Industry Co., Ltd., Hamaru Motor, Huffin City River Bus, Amfibus |