Industrial Air Filtration Market Report Scope & Overview:

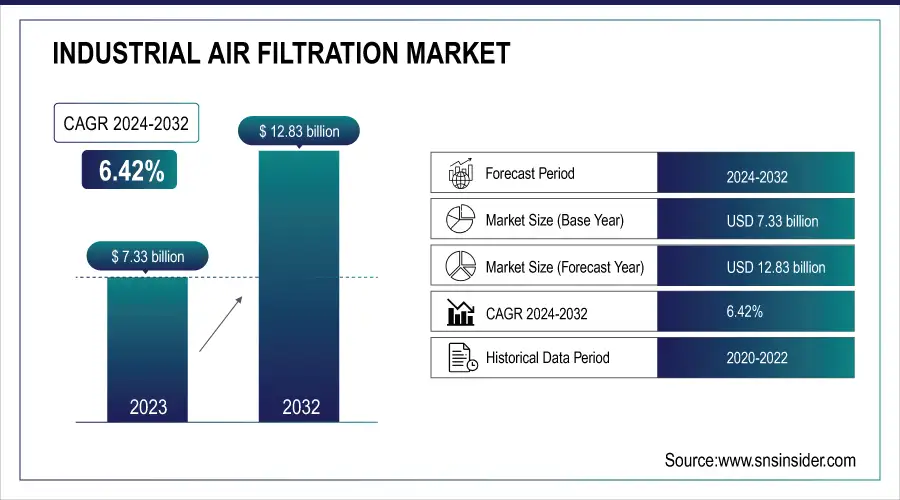

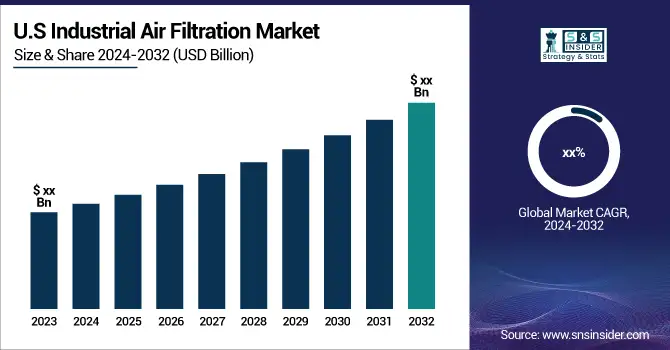

The Industrial Air Filtration Market size was valued at USD 7.33 Billion in 2023 and is expected to reach USD 12.83 Billion by 2032 and grow at a CAGR of 6.42% over the forecast period 2024-2032.

The Industrial Air Filtration Market has been witnessing significant growth, driven by heightened awareness of air pollution and its health implications, stringent workplace safety regulations, and the demand for energy-efficient filtration systems. This market serves various sectors, including manufacturing, food and beverage, pharmaceuticals, power generation, and chemicals, with a growing emphasis on clean air within industrial environments. The rising need for compliance with stringent environmental regulations, such as those established by the EPA in the U.S. and similar global agencies, compels industries to adopt air filtration systems to meet these standards. Key trends include the rising adoption of HEPA (High-Efficiency Particulate Air) and baghouse filters, renowned for their efficiency in capturing fine particulate matter, as well as a notable shift toward smart filtration systems equipped with IoT technology for real-time monitoring of air quality and filter performance.

To get more information on Industrial Air Filtration Market - Request Free Sample Report

This technological innovation not only enhances operational efficiency but also reduces maintenance costs. In terms of pricing, industrial air filtration machines typically range from $5,000 to over $50,000, varying based on type, size, and sophistication. Basic air filtration units for small industrial setups may cost around $8,000, while larger, more advanced systems can exceed $40,000. On the production side, costs encompass raw materials (e.g. high-grade filter media), labor, and energy, generally accounting for 35-50% of the retail price. A filtration system priced at $30,000 may incur production costs between $10,500 and $15,000. This cost structure is vital for manufacturers as they seek to invest in research and development while addressing the increasing demand for efficient, eco-friendly filtration technologies.

