Web Coating Equipment Market Size & Overview:

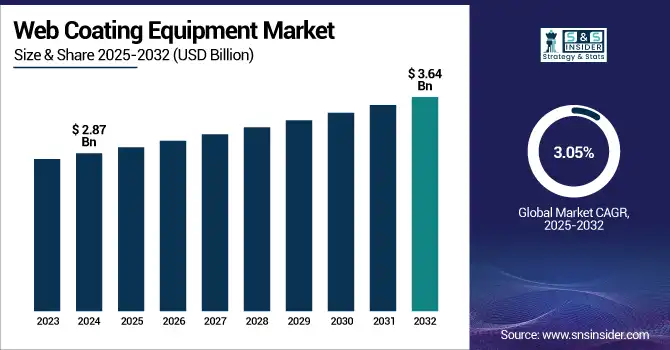

The Web Coating Equipment Market size was valued at USD 2.87 billion in 2024 and is expected to reach USD 3.64 billion by 2032, growing at a CAGR of 3.05% over the forecast period of 2025-2032.

To Get more information on Web Coating Equipment Market - Request Free Sample Report

The Web Coating Equipment Market growth is propelled by the increasing need for sophisticated surface finishing technologies across diverse industries, including packaging, electronics, automotive, and healthcare segments. Web coating is the technology of continuously applying functional and decorative coatings to flexible substrates, such as paper, film, or foil, as they travel through a roll-to-roll process. This is a key process for adding features, including product durability, aesthetic appeal, and functional properties such as barrier resistance or conductivity.

Innovation is shaping the Web Coating Equipment Industry, and is shaping innovation with the integration of automation, precision control systems, and energy-efficient technologies to improve throughput and coating uniformity. The movement toward sustainable and waterborne coatings and the increasing use of smart coating technology are impacting the design, features, and functionalities of equipment. Furthermore, demand for high-performance coatings, including flexible electronics, solar panels, and food packaging, is driving the development of advanced web coating technologies. With industries moving toward efficient and sustainable production processes, the Web Coating Equipment Market is gaining traction, providing customized solutions that suit modern manufacturing needs and emerging regulations. This growth in coating innovation and the complementary equipment is key to this market, enabling the next generation of material applications.

In April 2025: German engineering firms, including WIWA, are facing increased costs due to a new 20% U.S. tariff on European imports. Despite producing many products in the U.S., critical components sourced from Europe are now tariffed, impacting operations. The German Engineering Federation reports significant concern among manufacturers, with potential trade tensions prompting calls for EU countermeasures.

Web Coating Equipment Market Dynamics:

Drivers:

-

Rising Demand for High-Performance Coatings Fuels Growth in Web Coating Technologies

The increasing demand for advanced coatings in industries, such as packaging, electronics, and automotive is impacting the coating equipment market trends. Such sectors demand superior-performance materials with improved properties, such as moisture resistance, thermal insulation, and better electrical conductivity. Manufacturers are thereby being forced to adopt advanced web coating technologies that offer consistency, efficiency, and good-quality coating. For instance, Henkel and Panverta have worked together to create dry food packaging with better oxygen barrier characteristics, hence thinner and more recyclable packaging options. Advanced coating technologies are being used to protect and enhance electronic components in the electronics sector to improve durability and performance. In the same vein, the automotive industry is seeing increased demand for conformal coatings to protect advanced electronic systems in vehicles. Such innovations emphasize the importance of web coating systems in fulfilling the dynamic requirements of the contemporary manufacturing landscape.

In May 2024, PPG Industries announced a USD 300 million investment to boost its North American manufacturing. This includes building a new plant in Tennessee, its first in over 15 years, to meet rising demand for automotive coatings. The facility will produce 11 million gallons annually and create 130 jobs. Upgrades are also planned for sites in Ohio and Mexico to enhance sustainable coating solutions.

Restraints:

-

Impact of High Initial Investment Costs on Web Coating Equipment Adoption

The initial investment costs are very high, which is a crucial restraint to the adoption of web coating equipment, particularly for small and medium-sized enterprises. The leading coating systems demand significant investments for acquisition, installation, and integration into existing production lines. Many small manufacturers cannot justify the capital expenditure involved in new equipment, limiting their competitiveness in the market due to these financial constraints. This means these manufacturers stay shackled to aged or less effective technologies, making the entire sector grow and innovate more slowly. The penetration of cutting-edge web coating machinery is highly dependent on financial assistance and cost-effective options, and thus, they are multidisciplinary, which hinders the regional market growth and development.

