Waterjet Cutting Machine Market Report Scope Overview:

Get More Information on Waterjet Cutting Machine Market - Request Sample Report

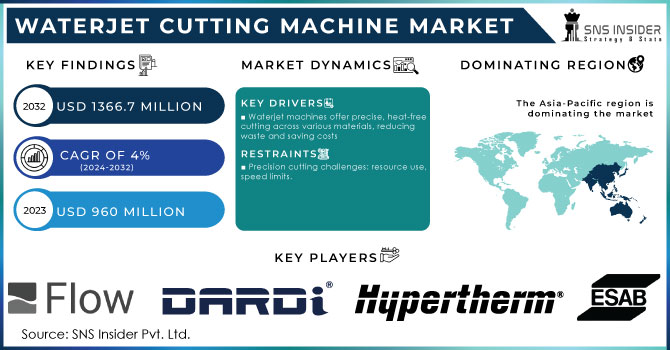

The Waterjet Cutting Machine Market size was estimated at USD 960 Million in 2023 and is expected to reach USD 1366.7 Million by 2032 at a CAGR of 4% during the forecast period of 2024-2032.

The Waterjet Cutting Machine Market is driven by its exceptional capability to accurately cut intricate shapes in various materials. The prominent products like Flow International Corporation's Mach series have the capability to process materials as thick as 24 inches. This technology is extremely flexible, enabling quick drilling and cutting of delicate details or exact shapes in materials like glass, stones, and metals. An abrasive cutter's pressure can hit 55,000 PSI, with water coming out of the nozzle at 762 m/s, exceeding the speed of sound by 2.5 times. Adding garnet sand changes the water jet to a grinding and cutting tool, creating forces at 305 m/s. Waterjet cutting technology consists of two types of ultra-high-pressure (UHP) water cutting: pure water cutting and abrasive cutting, with cutting slits varying from 0.1 to 1.8mm. An intricate waterjet machine can carve wood with a thickness of up to 125 mm at a speed of 15 m/min, without causing noticeable surface moisture or delamination, to allow for detailed carvings. Waterjets have the capability to penetrate materials that are 300 mm thick, with the potential to reach 600 mm for certain materials. Waterjets can process virtually any material, unlike laser cutting limitations with metals up to 25 mm thick and exclusion of reflective metals, and EDM restrictions to conductive materials under 300 mm thick. Both plasma cutting and flame cutting have restrictions despite their abilities to cut thick metals up to 75 mm and 150 mm respectively. For example, flame cutting is not suitable for aluminum and copper alloys and typically results in inferior edge quality when compared to waterjets.

In June 2024: The tech company WAZER, based in New York, has launched the WAZER Pro, a high-tech waterjet system for cutting materials in-house. Priced at $18,999, the WAZER Pro offers fast cutting abilities, allowing users to create parts quickly, either in minutes or hours. The cutting speed of the new WAZER Desktop model is two to four times quicker than the previous version. This strong system is capable of processing dense materials like aluminum, glass, plastic, and tile up to one inch in thickness, as well as steel up to three-eighths of an inch thick.

MARKET DYNAMICS

DRIVERS

Waterjet cutting machines are essential in numerous industries due to their precise cutting capability, ability to cut various materials without producing heat, and effectiveness in minimizing material waste, which leads to cost savings and resource optimization.

Waterjet cutting machines have become crucial in numerous industries due to their exceptional precision and versatility. These machines use a strong water stream, sometimes with abrasives, to slice various materials like metals, glass, ceramics, and composites. This method of cutting is highly appreciated for its precision in creating accurate cuts without generating heat. Waterjet cutting preserves the material's integrity, delivering clean edges and reducing the need for additional processing, unlike traditional cutting methods that may lead to thermal distortion or changes in material properties. Furthermore, waterjet cutting minimizes material waste by optimizing material use, resulting in cost savings and improved resource management. Waterjet cutting is a crucial tool in industries like automotive manufacturing, architecture, and metal fabrication due to its accuracy and minimal material wastage.

The increasing need for high-precision cutting, supported by waterjet cutting's cool process to prevent thermal distortion and its safety advantages of not generating harmful fumes or dust, is crucial for sectors such as aerospace and defense, and attractive in strict regulatory settings.

The increasing need for precise cutting in different industries, particularly in aerospace and defense, underscores the importance of waterjet cutting technology. The process's natural lack of heat prevents thermal distortion, a crucial benefit in applications needing precise tolerances and material integrity. Waterjet cutting improves safety and compliance by getting rid of hazardous fumes, dust, or particles that may be produced by different cutting techniques. This feature is especially appealing in sectors with rigorous regulation and safety protocols. By following these rules and guaranteeing accurate cuts, waterjet cutting fulfills the technical requirements of modern manufacturing while also complying with health and environmental standards, promoting a safer and more eco-friendly production setting.

RESTRAIN

The growing demand for precision cutting, along with its environmental and safety benefits, faces challenges from operational issues like continuous water and abrasive consumption, cutting speed and thickness limitations, complicating logistical and environmental management, and restricting its use in high-volume production environments.

The increasing need for precise cutting across different sectors is fueled by its capacity to create detailed and high-quality equipment with exceptional precision. This technology provides important environmental and safety advantages, such as decreased waste and improved workplace safety by reducing manual handling. Nonetheless, it encounters significant obstacles that affect its extensive acceptance, especially in high-volume manufacturing environments. Constant usage of water and abrasives needed for cooling and cutting may result in higher operational expenses and make waste disposal more challenging. Furthermore, the efficiency and throughput of precision cutting systems are limited by the cutting speed and thickness constraints they possess. These elements create logistical challenges and environmental concerns, which complicate the incorporation of precision cutting into large-scale production methods. Addressing operational constraints is essential for industries to maximize the potential of precision cutting technology while minimizing its impact on resources and production workflows.