Market Dynamics

Drivers

- Stricter environmental regulations globally are driving increased demand for industrial air filtration systems as industries must comply with stringent air quality standards to control emissions and pollution.

Stricter environmental regulations are playing a pivotal role in driving the demand for industrial air filtration systems. Governments across the globe are tightening air quality standards in response to increasing concerns about pollution and its impact on public health and the environment. In industrial sectors such as manufacturing, chemicals, pharmaceuticals, and food processing, these regulations mandate stringent control over air emissions, particularly particulate matter, volatile organic compounds (VOCs), and other hazardous pollutants.

Industries are required to comply with laws like the Clean Air Act (USA), Industrial Emissions Directive (Europe), and other region-specific frameworks, which impose limits on the release of harmful pollutants into the atmosphere. Failure to comply can result in hefty fines, production shutdowns, or reputational damage. Consequently, this regulatory pressure is pushing industries to adopt advanced air filtration systems to ensure emissions remain within permissible limits. Air filtration solutions such as HEPA filters, activated carbon filters, and electrostatic precipitators are commonly deployed to meet compliance standards. These technologies help in removing particulates, toxic gases, and airborne contaminants, ensuring a cleaner industrial output. Additionally, the focus on sustainability and corporate social responsibility is encouraging industries to integrate air filtration systems as part of their environmental stewardship.

- Expanding industries and increasing urbanization, especially in emerging economies, drive the demand for industrial air filtration systems to manage emissions and comply with pollution control standards in densely populated areas.

Industrial Growth and Urbanization play a crucial role in driving the demand for industrial air filtration systems. As industries expand, particularly in emerging economies, there is a significant rise in industrial activities such as manufacturing, mining, construction, and energy production. These activities produce large volumes of pollutants, including dust, particulate matter, fumes, and volatile organic compounds (VOCs). Consequently, the need for efficient air filtration systems increases to control emissions and maintain air quality within and around industrial facilities.

Urbanization further accelerates this demand. As populations grow and more people migrate to cities, the expansion of urban areas leads to greater industrialization to support economic growth. This results in a higher concentration of industries within or near urban centers. In densely populated areas, the consequences of poor air quality become more severe, impacting public health and overall quality of life. Therefore, regulatory bodies in many regions impose strict pollution control standards on industries, mandating the installation of air filtration systems to curb emissions and reduce the environmental footprint. Moreover, urbanization leads to the development of infrastructure, transportation, and energy systems, all of which contribute to air pollution. To meet the rising industrial output and urban development demands, industries must adopt air filtration solutions that are not only effective but also energy-efficient and compliant with environmental regulations. This dynamic makes industrial air filtration systems indispensable in both emerging and developed economies, driving market growth.

Restrain

- High initial installation costs of advanced industrial air filtration systems often deter small and medium-sized enterprises (SMEs) from adopting them due to the significant capital investment required.

High initial installation costs are a significant barrier in the adoption of industrial air filtration systems, particularly for small and medium-sized enterprises (SMEs). These systems, especially those incorporating advanced technologies such as HEPA filters, electrostatic precipitators, or ultraviolet germicidal irradiation (UVGI), require substantial capital investment upfront. The cost includes not only the equipment itself but also installation expenses, such as infrastructure modifications, power supply upgrades, and integration with existing systems. For industries dealing with hazardous pollutants, the need for more sophisticated, custom-designed solutions can further drive-up costs. For many SMEs, these high initial costs are prohibitive. Operating within tight budget constraints, SMEs often prioritize immediate operational needs over long-term investments in air quality control. While large multinational corporations may have the financial flexibility to invest in such systems, smaller firms may delay or entirely forgo these installations due to budgetary limitations.