For instance, High initial investment costs continue to restrict the adoption of advanced web coating equipment, especially among small manufacturers and those in developing regions. The substantial capital required for purchasing and integrating these systems often discourages upgrades, limiting growth and innovation in the market. Industry experts recommend flexible financing options and workforce training to help overcome these financial and operational barriers.

Web Coating Equipment Market Segmentation Analysis:

By Type

The Roll-to-Roll Coating segment dominates the Web Coating Equipment Market with a significant share of 32.02% in 2024 as it is a well-established method that lends itself to the continuous application of coatings onto flexible substrates, which is important for industries such as electronics, packaging, and solar panels. With its high-speed production and consistently high quality, the technology has become highly favored among manufacturers. It is also gaining traction due to roll-to-roll coating process advancements and increased need for lightweight and flexible materials. All these reasons make the Roll-to-Roll Coating segment a dominant segment in the web coating equipment market.

The Spray Coating segment is recognized as the fastest growing type within the Web Coating Equipment Market due to its ability to be used on different substrates, its efficiency, and ability to apply coatings uniformly. It provides benefits including accurate control on coating thickness, low material to waste, and it can make adjustments to the complexity of surface geometry. Secondly, the rapid adoption of it is driven by the growing demand for quality surface finishes in industries such as electronics, automotive, and packaging. Also, increasing technological advancement and preference for eco-friendly solvent-free coatings, which in turn have been affecting the growth of the Spray Coating segment, which is considered as one of the influencing segments in the market growth, are expected to act as a major driver for the growth of the market over the forecast period.

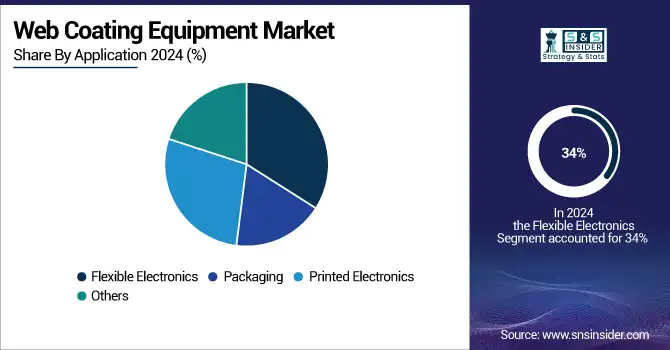

By Application

The Flexible Electronics segment dominated the market and accounted for 34% of the web coating equipment market share. The global market for flexible electronics is also being propelled forward by rising simple wearable technology, flexible displays, and smart packaging, all of which demand the advancement of coating techniques, able to provide superior performance and durability. Due to their flexible and light-weight form factor and versatility, the demand for web coating equipment has surged as a result of the rapid adoption of these electronics in a wide range of industries. With increasing investments in innovation and capacity to offer improved product functionality, the flexible electronics segment remains the largest segment in the market, and is expected to remain the same in the future as well.

The Printed Electronics segment is the fastest-growing application in the Web Coating Equipment Market due to its increasing adoption across various industries. This capability opens the door to low-cost and lightweight electronic components, suitable for applications in next-generation products, such as flexible displays, sensors, and wearables. Development in printing Technologies and increasing demand for smart packaging and IoT applications are some other factors fueling growth. Furthermore, low-cost, large-area, and efficient electronic devices lead to scalability that is attractive to investors and drives market growth.

Web Coating Equipment Market Regional Analysis:

