Wearable Payments Market Report Scope & Overview:

The Wearable Payments Market was valued at USD 632.50 billion in 2023 and is projected to reach USD 3622.66 billion by 2032, growing at a remarkable CAGR of 21.4% from 2024 to 2032. The most popular wearables are smartwatches and fitness trackers. Smartwatches, Augmented and Virtual Reality technologies, smart jackets, and a slew of other gadgets are all urging us to live in a more connected world. Rising demand for host card encryption and growing adoption of cashless transactions are driving growth in the Wearable Payment Market. HCE allows an imitation of a card to be made available on NFC enabled mobile or wearable devices without requiring access to the authentication element. By using advanced technology embedded in the wearables, Wearable Payments are a secure way for consumers to buy products or services. Moreover, in order to provide retailers with more secure and error free payment methods, it is known as the tap-and-go payment method by various retailers and organisations.

Get More Information on Wearable Payments Market - Request Sample Report

Additionally, for executive payments, it allows the tapping of contactless cards or payment enabled devices. In addition, because of the benefits offered by this technology such as reducing transaction times, increasing convenience and leveraging customer experience at POS terminals during transactions, contactless payments are being used in BFSI, retails, energy & utilities, more than one sector.

Market Dynamics

Key Drivers:

-

Increasing adoption of cashless payments throughout the world.

The market is being driven by increased investment in digital payment processes and increasing adoption of wearable and cashless payments technology across governments all over the world. Due to the increase in the demand for salary increases by employees and the decrease in the profitability of banks, which is driving the growth of the market, banks and the FinTech sector around the world are finding it difficult to manage cash transactions on a daily basis. Moreover, owing to their benefits, such as the formalisation of transactions and the reduction of human errors, various banks and commercial sectors are using wearable payment devices and cashless payment services.

-

Increasing the volume of financial transactions

Restraints:

-

High costs of wireless devices

The adoption of these wearable payment devices is hampering the business growth. The services relating to wearable devices and contactless payments are subject to a number of charges including maintenance, integration or upgrade. In addition, the initial cost of production of wearable devices is high and incurs additional costs, which hampers the growth of the market.

-

Limited Production

Opportunities:

-

Increasing the use of NFC, RFID and Host Card Emulation Technology to Pay by Wireless Device

NFC and RFID are the basic components of different types of payment devices, such as wristwatch payments or contactless payments. A number of manufacturers, including Apple, Samsung and Huawei, are using NFC and RFID technology to develop their smart cards and wireless devices which is expected to give them a valuable opportunity for growth worldwide.

-

Increased internet penetration has led to an increase in the adoption of connected devices.

Challenges:

-

Increasing competition in the market and low awareness about the product

-

The need for secure and safer payment transactions is growing with the emergence of wearable devices and contactless payments.

Impact of Economic Slowdown:

During an economic slowdown, consumers tend to become more cautious with their spending. They may prioritize essential purchases over discretionary spending, which could affect the adoption and usage of wearable payment devices. Wearable payments might see a decline if consumers are cutting back on non-essential expenses. Airlines, tourism, hospitality, hotels, entertainment and e commerce are experiencing a decline in digital payment volumes (non-essentials) and restaurants, among other sectors. In addition, due to the temporary closure of borders resulting in a limited movement of goods, remittances from B2B or C2B countries have considerably declined. This has also had an impact on and decreased remittances from abroad. Various financial and industrial sectors such as energy, oil and gas, transport and logistics, manufacturing and aviation have had a significant economic impact. As a result of the trillion-dollar loss, it is estimated that the world's economy will be in recession. Economic activity is decreasing, which would have a negative effect on the world economy as more countries place restrictions and extend them.

In order to provide and receive real-time information on COVID-19, each individual and government of the United States, State, Central, Local or Provinces have been in constant contact with one another.

Impact of Russia Ukraine War:

Russia's market leader is in the wearables technology sector of Central and Eastern Europe, so war will have a major impact on the markets. In Central and Eastern Europe, Russia has a 38% market share and more than 70% of smartwatches are made by Apple and Samsung. Russia will suffer from inflation, sanctions and companies leaving the region in 2023, which is expected to lead to a loss of $1.2 billion on the wearables market.

Ukraine is a key bridge between Western Europe and Eastern Europe, with many companies having distribution partners in the country. The war has forced many businesses to shut down and many Ukrainians to seek refuge abroad. This will lead to a fall of more than 90% in the market for wearable devices this year. Further uncertainty on market supply will be added by the seasonal lockdown of warehouses and COVID-19's impact, limiting growth over the next few years. The payments sector became a tool used to punish Russia for its invasion of Ukraine. For the rest of the world, Russia's exclusion from SWIFT and suspension of operations by International Card Schemes have been a warning sign. The payment provider sector was inevitably affected by this event, but not necessarily in an obvious way. The impact of the war in Ukraine on the payment industry in Russia and around the world is summarised in this briefing.

Market Segmentation:

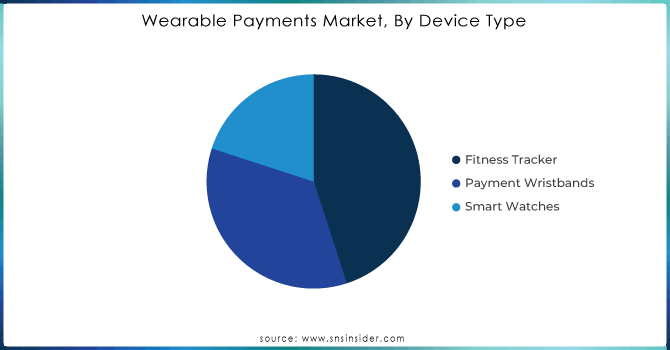

By Device Type

-

Fitness Tracker

-

Payment Wristbands

-

Smart Watches

In 2023, the fitness tracker segment accounted for more than 43.4% of global sales. Increasing use of a variety of fitness equipment and the growing number of people who are interested in exercise across the globe have led to an increased demand for fitness trackers.