Additionally, the perceived return on investment (ROI) for these systems is sometimes unclear to smaller businesses. Although industrial air filtration systems can reduce health risks, improve worker productivity, and prevent regulatory fines, the upfront costs can outweigh the immediate financial benefits for some companies. This cost barrier slows the overall adoption rate of these systems, particularly in regions with less stringent regulatory enforcement or among industries with lower profitability.

Market Segmentation Analysis

By Distribution Channel

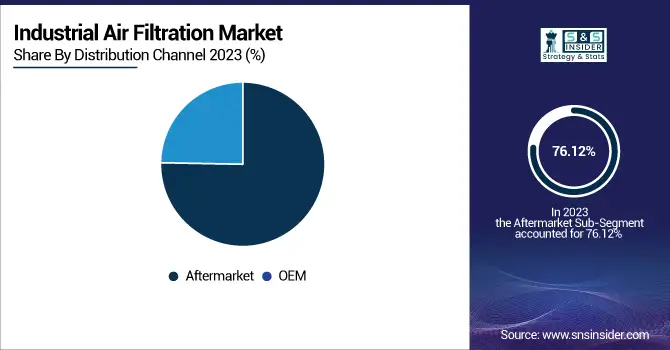

In 2023, the aftermarket sector had the largest revenue share at 76.12% in the market and is expected to maintain its dominance in the forecast period due to the strong sales of aftermarket filters for replacing filters at set times. Furthermore, aftermarket filters are chosen for their more affordable prices, yet they provide performance features comparable to OEM filters. Moreover, the increasing understanding of the significance of periodic filter upkeep and replacement for maintaining top-notch air quality and system efficiency is also a significant driver of aftermarket sales.

By Product

Dust collectors held the biggest market share of 43.08% in 2023 due to growing industrial activities and strict air quality regulations, leading companies to purchase efficient dust collection systems. Furthermore, the increasing recognition of workplace safety and health regulations is also driving industries to implement innovative filtration technologies. In addition, advancements in technology that improve filter effectiveness and lower energy usage are driving the need for dust collection filters in order to meet environmental regulations.

Regional Analysis

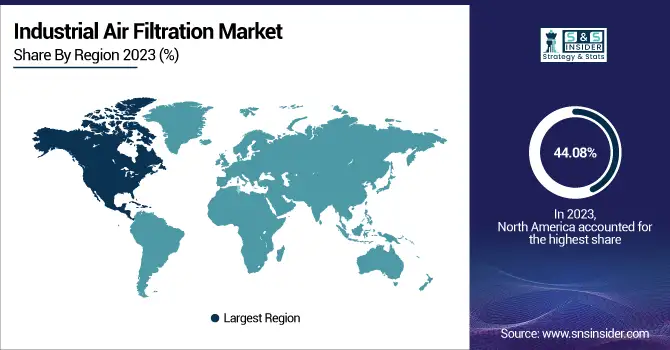

North America the industrial air filtration market held the majority of the market in 2023, with a significant revenue share of 44.08%, due to increased awareness of indoor air quality, updated regulations, and a focus on employee safety and well-being. Moreover, increased industrial and urban development results in higher emissions, requiring more sophisticated filtration solutions.

Asia Pacific industrial air filtration market is expected to grow at a CAGR of 6.8% during the projected time frame, due to quick industrial growth and urban development. The manufacturing industry is under immense pressure to keep up with the growing global population and demand for consumer goods. This results in the development of plans and efforts to boost industrial production and build new industrial plants. The Asia Pacific region is emerging as a center for the manufacturing industry because of advantageous factors like cost-effective labor, a streamlined supply chain, and relaxed regulations.