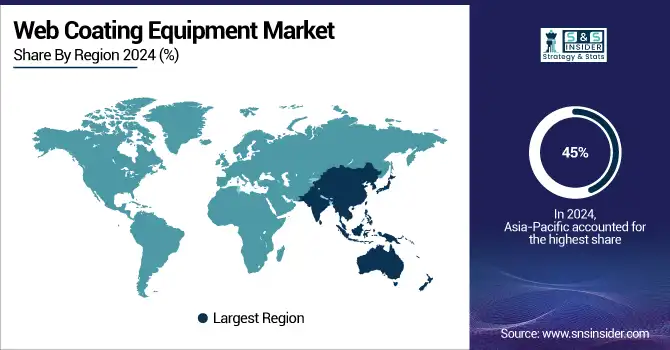

The Asia-Pacific region dominated with a market share of over 45% in 2024, due to its robust industrial base and rapid urbanization. Countries, such as China, Japan, South Korea, and India have a large manufacturing industry that requires high-end coating technologies in order to enhance the quality and efficiency of products. In addition, a large part of the automotive, packaging, electronics, and textile industries stimulates growth. The region also leads due to the right government policies, increased investment, and availability of a skilled workforce around the region. In addition, this domination is supplemented by continuous infrastructural development and rising adoption of automation in coating processes.

China is set to witness the fastest market growth in Web Coating Equipment, driven by a growing manufacturing market and a rising need for sophisticated coating solutions. The increase is spurred by rapid industrialization, growing automotive and electronics industries, and favourable government initiatives. Moreover, automation and innovation investments fuel the market growth in the country.

Europe is the fastest-growing market for Web Coating Equipment, due to technological advancement and environmental sustainability drive. With tight environmental regulations in the region promoting the use of eco-friendly coating solutions, the demand for innovative equipment is increasing. Furthermore, increasing investments in R&D and increasing the automobile and packaging industries are driving the growth at a pace. Germany, France, and the U.K. are some of the countries that are leading this trend by incorporating systems that practice Industry 4.0, allowing for greater efficiency and less waste. This is reflected in the strategic focus on innovation and green manufacturing, which consequently accelerates market growth in Europe.

North America holds a significant share of the Web Coating Equipment market, driven by its strong manufacturing base and high adoption of advanced technologies. Hidden Solutions: Industrial Coatings in the U.S. and Canada with several industries, such as automotive, aerospace, electronics, and packaging requiring precise and efficient coating solutions, the U.S. and Canada have their share of such industries. Market demand is fueled by investments in automation and customization. The presence of major equipment manufacturers and the development of coating materials continuously strengthen the region. North America is a critical market in terms of mature infrastructure and technology experience, even though the growth rates may be more stable relative to Asia-Pacific and Europe.

The U.S. web coating equipment market is expected to grow steadily from USD 0.34 billion in 2024 to USD 0.43 billion by 2032, with a CAGR of 3.09%. Growing requirement in end-uses such as packaging and electronics, and continuous investments in advanced coating technologies will drive this growth. During this period, the U.S. still plays an important role in being a contributor to the growth of the North American market.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key players:

Web Coating Equipment Companies are:

Comexi, Glenro Inc., Applied Materials, Inc., Davis-Standard, LLC, KROENERT GmbH & Co KG, Kampf Schneid, Faustel, Bobst, Lamina System AB, and Ferag AG.

Recent Developments:

In April 2025: Applied Materials acquired a 9% stake in BE Semiconductor Industries (BESI), becoming its largest shareholder. This move strengthens their collaboration on die-based hybrid bonding technology, key for advanced, energy-efficient semiconductors used in AI. The technology enables improved chip performance through direct copper connections.

In January 2024: Valmet partnered with KROENERT to boost quality management and automation in coating and laminating. They will integrate Valmet’s advanced technologies like the IQ Scanner into KROENERT’s lines to enhance machine performance and product quality. The collaboration also focuses on joint innovation in automation, digitalization, and data management to improve efficiency and productivity.

In March 2024: Comexi celebrated its 70th anniversary at drupa 2024 by unveiling the F1 Evolution flexographic press. This new press offers high-speed, high-quality printing with advanced automation and efficiency features. Comexi also introduced updates to its offset technology, reinforcing its leadership in sustainable and innovative packaging solutions.

| Report Attributes | Details |

|---|---|

| Market Size in 2024 | USD 2.87 Billion |

| Market Size by 2032 | USD 3.64 Billion |

| CAGR | CAGR of 3.05% From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (Roll-to-Roll Coating, Slot-Die Coating, Spray Coating, Curtain Coating, Others) • By Application (Flexible Electronics, Packaging, Printed Electronics, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, Poland, Turkey, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Rest of Latin America) |

| Company Profiles | Comexi, Glenro Inc., Applied Materials, Inc., Davis-Standard, LLC, KROENERT GmbH & Co KG, Kampf Schneid, Faustel, Bobst, Lamina System AB, Ferag AG |