Need any customization research on Wearable Payments Market - Ask For Customization

By Technology

-

Barcodes

-

Contactless Point of Sale (POS) Terminals

-

Near Field Communication (NFC)

-

Quick Response (QR) Codes

-

Radio Frequency Identification (RFID)

In 2023, the barcode segment dominated the Wearable Payments Market, accounting for more than 30.4% of worldwide sales. To improve the overall customer experience, retailers focus on removing friction at the checkout. The barcode scanners incorporate scan-and-go technology are embedded in the wearable payment devices.

By Application

-

Festival & Life Events

-

Fitness

-

Healthcare

-

Retail

-

Transportation

-

Others

In 2023, the Wearable Payments Market was dominated by retailers, accounting for more than 29.6% of total revenue. The growing demand for cashless payments in markets, local stores and online shopping can be attributed to the growth of this segment. By survey 72% of consumers believe that wearable payment devices will be the future of in store shopping.

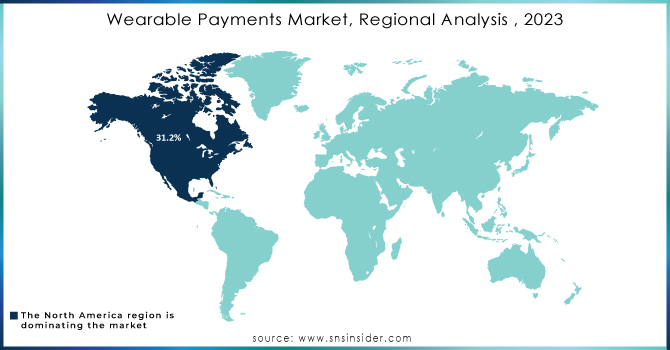

REGIONAL ANALYSIS:

In 2023, North America dominated the market with over 31.2% of total revenue. The presence of key players such as Apple, Inc.; Google, LLC; Mastercard, Inc.; and Visa, Inc. The growth of the region's market is also expected to be supported by trends such as growing technical dependence on timing and tracking, while fitness enthusiasts are increasingly adopting wearable device. Moreover, the production of smart devices with tracking and payment features in North America has increased significantly. During the forecast period, Asia Pacific is expected to be the fastest growing region in terms of growth. The presence of a large population and the growing demand for electronic devices in this region can be attributed to market increase. Market growth is expected to be supported by factors such as steady growth in the development of a cashless economy and the transformation of payment technologies. An important trend in the market is also an increasing number of competitors.

REGIONAL COVERAGE:

North America

-

US

-

Canada

-

Mexico

Europe

-

Eastern Europe

-

Poland

-

Romania

-

Hungary

-

Turkey

-

Rest of Eastern Europe

-

-

Western Europe

-

Germany

-

France

-

UK

-

Italy

-

Spain

-

Netherlands

-

Switzerland

-

Austria

-

Rest of Western Europe

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Vietnam

-

Singapore

-

Australia

-

Rest of Asia Pacific

Middle East & Africa

-

Middle East

-

UAE

-

Egypt

-

Saudi Arabia

-

Qatar

-

Rest of Middle East

-

-

Africa

-

Nigeria

-

South Africa

-

Rest of Africa

-

Latin America

-

Brazil

-

Argentina

-

Colombia

-

Rest of Latin America

KEY PLAYERS:

The major key players are Alibaba group holding limited, apple inc., Barclays plc, Fitbit, inc., google LLC, jawbone, inc., MasterCard, Samsung electronics co., ltd., visa, inc., PayPal inc. & Other Players

Recent Developments:

-

July 2022 Alibaba Cloud, the digital technology and intellectual backbone of the Alibaba Group, announced the global launch of Energy Expert, a sustainability platform to help customers worldwide measure, analyze and manage their carbon emissions from their business activities and products. The software, which is a service that provides customers with transformational insight and energy saving recommendations to speed up their sustainability journeys, also offers solutions in this area.

-

In August 2022, Samsung Electronics announced Galaxy Watch4 and Galaxy Watch 4 Classic. These smartwatches are equipped with the new Wear OS powered by Samsung, developed in collaboration with Google, which offers advanced hardware performance and a connected user experience.

| Report Attributes | Details |

| Market Size in 2023 | US$ 632.5 Billion |

| Market Size by 2032 | US$ 3622.66 Billion |

| CAGR | CAGR of 21.4% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Device Type (Fitness Tracker, Payment Wristbands, Smart Watches) • By Technology (Barcodes, Contactless Point of Sale (POS) Terminal, Near Field Communication (NFC), Quick Response (QR) Codes, Radio Frequency Identification (RFID)) • By Application (Festival & Life Events, Fitness, Healthcare, Retail, Transportation, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Alibaba group holding limited, apple inc., Barclays plc, Fitbit, inc., google LLC, jawbone, inc., MasterCard, Samsung electronics co., ltd., visa, inc., PayPal inc. |

| Key Drivers |

• Increasing adoption of cashless payments throughout the world. • Increasing the volume of financial transactions |

| Market Challenges | • Increasing competition in the market and low awareness about the product |