KEY SEGMENTATION ANALYSIS

By Industry

In 2023, the Automotive Industry has dominated a market share of 32%. Because waterjet cutting machines are widely used in producing complex automotive parts, the industry is growing and becoming more influential. Furthermore, the increase of robotic systems in the automotive industry, combined with the integration of WCMs on assembly lines, is leading to improved operational effectiveness.

By Product Type

The market is mostly led by 3D waterjet cutting machines, holding a majority share of 53% in 2023. Due to recent developments in the technology of 3D waterjet cutting machines, cutting heads can now perform 3D cutting by incorporating five-axis capabilities into their process. The method involves a turning head that can rotate 360 degrees and make cuts at angles of up to 46 degrees on all materials. Besides being capable of moving in the X, Y, and Z directions, it can also rotate between -360° and +360° around its axis, while the cutting head can pivot between +90° and -90°, making it easier to design in 3D.

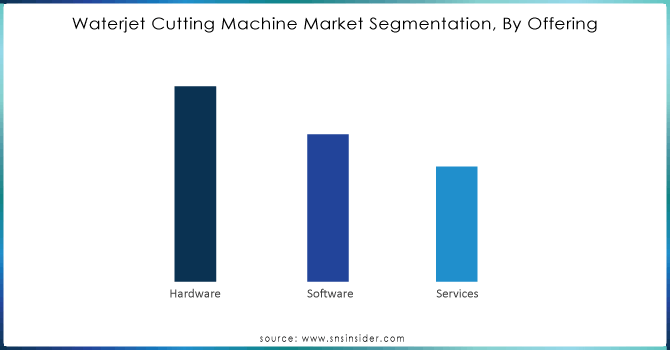

By Offering

The Hardware holds a 45% market share in 2023, making it the most dominant player. Waterjet cutting machines, along with key components such as high-pressure pumps, nozzles, and cutting heads, are the main expense for buyers.

The software segment is experiencing rapid growth in the Waterjet Cutting Machine Market. The growing demand for advanced software solutions is fueled by the rising requirement for automation, precision, and efficiency in cutting processes. These software programs improve the performance of waterjet cutting machines by Offering better control, simulation, and design features.

Get Customized Report as per your Business Requirement - Request For Customized Report

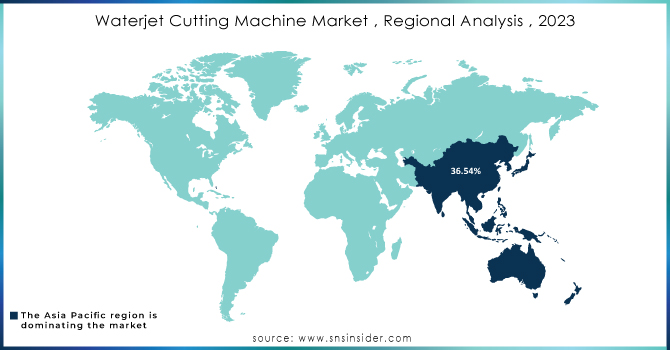

REGIONAL ANALYSIS

The Asia Pacific region dominated with a market share of 36.54% in 2023. Anticipated growth in the region's economy and industrialization, particularly in China, India, and South Korea, is expected to lead to an increase in product demand in the region. During the forecast period, the market is expected to be propelled by growth in the material handling, electronic component, metal and mining, food, beverage, and tobacco sectors in the region.

KEY PLAYERS

The major key players are Dardi International Corporation, ESAB, Flow International Corporation, Hypertherm, Inc., Jet Edge, Inc., Koike Aronson, Inc., OMAX Corporation, Resato International, WARDJet, KMT and others

RECENT DEVELOPMENT

In June 2023: Flow International Corporation unveiled Mach 200c and EchoJet waterjet systems, transforming precise cutting with bevel and five-axis functionalities. These advancements set new benchmarks in the industry, allowing for intricate manufacturing of parts.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 960 Million |

| Market Size by 2032 | US$ 1366.7 Million |

| CAGR | CAGR of 4% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Industry (Electronics, Automotive, Aerospace, Metal Fabrication, Construction, Others) • By Product Type (3D, Micro, Robotic) • By Offerings (Hardware, Software, Services) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Dardi International Corporation, ESAB, Flow International Corporation, Hypertherm, Inc., Jet Edge, Inc., Koike Aronson, Inc., OMAX Corporation, Resato International, WARDJet, KMT |

| Key Drivers |

• Waterjet cutting machines are essential in numerous industries due to their precise cutting capability, ability to cut various materials without producing heat, and effectiveness in minimizing material waste, which leads to cost savings and resource optimization. • The increasing need for high-precision cutting, supported by waterjet cutting's cool process to prevent thermal distortion and its safety advantages of not generating harmful fumes or dust, is crucial for sectors such as aerospace and defense, and attractive in strict regulatory settings. |

| Restraints | • The growing demand for precision cutting, along with its environmental and safety benefits, faces challenges from operational issues like continuous water and abrasive consumption, cutting speed and thickness limitations, complicating logistical and environmental management, and restricting its use in high-volume production environments. |