Do You Need any Customization Research on Industrial Air Filtration Market - Inquire Now

Key Players

Some of the major key players of Industrial Air Filtration Market

- Ahlstrom-Munksjö (Filtration media for industrial air applications)

- Air Filters, Inc. (HEPA filters, pleated filters)

- American Air Filter Company Inc. (Daikin Industries Ltd) (HVAC filters, dust collectors)

- Camfil (Clean air solutions, air filter panels)

- Donaldson Company, Inc. (Dust collection systems, cartridge filters)

- Filtration Group (Industrial air filters, HVAC filters)

- Freudenberg Filtration Technologies SE & Co. KG (Viledon filters, industrial air filters)

- Lydall, Inc. (Nonwoven filtration media, HEPA filters)

- MANN+HUMMEL (Air cleaners, dust removal systems)

- Parker-Hannifin Corporation (Compressed air filters, HVAC filters)

- Atlas Copco (Air compressors, air filtration systems)

- Nederman (Dust collection systems, fume extractors)

- Clarcor Industrial Air (Gas turbine air filtration, particulate filters)

- SPX FLOW, Inc. (Air dryers, filtration systems)

- GEA Group (Industrial air filtration solutions, HVAC systems)

- Eaton Corporation (Particulate filters, compressed air systems)

- Pentair (Industrial dust filtration systems)

- Schneider Electric (Air filtration for industrial environments)

- BWF Group (Filtration media, air pollution control products)

- AAF International (Clean air solutions, air filtration systems)

Recent Developments

-

In April 2024: MANN+HUMMEL opened a fresh Indonesian branch named "PT MANN AND HUMMEL Filtration Indonesia." This growth strengthens the company's global presence, solidifies its position in the pivotal Asian market, and enhances its sales and logistics activities in the region. The recently established branch will cater to key areas such as Bali, Borneo, Java, Papua, Sulawesi, and Sumatra.

-

In September 2023: Parker Hannifin's Industrial Gas Filtration division is launching BHA replacement dust cartridges designed for Donaldson Downflo Evolution (DFE) collectors. These cartridges offer both reduced costs and enhanced air filtration results in comparison to the original DFE filters.

-

In January 2023: K&N Engineering introduced a new division specializing in offering sustainable air filtration solutions for data centers and different industrial uses. Dedicated to decreasing the large amounts of air filter waste produced by data centers, the company plans to transform the industry with its efficient, washable, and reusable filters. CEO Randy Bays pointed out the environmental obstacles presented by traditional filters and stressed the significance of creativity in attaining sustainability.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 24.34 Billion |

| Market Size by 2032 | USD 12.83 Billion |

| CAGR | CAGR of 6.42% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • BY PRODUCT (Dust Collectors,Oil Mist Collectors,HEPA Filters,Cartridge Collectors & Filters (CC&F),Baghouse Filters,Welding Fume Extractors,Wet Scrubbers,Dry Scrubbers) • BY END-USE (Cement,Food,Metals,Power,Pharmaceutical,Agriculture,Paper & Pulp and Woodworking,Plastic,Others) • BY DISTRIBUTION CHANNEL(OEM,Aftermarket) • BY RATING (1 to 4 MERV,5 to 8 MERV,9 to 12 MERV,13 to 16 MERV,Above 17 MERV) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Ahlstrom-Munksjö, Air Filters, Inc., American Air Filter Company Inc. (Daikin Industries Ltd), Camfil, Donaldson Company, Inc., Filtration Group, Freudenberg Filtration Technologies, Lydall, Inc., MANN+HUMMEL, Parker-Hannifin Corporation, Atlas Copco, Nederman, Clarcor Industrial Air, SPX FLOW, Inc., GEA Group, Eaton Corporation, Pentair, Schneider Electric, BWF Group, and AAF International. |

| Key Drivers | • Stricter environmental regulations globally are driving increased demand for industrial air filtration systems as industries must comply with stringent air quality standards to control emissions and pollution. • Expanding industries and increasing urbanization, especially in emerging economies, drive the demand for industrial air filtration systems to manage emissions and comply with pollution control standards in densely populated areas. |

| RESTRAINTS | • High initial installation costs of advanced industrial air filtration systems often deter small and medium-sized enterprises (SMEs) from adopting them due to the significant capital investment required. |